Is the Recovery Spelled with a ‘V’ or a ‘U’?

- Is the Recovery Spelled with a ‘V’ or a ‘U’?

- ETF Talk: This Fund Combines Traits of Common Stock and Bonds

- Time for A Candid COVID Conversation

- Fear, Devils & Dust

***********************************************************

Is the Recovery Spelled with a ‘V’ or a ‘U’?

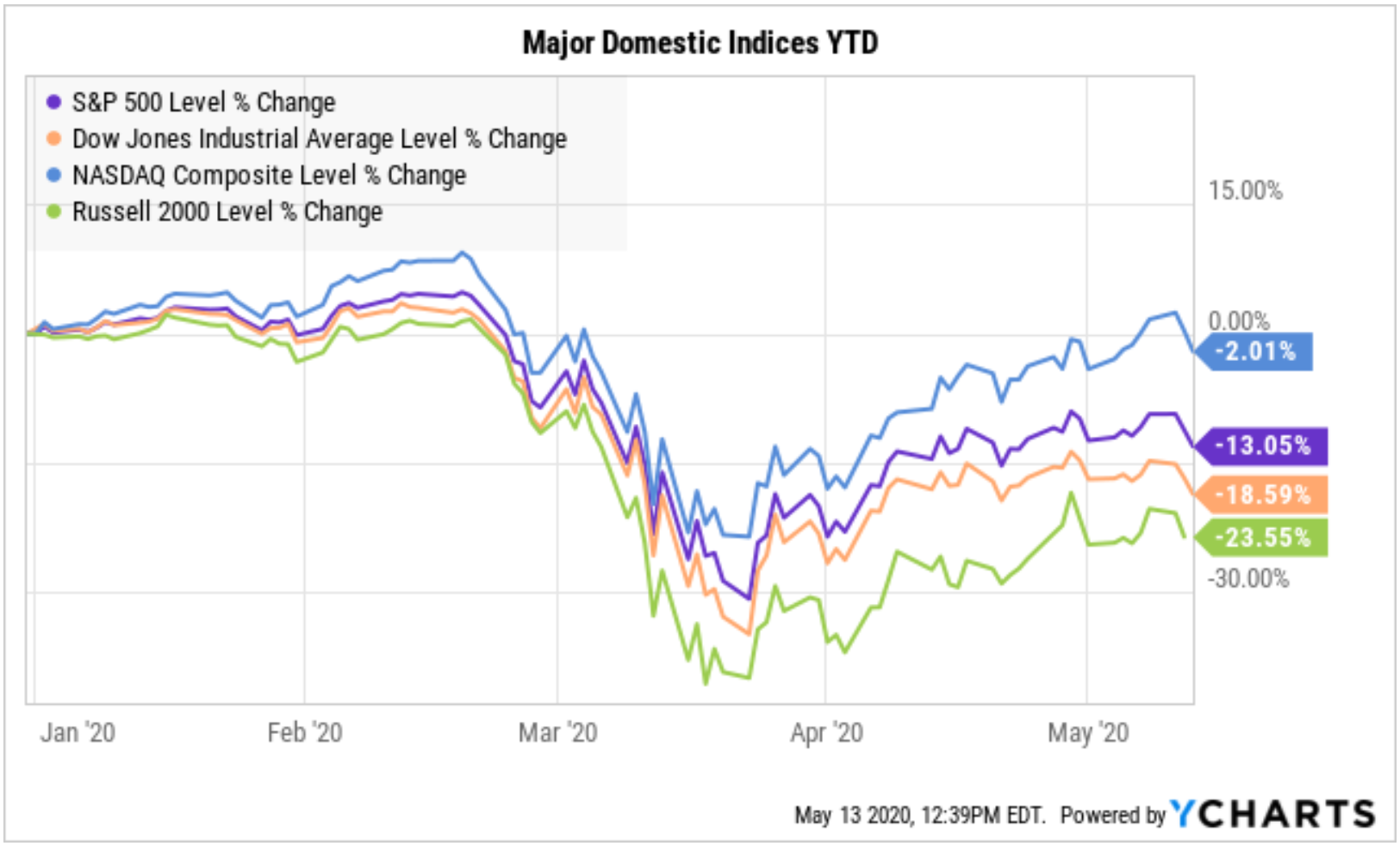

The market is telling us something very important, and what it is saying isn’t good.

Consider that, since last Wednesday, the S&P 500 Index is down about 1%. Yet, as is always the case in markets, that raw number doesn’t tell the real story. To figure out the truth, we have to dig a little deeper (hence our “Deep Woods” moniker). Now, the S&P 500 was up 1.15% last Thursday, and on Friday, stocks surged 1.69%. Then, after a flat start to the week on Monday, Tuesday saw a 2.05% drop followed by this morning’s approximate 2% decline as of noon EDT.

But why is the action over the past two days so important?

Well, because the reason why stocks have fallen is due to a confluence of negatives that threaten what market bulls, and just about everybody else in the country, are hoping for. That is a so-called “V-shaped” economic recovery.

A V-shaped recovery is one where economic activity plunges rapidly due to, in this case, the shutdown measures that were implemented on the global economy in order to stymie the spread of the coronavirus. And though social distancing measures, the wearing of masks and near-nationwide shelter-in-place orders have “flattened the curve” of new virus cases in most areas, those measures also have flatlined economic activity.

The decimation of economic activity is by far the worst we’ve seen in most of our lifetimes, and with a 14.7% unemployment rate and tens of thousands of businesses permanently closed, it’s easy to understand the initial half of the “V” shape in any graphic display of economic activity.

But what about the second half of that “V” shape? The price action in stocks since the lows in late March suggest that there’s optimism regarding the fact we will have a V-shaped recovery in the third and fourth quarters as well as in 2021.

Yet the actual numbers, and recent comments by medical experts and Federal Reserve Chairman Jerome Powell, suggest that we aren’t in for a V-shaped recovery. Rather, we will see a recovery that’s much more likely going to be “U-shaped.”

On Friday, the Labor Department reported a plunge in the number of non-farm payrolls of 20.5 million during the month of April, along with the aforementioned unemployment rate of 14.7%. Those are Great Depression numbers!

Then, in a speech this morning, Chairman Jerome Powell described the economic path ahead as “highly uncertain and subject to significant downside risks.” The Fed chief also said that, “Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery.”

Basically, he’s telling us that the government is going to have to print more money to keep the economy afloat, and that things are going to be rough for some time. Now, while this shouldn’t come as much of a surprise, it is nevertheless a disconcerting thing to hear. As a result, the Dow traded down some 500 points on Powell’s comments.

Want more reasons to think we are in for a U-shaped recovery? I direct you to the latest survey of economists by The Wall Street Journal. According to the survey, “the U.S. [economic] contraction caused by efforts to contain the coronavirus will be larger than previously anticipated. The economists expect gross domestic product to shrink 6.6% this year, measured from the fourth quarter of 2019.”

Again, a contraction, i.e. a recession, of this magnitude was expected, but as more and more data come in, we will all realize just how bumpy, dangerous and difficult to navigate the economic road ahead is likely to be.

Despite its challenges, hope springs eternal for the U.S. economy. The way I see it, after some two months of what amounted to a national quarantine, the natives have become restless. Americans in many states are starting to see their economies open up, and while that’s not true yet for the majority of states, it probably won’t be too much longer before a national reopening is seen.

That’s good news for the economy, and very much-needed good news for the 20.5 million Americans who lost their jobs last month.

Of course, the economy is not a light switch that can simply be flipped on to allow us to be suddenly return to full illumination. The economy is more like a chandelier with a rheostat, and one that will take a while to dial up before we can see “normal” again.

And though I fully expect the economy to recover, whether we spell that recovery with a “V” or with a “U” is going to be the key question. If we spell it with a V, then April’s record-high stock market surge of 13% on the S&P 500 will be validated.

If, however, we spell the economic recovery with a U, then the road ahead for equities over the next several months will look more like a microcosm of the past week, i.e. big up days followed by big down days… et cetera, et cetera, et cetera.

**************************************************************

ETF Talk: This Fund Combines Traits of Common Stock and Bonds

(Note: This is the second in a series of preferred ETFs designed for income-oriented investors who are looking for added yield and share price performance).

Preferred stock is a type of asset that stands to some degree in between common stock and bonds, with some characteristics of each.

Like common stock, preferred shares allow holders to participate in gains in the company’s stock price. However, preferred shares also involve greater guarantees on distributions, have a heightened guarantee to receive a more fixed dividend income and typically do not come with full corporate voting rights.

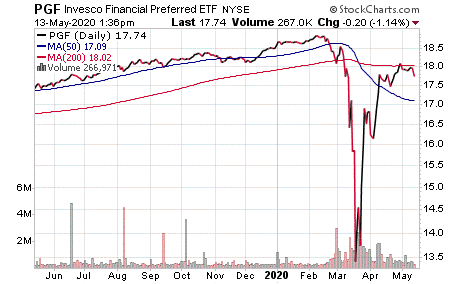

One way to invest in this type of asset is through an exchange-traded fund (ETF) such as the Invesco Financial Preferred ETF (PGF). The ETF is based on the Wells Fargo Hybrid and Preferred Securities Financial Index (WHPSF Index). The fund generally will invest at least 90% of its total assets in preferred securities of financial institutions that comprise the Index.

PGF’s holdings, weighted based on market cap, are invested fully in a wide range of preferred securities. Not surprisingly, given its name, it is focused on the financial sector. Its holdings are generally not top-rated in terms of quality (i.e. safety) and may pay greater yields as a result.

The fund is performing adequately this year, while somewhat insulated, as you might expect from a safer investment vehicle, from wild swings in the market. Its 12-month performance is close to unchanged, and it has paid out more than 5% in dividends over that time. PGF holds $1.46 billion in net assets, while its expense ratio is 0.62%.

Chart courtesy of www.StockCharts.com

This fund tends to own a number of different coupon varieties for particular companies. The top companies in its portfolio include JPMorgan (NYSE:JPM), PNC Financial Services Group (NYSE:PNC), Wells Fargo & Co. (NYSE:WFC), Bank of America Corp. (NYSE:BAC) and Citigroup Inc. (NYSE:C).

If preferred stock is an investment vehicle that may fit in your portfolio, Invesco Financial Preferred ETF (PGF) offers a way to invest in that segment of that market.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

In case you missed it…

Time for a Candid COVID-19 Conversation

Nerves are frayed, tensions are high and the country seems to be at an inflection point in this microscopic war. As the COVID-19 death toll mounts, so too does the number of Americans unemployed. On Friday, we’ll find out just how grotesque the jobs picture is, but at this point there’s no question it will be reminiscent of the works of Hieronymus Bosch.

On an individual level, I know we’re all struggling to make sense of how best to conduct our lives during this pandemic. And if you’re a thoughtful person (and I know The Deep Woods readers are), then you’ve probably wrestled with the macro and micro issues and complexities surrounding these unprecedented circumstances.

Macro issues such as when and how the economy should reopen are crucial questions, and both praise and criticism can be levied at those in political power at various levels for their handling of the matter. On a micro level, we all face questions such as when and how we should return to interacting with the world, what kind of safety precautions we should take and what course of action is in our own self-interest.

There are no easy answers to these questions, at least not from my perspective. But, fortunately, there is a way to help figure out the best way to conduct ourselves, and that is to talk to people whose opinions we trust, love and respect.

For me, a person who fits that description is my longtime friend, writer/filmmaker/intellectual activist Stewart Margolis. After reading some of Stewart’s thoughts on these issues, both macro and micro, I reached out to him via phone to discuss things. I found the conversation so fruitful that, with his permission, I decided to share some of the highlights of our discussion here.

Jim Woods (JW): Stewart, I know that many people are struggling with the best way to deal with this whole COVID-19 mess. How are you dealing with it, and what are your thoughts on the best approach?

Stewart Margolis (SM): I’m trying to gather as much objective evidence as I can on what is actually going on, but that’s not as easy as you might think. Because even with the best intentions, the reporting of the data out there is incomplete. And, it’s still very early on in terms of us dealing with this virus, and there are still so many unknowns it’s hard to know what the truth is out there.

JW: I’ve found the nature of this virus troubling in that there are so many unknowns regarding how it can cause death and/or severe damage in one person and how it can cause very little damage in another. Then there are those who are asymptomatic carriers of the disease and who most likely don’t even know they have it unless they’ve been tested. So, in the face of this uncertainty, knowing what to do isn’t easy.

SM: It is a bad situation, and especially because we all have to make decisions based on limited information. For me, the issue of how to act in the face of this pandemic comes down to the best assessment of what is in my rational self-interest. I am fortunate enough to be able to work from home and still do my job, so for me the best course of action might be different than if I had a profession or business that required me to be out there interacting with people.

JW: I’m in that same fortunate situation, as I’ve worked from home for most of the past two decades. And while I miss going out to restaurants, the pub, the gym, concerts, etc., I don’t miss it enough to put my health at risk.

SM: In my hierarchy of values, my health is very important. So, for me, regardless of what the government is telling me, I am going to take sensible precautions. That means I am going to avoid big gatherings and not go to concerts or movies. Now, that said, I think people should be allowed to take on their own level of risk as it pertains to their hierarchy of values.

JW: I consider life to be the standard of value. That means that acting in a manner that jeopardizes my life is antithetical to my top value. So, I therefore won’t eat poison when I could eat healthy food. It also means I wouldn’t choose to visit a COVID-19 hospital ward without protective gear. Yet somewhere in between is where the struggle comes in, and knowing how to navigate that struggle is a hard problem. It also is a hard problem when you extrapolate that out to the question of what society should do.

SM: I have mixed feelings on that, as I know you do as well, because as an advocate of liberty and free markets, I am very sympathetic to people out protesting who want to reopen their businesses and the economy. They should be allowed to reopen their businesses. However, if you are out there protesting without a mask and screaming in a police officer’s face, then you don’t seem to be someone who is cognizant of the reality of this disease.

JW: As you know, I am an advocate of limited government, and specifically a government whose basic role should be limited to the protection of individual rights. And while I understand the need for civil disobedience here, I think an in-your-face, aggressive approach is counterproductive. It gives the side arguing for more government control reasons to exercise that control and reasons to portray the protesters as anti-science extremists.

SM: I have a wide variety of friends in the liberty movement, and really all over the philosophic map, and there’s a subsection of people who are referring to COVID-19 as a “faux-pandemic,” or who think this is some kind of hoax. What I have pointed out to them is that this time of flippant dismissal of the crisis when tens of thousands of people are dying is not helping the cause of opening up the economy. It is making people who argue for opening the economy seem like callous, anti-science dolts. I think that if we want the economy to reopen, and we do, then we have to be reasonable about the reality of the situation.

JW: You and I aren’t afraid of the “extremist” moniker when it comes to ideas, but our ideas are not extremist in the sense of advocating for people to take reckless chances with their lives and also putting other people’s lives at risk in the process. I also think a rationally self-interested approach such as the one we advocate is not extreme, but rather should be the standard. And I agree with you on the counterproductive nature of ignoring the science and ignoring the reality of this virus. The only true victory that can be won here is through a rational exercise of our best judgement given the objective reality of the facts as best we can ascertain and evaluate them.

SM: Letting ideology crowd out reality is never a good thing. Reality always has to come first, and then you can figure out how it fits into your ideology. You simply cannot be editing reality because it doesn’t fit your narrative.

JW: You see, it’s a quotable gem like this that I wanted to make sure I share with The Deep Woods readers, and I think that’s a great place to leave it. Thank you, Stewart.

SM: Thanks, Jim. I always enjoy our discussions.

If you’d like to listen to a conversation I had with Stewart Margolis prior to the coronavirus, then I invite you to check out the podcast we did together from last year’s FreedomFest conference.

*********************************************************************

Fear, Devils & Dust

We’ve got God on our side

We’re just trying to survive

What if what you do to survive

Kills the things you love

Fear’s a powerful thing

It’ll turn your heart black you can trust

It’ll take your God filled soul

Fill it with devils and dust

–Bruce Springsteen, “Devils & Dust”

These days, a sense of fear feels omnipresent. Fear for our health, fear for our economy, fear for our friends and family, and fear for the preservation of the core American value — freedom. Yet as the great Bruce Springsteen writes in his 2005 masterpiece “Devils & Dust,” fear’s a powerful thing. And if we are not vigilant, it will turn our hearts black. So, don’t let your soul be filled with devils and dust. Yes, it’s ok to feel fear, but also let yourself feel the force that always vanquishes fear — a rational love of existence.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods