Is a 29% Plunge Coming?

Stocks are in a bullish mood. In fact, the markets are up about 6.6% over the past month, and year to date, the broad-based measure of the domestic equity market, the S&P 500 index, is up some 24.6%. Yes, it’s another bull march for stocks, and that’s made intrepid investors a lot of money along the way (and that’s especially true for subscribers to my newsletter advisory services).

Yet what if I told you that given this market’s fundamental and technical dynamics, there is a possibility of up to a 29% plunge off current levels?

Okay, now catch your breath for a moment and hear me out. First, I am NOT saying that a 29% plunge is imminent. Far from it. In fact, I see more upside in equities as we close out the year due to factors such as the Federal Reserve signaling what the market expects on its tapering plans (start that sigh of relief).

Still, if we do a little market multiple analysis and plot that analysis on a chart of the S&P 500, we do find that from a valuation standpoint this market has far less upside potential here than it does downside exposure, at least by historical valuation measures.

Let’s take a look at an excerpt from this morning’s edition of my daily market briefing, the “Eagle Eye Opener,” to see just what I mean. Here, we will look at the “current situation” with respect to the market multiple, the “better-if” scenario and what that means on the charts and then the dreaded “worse-if” scenario, which pegs that potential for a 20% plunge.

The Current Situation: The current situation improved in November with respect to the market multiple, with expected 2022 S&P 500 earnings rising from $220/share in October to $223/share this month and the multiple range increasing from 19.5X-20X in October to 20X-21X now. Those new figures provide us with an updated target range spanning from 4,460 to 4,683 with a midpoint level of 4,572.

Looking at the chart, the current situation is appropriately in line with where stocks ended October. Notably, there was some very light volatility around the midpoint at 4,572 in late October, which increases the technical significance of that level as more volume traded hands there and it should be viewed as a key initial support level on a lower time frame. Below there, the low end of the current situation at 4,460 corresponds with the upper portion of the broad pivot reversal out of the late-September/early October bout of volatility and should be viewed as a secondary support level near to medium term.

The Things Get Better If Scenario: After a slight deterioration in October, the better-if scenario rebounded back higher in November as the multiple increased from 20.5X to 21X, while 2022 earnings expectations for the S&P 500 held steady at $225/share. That provides a new better-if scenario target of 4,725, up from 4,613 in October.

On Friday, Nov. 5, the S&P 500 came within seven points of the new better-if target, but stocks have since turned sideways as the sprint higher in stocks realized over the last month is digested. In the near-term, we expect the better-if target of 4,725 to act as a modest resistance area unless there is a meaningfully positive catalyst that could send stocks to new record highs.

Since our last market multiple chart analysis, the S&P 500 finally hit the longstanding measured move target that we calculated using the extremes of the massive trading range of first-half 2020. That target was 4,596 and, interestingly, there was some noticeable profit taking at that level as the S&P edged past that mark by two points on Oct. 26, before dropping by nearly 50 points in the subsequent two sessions. It was not as substantial a resistance level as initially expected but the fact that there was hesitation by the market at 4,596 reiterates the importance of technicals on the broader stock market.

For the last few months, we have been running a regression line through this year’s price action and extending it through the end of December to help offer an additional upside target into year-end based on 2021 price action. The latest update provides us with a year-end target of 4,785 for the S&P 500, down modestly from last month’s target of 4,825. The lower revision reflects the loss of upside momentum during the September/October pullback. From where the S&P 500 began the week, that is less than a 2% move higher for the index.

The Things Get Worse If Scenario: After several months with no change, the worse-if scenario improved modestly in the November market-multiple update as 2022 S&P 500 earnings expectations increased by $5 to $215/share, with the multiple range unchanged at 17X-18X. Those figures provide a new target range of 3,655-3,870 with a midpoint of 3,763.

The upper half of the worse-if scenario range between 3,763 (midpoint) and 3,870 (upper bound) encompasses most of the moderately volatile trade that occurred in the first quarter of 2021 (think GME squeeze and the Archegos debacle), which adds technical significance to the area due to the high amount of volume that changed hands. Additionally, the midpoint of the worse-if range on the S&P 500 is within 10 points of where the index closed out 2020 and began 2021, another reason it would be psychologically important in the event we see a substantial surge in volatility between now and year-end.

Yet from the latest all-time highs, a drop to the worse-if target zone would constitute a decline of between 21% (upper end) and 29% (lower end), which would mean the stock market giving back all the year-to-date gains.

Now again, I am not saying this is going to happen. I DO NOT think it will. Yet doing this kind of analysis, the sort you’ll find every trading day in the “Eagle Eye Opener,” is the kind of prudent lens by which to look at this market — or any market.

So, if you don’t want to be blindsided by the market’s valuation, by the real drivers of the market or the potential exogenous events that can threaten your money, you should consider subscribing to the “Eagle Eye Opener” today. Doing so will not only give you piece of mind, but it also will give you the confidence to act in defense of your own money so that you can maximize gains and minimize portfolio damage.

***************************************************************

ETF Talk: Invest in Small-Cap U.S. Energy with This Fund

The Invesco S&P SmallCap Energy ETF (NASDAQ:PSCE) is a $106 million fund that seeks to track the investment results (before fees and expenses) of the S&P SmallCap 600 Capped Energy Index.

The fund generally will invest at least 90% of its total assets in the securities of small-capitalization U.S. energy companies that comprise the underlying index. These companies are principally engaged in the business of producing, distributing or servicing energy-related products, including oil and gas exploration and production, refining, oil services and pipelines. With its focus on energy, the fund is non-diversified.

PSCE represents the energy segment of the S&P SmallCap 600, a market-cap-weighted index that consists of U.S. small-cap companies screened for size, liquidity and financial viability. The fund holds a concentrated portfolio of small-cap energy firms, which may include those involved in oil & gas exploration and production, refining, oil services, as well as pipelines.

Selected securities are weighted by market cap and are constrained at each quarterly rebalance, such that individual securities will not exceed 22.5% weight. The aggregate weight of securities with more than 4.5% allocation is capped at 45% weight of the portfolio. Overall, PSCE is an interesting small-cap play in the U.S. energy sector.

Source: StockCharts.com

PSCE’s share price has experienced explosive gains of more than 136% during the trailing 12-month period and the fund looks poised to continue going higher. It has a 0.37% yield and 0.29% expense ratio, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

However, as with any opportunity, I urge all potential investors to exercise their own due diligence in deciding whether this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************

Milton Friedman, Happy Warrior

When I was a kid, I watched a documentary that influenced my young brain immensely, and it was called “Free To Choose.”

The original 1980, 10-part television series was by the great Nobel-Prize-winning economist Milton Friedman.

In academic circles, Friedman was chiefly associated with the renaissance of the role of money in inflation and the consequent renewed understanding of the instrument of monetary policy. For his studies in these subjects, he was awarded the Nobel Prize in 1976.

Yet it was the “Free To Choose” documentary, as well as his many subsequent public appearances via lectures and on TV, that helped bring into the mainstream the meaning of freedom, and why it is so vital to economic prosperity and social prosperity.

The “happy warrior” approach that Friedman took, as well as his passion for ideas, are kept alive by the Free To Choose Network, a global media nonprofit organization dedicated to promoting Friedman’s work, as well as other outstanding scholars such as Thomas Sowell.

Directing that effort is Free to Choose Network President and CEO Robert Chatfield.

At the recent FreedomFest Conference, Chatfield sat down with me for an episode of the Way of the Renaissance podcast to reminisce about Freidman, his wife and intellectual partner Rose, Friedman’s insatiable intellectual curiosity, the history of the “Free To Choose” documentary and how it came to fruition and even how Milton Friedman, at age 90, learned how to do stomach crunches!

I loved this interview with Robert Chatfield, and if you’ve ever wanted to learn more about the great Milton Friedman and the critical role he played in my life, and the life of society at large, then this episode of the Way of the Renaissance Man podcast is just for you.

*****************************************************************

In case you missed it…

Under A Benevolent Mushroom Cloud

Growing up as a child during the Cold War, I had a persistent, if not immediate, sense of fear omnipresent in my mind. That interred fear was caused by what was then a very real possibility of a global thermonuclear war between the United States and the Soviet Union.

Indeed, the horrifying idea of a world engulfed in a skyline of atomic “mushroom clouds” capable of wiping out humanity was the unthinkable fear I suspect was buried in the back of every schoolkid’s developing brain from the 1950s all the way up until the fall of the Berlin Wall, when the “Doomsday Clock” was finally dialed back.

The ominous fear generated by the thought of a nuclear mushroom cloud capable of incinerating the planet and ushering in a post-apocalyptic landscape with few, if any, survivors was the stuff of Cold War kids’ nightmares.

In fact, I can vividly conjure up the thought of a mushroom cloud, and to this day it gives me a deep sense of impending doom. Well, at least it did until I discovered what I suspect could be the next big development in human health and physical and mental performance.

You see, I think we could be ready to experience a very different kind of “mushroom cloud,” one that’s capable of generating a benevolent radiation throughout humanity.

A radiation that not only will benefit mankind’s collective health, but one that also could radiate huge profits for savvy investors who get in during the early stages of this health, fitness and medicinal explosion.

This new, benevolent mushroom cloud comes to us courtesy of a company whose express purpose is to “create the future of human optimization through natural and medical fungi derived solutions.”

That company is Optimi Health (OTC: OPTHF; CSE: OPTI), and in my free, just-released special report, I introduce you to this leader in the “functional mushroom” market, and I show you why this company is one you should be thinking about as an investor, right now.

Interestingly, I got a hint about Optimi Health almost a year ago today. That’s when I attended an unusual gala fundraiser in Malibu, California. This gala celebration was the first “real-life” event I attended in pandemic 2020; it was held outdoors, and the attendees all were tested for COVID-19 before entering the premises.

This fundraiser also was unusual in that it celebrated freedom, reason and capitalism, with no apologies for the virtue of any of these values.

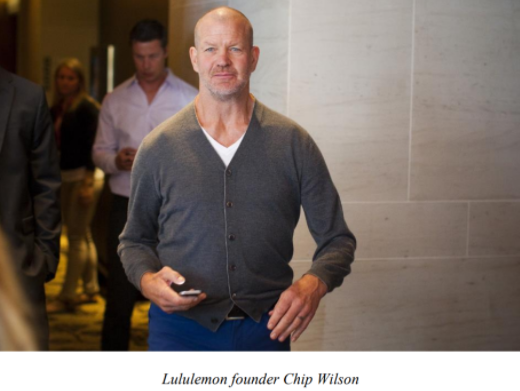

One of the capitalists celebrated that night was Lululemon Athletica (NASDAQ:LULU) creator Chip Wilson. The Canadian businessman and philanthropist, and the man who is basically responsible for creating the athleisure trend, also happened to be quite approachable.

I introduced myself to Wilson that night, and we exchanged pleasantries. I also told him I was a big admirer of his work and his fantastic achievement with Lululemon. I joked with him about how much money I’ve spent over the years buying his products. He laughed with me on that front, and then he said that he was working on some new projects that I could spend my money on.

Now, Wilson didn’t mention any specifics about what he was working on that night, but I was intrigued. After all, when you have a track record of creating a mega success such as Lululemon, investors pay close attention.

Fast forward about 11 months and I discover the new project Wilson was working on — and that project is Optimi Health, as Wilson is an advisor to the company as well as an investor.

So, what is Optimi Health’s mission?

Well, it’s quite philosophical, and if you are familiar with my work, it shouldn’t come as a big surprise that the company’s message resonates with my own sense of life.

Here’s the money quote from Optimi Health’s Initial Public Offering presentation:

“Optimi Health believes that personal identity is a fluid and evolving aspect of all our lives and encompasses our physical, spiritual and mental well-being.”

Now, that is a broad and ambitious idea. I mean, what kind of company talks about a fluid sense of “personal identity” that includes “physical and spiritual well-being” in its mission statement?

Well, it’s the kind of company that wants to bring medical and nutraceutical mushrooms into mainstream use.

If you want to know more about Optimi Health’s mission, its products and the investment opportunity in the nascent stages of a well-positioned company in the booming mushroom industry, then simply go to my free special report, “Profiting Under the Radiation of A Benevolent Mushroom Cloud,” right now.

*****************************************************************

Put Work Into It

You want a hot body? You want a Bugatti?

You want a Maserati? You better work, b**ch

— Britney Spears, “Work B**ch”

It’s fashionable these days to criticize the Millennial generation for being “snowflakes” and for being “entitled” and “woke,” but my experience with the younger generation has been largely that they are go-getters intent on maximizing their lives. Maybe it’s because that’s the kind of people I surround myself with, but I tend to think that many of us Baby Boomers dismiss younger generations just because it’s not the way we did things.

An example of this go-getter ethos can be found in the 2013 pop anthem, “Work B**ch,” by Britney Spears. Here, the singer reminds her fans that anything great in life must be worked for, and that if you want to live an exotic and exciting existence, you better put work into it. I love this sentiment, and I suspect you do, too. And as a side note, what other publication gives you edgy, pop star wisdom like this?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.