Introducing My Secret Market Insider

Step aside, Woodward and Bernstein, I have my very own “Deep Throat.”

That’s right, I have my very own “insider,” in much the same way the two celebrated Washington Post reporters had in the 1970s when they broke open the Watergate story that eventually toppled President Nixon.

Only my insider isn’t telling me about the lurid political machinations at the White House. Instead, my insider tells me every day what is really happening in financial markets, why it’s happening and what the most important things are for me to focus on in the short and intermediate term to gain that extra alpha on the competition.

Now, I promised this insider that I would never reveal his identity, and because I am a man of my word, I never will. Yet what I have persuaded him to do is to share his insights with you, in much the same way that I get his insights each and every market day.

So today, I am proud to introduce a new product in Jim Woods’ universe of newsletter offerings. That product is called the Eagle Eye Opener, and it makes its official debut this Monday, May 17, at 8 a.m. EST.

So, just what is the Eagle Eye Opener?

Well, think of it like a top-level intelligence briefing that gives you the heads up on what’s moving the markets and, more importantly, why markets are moving.

This insider intelligence also identifies the trends that day, what’s likely to happen in the short term and the medium term, and most importantly — what is the best course of action for you to take to profit from multiple market scenarios.

If you already subscribe to one or more of my newsletter advisory services, you know that I put a lot of research into each issue, and that I back up our investment decisions with that in-depth research. Well, a lot of my knowledge is bolstered by my market insider, as he is not only a friend, but he is also one of the smartest and wisest Wall Street analysts I know.

Most importantly, he has earned my trust over the years with his spot-on analysis and wise counsel.

And now, I can share that expert analysis and wisdom directly with you via the Eagle Eye Opener.

This publication comes out every trading day at 8 a.m. Eastern Time, and the best part about it is it only takes about five minutes each morning to read. That’s right, in just five minutes in the morning (maybe 10 minutes if you are like me and prefer to read slowly and methodically) you can gain an edge on the markets using the same institutional-level intelligence the pros on Wall Street use to make their big-money decisions.

Perhaps most importantly, the Eagle Eye Opener will help you avoid getting blindsided by market developments not covered deeply in the mainstream financial media.

Think of this publication as a kind of intel playbook. So, if you read it every day, you’re going to know what’s driving the market. You’ll know which way the markets are likely to go… and what to do when that happens.

You’ll also know what to do if it does the opposite.

That means you’ll know what to do ahead of time, whichever way the market swings… and you’ll know why and where the profit zones are.

Now, I am not claiming that this information is some kind of crystal ball, as there is no such device. However, it is the best tool I’ve found, and it’s the same information that Wall Street elites have at their fingertips each day — and now you can have it, too.

Once again, when you subscribe to Eagle Eye Opener, every trading day at 8:00 a.m., I’ll send you proprietary intel that was once for institutional investor eyes only. The intel covers breaking opportunities in:

- Stocks

- Exchange-traded Funds (ETFs)

- Bonds

- Currencies

- Commodities

You’ll also get the latest economic data that impacts investors in the market, as well as special features that more deeply analyze certain market sectors or developments (e.g., the current spike in inflation, the latest on when the Federal Reserve is likely to consider tapering its bond buying scheme and what to look for in terms of the next big market catalysts).

For me, the content in the Eagle Eye Opener gives me the confidence of being forearmed with this information before the opening bell… all in just about five minutes of your time.

For more about the Eagle Eye Opener, and how it can do for you what it does for me and thousands of other Wall Street pros each morning, I invite you to check it out right now.

As you know, knowledge is power. And with the Eagle Eye Opener, that power translates directly into profits.

***************************************************************

ETF Talk: Building a Barricade Against Inflation Via Real Estate ETF

After about a decade of enjoying a strong economy, low prices and sky-high job numbers, inflation is rearing its head once again.

The current inflation is mainly connected to the Fed’s easy-money policies and ever-growing amounts of government spending to combat the economic effects of the COVID-19 pandemic. The most recent Consumer Price Index (CPI) report showed a 4.2% increase in April from a year earlier, up from 2.6% for the year ended in March. Consumer prices increased a seasonally adjusted 0.8% in April from March.

More specifically, energy and food prices climbed to show their biggest respective hikes in months. To take advantage of these trends and to help mitigate the corrosive impact of inflation, I have identified four exchange-traded funds (ETFs) that might be worth considering. Last week, I discussed iShares TIPS Bond ETF (NYSEARCA:TIP). This week, I will delve into the Vanguard Real Estate ETF (NYSEARCA:VNQ).

Much like gold, it is common to see property prices increase due to inflation. In turn, landlords and real estate companies typically increase their rates on both commercial and residential real estate during such times. VNQ is one of the largest and most liquid real estate ETFs.

The fund tracks a broad index that captures a large portion of the U.S. real estate market and stands out from its peers as it shies away from specialized real estate investment trusts (REITs) and favors commercial REITs. The fund holds a wide array of related companies, including telecom property operator American Tower Corp. (AMT), warehouse giant Prologis (PLD) and mall owner Simon Property Group (SPG). VNQ seeks to closely track the return of the MSCI US Investable Market Real Estate 25/50 Index, and it offers high potential for investment income and some growth. Moreover, as a result of the portfolio’s good management, the cost of owning VNQ has been even lower than its stated expense ratio.

The fund has an expense ratio of 0.12% and a dividend yield of 3.24%. An incredibly liquid fund, VNQ has an average daily volume of $404.04 million and $37.93 billion in assets under management.

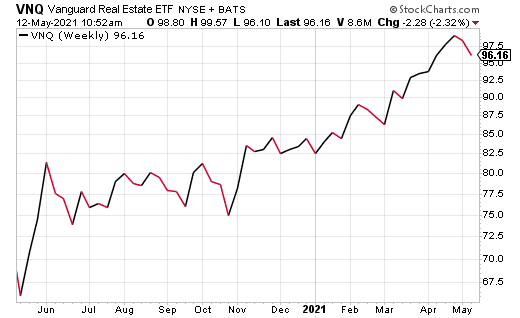

Year to date, VNQ has been privy to a relatively strong performance. The fund incurred a significant dip in November 2020, but quickly regained momentum and has been climbing since then. Currently, the fund is trading at the high end of its 52-week range and opened today, May 12, at $98.80.

Chart courtesy of StockCharts.com.

The fund’s top holdings include Vanguard Real Estate II Index (VRTPX), 11.88%; American Tower Corp. (AMT), 7.12%; Prologis Inc. (PLD), 5.25%; Crown Castle International Corp. (CCI), 4.92%; and Equinix Inc. (EQIX), 4.04%.

In summation, Vanguard Real Estate ETF (NYSEARCA:VNQ) is an extremely large and liquid fund that holds a wide array of commercial REITs. Further, it offers a high potential for investment income and some growth. So, while VNQ may be appealing for investors looking to explore the REIT space, it is important to conduct independent research to ensure a fund fits personal goals and risk tolerance.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Putting One Fake Foot in Front of the Other

Some men, when faced with overwhelming, life-shattering adversity, choose to embrace the circumstance. And in doing so, they live a life of epic inspiration.

In the new episode of the Way of the Renaissance Man podcast, I speak with just such a man, former Army soldier and retired police officer Steve Martin.

Steve is an Afghanistan war veteran whose battlefield injuries cost him both of his legs.

Yet rather than allow that to stop him, Steve chose to overcome his personal battles, conquer his inner demons, and live a life that can inspire the rest of us.

From overcoming pain medications and becoming one of the first double-amputee field police officers in the country, while exceling as an athlete and participating in high-profile competitions to raise awareness for life after amputation, Steve is a man whose mindset we all can learn from.

If you want to be motivated by a real-life hero and learn about his new adventure with an organization that I am proud to sponsor and support, Friends of Freedom USA, then you will really enjoy my inspiring conversation with Steve Martin.

*****************************************************************

In case you missed it…

Nobody Gets Footloose in D.C.

“You won’t get any dancing here, it’s illegal.”

That’s a line from the 1984 film “Footloose” starring a then-young Kevin Bacon with the very cool character name “Ren McCormack.”

Now, I know I am biased here, given my alter ego is “Renaissance Man,” and given that a certain cadre of in-the-know friends actually call me “Ren.” But objectively speaking, that has to be one of the best character names in all of film. Maybe only bested by “Dirty Harry” or “Clubber Lang,” or maybe “Snake Plissken.”

So, in case you aren’t familiar with the plot of “Footloose,” it’s about a big city teenager who moves to a socially repressive small town where rock music and dancing have been banned. Well, Ren isn’t about to let this stand, so he unleashes his formidable rebellious spirit and really shakes up the place.

Oh, if only Ren were real, because the residents of our nation’s capital could you use a little of that rebellious spirit about now.

Recently, Washington, D.C. Mayor Muriel Bowser announced that the city has banned dancing at wedding receptions. The reason? As a way to prevent the spread of COVID-19.

Now, I am all for preventing the spread of COVID-19. I am not one who thinks the virus is a hoax, that it’s a “plandemic” or that its dangers have been overblown. Far from it. In fact, I have already written about how I think everyone should choose to get vaccinated.

I am, however, an advocate of freedom — and that means I find a ban on dancing at private gatherings, ones that are freely engaged in by free people, to be one of the most repugnant ideas imaginable.

The mayor issued the “no dancing” order along with new masking policies and changes in other restrictions for businesses and gatherings. So, if you want to get married in D.C., the mayor will “allow” you to have an indoor wedding at 25% capacity, or up to 250 people. However, standing and dancing at the wedding reception is not allowed.

In researching this issue, I further discovered that this “no dancing” edict applies to not only indoor weddings, but also to outdoor weddings. Moreover, it doesn’t matter if those in attendance are vaccinated, if they’re wearing masks or if they’ve all tested negative for COVID-19 that day.

You see, in D.C., it doesn’t matter what the circumstances are. There will be no enjoyment. There will be no freedom, and nobody will be permitted to get “Footloose.”

Instead, you will obey. Instead, you will learn to love Big Brother, because Big Brother knows what’s best for you.

Perhaps next the mayor will explain to us that: War is peace. Freedom is slavery. Ignorance is strength.

Ironically, the “no dancing” decree came on April 29. Or as Orwell writes, “It was a bright cold day in April, and the clocks were striking thirteen.”

Now, lest you think I am making too big a leap from a dancing ban at weddings to a totalitarian state, keep in mind that the first step to loving the state and accepting its authority over your personal sovereignty is first to accept the premise that it knows what’s best for you.

Once you grant the state supremacy over your mind, you have taken the first step toward permitting tyranny.

Citing Orwell again, “Until they become conscious, they will never rebel, and until after they have rebelled, they cannot become conscious.”

So, if you live in D.C. and you are planning on attending a wedding, I say be like Ren and get rebellious. Put your dancing shoes on and get Footloose. Do it for yourself and do it in defiance of Big Brother.

*****************************************************************

The Heart Is A Dark Forest

“The heart of another is a dark forest, always, no matter how close it has been to one’s own.”

–Willa Cather

The great novelist provides a stunning insight into the nature of our inner lives, an insight that we all know is true, but that might also disturb us on certain levels. You see, no matter how well you think you know someone, there is always that dark forest that can only be accessed by that person. Perhaps this is a good thing, as we all need to have that private place that we can call ours, and ours alone.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.