In Defense of Economic ‘Bigness’

There’s an op-ed in the New York Times that has been getting some buzz over the past few days. It is written by Tim Wu, a law professor at Columbia University, one of the most outspoken advocates for harsher and more intrusive antitrust laws.

In his latest piece, “Be Afraid of Economic ‘Bigness.’ Be Very Afraid,” Wu makes the argument that monopoly and excessive corporate concentration can lead to what Supreme Court Justice Louis Brandeis once called the “curse of bigness.” Wu also argues that this “bigness” was a key component that led to the rise of Hitler, and that it was part of the economic origins of fascism.

What is that they say about an argument… if you have to resort to a Hitler reference, well, you’ve already lost?

Now, I don’t quite view Professor Wu’s argument in such simplistic terms. I do, however, think it ironic that fascism — which is just another form of big-government collectivism where the state is in control of the economy — is somehow the result of big business.

To be fair, Wu says it was the German economic structure, which was dominated by monopolies and cartels, that was essential to Hitler’s consolidation of power. And while it’s true that dictators throughout history nationalized industries and businesses under the threat of violence for their own nefarious purposes, it seems to me that blaming “big” industries for those nefarious purposes is a woefully misguided case of putting the cart before the horse.

But Wu doesn’t stop with just a look back at Nazi Germany. Instead, he applies the fear of bigness to what’s going on in the economy now, and particularly in places such as Silicon Valley, to argue that we need more invasive government and more antitrust law enforcement to rein in the bigness.

Here’s Wu’s basic thesis, in his own words:

“There are many differences between the situation in 1930s and our predicament today. But given what we know, it is hard to avoid the conclusion that we are conducting a dangerous economic and political experiment: We have chosen to weaken the laws — the antitrust laws — that are meant to resist the concentration of economic power in the United States and around the world.”

But are antitrust laws really designed to resist economic concentration of power, or are they more like legal means to give the government more power over a free society?

According to novelist/philosopher and free-market champion Ayn Rand, antitrust laws were “allegedly created to protect competition.” Yet Rand argued that these laws were based on the “socialistic fallacy” that a free market will inevitably lead to the establishment of coercive monopolies. She further argued that it was government that was the cause of monopolies, not free markets.

As Rand writes, “Every coercive monopoly was created by government intervention into the economy: by special privileges, such as franchises or subsidies, which closed the entry of competitors into a given field, by legislative action… The antitrust laws were the classic example of a moral inversion prevalent in the history of capitalism: an example of the victims, the businessmen, taking the blame for the evils caused by the government, and the government using its own guilt as a justification for acquiring wider powers, on the pretext of ‘correcting’ the evils.”

Well, Wu certainly wants to correct what he sees as these evils, and he wants the government to do so much more than it has been doing.

“In recent years, we have allowed unhealthy consolidations of hospitals and the pharmaceutical industry; accepted an extraordinarily concentrated banking industry, despite its repeated misfeasance; failed to prevent firms like Facebook from buying up their most effective competitors; allowed AT&T to reconsolidate after a well-deserved breakup in the 1980s; and the list goes on,” writes Wu.

Note the term “we have allowed,” as if government was the moral arbiter of one group of individuals and the free exchange of ideas, capital and cooperation with another group.

Wu even doubled down on the Facebook (FB) and Silicon Valley consolidation trends in an interview Tuesday with CNBC, saying, “I think it could be very important, for example, to take action against Facebook to break-up some of their illegal mergers, especially Instagram and WhatsApp, to kind of recharge the innovation environment.”

Recharge the innovation environment, really?

I don’t know if Mr. Wu has visited Silicon Valley lately, but I can assure him that there is no shortage of innovation among tech startups. And, in fact, many are those startups would love to be acquired by the likes of Facebook or Alphabet (GOOGL) or Apple (AAPL) or any number of bigger suiters.

Oh, and who wins from such mergers? Well, it’s usually customers who get convenient access to better products, and shareholders of firms that are monetizing these acquisitions. Facebook, for example, has seen its share price surge some 200% over the past five years. And while it’s not always the case that consumers or shareholders win when an industry consolidates, it usually always is the case that consumers lose when big government comes in and dictates the winners and losers.

Now, this is The Deep Woods, and in this publication, we dig into the deeper principles of an issue. Here, the principle involved is the proper jurisdiction over free peoples.

By what right, I ask you, does the government claim to legislate the free actions of individuals that make up corporations and companies? These entities are freely associating with others, and using capital to make sound business decisions such as acquisitions, mergers, etc. We must assume here that these individuals are acting in what they consider to be their own mutual best interests, even if those choices ultimately turn out to be wrong.

The answer, of course, is the government has no right, and these companies are violating no laws. So, the government had to make up a new right, and that’s what they call antitrust laws.

Finally, the only real danger in the history of humanity from “bigness” is the rise of big government, i.e. the rise to power of those who wield the swords, guns and missiles — and, of course, the big laws they have restricting the freedom of citizens.

**************************************************************

ETF Talk: This Fund Focuses on U.S. Media Companies

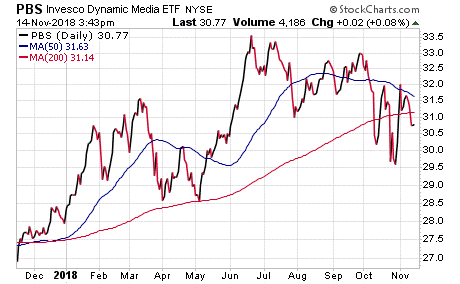

The Invesco Dynamic Media ETF (PBS) is an exchange-traded fund (ETF) that relies on the Dynamic Media Intellidex Index to indicate which common stocks will receive the fund’s assets.

Generally, the fund will allocate around 90% of its net assets into the common stocks that comprise the index to maximize its returns. It is worth noting that the Intellidex Index chooses its stocks with the goal of maximizing capital appreciation.

Thus, it evaluates companies based on price momentum, earnings momentum, quality, management action and value. Specifically, the underlying Intellidex Index is comprised of the common stock of 30 U.S. media companies.

Some of the fund’s holdings are in the CBS Corporation (NYSE: CBS), Twenty-First Century Fox (NASDAQ: FOXA), The Walt Disney Company (NYSE: DIS), HIS Markit Ltd. (NASDAQ: INFO), Twitter, Inc., (NYSE: TWTR), Netflix (NASDAQ: NFLX) and Sirius XM Holdings (NASDAQ: SIRI).

As the media environment in the United States continues to shift away from traditional forms of media (such as the radio and television) and more towards the digital, it is important that one’s portfolio also reflects the changes in the real world. In this sense, PBS is a good portfolio since many of its holdings are either entirely within the digital realm or are expanding their assets within it.

For instance, Disney’s recent announcement that it will launch an online video streaming service to compete with Netflix and its decision to acquire Twenty-First Century Fox are very interesting moves that likely will continue to push Netflix to either innovate or expand its digital library still further.

It is also important to note that the fund currently has $73.91 million in assets under management and has an average daily trading volume of 21,467, and an average bid-ask spread of 0.17%. PBS also has an expense ratio of 0.63%, meaning that it is a bit more expensive to hold in comparison to other exchange-traded funds.

At the same time, over the past three years, the returns from PBS holdings have been growing at a slightly slower rate than the segment benchmark. For instance, PBS holdings have climbed 6.51% over the course of the last year but the Dynamic Media Intellidex Index has risen 6.54% over the same period.

In short, while PBS does have several advantages over some of its peer funds, its risks are not zero. Interested investors should use their due diligence to decide whether the fund is suitable for their portfolios.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**********************************************************************

And the Winner is… America

In the fantastically entertaining, although mostly unrealistic, modern film classic, “Wall Street,” the unforgettably unctuous villain Gordon Gecko famously made a speech where he proclaims, “Greed is good.”

Today, I’ve decided to channel my inner Gecko and make a similar proclamation regarding the recent midterm election results, and it is… “Gridlock is good.” Yes, gridlock in Washington is back, and that means that the real winner is America.

I say that because through my libertarian-tinted glasses, the less that “gets done” in Washington, the better. Stated differently, the fewer new laws that rob Americans of their liberty and their property, the better off everyone will be.

With the Democrats soon to be in control of the House of Representatives, and the Republicans still firmly in control of the Senate and the White House, we have a potent prescription for gridlock of the sort that freedom-loving Americans should embrace.

What gridlock means in today’s context is no threat to the Trump tax cuts. Unfortunately, it means no further tax cuts are likely, but further tax reform isn’t what most experts thought was on the agenda anyway.

Gridlock also likely means no big spending legislation over the next two years. The one caveat here comes if Democrat and Republican leaders get together with President Trump to pass some big-government infrastructure spending bill. A huge infrastructure spending bill means a lot of debt, and likely a lot of inefficient use of our tax dollars.

For Wall Street, at least historically, gridlock has been a very good thing. An article today at MarketWatch cited some eye-opening statistics from Bank of America showing that since 1928, stocks in the S&P 500 have produced an annual average return of 12% in years when a Republican president held office and Congress was split.

That research also showed that in the year following a midterm election that resulted in a Republican president and a split Congress, returns for the S&P 500 have averaged more than 20%.

The data here shows the historical validity of my “Gridlock is good” thesis, but the reason why I think markets are in a good position going forward this year is because now markets can get back to focusing on what really matters — i.e. fundamental drivers of equity prices such as corporate earnings growth, economic growth and monetary policy.

So far, corporate earnings growth continues to be strong, and that’s despite the relatively large number of high-profile earnings and outlook disappointments we saw in Q3. Moreover, broad macroeconomic data continues to be strong (GDP growth, employment data, sentiment surveys) despite a few points of weakness (housing and building permits).

As for monetary policy, the Federal Reserve’s Open Market Committee (FOMC) just happened to begin its two-day policy meeting the day after the midterm election. And while no change in interest rates is expected this month, what the markets want to see is if there will be any alteration to the “hawkish” rhetoric we’ve been hearing for the past couple of months.

Recall that one of the reasons for the equity market volatility in October was the hawkish comments from Fed Chair Powell, when he said that rates were likely a “long way” from neutral, implying a lot more rate hikes to come.

Finally, there is one more seasonal trend that deserves mention here that isn’t even correlated to the “Gridlock is good” thesis, but that nevertheless happens to be true an amazing 100% of the time.

This indicator was brought to my attention by Tom Essaye of the Sevens Report, who cited research showing that since 1946, there have been 18 midterm elections. And, in the 12 months following each of those elections, the stock market has rallied sharply. In fact, Tom shows that fully 100% of the time, stocks have been higher 12 months after a midterm election by an average of 17%.

Additionally, the average gain from the lows of the year during the midterm was 32%. And as Tom points out, “Those two numbers equal 3,223 in the S&P 500 (a 17% gain from Tuesday’s close) and 3,340 (a 32% move from the 2,530 2018 low). So, not only is gridlock good — but for markets, the 12 months after the midterm also happen to be very good, 100% of the time!

I don’t know about you, but to me, that sounds like America is the real winner today.

*********************************************************************

Shooting the Breeze with an FBI Counterterrorism Expert

Have you ever wondered what it’s like to be on the frontlines of America’s war on terror?

I did, and that’s why I wanted to have a conversation with one of the leading experts on counterterrorism in the country, Retired FBI Special Agent John Iannarelli.

Not only did John spend more than two decades as an FBI Agent and member of the FBI’s elite SWAT Team, he’s also the author of the book, “How To Spot A Terrorist: Before It’s Too Late.”

In the latest episode of the Way of the Renaissance Man podcast, I spoke with John to get his thoughts on why it’s incumbent upon all of us to be prepared for the unlikely, yet potentially catastrophic, act of violence and terror.

In this fascinating conversation, we also talked about:

What the FBI looks for as “suspicious activity” in order to prevent catastrophic events such as acts of terrorism.

What it was like at “Ground Zero” during the Las Vegas shooting rampage.

The steps John took to fulfill his childhood dream of becoming an FBI Agent.

What John means when he says, “I’ve never learned anything by doing it right.”

Plus, much more.

If you ever wanted to peek into the brain of an elite member of America’s premier law enforcement agency, then today’s episode of the Way of the Renaissance Man podcast is for you.

Finally, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

*********************************************************************

On the Virtue of Humility

“Stay humble or the market will do it for you.”

— Anonymous

There are a lot of great wisdom-laced Wall Street maxims, and many can teach us a lot about ourselves if we allow them. In this classic, the anonymous saying reminds us of the virtue of humility when it comes to investing in markets. It’s been my experience that those who boast the most about being spot-on about the markets are usually the ones who are one trade away from a major loss. Keep this in mind, and always stay humble. You’ll enjoy and appreciate your success a lot more for doing so.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods