I Love Gold and I Love Bitcoin

- I Love Gold and I Love Bitcoin

- ETF Talk: Invest in Pure-Play Silver with This Fund

- Helping Musicians Achieve Greater Wellness

- Lincoln on Happiness

***********************************************************

I Love Gold and I Love Bitcoin

Can you love more than one person at the same time?

It’s an age-old quandary and one that I will admit I’ve been mired in more than once in life. The answer, of course, is you can. Just like you can love bourbon and wine at the same time, and just like you can love Porsche and Maserati at the same time — and especially just like you can love two investment asset classes at the same time.

Yes, I know romantic love isn’t the same kind of love as one feels for libations, exotic cars or investments but getting all of those right in your life does give you an eerily similar ecstatic sense of life.

So, here, I admit to you that I love gold, and I love Bitcoin.

Yes, I know that the financial media as well as those with a vested interest in one side or the other would like you to think these are competing asset classes, but I don’t see it that way. The way I see it, you can love both, and you can profit from both.

In discussing this with other investment experts, I found that many seemed to be taking an either-or approach to this situation. Sort of like I had to love one or the other.

Then I spoke to a real gold expert, my friend, former U.S. Army colleague and all-around Renaissance Man, Rich Checkan of Asset Strategies International.

I asked Rich if he would be willing to tell The Deep Woods readers what he thought about gold and Bitcoin, and of course, he came through for me like the kick-butt soldier that he is.

So, here is Rich Checkan with his thoughts on gold, Bitcoin and the current state of these asset classes, from his article…

New Year’s Resolution… Keep What’s Yours!

By Rich Checkan, President and COO, Asset Strategies International

Last January, I predicted…

- A U.S. dollar bear market would be confirmed

- Gold would hit highs above $1,900, not lows around $1,050

- Silver would outperform gold

- Smart money would be in precious metals

All came true.

The U.S. dollar followed a 7% loss in 2019 with a 6.9% loss in 2020. Gold hit a new all-time high at $2,075 per ounce. Silver (48.5%) nearly doubled gold (25%) in appreciation. Those who owned precious metals were rewarded.

In 2021, expect more of the same. Here’s why…

Debt, Dollars and Interest Rates

For years, we have focused our clients on the U.S. debt and the U.S. dollar to guide their decisions regarding precious metals. After all, gold and other precious metals flourish when the U.S. dollar weakens.

The overhang of debt, the reversal of a multi-year trend of dollar strength, and artificially low interest rates should conspire to drive investors to gold and silver, and, to a lesser extent, to platinum and palladium as well.

As 2021 begins, the federal debt is over $27 trillion, the U.S. dollar is firmly entrenched in bear territory below 90 on the U.S. Dollar Index — a reading below 95 is dollar-bearish — and interest rates remain dug-in near zero.

The net result is no opportunity cost to owning precious metals versus “safe” term deposits, and the U.S. dollar is worth less and less due to stimulus and monetary expansion.

But… There’s More

Since President Nixon closed the window of convertibility between gold and dollars, we’ve seen two precious metal bull market cycles (1971-1980 and 2001-2011).

They shared common signals as they turned bearish…

- Duration… Roughly 10 years.

- Gold Price… Roughly two to three times the previous high ($1,921.17).

- Gold/Silver Ratio (GSR)… The number of ounces of silver it takes to buy one ounce of gold should drop from here (around 70) to between 35 and 50.

- Sentiment… Uber drivers start giving tips on buying gold and silver.

- Interest Rates… Rates climb to high single digits or more.

- S. Dollar… Dollar strength climbs up through 95 on the DIX.

- Social and Political Stability… When both are restored, the safe-haven luster of gold will fade.

We anticipate this current bull market to behave similarly. Typically, you need to see several of these factors converge before it is time to start exiting in an orderly fashion… and that point is nowhere close.

Bitcoin Is NOT the New Gold

In 2020, the idea emerged that Bitcoin is better at being gold than gold is. Many suggest capital flowing into Bitcoin will significantly and negatively impact the gold market.

In fact, there is a big push right now for Bitcoin legitimacy…

Grayscale Investments – Drop Gold Commercial

My good friend, Mark Skousen, sent this video to me. The idea is you only have two choices… own Bitcoin or own gold… and, Bitcoin is better at being gold than gold is. Very clever and equally preposterous.

Bitcoin just turned 12 this past Sunday. Gold has been the world’s only real money for more than 5,000 years.

Clever marketers realize Bitcoin lacks the credibility that a real track record establishes. But that credibility cannot be achieved with a clever ad.

Tiger Woods set the standard in golf. I aspire to attain his standard. Gold is the standard for purchasing power protection. Bitcoin aspires to the Gold Standard.

It is a noble pursuit, but Bitcoin is not there yet. Check back in 4,988 years or so.

The best choice, in my opinion, is to own both.

But understand what they both do for your portfolio, and size your allocations accordingly.

Most commonly, the following allocations are suggested…

- 1% to 2% max for Bitcoin

- 10% minimum for Gold

Bitcoin, in my opinion, is real. Certainly, the speculative potential is there. So, I speculate with Bitcoin.

Gold is proven wealth insurance for over 5,000 years. I preserve my wealth with Gold.

When I rebalance and take profits from my Bitcoin speculation, I preserve a portion of them (10% minimum) in gold… as I continue the speculation.

This is not a zero-sum game, and I do not expect Bitcoin to make gold obsolete.

So, resolve to keep what’s yours in 2021 by 1) Owning gold as wealth insurance, 2) Owning silver for profit, 3) Speculating with Bitcoin and banking profits in gold.

**********

P.S. For more brilliant insight from Rich and the crew at Asset Strategies International, I highly recommend all of my readers check out his latest FREE special report, “The Top Ten Mistakes First-Time Gold Buyers Make.” If you want to know about gold investing, you need this special FREE special report.

***************************************************************

ETF Talk: Invest in Pure-Play Silver with This Fund

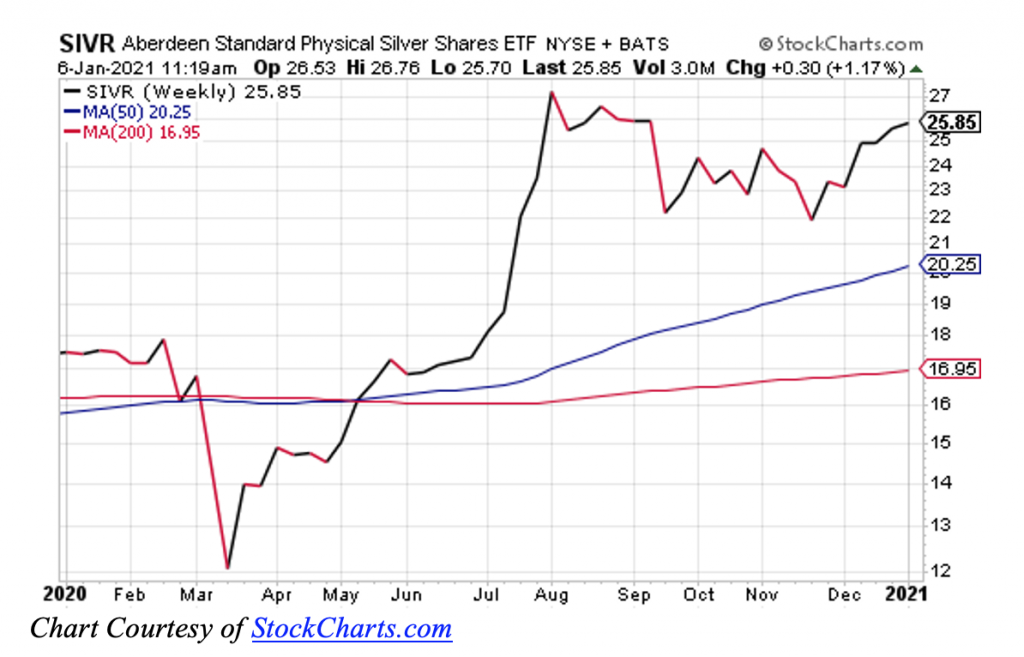

The Aberdeen Standard Physical Silver Shares ETF (NYSEARCA:SIVR) uses silver billion to track the silver spot price minus trust expenses.

SIVR gives investors pure exposure to silver by holding the physical metal in trust. Each share represents a fractional interest in the trust. The metal is held with JPMorgan Chase Bank in London in a secured vault to provide a convenient way to invest in silver without needing to safeguard it personally.

The fund is designed to track the spot price of silver perfectly. The net asset value (NAV) of the trust is based on the value of silver on an ounce price basis as set by the London Bullion Market Association at noon London time, divided by the number of shares outstanding for the fund at 4 p.m. in New York, every trading day.

In addition, investors should be aware of the tax treatment, as SIVR is deemed a collectible by the Internal Revenue Service (IRS).

As one might expect, SIVR holds one asset class with a 100% weighting in silver. A main rival exchange-traded fund (ETF) is iShares Silver Trust (NYSEARCA:SLV). SIVR so far has amassed $863 million in assets under management. Its expense ratio of 0.30% is inexpensive to hold relative to other exchange-traded funds.

SIVR seeks to offer investors a simple, cost-efficient and secure way to access the precious metals market. The fund is intended to provide investors with a return equivalent to movement in the silver spot price. The fund currently trades around $26 and is up almost 50% year over year. Its three-year return is an impressive 16.7%, and its five-year return is 14.23%.

However, I urge interested investors to conduct their own due diligence to decide whether this fund fits a particular individual’s personal portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

Helping Musicians Achieve Greater Wellness

In my spare time, I play music. I play piano, guitar, harmonica and I sing. I also write songs. It’s a fun hobby that I take seriously, and at one point in my youth, it played a big role in my professional pursuits.

One of the downsides of playing music is the repetitive use injuries that can happen after the many hours, and the many years, spent playing your instrument. I’ve had several hand issues related to my playing, but fortunately, I found someone to help me get through it.

That someone is Dr. David Allan, and he’s my guest on the newest episode of the Way of the Renaissance man podcast.

David is a Renaissance Man in the true sense. He’s an accomplished jazz guitarist, pianist and trumpet player, and his early career and formal educational background is in music. Yet like so many Renaissance Men, David is a seeker. And after pursuing his music career for a number of years, he began looking into ways to help people and his fellow musicians enhance their wellness and live better, healthier lives.

In this episode, you’ll learn all about David’s journey and his approach to integrated wellness, one that incorporates chiropractic care, posture and movement education, exercise, lifestyle and nutrition.

You also learn about David’s new wellness program designed specifically for musicians. This program is aimed at eliminating muscle, nerve and joint pain caused by repetitive use injuries, while also teaching musicians how to build good physical habits that can enhance and extend their careers.

Plus, you’ll also discover how I overcame my own persistent music-related wrist injury with David’s expert treatment.

If you are a musician, or even if you aren’t, I think you’ll find my conversation with Dr. David Allan interesting, helpful, and healing.

*****************************************************************

Lincoln on Happiness

“Most folks are as happy as they make up their minds to be.”

–Abraham Lincoln

Mindset is everything in life. Without the right mindset, you are doomed to whatever wave of mental state happens to crash onto your shore. And, as “Honest Abe” reminds us, we are as happy as we make up our minds to be. So, cultivate a mindset that’s oriented toward happiness — it’s your best chance at achieving that state of being we all desire.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods