How to Win More by Doing Less

- How to Win More by Doing Less

- ETF Talk: Entering the Organic Food Market

- Taking A Few Trips Around the Sun with A Fellow Renaissance Man

- It’s Time to ‘Be Somebody’

***********************************************************

How to Win More by Doing Less

Let’s face it, we all love winning.

I don’t care who you are, winning in life — however you define that rather broad term — is something that feels damn good. The way I look at the concept, winning is being able to bring my values into existence by achieving the goals that I’ve set. If my goals are rational, which I consider them to be, then when I achieve my goals, I will also help my fellow humans win.

Yet for most of us, the idea of winning and achieving our values comes with the corollary notion that we are going to have to do a lot more, put in way more hours, work harder and generally take on more and more tasks and responsibilities.

But what if doing less could allow you to achieve more? Now, when I say, “doing less,” I am not talking about slacking off and just letting fate’s wind sail you across life’s lake. What I am referring to here is taking on fewer overall tasks and really concentrating on getting the critical things in life right.

Another way to describe this principle in action is to hone your focus on the most important tasks at hand and thereby become a “master of selectivity.” You see, it is by concentrating your efforts on the most important priorities that are needed to achieve your goals and letting go of extraneous and often distracting tasks that you can enhance your performance in business and in life — and increase your winning!

This idea of mastering selectivity and prioritizing tasks was the subject of a Wall Street Journal article titled, “How to Succeed in Business? Do Less,” by Morten Hansen, a former management consultant and now professor of management at the University of California, Berkeley.

In the article, Hansen explained how his strategy for success at his “dream job” at Boston Consulting Group was to work exorbitant hours, a practice which he said often resulted in 90-hour work weeks. Yet despite all his time and hard work, there was one colleague that he had who put in far fewer hours, yet always had better solutions to problems than he did. Moreover, this co-worker put in a normal 8 a.m. to 6 p.m. day, never stayed late and never worked nights or weekends.

So, was this outperforming co-worker just that much smarter and talented than Hansen (as well as the rest of his colleagues)?

What Hansen discovered later in his academic research is that it’s not a case of “talent” or “natural ability” or the willingness to “work hard” that results in successful outcomes. Rather, what researchers have found that what is even more important to success is the ability to master selectivity.

“Whenever they [top performers] could, they carefully selected which priorities, tasks, meetings, customers, ideas or steps to undertake and which to let go,” wrote Hansen. “They then applied intense, targeted effort on those few priorities in order to excel.”

Hansen’s research also found that just a select few critical work practices that are related to such selectivity accounted for as much as two-thirds of the variation in performance among the subjects in a 2011 research study. “Talent, effort and luck undoubtedly mattered as well, but not nearly as much,” wrote Hansen.

So, how did the best performers in his study do this?

According to Hansen, “Rather than simply piling on more hours, tasks or assignments, they cut back.” Hansen then likened this ability to cut back and focus on what really makes the most difference to the philosophical principle known as Occam’s Razor.

Named after the philosopher and theologian William of Ockham, this principle stipulates that the best explanation in matters of philosophy, science and other areas is usually the simplest.

“At work, this principle means that we should seek the simplest solutions — that is, the fewest steps in a process, fewest meetings, fewest metrics, fewest goals and so on, while retaining what is truly necessary to do a great job,” wrote Hansen. “I usually put it this way: As few as you can, as many as you must.”

I like to apply this principle to my own life via something called the “minimum effective dose.” What this means is that you want to concentrate on doing the things that have the most impact on your results and that have the fewest extraneous elements and/or time commitments.

For example, in the realm of fitness, I engage in what’s known as high-intensity training, or HIT, to get the best strength and conditioning results in the briefest period of time and in the safest, most efficient manner.

Your editor engaging in high-intensity training.

When investing and selecting top-performing companies for my Bullseye Stock Trader advisory service, I concentrate on finding stocks with the strongest earnings, strongest relative share-price performance and stocks that are in the strongest industry groups. By focusing on these key components and filtering out much of the “noise” of extraneous data, I am better able to make good investment choices.

Finally, the principle of focusing more on less, i.e. focusing your effort on the most critical elements of a task or objective rather than becoming sidetracked by the superfluous, is something we can all apply to nearly every part of our lives.

So, if you want to win more, achieve your values and make the world a better place, then focus on the critical elements — and then get them right. Once you do that, you’ll often find that the rest of the winning falls right into place.

**************************************************************

ETF Talk: Entering the Organic Food Market

(Note: The third in a series of ETF Talks on the Millennial generation).

The French gastronome Anthelme Brillat-Savarin once wrote, “Tell me what you eat and I will tell you what you are.” Since our bodies are fueled with what we eat, we should choose our foods wisely.

The adverse health benefits of eating processed, and packaged foods is a scientific fact and is leading more and more millennials to return to humanity’s roots by seeking out natural, sustainable and organic foods for their nourishment. Indeed, a 2016 survey conducted by the Organic Trade Association revealed that 40% of millennials believe that choosing organic is an integral part of living green. At the same time, only 32% of Generation Xers and 28% of Baby Boomers agree.

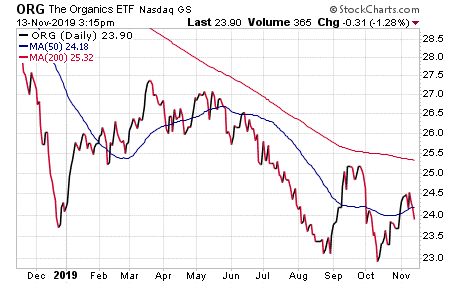

Similarly, the Organics ETF (NASDAQ: ORG) is an exchange-traded fund (ETF) that seeks investment results which correspond to the performance of the Solactive Organics Index. Thus, ORG provides investors with exposure to global companies that focus on naturally derived food and personal care items. These companies, most of which are food retailers, produce, distribute, market and sell organic food, beverages, supplements or packaging.

The top 10 countries that this ETF is invested in include the United States (34.29%), Denmark (20.91%), Australia (16.61%), Japan (11.82%), Hong Kong (6.51%), Canada (3.60%), the United Kingdom (2.38%), Thailand (1.82%), Sweden (1.18%) and Italy (0.63%).

Some of this fund’s top holdings include Chr Hansen Holding A\S (OTCMKTS:CHYHY), Sprout Farmers Market Inc. (NASDAQ: SFM), Hain Celestial Group Inc. (NASDAQ:HAIN), Ariake Japan Co Ltd. (TYO:2815), L’Occitane International SA (OTCMKTS:LCCTF), United Natural Foods Inc. (NYSE:UNFI), John B. Sanfilippo & Son Inc. (NASDAQ:JBSS) and Bellamy’s Australia Ltd. (ASX:BAL).

This fund’s performance has been solid in the short run. As of November 11, 2019, ORG is up more than 5.90% in the past month and 2.75% for the past three months. It is currently up 0.76% year to date.

Chart courtesy of www.stockcharts.com (accessed on November 13, 2019)

The fund has amassed $7.37 million assets under management and an expense ratio of 0.35%, meaning that it is cheaper to hold in comparison to many other exchange-traded funds.

In short, while ORG does provide an investor with a chance to profit from the world of organic food, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Taking A Few Trips Around the Sun with A Fellow Renaissance Man

When someone sees you at an investing conference and shouts out, “Hey, Jim Woods, I really like your stuff,” you know that’s a pathway to making a new and deep friendship.

That’s how I met former U.S. Air Force and Delta Airlines pilot Crosby Ruff. And after enjoying a beer together, we discovered that we had a whole lot more in common than just a love of investing and a military background.

In the newest episode of the Way of the Renaissance Man podcast, you’ll learn about Crosby’s journey from college student to Air Force pilot and from schoolteacher to commercial airline pilot.

Photo courtesy of Unlock Your Wealth TV

Plus, you’ll hear the fascinating story of Crosby’s close brush with death and how his decisive action during an intense nor’easter storm narrowly averted the disaster of his commercial airliner plunging into the frigid waters surrounding Newark Airport.

Crosby Ruff is an example of someone who lives the Renaissance Man ethos. A man who has exhibited extreme grace under pressure and someone who trusts himself and his training to get through the most extreme circumstances.

It’s often said that people come into your life that make a lasting impression. My friend Crosby Ruff is one of those people, and you’ll find out why in this episode.

*********************************************************************

It’s Time to ‘Be Somebody’

“Get action; do things; be sane; don’t fritter away your time; create; act; take a place wherever you are and be somebody; get action.”

–Theodore Roosevelt

The 26th President of the United States, soldier, conservationist, naturalist and writer was a very accomplished man. In the quote here, Roosevelt offers up some of his keys to productive achievement. My favorite part of this quote is “… wherever you are… be somebody.”

I take that to mean that whatever your station in life, whether you’re retired, at the peak of your career, or just getting your career going, carry yourself with the confident swagger and gravitas that tells the world you are “somebody.” The world, and you, will be better off for it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods