How To Be the Lead Mare

I’m a horseman, and I own several of these gorgeous creatures along with a small ranch in Southern California. I love my animals, and I take pride in learning about myself from one of the best teachers on Earth — the horse.

You see, the horse is a herd animal, and one that has evolved over hundreds of thousands of years to thrive in its group social structure. The horse also is an animal that requires leadership, as the highest-ranking mares (and sometimes the stallions) in the herd are leaders, directing the movement of the group to different grazing areas or water sources.

In “natural horsemanship” of the kind I practice, the horseman is tasked with taking the “lead mare” role. In doing so, the horseman must provide the leadership to his/her beloved animals that they require to survive and flourish.

This method works well, provided the horseman has the requisite confidence in his/her knowledge and skills, and provided he/she has accepted the responsibility of assuming the lead mare role. Confidence here is perhaps the most important ingredient, but confidence only comes after you’ve done the hard work to acquire the knowledge and skill necessary to assume that confident lead-mare swagger.

Have you ever noticed that truly confident people walk with their heads up? Think about that for a moment. Have you ever known a confident person who is always looking down? The answer is almost certainly no, and the reason why is because confident people don’t look down. They look up, and they take on life as the lead mare.

That lead mare role is one that I assume not only with my horses, but also with my approach to investing, and to helping readers of this publication, as well as subscribers of my newsletter advisory services.

After more than two decades in this industry, I know I have built up the requisite knowledge and skills needed to be the lead mare when it comes to helping investors grow and protect their money.

Your editor assuming the role of lead mare.

That’s why you’ll always get the sense from me through my writing and my speaking events, and if you ever meet me in person, that I am the type of person who never looks down when I walk. So, if you want to be the “lead mare” of your life, cultivate the confidence to take on the responsibilities and obligations reality requires of you, and step up to the task with the fortitude, intelligence and love required to live a beautiful existence as the best human you can be — a human that helps others celebrate the very best within us all.

And if you want to live a profoundly meaningful life, and I assume that if you’re reading this you do, then think about the world with the following mental scaffolding. There’s an old saying in the literary world that I’m fond of telling everyone that I can, and it is that a man’s life is incomplete until he has tasted love, poverty and war.

Beginning with the latter, my closest brush came in January 1991. I was just graduating from the U.S. Army Airborne School at Ft. Benning, Georgia, as the bombs began raining down on Saddam Hussein’s Iraq. As it turned out, that conflict was so short-lived that I missed out on the war leg of the complete life.

As for poverty, well, although I come from a modest middle-class American family, I would hardly say that qualifies as poverty by global standards. And aside from some lean post-college days working at the financial newspaper Investor’s Business Daily, I would also have to say that poverty has mostly eluded me.

Now, when it comes to love, I think this is where I’ve more than made up for any deficit in the other two complete life components.

Love of family, friends, career, music, literature, philosophy, nature, fitness, sport, combat and perhaps most of all, love of learning and educating are the animating forces at the core of my being. That love runs particularly deep when talking about the love I have for helping investors better understand — and better profit from — the financial markets.

In fact, you might say that this love is a form of war on poverty itself… the poverty of knowledge that keeps investors paralyzed into subpar performance. Ironically, my love for this pursuit also encompasses my own desire to be a complete man, engaging in a war to help others overcome their own conception of poverty — and in the process taking on the role of the lead mare that we all need to embrace.

So, be the lead mare — and be the very best human you can. The world needs it, and you need it.

P.S. I will be holding a subscribers-only teleconference entitled “Navigating the Markets Dire Straits” at 1 p.m. EST on April 27. Attending is free, but you must click here to register. Don’t miss out!

***************************************************************

ETF Talk: Invest in the Best with This Mega-Cap ETF

Even a cursory look at stock market history can tell anyone that buying the largest U.S. companies by market capitalization have been a strong investing strategy over the years.

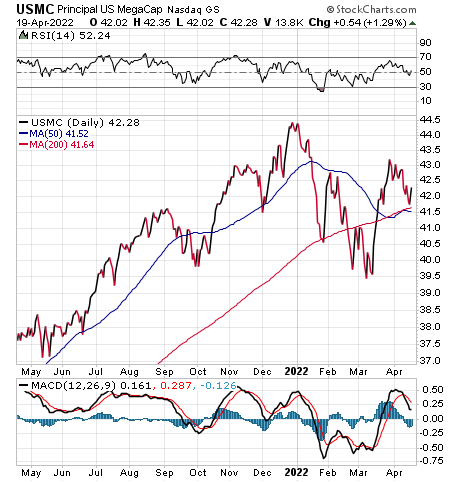

After all, growing into one of the largest companies on the U.S. stock exchanges requires an organization to be well managed and experience a long trend of success. There are many ways to invest in these companies, and one such example is to purchase shares of Principal U.S. Mega-Cap ETF (USMC).

This exchange-traded fund (ETF) invests in some of the biggest companies on the market, but its strategy is a little more nuanced than just betting on the field of large-cap stocks. USMC also weights less volatile companies more strongly within the universe of those from which to select its holdings.

Market cap, calculated by multiplying the total number of shares by the present share price, is also a factor for investors to consider. But weighting companies that have less volatility more strongly than others in a purely cap-weighted fund puts Apple Inc. (NASDAQ: AAPL) near the top of the list of USMC’s largest holdings. It is followed by more value-oriented mega-caps such as Walmart (NYSE: WMT) and Johnson & Johnson (NYSE: JNJ). For reference, tech stalwarts Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN) are the 18th, 23rd and 25th largest holdings, respectively.

In the last year, this fund has outperformed the S&P 500 with a gain of 9.5% compared to the index’s 4.9%. Part of the fund’s goal is to perform better during market downturns than a pure mega-cap strategy, and it looks to have accomplished this objective. The fund significantly outperformed the S&P in the month of April. USMC manages a total of $1.63 billion and its 0.12% expense ratio is fairly cheap, especially for a fund with a nuanced strategy. Income investors will be pleased to know USMC offers a dividend yield of 1.44%.

Chart courtesy of www.stockcharts.com

Top holdings for USMC not only include Apple Inc., 6.59%, but Berkshire Hathaway Inc. (NYSE: BRK.B), 3.99%; Coca-Cola Co. (NYSE: KO), 3.86%; PepsiCo Inc. (NASDAQ: PEP), 3.56%; and Procter & Gamble Co. (NYSE: PG), 3.53%. Further, 37.81% of the fund’s assets are invested in its top 10 holdings.

For investors interested in gaining exposure to a less volatile basket of proven winners, Principal U.S. Mega-Cap ETF (USMC) could be an ETF worth holding.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Financial Chemo Hasn’t Started Yet

Sometimes, remembrance of past things can serve as an excellent tool to help illuminate a current situation. This is true not only for our personal lives, but also for the lives of those organisms we call the financial markets and the economy.

I wanted to present you an excerpt from the April 12 edition of my daily market briefing, Eagle Eye Opener. In it, my partner and “secret market insider” in this venture shared a heartfelt anecdote about a very difficult time for him personally, and he uses it to provide what I think is one of the most powerful analogies about what the market and the economy face going forward.

So, without further preamble, here are the powerful thoughts from the Eagle Eye Opener…

One of the biggest lessons I’ve learned from studying markets for over two decades is that experiences in real life, both positive and negative, can provide valuable insights into the assessment of risks and opportunities in the economy and the market.

I was reminded of that again this weekend, as I was trying to explain to some friends why I was nervous about the U.S. economy and the markets — not right now or in the next few weeks, but instead in the coming months and quarters. I was trying to explain that, while everyone knows the Fed is hiking rates and dialing back accommodation, we haven’t even started to feel the pain from these actions — and we shouldn’t be lulled into a sense of security.

To help better explain this situation, I revisited a difficult period for my family from years ago, when my mother was diagnosed with cancer. Surprisingly, I found that experience provided a clear analogy as to why I am nervous about the economy in the months ahead.

Now, before I begin that analogy, let me be crystal clear: I am in no way equating the tragedy of cancer with economic matters. People are more important than money, and I know firsthand the carnage and tragedy that cancer can unleash on a family. That said, I think the analogy of my experience some years ago and my current concern for the economy are apt, and the analogy helped my friends understand my concern, and I hope you do as well.

In the mid-2000s, my mother was diagnosed with breast cancer. The diagnosis was a shock, as she was healthy and vibrant. As far as we could see, nothing was wrong. But clearly there was something wrong.

Notably, when the cancer was diagnosed, that’s when we all emotionally braced for what was to come. It was like we expected everything to turn bad right then. But at first, it wasn’t so bad. My mother didn’t feel bad. She had to go to numerous follow-ups that impacted her schedule and obviously there was anxiety about the future, but life generally carried on as normal while her doctors formulated a treatment plan.

As we all went through that process, with my mother still feeling fine, we were anxious, but life was mostly normal — just talks about what was to come and dealing with the doctors, etc. And, at times, we remarked to ourselves that it wasn’t so bad, and we were making the best of it.

Then the chemo began.

Chemotherapy is a necessary evil in the fight against cancer, but what damage it can do! In many ways, my family walked into the chemo part of the treatment naïve. Yes, we had heard it would be bad, but my mother was a New Yorker, and she was tough! It was awful for her and us, and while, in the end, the chemo did its job and my mother thankfully became cancer free, those months were brutal for all of us.

Turning to the economy, it’s become infected with a cancer of sorts, i.e., inflation. If left untreated, it will destroy savings, make the less fortunate even poorer, reduce corporate profits, increase unemployment and slow consumer spending. If left unchecked, inflation will end an economic expansion.

Like cancer, inflation largely goes unnoticed at the beginning. But it has now been diagnosed by the Federal Reserve and monetary officials, and the Fed has been formulating its treatment plan for the past several months. While the Fed has been formulating its treatment plan, there’s anxiety about what will be done: Rate hikes, quantitative tightening (QT), etc. However, life is continuing generally as normal, and it’s not that bad right now.

But the financial chemo hasn’t started.

Just like real chemo was a necessary evil to rid my mother of cancer, “financial chemo,” such as rate hikes and QT, is a necessary evil to rid the economy of inflation. But the economy hasn’t started treatments yet, and just like my family was taken aback by how hard those chemo treatments were first on my mother but also all of us, so too am I nervous the economy isn’t prepared for how hard this financial chemo might be for the U.S. consumer and the economy. The problem has been identified and the treatment plan formulated, but the real hard stuff hasn’t even started yet.

That’s why I’m nervous about the economy in the future. The market has not priced in the impact of all this Fed tightening and QT. Hopefully, my fears are overblown. But I worry that they are not, and while I still think we could see stocks rally short term if we get some good news on inflation (peaking), earnings (solid) or geopolitics (Russia/Ukraine cease fire), we must be cautious here, because the financial chemo to rid the economy of inflation hasn’t even started yet.

***

If you want to get access to this kind of unique market analysis every trading day, directly to your inbox at 8 a.m. Eastern, then I invite you to check out my Eagle Eye Opener right now. There’s no time like the present to gain more market insight.

*****************************************************************

More Horsemanship Wisdom

“You cannot train a horse with shouts and expect it to obey a whisper.”

— Dagobert D. Runes

The philosopher/author reminds us here that how you train a horse is as important as what you train a horse to do. More importantly, the quote here lets us know that you can’t expect a certain result if what you’ve always done is practiced the opposite of that result. If you want a successful, prosperous and epic life, you must do the things that lead to that outcome.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.