The Hidden Positive in the Fed’s Emergency Cut

- The Hidden Positive in the Fed’s Emergency Cut

- ETF Talk: An Inverse ETF Can Be Effective in Navigating Volatility

- A Visit with Our Resident Guru of Happiness

- On Becoming the Bull

***********************************************************

The Hidden Positive in the Fed’s Emergency Cut

By now, everyone knows that the Federal Reserve sprang into action on Tuesday with an emergency rate cut of 50 basis points on the federal funds rate. The move by the U.S. central bank was the first such inter-meeting cut since the 2008 financial crisis, and the reason that was cited for the action was the fear that the coronavirus epidemic has markedly increased the risk of a recession for the U.S. and global economies.

According to Federal Reserve Chairman Jerome Powell’s statement during his surprise press conference, “The virus and measures being taken to contain it will weigh on economic activity here and abroad for some time.” The Fed’s actions have told me that policy makers are trying to do what they can to prepare for what could be a whole lot of distress in the global economy during the months ahead.

Yet, the question that I’ve received from many readers, friends, family members and colleagues is: Will the Fed cut really stop the market bleeding, and will it be a positive for the economy?

Given that, as of 1 p.m. EST today, the Dow was up about 800 points, or more than 3%, you might think the answer to the first part of that question would be “yes.” However, that’s not the case. We know that, because on Tuesday, the market plunged nearly 800 Dow points despite the Fed’s move.

The more likely cause of today’s big gains is the much-better-than-expected showing by Vice President Biden in the Super Tuesday states last night. Markets are now pricing in the reduced possibility of a Bernie Sanders presidency, and a Sanders administration is something the markets definitely do not want. Keep in mind, however, that the race for the Democratic nomination is far from over, and it will likely be in flux for many more months. Therefore, look for politics to continue influencing this market.

So, if the answer to the first part of our question is “no,” then does that mean the Fed’s emergency cut won’t be a positive for the markets and the economy? Not necessarily.

To dig into this situation a little deeper, I consulted with my friend, fellow Successful Investing and Intelligence Report contributor and macro-analyst extraordinaire Tom Essaye of Sevens Report Research.

As Tom told me when I asked his opinion about the Fed’s move and its likely effects, “Liquidity is not a problem in this economy, rates are already unbelievably low and a 50-basis-point cut won’t cure one case of coronavirus.”

Yet, as he is so good at doing, Tom was able to put the Fed’s emergency rate cut into the proper historical context. And, it is in this historical context that we can see that the Fed’s move yesterday may indeed be a very big positive for markets and the economy going forward.

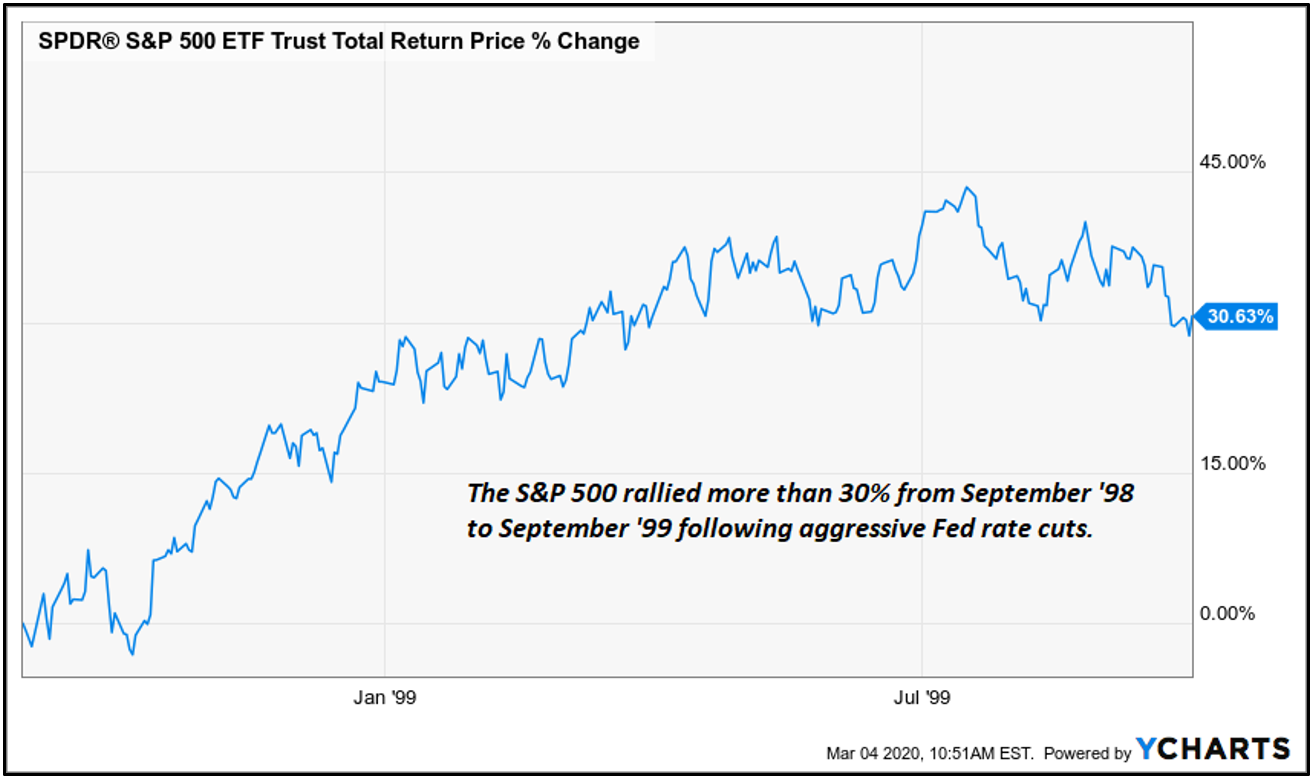

As Tom told me, “History tells us an emergency rate cut won’t help markets, but there’s an important exception here. There have been eight inter-meeting, surprise rate cuts since 1994, including yesterday’s cut. Of those cuts, five saw the S&P 500 decidedly negative over the next year, by an average margin of an 18% decline. The one big exception was 1998, where the Fed executed a surprise cut to help the economy and, after a few weeks of volatility, the stock market rallied hard. Over the next year, the S&P 500 returned more than 19% and rallied nearly 45% at the peak.”

According to Tom, the reason 1998 is a good comparison with today is because there are several big similarities between the 1998 experience and the present. For example, in 1998 the Fed cut rates to relieve stress caused by the Asian debt crisis and, more directly, the failure of the hedge fund Long-Term Capital Management (LTCM). The cuts here were proactive and were done to counter a one-off, unique event that was putting stress on the economy. And, those rate cuts worked since the Asian debt crisis subsided. Furthermore, as LTCM did not cause contagion, the economy continued to expand for two more years.

Today, the economic and earnings impact of the coronavirus is still very much an unknown. Yes, it could turn out to be a very significant market negative, or, it could be a temporary blip that we are well beyond by this summer. The point here is that like 1998, the coronavirus and its negative economic effects also are a one-off, unique event.

“If there was no coronavirus, the Fed would not be cutting rates, as the economy simply does not warrant it and liquidity issues don’t warrant it,” said Tom. “So, this emergency cut was a preventative move designed to help the economy if the coronavirus causes a material slowdown.”

Herein lies the hidden positive of the Fed’s emergency rate cut — and it is the blunting of the one-off, unique event that is the coronavirus and its potentially very pernicious crimp on the global economy. Moreover, if we see more evidence of that occurring, you can bet the Fed will step in again with more stimulus measures — and that is a definitely positive for markets and the economy.

P.S. Do you know precisely when to sell your stocks? We do, because we have a plan in place to tell us when to buy — and more importantly — when to sell our positions. That plan is the proven, four-decade-plus trend-following plan at the core of my Successful Investing advisory service.

If you want to make sure you have our proprietary “Safety Switch” in place that tells you when this market should be sold, and when it’s safe to get back into the market after you sell, then you simply must check out my Successful Investing advisory service, today.

**************************************************************

ETF Talk: An Inverse ETF Can Be Effective in Navigating Volatility

The recent fall in the market due to the global spread of the coronavirus has forcibly reminded us of the old adage, “what goes up, must come down.”

In fact, that maxim is truer now than it was when the market seemed to only go up. At a time of such global uncertainty, there are ways for investors to profit, even when the market is sliding as it did last week and one path is through the judicious use of inverse exchange-traded funds (ETFs).

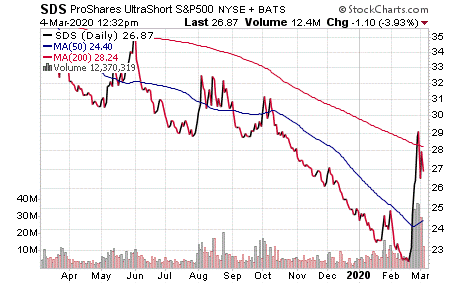

The ProShares UltraShort S&P500 (NYSEARCA: SDS) is an inverse ETF that seeks investment results which correspond to two times the inverse (-2x) of the performance of the S&P 500. The ETF provides exposure to a market-cap-weighted index of 500 large- and mid-cap U.S. firms that the S&P committee selects.

It is worth pointing out that this fund, like most leveraged and inverse ETFs, is designed to provide a positive return at a time when the S&P 500 is dropping. However, SDS, and inverse ETFs in general, do their best work when they are held for only a short time. Holding on to shares of SDS for longer periods is a tricky proposition, as it always is difficult to determine how long a market downturn will last. Thus, it is best to avoid undue risk of confusing a temporary aberration with the start of a bear market.

Furthermore, failing to rebalance SDS shares regularly, especially at a time of heavy market volatility, has the possibility of leaving investors vulnerable to performance drift from the S&P 500 index. This means that it is possible for the value of your shares to fall even as the market moves in a desirable direction.

Chart courtesy of StockCharts.com

The fund currently has more than $1.2 billion in assets under management and an average spread of 0.04%. It also has an expense ratio of 0.89%, meaning that it is more expensive to hold than some other ETFs.

According to Morningstar.com, this fund’s performance has been positive in both the short and long run. As of 3/3/2020, SDS has jumped 14.12% in the past month, 3.14% for the past three months and 12.51% year to date. This is not surprising, since the S&P 500 yielded negative returns during parts of each of those time periods.

In short, while SDS does provide an investor with the ability to profit at a time when the S&P 500 is yielding negative returns, inverse ETFs may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

A Visit with Our Resident Guru of Happiness

Happiness isn’t easy. In fact, learning how to be happy can be one of the most difficult things a person can do.

In the new episode of the Way of the Renaissance Man podcast, I visit with our resident “guru of happiness,” the great Dr. Joel Wade.

Dr. Wade’s first podcast appearance on the show last year elicited some of the best comments we’ve had on any show, so I knew it was about time for another conversation with this exceptional individual.

Photo Courtesy of Unlock Your Wealth TV

In this episode, Dr. Wade and I discuss the history of the positive psychology movement, how he got started in the field and why this subject resonated with him as a young man.

The conversation then gets into details on how we all can implement practical techniques on how to increase happiness, including how to focus our minds on what actually makes us happy, and how to look at a problem from “the outside.” We also discuss why focusing on the negative is not a good problem-solving technique.

I’ve described this episode as another home run podcast for listeners, and I’m pretty sure you’ll agree after listening to this special man’s take on a very serious, yet critical, subject to us all.

*********************************************************************

On Becoming the Bull

Back and forth, the struggle consumes us all

Trying to keep a level head

In the most unsettling of times

Today, I’ll become the bull…

–Atreyu, “Becoming the Bull”

The rock band Atreyu is known for its hard-driving riffs and aggressive vocals, but it’s also known for its powerful lyrics. The sentiment here from the band’s hit, “Becoming the Bull,” seemed particularly poignant, given the past two weeks in financial markets.

And though I doubt the song was written with a “bull market” reference in mind, the sentiment of an all-encompassing exertion to stay calm in the face of volatility is something every investor can relate to. So, whether the market is up or down, make sure that you approach your actions with an attitude and mindset that you can “become the bull” despite the most unsettling of times.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods