The Head-Scratching Trump Tariffs

I guess it shouldn’t have come as a big surprise. After all, presidential candidate Donald Trump promised to protect American jobs and right the perceived wrongs of “very, very bad trade deals.”

Still, the surprise announcement by President Trump last week of some rather substantial tariffs on all steel and aluminum imports into the United States left me scratching my head. I say that because I don’t know anyone who can give me a good argument that tariffs (which are just another form of taxation) on the American people are good economic policy.

Moreover, additional taxes that favor one industry at the expense of many others amount to everything wrong with the special-interest-run “Washington swamp” that President Trump said he wanted to drain.

In an op-ed titled, “Tariffs Are Taxes,” written by three well-known free market advocates — Larry Kudlow, Art Laffer and Stephen Moore — the authors make the following keen observation:

“President Donald Trump genuinely believes that his steel and aluminum tariffs will save thousands of blue-collar jobs. And we know from our interactions with him that he truly cares about these workers in Pennsylvania, Ohio and other Rust Belt states. We do, too, and we don’t want factories to shut down. But even if tariffs save every one of the 140,000 or so steel jobs in America, it puts at risk 5 million manufacturing jobs and related jobs in industries that use steel. These producers now have to compete in hypercompetitive international markets using steel that is 20 percent above the world price and aluminum that is 7 to 10 percent above the price paid by our foreign rivals.”

The point here is that while the steel and aluminum industries may capture a short-term, government-induced win, steel and aluminum users and consumers will suffer the loss.

Still, we hear the arguments from those advocating tariffs as a corrective measure to the perceived injustices on the trade landscape. These arguments include claims such as: 1) The domestic steel industry has been decimated, 2) We must impose tariffs because foreign governments subsidize their industries, 3) We should impose tariffs for national security reasons, and 4) We need tariffs to fight against China’s overproduction and subsidies.

Each of these arguments are refuted brilliantly by Veronique de Rugy, a senior research fellow at the Mercatus Center at George Mason University, in a great piece in Reason. For those who want to dig into the details of each refutation, I recommend giving it a read.

Yet, as investors, we have a more direct stake in the tariff issue.

In fact, the question I’ve been asked most over the past several days by friends, colleagues and readers alike is, “Will tariffs hurt the economy, and will tariffs send the stock market lower?”

On the economic front, I think it helps to put things into perspective.

According to the Commerce Department, steel and aluminum imports in 2017 were $37 billion and $10 billion, respectively. Steel production was about $100 billion while aluminum was about $2 billion.

While those might appear to be big numbers, given the scale of the U.S. economy, they are actually very small. Together, steel and aluminum imports reflect 0.2% of U.S. gross domestic product (GDP), while steel and aluminum production reflect about 0.5% of U.S. GDP. Combined, that isn’t even 1% of U.S. GDP.

Now, given the relatively minute size of the steel and aluminum industry, how could a 25% and 10% respective tariffs on each really be a negative for the economy? The answer depends on how the rest of the world reacts to these tariffs.

Consider that the European Union (EU) already has threatened to retaliate to the tariffs by imposing 25% tariffs on over $3 billion of U.S. exports to Europe. In reaction, President Trump tweeted that if the Europeans did that, he’d slap a tax on European auto imports.

And herein lies the real threat to both the economy, and the stock market — the threat of a potential global trade war.

If that happens, it will be devastating from both an economic standpoint and a stock market standpoint. A trade war between the United States and the European Union, China and other major economies will slow down the U.S. economy while at the same time ramping up inflation.

Additional taxes (tariffs) on imported consumer goods, especially from China, would hit consumers’ pocketbooks hard, while also causing prices in general to rise. That, in turn, could cause a slowdown in consumer spending that would hurt corporate profits.

Fortunately, things haven’t escalated yet, but then again, the tariffs proposed by the president have yet to become official. Still, the question remains: Will tariffs and a possible trade war cause a correction in stocks?

The way I see it, all we can say for certain at this stage of the game is that tariffs enhance market uncertainty, and enhanced uncertainty leads inevitably to increased volatility. That doesn’t mean a correction is imminent, as markets tend to climb walls of worry.

It does, however, mean that in addition to a Federal Reserve committed to hiking interest rates and unwinding its balance sheet, amid equity valuations that are very high by every historic measure, and a rising interest rate environment, the market now also must grapple with tariffs and a potential trade war.

That’s not positive for the bulls, no matter how you look at it.

***********************************************************

ETF Talk: Consider an Energy-Focused Commodities Fund

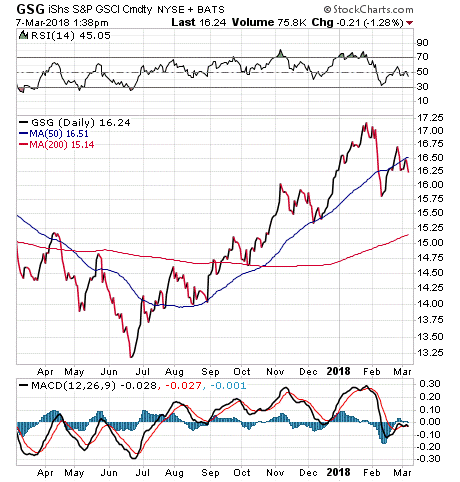

The iShares S&P GSCI Commodity-Indexed Trust (GSG) provides investors with exposure to a broad range of commodities.

The fund does this by following the S&P GSCI index, which is composed of a diversified group of commodity futures. A unique feature about GSG is that it is not a standard exchange-traded fund (ETF), but rather a commodity pool.

The commodity pool uses investor contributions as leverage in the commodities trading markets. Another distinction is that commodity pools are regulated by the Commodity Futures Trading Commission and not the Securities and Exchange Commission (SEC).

GSG does not hold contracts in the underlying commodities (energy, industrial and precious metals, agricultural and livestock) like many other funds, but instead holds only long-dated futures contracts on the GSCI itself, as well as substantial cash and treasury bills as warranted. Investors can use GSG as an easy way to diversify their portfolios, since the fund’s huge total assets of $1.45 billion and daily trading volume of 1.2 million give it great liquidity.

In terms of offering exposure to various commodities, GSG more or less covers the normal broad spectrum. However, the fund does place a heavier emphasis on energy commodities. WTI crude, crude oil, natural gas and other energy commodities make up 61% of the index’s exposure. Agriculture commodities account for 16%, while industrials metals compose 11%, livestock take 7% and precious metals comprise 4%.

GSG is something of a turnaround play. The fund, launched in July 2006, originally traded above $30 a share before falling by more than half in 2014 and 2015. The fund’s one-year return is 4.48%, and it currently is almost 25% above its intraday low of $13.17 on June 22, 2017. GSG carries a rather high expense ratio of 0.75% and does not pay a dividend.

For investors who are seeking a convenient way to make a play on the overall commodities market, I encourage you to consider the iShares S&P GSCI Commodity-Indexed Trust (GSG).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**********************************************************

On Freedom, Fast Money and Sin City

What’s the one thing you can do to increase your freedom?

While some might say it’s getting politically active and working to enact legislative change, I say there’s something much more personal — and eminently easier — that you can do to increase your freedom quotient.

And, the best part of this freedom-enhancing move on your part is that you’re also going to have a lot of fun in the process.

You see, the one thing you can do to increase your freedom is to get richer.

Yes, accumulating wealth is perhaps the best way to increase your personal freedom. The reason why is that having financial peace of mind allows you the freedom to do what you want — and to do it on your own terms.

Fortunately, increasing your wealth doesn’t have to be a mystery. In fact, all it takes is a little discipline, a little confidence and a little knowledge.

And, when it comes to the knowledge component, I am proud to announce that I, along with my investment advisor partner and world-renowned economist, Dr. Mark Skousen, will be teaming up to help provide you with the knowledge you can use to supercharge your freedom.

Along with Eagle Financial Publications Publisher Roger Michalski, Mark and I will be holding a special event we’re calling the “Fast Money Summit” at this year’s FreedomFest conference.

Known as “The World’s Largest Gathering of Free Minds,” FreedomFest takes place from July 11-14, 2018, at the Paris Resort, Las Vegas, Nevada.

Dr. Skousen and I will start the summit with a special session of our Fast Money Alert service, revealing our winning formula for successfully maneuvering through the treacherous marketplace with our own special brand of fundamental and technical analysis.

In the past year, we’ve used our system to make substantial profits, including a stock that rose 120% in only six months.

Our session will include a specific stock recommendation that has equal potential to double in price in 2018.

Then you will meet with our experts in the “Eagle’s Nest,” a designated room for subscribers, and hear them reveal their most valued secrets to make you a much better investor and speculator. Michalski will be the moderator.

The Fast Money Summit also will feature some of the best and brightest of the investment field, including such luminaries as Jim Rogers, Donald Smith, Rob Arnott, Gary Smith, Doug Casey, Peter Schiff, George Gilder, Mark Mobius, Keith Fitz-Gerald, Alex Green, Robert Kiyosaki and many, many more.

If you want to put yourself on the path to achieving more personal freedom, then this event is aimed directly at you.

And, if you register for this event by March 31, you’ll get a very special discount price — and one that increases your freedom even more by increasing your savings!

We hope to see you there.

*********************************************************************

Thoughts from the Monkey Cage

“Democracy is the art and science of running the circus from the monkey cage.”

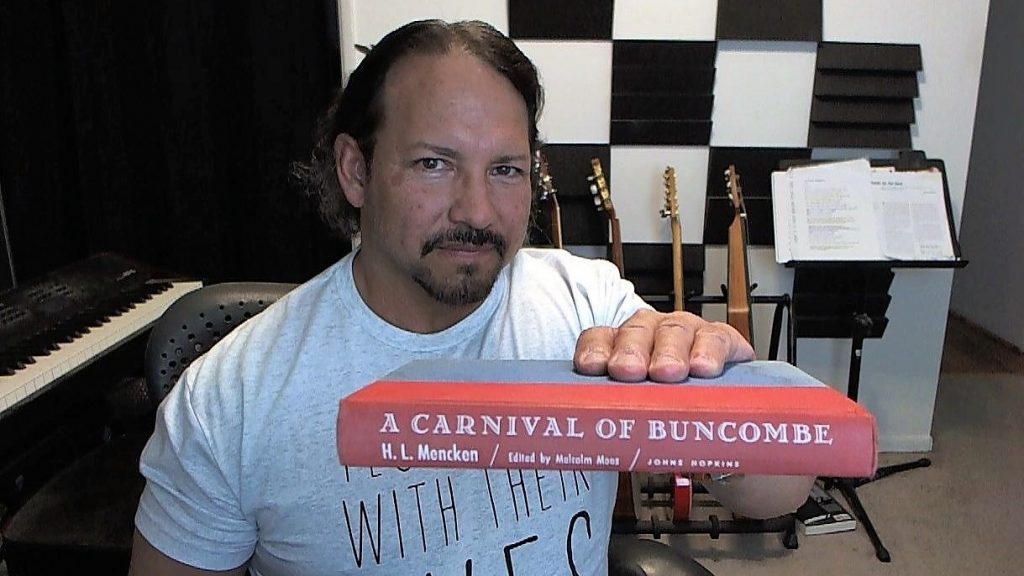

— H. L. Mencken

If you write for a living, you owe at least a modicum of debt to the great Henry Louis “H. L.” Mencken. Known as the “Sage of Baltimore,” the journalist, cultural critic and satirist was one of the wittiest observers of society that anyone has ever had the pleasure of reading.

If you’ve yet to read any of Mencken’s work, I highly recommend doing so, and not just simply for the pure pleasure of his prose (although that’s reason enough). The broader reason is that in an era of ludicrous and concept-destroying political correctness, a precision critic of political speech such as that found in Mencken’s “A Carnival of Buncombe” will teach you a lot about how to put into proper perspective the rhetoric you hear from both sides of the political aisle.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.