‘Harvey,’ Heroes and Market Bravery

I don’t like the name Harvey. And, after the events of the past week in Houston, I really don’t like the name Harvey.

Ok, if your name is Harvey, I apologize. And hey, in the interest of fairness, I do like the actor Harvey Keitel, and the tire magnate Harvey S. Firestone, Jr.

However, I really despise the devastating destruction wrought by Hurricane, and then Tropical Storm, Harvey, on the people of Houston, Southeast Texas and quite possibly Louisiana and other regions flooded by this epic storm.

Watching the heartbreaking coverage of those imperiled by the flooding, I thought of what Francis Bacon once famously wrote, “Nature, to be commanded, must be obeyed.”

And while I completely concur with this premise, sometimes Mother Nature acts so harshly that she is just the rightful subject of pure fear, and genuine awe. Such is the case over the past week, as Harvey has dumped more than 50 inches of rainfall on the Houston and surrounding areas. Sadly, the devastation isn’t over yet.

The human cost from Harvey is going to be incalculable, as will be the economic cost of the storm’s damage. Certainly, the region’s economy will be hit with losses in the hundreds of billions of dollars. And for individuals, the losses will be, in many cases, total.

Yet amidst the devastation, there have been so many great stories of heroism, feats of bravery and people coming to the aid of those in need that I wanted to be sure they are acknowledged.

I also want to let you know that you, too, can be a hero by donating any extra money you might have to the charitable organization of your choice.

(Photo by Scott Olson/Getty Images)

A friend of mine is affiliated with a group called Upbring, and they are doing great work to help the people of Houston. I have donated to them, and I hope you will too. The best part about donating is that it’s easy, simply follow this link.

As for the financial markets, well, they too are acting bravely in the face of Harvey.

Rather than selling off in response to the disaster, stocks are holding firm. In fact, all three major indices (Dow, S&P 500 and Nasdaq) are up nicely over the past five trading sessions.

Take that, Harvey.

The market’s bravery in the face of what is likely to be major financial damage shows an understanding that as bad as this storm may be, storms do not generally have a lasting effect on markets.

Hurricane Katrina and Superstorm Sandy had impacts on the local economies, but the broader macro influence was not big. Moreover, Harvey should not, and has not, changed Wall Street’s stance on the macro influences capable of keeping this bull market running. Those influences still are earnings, economic data and most importantly, tax reform.

Until we see a storm surge on one of those fronts, markets will keep up their bravest face.

Upcoming Appearances

Dallas MoneyShow, Oct. 4-6: If you’re in the “Big D” in early October, then come by the Hyatt Regency Dallas and see me, as well as many other great industry speakers, at the Dallas MoneyShow. I will be giving a presentation on Friday, Oct. 6, 8:00 – 8:45 a.m., titled, “5 ETFs to Fight the Fake News.” For your complimentary tickets, go to Woods.DallasMoneyShow.com.

*************************************************************

ETF Talk: An Income Fund that Rewards the Patient Investors

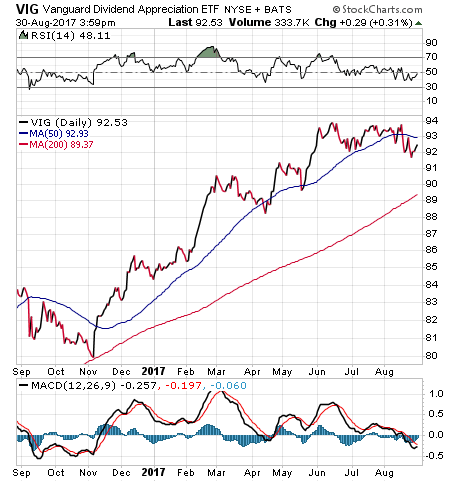

This week’s exchange-traded fund, the Vanguard Dividend Appreciation ETF (VIG), focuses on a strategy based neither on value nor growth investing. Instead, VIG selects U.S. companies that have appreciating dividend yields.

Specifically, VIG holds companies that have increased their annual dividends for 10 or more consecutive years, known to some as the “dividend achievers.” This distinguishes VIG from many other dividend funds such as the Vanguard High Dividend Yield ETF (VYM), which typically focuses on stocks that have the highest current yield.

Dividends not only provide a steady stream of income, they also reduce a portfolio’s risk profile. This has helped VIG avoid some of the market’s weakness from time to time. For example, during the 2008 crisis, the fund decreased by a little over 30% while the S&P 500 shed over 37%.

VIG is one of the most popular ETFs in the U.S. market, managing $24.55 billion in total assets, and has an average daily trading volume of $51.89 million. VIG is fully invested and employs a passively managed, full-replication strategy that focuses on large equities, with the philosophy that income-producing equities will outperform other types of equities over the long term.

VIG has a distribution yield of 2.09% and a low expense ratio of 0.08%, making the fund cheap to hold. It pays a quarterly distribution. Year to date, the fund has returned 8.08%, compared to the S&P 500’s 8.99%. Over the past 12 months, VIG has risen by about 11%.

VIG’s top five holdings are Microsoft Corp. (MSFT), 4.38%; Johnson & Johnson (JNJ), 4.18%; PepsiCo Inc. (PEP), 4.07%; 3M Co (MMM), 3.32%; and Medtronic PLC (MDT), 3.19%.

The fund is 28.75% invested in industrials and 17.16% in health care. Other areas of focus are consumer defensive, technology and financial services.

For those who are looking for appreciating long-term income, the Vanguard Dividend Appreciation ETF (VIG) may be worth adding to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

Markets, Tax Cuts, A Tale of Two Cities… and Politico?

The hope of tax reform. It’s what I’ve been telling you, as well as telling readers to my Successful Investing newsletter, has been the key to this market rally since November 9, 2016.

That, of course, is the day after Donald Trump was elected president. And ever since then, markets have rocketed higher on the hope of that President Trump and a Republican Congress could put in place key elements of the pro-growth economic agenda he told America he wanted to enact.

That agenda is comprised of regulatory rollback, Obamacare repeal/replace, and tax reform that includes a reduction in the corporate tax rate, and a foreign profit repatriation holiday. And while there has been regulatory rollback, there was no Obamacare repeal and replace.

Two weeks ago, the remaining leg of the pro-growth agenda — corporate tax cuts and a repatriation holiday — appeared to be in serious trouble.

The reason why had a lot to do with the reaction to President Trump’s stunning remarks regarding the deadly violence in Charlottesville, Virginia. Recall that last week, I mentioned that the president’s “both sides to blame” for the violence comments had alienated key members of his own party, and especially key members in Congress that he needs to help pass tax reform legislation.

Apparently, the comments also roiled the president’s key economic advisor, Gary Cohn.

According to multiple news reports, Mr. Cohn was “upset” and “disgusted” with the president’s response to the violence in Charlottesville, and was actually considering leaving the administration because of it.

That news on Thursday, Aug. 17, resulted in the biggest, one-day decline in markets in months, as stocks sank nearly 2% across the board. Now, it’s not that Wall Street necessarily loves Gary Cohn, although he is trusted and respected by the Wall Street elite. The bigger issue is that Mr. Cohn’s departure would be interpreted as a true tax reform killer. And if tax reform is dead, then so too is the Trump bull market.

Fortunately, this tale-of-two-cities drama took a bullish turn the following week, and it did so thanks to a story that appeared on the Washington-insider website Politico.

The article implied there was substantial progress being made on corporate and personal tax reforms, which served to reverse the “Cohn resignation rumor” decline in stocks. And given the absence of any other material catalysts that Tuesday, Aug. 22, stocks rallied on that report.

The bottom line here is that these two extreme days in markets were prompted by separate media reports regarding the fate of tax reform. The negative report of a potential Cohn resignation (which proved untrue) took stocks down hard and fast. Then a positive report on tax reform and the progress made by key administration and Congressional figures sent stocks soaring.

Now, do you have any doubt remaining that what I’ve been telling you about tax reform being the key to this bull market is true?

I should hope not.

***************************************************************

Wisdom From A Bottle

“Whatever you do, pour yourself into it.”

— Robert Mondavi

I often find wisdom in a bottle of wine, but this week, I also found wisdom written on a cork. Master wine maker Robert Mondavi knows that the key to creating something truly great is to give it your all. And by “all,” I’m not just talking about the old college try. By “all,” I mean you must be willing to sacrifice just about everything in the service of your goal. It is this spirit that makes a person, a culture and a country great. And, it’s this spirit that will help our friends in Houston recover, rebuild and prevail… and, in the process, give a big middle finger salute to Harvey.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.