Giving Thanks and Naming Names

- Giving Thanks and Naming Names

- ETF Talk: A Lean, Green Alternative-Energy Machine

- Audio Essay: A Revealing Plane Ride with the President-Elect

- On Bad Taste

***********************************************************

Giving Thanks and Naming Names

Tomorrow is Thanksgiving Day. And much like everything else in this coronavirus-infected 2020, this year’s celebration will not only look and feel different, it will also be different. I say that because this year, we all should have a new and profound appreciation for society’s simultaneous vulnerability to nature and its rational resolve and steadfast determination to prevail in the face of a pandemic.

This year, perhaps more than in any year I can remember, we have to stop and really give thanks for our survival to the industries, companies, corporate leaders, inventors, research scientists, doctors, nurses and front-line workers who have allowed us to continue to live as close to normal as we can during extremely difficult circumstances.

Atop my Thanksgiving list of heroes to thank this year are the producers and tech entrepreneurs that make the products that permit us all to live, work and attend school from our homes.

Here, I am specifically referring to companies such as Zoom Video Communications (ZM), whose software enabled businesses, universities, doctors and myriad other organizations to meet up virtually and conduct the business of life via the internet. I’m also referring to Microsoft (MSFT), whose software and cloud storage business also makes working from home possible. And of course, Amazon.com (AMZN), whose logistical prowess and seemingly unending list of goods to buy with one click of the mouse make shopping for essentials safe, easy and fun.

Of course, these are just three of the companies that make the technology that is critical to keeping us connected in an otherwise isolated viral world. And much to society’s great benefit, there are so many more companies that do this that I couldn’t even begin to justly innumerate them all. So, for all of the great producers, tech companies, entrepreneurs, engineers, etc., that make a connected world possible, I am thankful for you.

Then, there’s the medical, pharmaceutical and scientific research communities. These brilliant men and women figured out how the virus works, how the virus spreads, how to treat the virus and what drug therapies could best ameliorate the virus’ harm. And very soon, we are likely to have at least three new vaccines available to inoculate the world against COVID-19. If these vaccines are successful in returning society to a pre-COVID-19 state, we all should be thankful for all involved in literally saving the world.

Yet, when I think of being thankful, I don’t want you to get the impression that my thanks here are just general in nature. Rather, when it comes to truly being thankful, I’m inclined to name names. You see, being thankful is all about valuing the individuals in your life. It’s all about embracing and acknowledging the gratitude one has for the people close to you that have had a direct hand in your life and whose very existence enhances one or more aspects of your life.

In my case, this thanks and gratitude extends to so many professional and personal colleagues, friends and family members, that I couldn’t begin to justly enumerate them all. And while I know I am just going to be scratching the surface here, I think that those closest to me deserve to be thanked, by name, in public, right here in the digital pages of this column.

To my colleagues at Eagle Financial Publications, I am thankful for you for always doing your best to make me look good and for working so hard to help us all achieve success. Special thanks go out to my publisher, Roger Michalski. Thank you for always “having my back” and for the support and diligent care you’ve taken with me for these 15-plus years. I’m also thankful for my editorial director, Paul Dykewicz, for his care, attention to detail and for always keeping the trains running on time. And thanks to the “big boss,” Salem Media President David Evans, whose expert stewardship makes it all possible.

I also want to thank my editorial staff: Toni, Nicholas, Tyler, Emily, Jason and Josh, for their most excellent work. Big thanks to my marketing minds: Kim, John, Wayne, Shawn, Bob, Doug, Barry, Kevin, Kate, Elaine, Peter, Samantha, and especially Grant, whose tremendous skill keeps us all in the money. Heartfelt thanks also go out to my friend and public relations pit bull Darlene March, who believed in me from day one, and whose respect I am proud to have earned.

I am also eminently thankful for my friend and colleague Tom Essaye of Sevens Report Research, whose brilliant insights on the market are the best I’ve ever seen. Equal thanks go to my friend and go-to research resource David Fabian, for his savant-like knowledge of exchange-traded funds. And finally, I am supremely thankful for my relationship with fellow Eagle newsletter editor and my Fast Money Alert co-editor Dr. Mark Skousen. Your passion for investing, promoting rational ideas and defending liberty reminds me each day that I have an intellectual brother in arms at my side.

Heartfelt thanks go to all of those involved in my podcast project, “Way of the Renaissance Man.” I am truly thankful for all of the fantastic renaissance men and women who have been a guest on the show over the past three seasons. I’m also thankful for my sound and production guru, Michael Terry, whose expertise assures me that my product will be delivered with the utmost quality. And of course, I am eternally thankful for my producer, web guru, voiceover pro and most fabulous friend, Heather Wagenhals. I could not, and would not want to, do this without you.

Further Thanksgiving love goes out to so many others in my life, but especially to those whose very existence makes my existence happier. To my good friends Les Wise, Charles Redondo, Stewart Margolis, James Williams, Rich Checkan and Kyle Woodley, I love you all and value you like brothers.

To my music teacher and friend, Brent Larimore, for his caring tutelage and constant push to make me better. And to my friend Kathy Quinn of Moon Owl Nocturnal Eats, whose life inspires me and whose gourmet meals and desserts arouse my senses.

Finally, and most of all, I am thankful for you, the reader of this publication and my many other advisory publications. It is your patronage, your confidence, your trust in me and your decision to entertain my ideas each week that I am exceedingly thankful for.

Without you, I could not do what it is that I love to do every day, and that makes me thankful for you and the life you’ve allowed me to live.

So, happy Thanksgiving to you, from the very best and most thankful within me.

***************************************************************

ETF Talk: A Lean, Green Alternative-Energy Machine

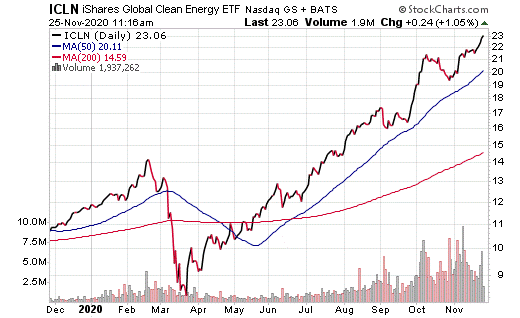

For investors looking to “go green,” the iShares Global Clean Energy ETF (NASDAQ:ICLN) may be a fund worth looking into. The fund, which was created in 2008, tracks a market-cap-weighted index of the 30 most liquid companies involved in businesses related to clean energy.

In this fund, “clean energy” is defined as companies involved in biofuels, ethanol, geothermal, hydroelectric and solar and wind industries. Not only does this portfolio consist of companies that produce energy in such a manner, but it also includes the companies that develop the technology and equipment used in the process.

ICLN has holdings that are both domestic and international, which gives investors access to clean-energy stocks around the world. Though this ETF may not be a core holding for most, it may be considered a savvy satellite holding, as it covers a corner of the market likely to do well during a green-energy-friendly Biden administration. With a new administration poised to reign in 2021, alternative energy stocks are gaining traction, as the coming year may be more focused on clean and renewable energy resources versus coal and oil.

For investors seeking more targeted exposure within the clean energy sector, ICLN provides multiple options for delving more deeply into renewable energy.

ICLN has an expense ratio of 0.46% and a dividend yield of 0.69%. It has $2.59 billion in assets under management and total net assets of $1.96 billion. More impressively, the fund’s year-to-date (YTD) daily total return is 92.13%.

Source: StockCharts.com

Unlike many big-name funds, ICLN has seen a gradual increase in both its 50-day and 200-day moving averages year to date. However, much like all other sectors, the fund saw a huge drop in mid-March, courtesy of COVID-19. Since that drop, it’s seen a great upward trend, surpassing its all-time high of $14.23 in February. As of today, it’s hit a new all-time high of $22.89 — a nice Thanksgiving bounty.

ICLN’s holdings are primarily in three sectors: 52.33% in Utilities, 28.71% in Technology and 16.45% in Industrials. Its top five holdings include First Solar Inc. (FSLR), 5.28%; Xinyi Solar Holdings Ltd. (00968), 5.04%; Orsted A/S (ORSTED), 4.86%; Contact Energy Ltd. (CEN.NZ), 4.82% and Meridian Energy Ltd. (MEL.NZ), 4.82%.

In sum, the iShares Global Clean Energy ETF (NASDAQ:ICLN) may be an interesting option for investors looking to expand their secondary holdings and break into the clean-energy space. With a portfolio made up of not only companies using alternative energy sources, but also the companies working to develop the technology and equipment to harness it, there is a plethora of alternative-energy stock options, both domestic and international.

However, investors should always do their due diligence to determine if an ETF is appropriate for their portfolio strategy.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Audio Essay: A Revealing Plane Ride with the President-Elect

What’s it like to take a cross-country plane ride with now President-elect Joe Biden?

In this special audio essay, I read my 2008 article, “We All Scream for Ice Cream: A Joe Biden Tale.” This is a piece I wrote that details my impressions of the then-senator after I sat next to him on an airplane for nearly six hours. I also add a new introduction to the essay to put it in its current and proper context.

Interestingly, what I found out about the man while doing just that is sure to make you pause, and make you laugh out loud.

If you want to find out more about one very peculiar habit of our next president, then this special audio essay is for you.

******************************************************************

On Bad Taste

“The world has bad taste; or haven’t you noticed yet?”

— Salman Rushdie

This quote from the great novelist was spoken to his friend and equally brilliant fellow novelist, Martin Amis. The two had just watched a very bad film together, and Amis had asked Rushdie about why people liked such drivel. Rushdie’s dry and witty response is characteristic of the British literary lion, but it also resonates with me as an American-made man.

You see, there is much in the world that I don’t have a taste for, but that just makes the things I do have a taste for burst with that much more flavor. So this Thanksgiving, savor the flavors of your life — because whatever your tastes are, they’re yours to relish.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods