Get Ready to Achieve Economic Freedom

“Economic freedom is available to every American.”

This is the positive message direct from the mind of my friend, colleague and former editor of the Weekly ETF Report, Doug Fabian. Now, long-time readers of this publication might remember that it was just about a year ago that Doug handed the reins over to me, along with the editorship of the Successful Investing advisory service.

Given the approximate one-year anniversary of my taking control of this publication, I thought I would give readers a treat by presenting some highlights of a conversation I had with Doug just this morning.

We start off with a discussion of the markets, including his thoughts on the recent bout of hyper-volatility. We then addressed how investors should approach the current market, and what they should be doing now with their portfolios.

Finally, we talked about Doug’s new project, a new podcast and website called The Science of Economic Freedom. I am very excited to tell you about this, as I think Doug’s uber-positive message has the potential to help millions of people define, and then achieve, their vision of economic freedom.

So, let’s dig in!

Jim Woods (JW): Doug, tell me what you think about the recent bout of market hyper-volatility. Is this something investors should be worried about, or is this all part of the natural ebb and flow in financial markets?

Doug Fabian (DF): We went through an extended period of low-volatility in markets. Since the presidential election, we went nearly 16 months without a single down month for stocks. I can’t remember a time we’ve ever seen that kind of constant, stair-step rise in markets, and that’s what was unusual.

Yes, we hit an air pocket in late January/early February. While there were plenty of reasons why, those reasons aren’t as important as the fact that markets normally ebb and flow. It also is my opinion that we are going to continue to see more bouts of volatility as the year unfolds, and that’s chiefly because we are in a rising-interest-rate environment, and because stock valuations have climbed to the higher end of their historical norm.

JW: What do you suggest readers do right now, in general, to prepare themselves and their money for a year of increased volatility and a rising-rate environment?

DF: I think people should make sure that they look at their money in terms of different “buckets.” You should have a safe-and-secure bucket where you hold cash and cash alternatives. Then you have your taxable account bucket, and your retirement account bucket. Depending on where you are age wise, you should define your risk profile, and then you should seek the highest returns associated with that risk.

If your time horizon and risk profile allow it, you should use bouts of volatility such as the recent market pullback to your advantage. That means adding capital to the best stocks, exchange-traded funds (ETFs) and mutual funds out there. Finally, we are in tax season, and that means we should be taking steps to minimize our tax liability. Taxes matter, and managing your tax situation with respect to your investments is an often overlooked, but critically important, part of your overall investment strategy.

JW: You have a new project you’ve just kicked off, and I love the title. It’s called The Science of Economic Freedom. It’s both a podcast and a website, and I am really excited to introduce it to my readers. Tell us more about this project, what its goal is and how readers can benefit from your wisdom on these matters.

DF: The Science of Economic Freedom is something that I’m extremely excited about, as I think it has the potential to positively affect thousands, if not millions of people if I do it right. You’ve heard me talk before about my personal passion in life, and that passion is to be a positive influence on the lives of the people I touch. With The Science of Economic Freedom podcast, I get a chance, thanks largely to the help of my partners at Mercer Advisors, to present a free educational initiative to the audience designed to not only educate, but also to help provide the requisite information and motivation to the audience to help them with their investing endeavors.

Much of the reason why I started this new project is because of the overwhelming lack of financial literacy in the country. I’ve read statistics showing that some 70% of people in the United States don’t know how to handle money. That’s an appalling statistic I’d like to improve, and one that this podcast and website is dedicated to changing.

More importantly, The Science of Economic Freedom is not just about investing. It’s also about basic money and personal finance concepts. Concepts such as how to manage taxes, estate planning, insurance planning — and, yes, investing concepts such as asset allocation are covered as well. Just about everything that contributes to achieving economic freedom is a topic of conversation.

And yes, economic freedom is available to every American, but few people actually achieve that freedom because they haven’t been taught how. Many people unknowingly make the same mistakes over and over again, and this is a situation I feel compelled to correct.

I think that with the proper knowledge, and the proper motivation, every American can live out his or her own version of economic freedom — and that’s what the new podcast and website is all about.

JW: Thanks Doug.

I strongly encourage you to check out the great audio content, articles and resources at The Science of Economic Freedom website. You can start anywhere, but I recommend starting out with Episode 1 and listening to each episode in order. Doing so will provide you with the essential basic concepts or how to think about, and ultimately achieve, economic freedom.

I really think you’ll find it a valuable resource, and a great adjunct to what you read in this publication, and to the information you’ll find in my Successful Investing, Intelligence Report and Fast Money Alert advisory services, all of which can be found at JimWoodInvesting.com.

And once again, a big thanks to Doug Fabian for his wisdom and insights.

***********************************************************

ETF Talk: A Less Risky Way to Short the Bond Market

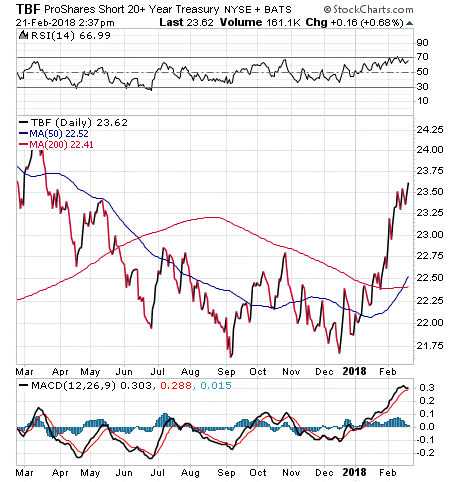

This week’s featured exchange-traded fund (ETF), ProShares Short 20+ Year Treasury (TBF), is another way for investors to take advantage of widely expected interest-rate hikes by the Fed.

Similar to the ProShares UltraShort 20+ Year Treasury ETF (TBT), which was the topic of last week’s ETF Talk, TBF seeks to deliver daily results that equate to the inverse of an index that consists of U.S. Treasuries with maturities longer than 20 years. Compared to TBT, which uses leverage to obtain double the inverse return of the same index, TBF is a less aggressive and less risky fund.

Since these inverse bond ETFs are designed to move in the opposite direction of the U.S. Treasuries Bonds index, many investors use them to hedge against interest-rate risk.

TBF has $722.42 million in total assets and has an average daily trading volume of $17.37 million, making it a very liquid and tradeable fund. While TBF is not the segment leader, recent concerns about rising interest rates have led the fund into an upward trend.

For investors who are wondering why TBF only holds Treasuries with maturities longer than 20 years, it is because in the event of a series of interest rate increases, Treasuries that are locked into longer maturities will be hit the hardest. Consequently, achieving a return that is the inverse of the performance of those Treasuries in such a case will yield the most gains.

In the chart below, you can see that TBF had been on a slow path lower since the beginning of 2017. However, that trend is beginning to reverse rapidly in 2018 due to the wide expectation that the Fed plans to raise rates during the year. TBF’s performance in the last six months is -0.22%, but its year-to-date return is 3.53%. TBF has an expense ratio of 0.94%.

As an inverse ETF, TBF’s portfolio shorts treasuries rather than holds them, so its holdings are listed with negative percentages. TBF’s top holdings are -23.45% in Ice 20+ Year U.S. Treasury Index Swap Societe Generale, -19.46% in Ice 20+ Year U.S. Treasury Index Swap Citibank Na, -7.75% in Ice 20+ Year U.S. Treasury Index Swap Morgan Stanley & Co. International Pl and -4.55% in Ice 20+ Year U.S. Treasury Index Swap Goldman Sachs International.

For investors seeking a relatively less volatile way to benefit from the upcoming Fed interest rate hikes, I encourage you to look into ProShares Short 20+ Year Treasury (TBF).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************************

What Valentine’s Day Teaches Us About Investing

Last week, Feb. 14, America celebrated Valentine’s Day. This is the day we’ve designated to celebrate our romantic relationships. It also is a day where many people spend a lot of money on things like flowers, candy, teddy bears, champagne and dining out… all in an effort to revel in their relationships.

While I get this impulse, for me, Valentine’s Day also serves another function. For me, Valentine’s Day can be used as a pedagogic tool that can help us learn and understand some of the key principles involved when finding the right investments.

You see, when it comes to matters of the heart, most of us feel as though this part of our lives is directed and governed by intense emotions. These emotions are essential to human beings, and life would be rather empty without them. Perhaps that’s why the longing for love in all its forms (romantic love, love for a child and immediate or extended family, love of career, money, health, etc.) are so sought after by virtually everyone.

Yet my view here is that the intense amorous emotions we feel on so many fronts are a direct result of our rational (and sometimes irrational) needs. For example, the search for romantic love is based largely on our biological need to reproduce. That need burns deep in most humans, and it compels us to throw ourselves headlong into the search for the right mate.

When it comes to investing, our rational need is to protect and grow our money so that we can use it to fund our retirements, or to live a life free of financial stress, or to be able to live a more prosperous and luxurious existence.

And much like we search for the right romantic partner/life mate, proper investing involves searching for the right stocks, exchange-traded funds (ETFs), mutual funds and other asset classes that fit our rational needs.

In the case of a romantic partner, most of us want the excitement and passion of a physical, emotional — even spiritual, connection. Most of us also want the safety, stability and security of a rational spouse that can provide us with the emotional comfort we need to get through life’s inevitable pain.

Of course, most of us know that combination is not very easy to find in one person. Yet if we’re lucky enough to find it, you have to cherish and nurture that find — and I think that’s what Valentine’s Day is all about (at least, it is for me).

Now, when it comes to your money and investments, the right stocks, ETFs, mutual funds, etc. also aren’t very easy to find.

To find the right asset mate, you have to define your rational goals, which include identifying your time horizon; assessing your risk profile, evaluating your overall financial picture and determining a host of other considerations.

It is only after you know what you want that you can find the right “investment mate.”

For example, if you are looking for a stable, safe and secure life mate, then you usually don’t want to go for the “bad boy” or the “wild girl” type. And if you’re looking for a stable, safe and secure investment, then you don’t want to buy high-yield junk bonds or bitcoin. Here you would be better off with a bond fund and/or dividend-paying equities.

Of course, there is one thing that investing has over the search for that perfect Valentine, and that is diversification. Every investor can construct his/her portfolio with a combination of equities, fixed income and alternative assets that fit his/her rational goals. But unless you have a very open situation, it’s hard to “diversify your portfolio” when it comes to mates.

Score one here for investing over the search for the perfect Valentine — although I doubt any of us would trade a winning investment portfolio for the perfect spouse.

Fortunately, you don’t have to choose one or the other. You can celebrate both by making the right investment choices for your rational goals — and by finding the right person to be that special Valentine.

So, if you have that special person, celebrate that on Valentine’s Day… and every day.

*********************************************************************

On the Importance of Communication

“The way we communicate with others and with ourselves ultimately determines the quality of our lives.”

— Tony Robbins

As humans, we face two alternatives when it comes to persuasion. We can have conversations, or we can employ violence. Fortunately, our world is dominated by the conversation option. Yet, that hasn’t always been the case. In fact, the historical record is basically a ledger of times when conversation failed.

Now, when it comes to individual relationships, the importance of communication cannot be denied. The better quality your communication is, the better quality of experiences you’ll have. And, the better your experiences, the richer and more beautiful your life will be.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.