Gentlemen, Start Your Investing Engines!

“There are only three sports: bullfighting, motor racing, and mountaineering; all the rest are merely games.”

— Ernest Hemingway

Hemingway’s inclusion of motor racing as one of only three real sports is often quoted with a sense of pride among those of us who pour our love, time and, yes, considerable financial resources toward this endeavor.

Speaking of the latter, there’s another saying that’s common in the auto racing world, and it goes like this:

Do you know how to make a small fortune in auto racing? You start with a big fortune.

This apropos adage is certainly one that amateur, semi-pro and even professional auto racing team owners discover very quickly, and that’s because when it comes to a costly venture, few things add up as fast as motor racing.

Now, the reason this subject is at the forefront in my mind today is because over the weekend, Formula 1 held the United States Grand Prix at the Circuit of the Americas in Austin, Texas. I wasn’t able to attend the event, but I had several friends who did and they told me about the excitement and pageantry of this tremendous event.

Of particular note was the remarkable drive by the former F1 champion, and my favorite driver on the circuit, Fernando Alonso. After being crashed into by another driver on a restart, Alonso went into the pits for a nose and tire change, and then went right back out and worked his way through the field for what many of us think was the drive of the season.

Here is how former F1 driver Jolyon Palmer described the remarkable Alonso: “Fernando is a driver of the steeliest determination. I remember his recovery in Baku a few years ago when he brought a hobbled McLaren back to the pits at the end of lap one, only to go back out and eventually come home in the points. This race I think was an even more spectacular recovery.”

So, now you know why Alonso is my favorite driver, as “steeliest determination” is one of the character traits I admire most in my fellow humans.

Interestingly, my friend who attended the F1 race once made an observation about the whole racing enterprise that sparked an idea for this column. Here’s what he told me:

“Jim, the racing business sort of seems like what you do. The team owners pour money into their people and products in pursuit of victory. And when it comes to investing, we put money into companies in pursuit of winning by growing our money.”

I thought about this for a while, and then I came to the conclusion that my friend was partially right. You see, in some ways auto racing is similar to investing, but in other ways, it’s very far from it. Let me explain.

Like auto racing, investors want to win. And like auto racing, investors have to take risks to come out with a victory.

And if you want to win in your portfolio, sometimes you have to push things along by buying high-momentum stocks and out-of-the-money call options on those stocks in pursuit of really fast gains, like the way we do in my Bullseye Stock Trader advisory service.

Yet unlike auto racing, when we put our money into a company, our winning comes in the form of more money.

You see, in auto racing, and particularly in the amateur and semi-pro ranks, but also largely in the professional ranks, the money you put into the venture doesn’t come back to you multiplied the way a good investment does. Sure, you might win a trophy, and it might be really fun, exhilarating and satisfying, but it’s going to cost you a whole lot of capital.

But when we invest, the trophy is the increased capital, and the bigger the gains, the bigger the trophy. So, unlike a pursuit that costs you money, investing is a pursuit that, when done properly, is going to make you a whole lot of money.

Another way to frame this for contrast is that unlike auto racing, investing doesn’t take a big fortune to make a small fortune. Instead, when you invest, you can take that small fortune and turn it into a really big fortune.

And when it comes to investing, there’s no time like the present to go out on the track and test your driving skills.

So, gentlemen, start your engines!

***************************************************************

ETF Talk: Swimming in A Wide Moat

One trait found among many successful companies is the quality of competitive advantage, or “moat.”

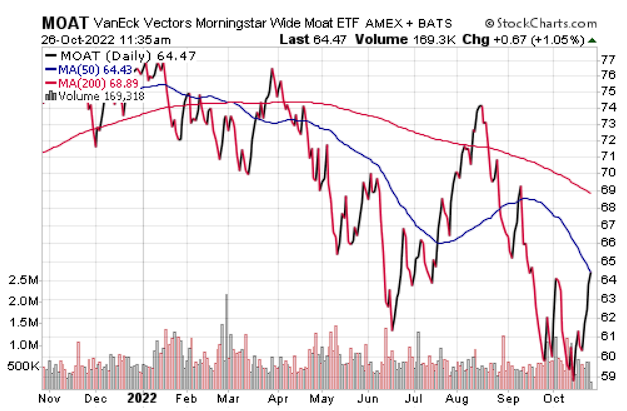

This means that competing with these companies is difficult, whether due to significant barriers to entry in the industry or other factors such as important patents. VanEck Morningstar Wide Moat ETF (MOAT) is an exchange-traded fund (ETF) that invests in an equal-weighted basket of U.S. companies determined by stock rater Morningstar to be among the “wide moat” companies with the highest fair values and subjective economic rating.

The companies among MOAT’s holdings span a variety of industries, from tech and biotech firms to giants like Amazon (AMZN) and Wells Fargo (WFC).

Year to date, this fund has struggled by dropping 20%. However, over a longer time frame, its performance follows a fundamentally upward trajectory, as its value doubled in a less than four-year span from mid-2018 to earlier this year. It has recently begun to recover from a precipitous October tumble, along with much of the market. But its strategy may be more useful for long-term performance than short-term variation.

Chart courtesy of www.StockCharts.com

The ETF’s expense ratio of 0.47% is ordinary and easily more than paid for by its 1.37% dividend yield. Nearly $6 billion in net assets makes MOAT a relatively heavy hitter.

Among the stocks owned by this fund are Biogen Inc. (BIIB), 3.47%; Etsy, Inc. (ETSY), 2.98%; MercadoLibre, Inc. (MELI), 2.92%; Gilead Sciences, Inc. (GILD); and Wells Fargo & Co. (WFC), 2.83%. Because the fund pursues an equal-weighting strategy, all 40 companies impact its performance roughly equally, though there can be some variation because the fund is rebalanced on a staggered quarterly basis.

For investors wo are interested in the strategy of investing in companies that are difficult to compete against, VanEck Morningstar Wide Moat ETF (MOAT) provides a diverse collection of 40 stocks based around that exact thesis.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

Wednesdays Mean Wisdom

Wednesdays mean wisdom, and that’s especially true at my podcast and lifestyle website, Way of the Renaissance Man.

This week’s wisdom comes to us courtesy of American statesman, diplomat, Founding Father and the fourth President of the United States, James Madison.

The insightful Madison warns us that if tyranny and oppression ever come to America, it will be in the guise of fighting a foreign enemy.

For the complete dose of Madison’s brilliance, check out the newly published Wednesday Wisdom featured right now at Way of the Renaissance Man.

*****************************************************************

In case you missed it…

He Eat a Lot of Ice Cream

When asked in an interview on “Meet the Press” if he could name one thing that President Biden has done that he supports, Georgia Senate candidate Herschel Walker uttered the following response…

“He eat a lot of ice cream.”

Walker’s bid for the Senate, which includes the endorsement of former President Trump, has been highly controversial for many reasons that you’ve likely heard about already.

I am going to leave those issues for another discussion, because today I want to point out the relationship President Biden has with ice cream — a relationship I’ve had first-hand knowledge of since before he was even vice president.

In fact, the Walker comment got me reminiscing about one of the most interesting airplane journeys I’ve ever been on, courtesy of the then-Senator from Delaware.

So today, I bring you my recollections from that episode, which have appeared before in this column and that were originally written in August 2008. And given the recent Walker comment, I think these thoughts are once again all too timely.

We All Scream for Ice Cream: A Joe Biden Tale

You can tell a lot about a man by the way he eats.

Some men like to sit down to a meal, take their time and savor each and every morsel of food and drink. People like this tend to be thoughtful, meticulous, confident and in many cases, hedonistic. How do I know this? Well, I’ve been known to spend more time than most getting through a multi-course, wine-paired meal.

Still, other men like to dig right into their prize, attacking the meal with fervor and a literal hunger for life that reveals their carpe-diem approach to the world. This type of person tends to be decisive, purposeful, driven and a born leader. My favorite example of this type of eater is my good friend and fellow investment guru Doug Fabian.

But what do you say about a man who eats his meal in reverse order?

That thought has plagued me ever since I sat next to Sen. Joe Biden on a flight from Washington, D.C. to my hometown of Los Angeles, California. Sen. Biden was on his way to L.A. for an appearance on HBO’s “Real Time with Bill Maher,” while I was returning home from my annual pilgrimage to the nation’s capital for a meeting with friends, publishers and people from some of my favorite think tanks.

After exchanging pleasantries with the senior senator from Delaware, Biden wasted no time in digging right into his criticisms of the war in Iraq, and what he perceived to be the folly of the Bush administration. I expected nothing less from the senator, as he’s known for his outspoken critiques and his shoot-from-the-hip commentary.

What I didn’t expect was a lesson in how to eat a meal backwards.

Now, since I had the benefit of first-class seating accommodations during this journey, the flight attendants were very conscientious when it came to serving what was a surprisingly tasty meal. The first course was a salad with Italian dressing, which was followed by a main course of a plump, well-seasoned chicken breast and a side of rice. The best part of the meal for me was the dessert, which was a generous scoop of gourmet chocolate ice cream.

I ate my meal with my usual casualness, and in the aforementioned order. Sen. Biden, however, took a different path. Biden accepted the salad, but he put it aside and saved it for later. When the main course came, he politely rejected it. But when the ice cream came, Biden’s fervent personality really came out. He emphatically asked for a serving, although he had not yet eaten any food.

Biden ate his ice cream while we discussed Kevin Phillips’ book “American Theocracy,” the then-latest critique of the Bush administration’s religious overtones. After eating the ice cream, Biden pulled out a hefty ham sandwich from his briefcase and consumed it in a deliberate and determined fashion. Once the sandwich disappeared, the senator turned to the only remaining bit of food left on his tray table, the salad.

As I watched this reverse-order meal consumption, a thought occurred to me: Is this why the federal government is so screwed up? Is Sen. Biden’s backwards approach to a meal indicative of what’s wrong with Washington? Does this backwards eating pattern explain why the government does everything less efficiently and less effectively than the private sector?

Given my theories on discerning knowledge of a person based on how they eat, what was I to make of Sen. Biden’s meal habits? The only logical conclusion is that Biden looks at the world — shall we say — differently from the rest of us. And while there is nothing wrong with a little different perspective on things, I don’t think I want someone a heartbeat away from the presidency who eats his ice cream first.

The next thing you know is that person will advocate raising taxes to stimulate the economy, negotiate with our ideological enemies as a means of portraying strength and railing against judges who think interpreting the Constitution is the only proper function of the courts.

Wait a second… that’s what Biden wants?

I knew there was a reason why he ate the ice cream first.

*****************************************************************

On Love and War

“Love is like war: easy to begin but very hard to stop.”

— H. L. Mencken

Perhaps the greatest journalist, social critic and American man of letters that’s ever picked up a pen, Henry Louis “H.L.” Mencken was a veritable quote machine throughout his prolific and always-scintillating writings. If you want to discover what real political writing is, then I highly recommend the collection, “A Carnival of Buncombe.”

Here I am with my own tattered and road-ridden copy, one of the crown jewels of my collection of Mencken works, of which I am proud to say is everything the man ever published.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.