The Feds Want Your Bitcoin Profits

Bitcoin, cryptocurrencies and blockchain technologies have become all the rage over the past year.

Some people think Bitcoin and other cryptocurrencies are going to liberate the planet from the clutches of fiat currencies and big-government-controlled central bank manipulation. Others think they represent the biggest bubble and the biggest boondoggle in recent market history.

I suspect that the truth lies somewhere in between. I also think the rise of non-government-controlled cryptocurrencies can be both a liberating development for society, and a giant bubble at the same time.

While the drama that is Bitcoin, cryptocurrencies and the volatile nature of this asset will play itself out over time, there is one constant that never seems to go away — and that constant is Uncle Sam wanting its pound of flesh.

For example, in November, a federal court ruled in favor of the U.S. Internal Revenue Service (IRS) in its suit against cryptocurrency exchange Coinbase.

The IRS wanted to get information from Coinbase on transactions worth $20,000 or more between 2013 and 2015. Coinbase refused the IRS request, so the agency took Coinbase to court — and won.

In a recent article on the website Finance Magnates about this concern, “No Taxation Without Decentralization: The IRS Closes in on Crypto,” writer Rachel Macintosh notes:

2017 was also the year that cryptocurrency caught the eyes of the world’s governments in a serious way. The global fever to regulate cryptocurrency has certainly not passed through the West without affecting none other than the Internal Revenue Service (IRS), the United States government’s department of taxation.

In addition to the exponential rise of the crypto markets at large, the IRS has certainly taken notice that a relatively low number of tax returns reporting crypto capital gains have been filed, despite the fact that so many new investors came into the space.

The Coinbase data “request” by the IRS was part of that move to get a handle on the cryptocurrency trading profits. And as Macintosh further notes:

So far, there has been no direct implication that the United States government is taking steps to seize information from other centralized crypto wallets and exchanges. However, the fact that it has happened at all is certainly some indication of the future.

One thing is clear — the IRS has a vested interest in collecting on funds gained from trading and holding cryptocurrency.

This last point should come as no surprise to anyone, as the IRS has always wanted a piece of your trading profits. Every investor who has ever declared a capital gain knows that.

So, if you are dabbling in Bitcoin or other cryptocurrencies, remember that it’s an asset class subject to taxation just like any other. And though governments don’t consider Bitcoin and other cryptocurrencies “legal tender” in the official sense, if you buy and sell these assets with U.S. dollars, and if you make a profit in U.S. dollars, those dollars are going to have to be declared.

Hey, even Coinbase got into the reminder act, as it has now put the following reminder graphic on its website:

Of course, the flipside here is that given the volatility in Bitcoin and related stocks, trusts and exchange-traded funds (ETFs) in 2017, many investors probably have a few realized losses that can be used to offset any gains.

Now, beginning this week, I’ll look at one of several new ETFs in the Bitcoin-related space. Indeed, the entire subject of cryptocurrencies and the blockchain technology on which it rests has become an exciting — and now very investable — area.

ETF issuers know this, and that’s why this month there have been two new funds that have come to market in the space.

In today’s ETF Talk, we begin our series on these funds, starting with the Reality Shares Nasdaq NextGen Economy ETF (BLCN).

I think you’ll find this series most interesting.

And remember, if you want my latest ETF, mutual fund and stock recommendations, check out my Successful Investing advisory service, or go to my website at JimWoodsInvesting.com.

***********************************************************

ETF Talk: New Fund on the Block Bids on Today’s Hottest Technology

As the world is caught in a fervor over Bitcoin and other cryptocurrencies, as well as the new blockchain technology, new investment opportunities similarly have started to pop up.

Exchange-traded funds (ETFs) with cryptocurrency and blockchain themes also have soared in popularity. This week’s featured ETF, Reality Shares Nasdaq NextGen Economy ETF (BLCN), is one such fund that is gaining attention.

So, what is blockchain? Simply put, it is a record of new transactions (such as the change in the location of cryptocurrency, research data, voting records, etc.). Once a block of information is completed, it is added to the chain to create a chain of blocks known as a blockchain.

Owning cryptocurrencies essentially means owning “private keys” to certain addresses on the blockchain. Since information stored in the blockchain is publicly available, it is comparable to a public ledger of sorts that does not rely on a single computerized server to function. The World Economic Forum predicts that 10% of global gross domestic product (GDP) will be stored on blockchain platforms by 2027.

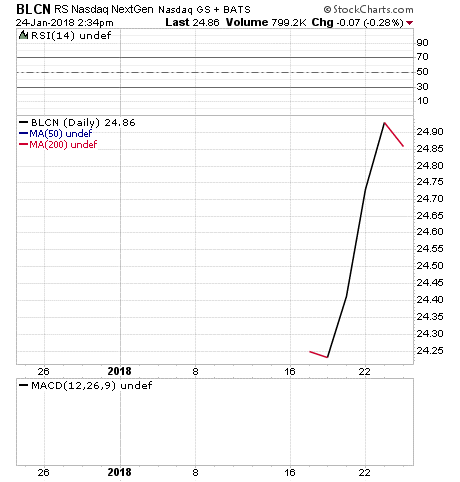

Many recently launched funds were created to take advantage of this blockchain technology, which some observers view as revolutionary. BLCN, created on January 17, 2018, through a partnership between Reality Shares and Nasdaq, is one of those funds. The fund seeks long-term growth by investing in blockchain-related companies.

BLCN has been aggressively investing in companies around the world and across sectors that contribute to the underlying technologies behind blockchain. The fund currently has 56 holdings and is 57% invested in the information technology (IT) sector. Roughly half of BLCN’s holdings are in North American companies, while the rest are split between Asia and Europe.

Since the fund is still in its infancy, it will take a bit longer to see how it will perform compared to the broad market. The chart below, though not too meaningful, shows that BLCN has been on an uptrend so far during its first week of trading.

BLCN currently manages $47.4 million in total assets and pays a quarterly distribution with a yield of 1.69%. Its expense ratio is 0.68%.

Top holdings for BLCN include Intel Corp. (INTC), 2.43%; Overstock.com Inc. (OSTK), 2.39%; IBM (IBM), 2.37%; Cisco Systems Inc. (CSCO), 2.26%; and Hitachi Ltd. (HTHIF), 2.21%.

For investors who want to know more about blockchain technology, I encourage you to look into Reality Shares Nasdaq NextGen Economy ETF (BLCN).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Thoreau on Wealth

“Wealth is the ability to fully experience life.”

— Henry David Thoreau

Real wealth isn’t just about your net worth. I say that because money and assets shouldn’t be the goal of your investing life, or your work life. The goal of your investing life should be to acquire enough assets to allow yourself to experience the most life has to offer. And, the goal of your work life should be to do the most meaningful work you can — and to really “love the doing” in the process.

Hey, we all know people with a lot of money who hate their work and who always seem miserable. I suspect that’s just a flaw in their personal software. To me, making money is fun, and doing the meaningful work that I do is even more fun. It is the combination of both that give me the ability to fully experience life.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods