The Fed Hikes, ups 2017 Expectations

The big market-moving news this week was the Fed, and its decision to raise interest rates for the first time in a year.

That move on Wednesday by Janet Yellen and her fellow central bankers was widely expected. What wasn’t anticipated was the ratcheting up of rate-hike expectations for 2017.

The Fed “dots,” which are just a plotting of where the Fed members think interest rates will be at the end of next year, now reflect as many as three 25-basis-point hikes to the federal funds rate in 2017. Before the meeting, the smart money was projecting the Fed’s dots would only reflect two rate hikes next year.

The increased dots, along with a clearly “hawkish” Yellen press conference, made it clear to us that interest rates are likely to go up at least a few times next year. Of course, this is by no means a certainty. Remember that this time last year the dots were calling for four rate hikes in 2016, and we only saw one.

What Yellen also made clear is her intent to not let the economy run hot, particularly if President-elect Trump succeeds in adding more fiscal stimulus to the economy early in his administration.

While the market reacted with a sell-off on Wednesday following the Fed announcement and Yellen presser, stocks staged a nice rebound on Thursday.

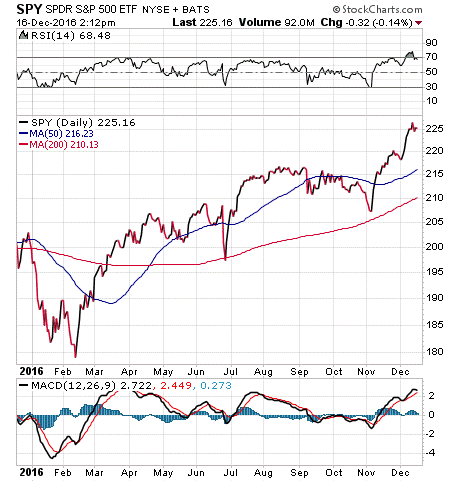

The S&P 500, as measured by the SPDR S&P 500 ETF (SPY), continues to trade very close to all-time highs, as the “Trump rally” remains firmly intact. Meanwhile, there have been other segments of the market that also continue to heat up, namely interest rates and the U.S. dollar.

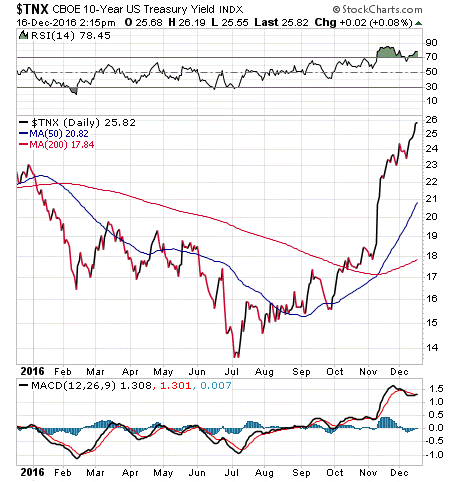

The chart here of the 10-Year Treasury Yield tells you all you need to know about rising bond yields (interest rates). Eventually, that could be a headwind on stocks, although there’s no sign of that yet.

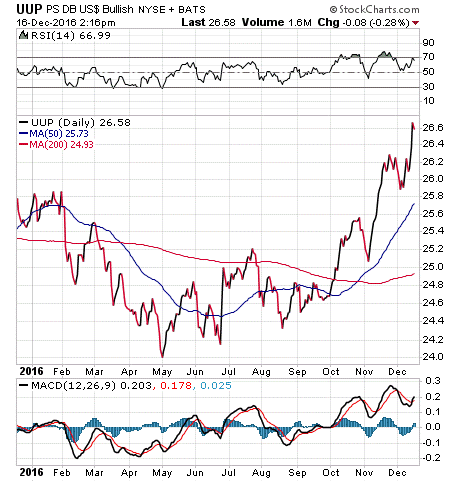

Finally, the value of the U.S. dollar vs. rival foreign currencies is clearly on the move higher, with the greenback now trading at 14-year highs.

The chart here of the PowerShares DB US Dollar Bullish (UUP), a fund pegged to the Dollar Index, clearly shows the post-election surge in the greenback vs. its rivals.

While a strong dollar is good for some sectors, keep in mind that it’s not good for export-oriented multi-national companies. If we see earnings pressured in these sectors in fourth-quarter earnings reports, that also could be a headwind on this rally.

Still, the Trump bump continues, and that is a good sign for stocks and the economy.

May the optimism continue!

If you’d like to find out how you take advantage of the optimism reigning supreme in markets right now, then I invite you to check out my Successful ETF Investing advisory service today.

ETF Talk: This Pure Play Represents 85% of the Taiwanese Market

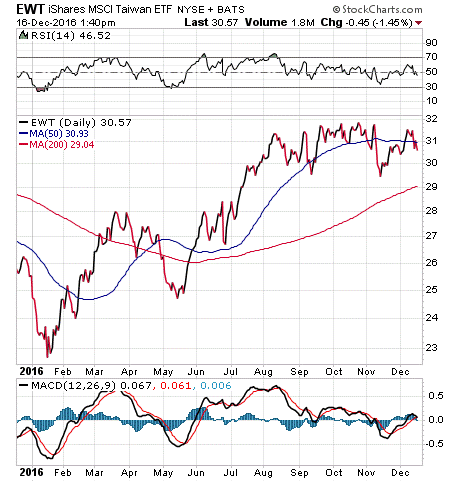

Our coverage on single-country exchange-traded funds (ETF) brings us to the iShares MSCI Taiwan Capped ETF (EWT), a fund that is incorporated in the United States and provides exposure to large- and mid-sized companies in Taiwan.

EWT targets the equity market in Taiwan by holding only stocks that are traded on the Taiwan Stock Exchange. Since its launch in 2000, EWT has amassed $2.92 billion in total assets and has retained its robust liquidity with a high daily trading volume, far outranking its competition.

In fact, many investors consider EWT the most stable and most liquid Taiwan play going into 2017. The potential benefit of investing in EWT instead of a more broad-based emerging market ETF is that investors could gain a great deal more from a growing Taiwanese economy by buying shares of EWT.

The fund is intended to replicate the top 85% of the Taiwanese stock market, in terms of market capitalization. EWT is a heavyweight player in the technology sector, with 55% of the fund’s assets invested in technological companies. Financial services and basic materials are the other two major sectors for the fund, composing 18.3% and 10.5% of EWT’s portfolio, respectively.

As you can see from the graph below, EWT has zoomed in price from the low $20s to the $30s, an increase of nearly 50%. Its year-to-date return is 21.14%, which is almost double that of the S&P 500’s gain of 10.86% for the same period. EWT has a reasonable expense ratio of 0.62%. It pays a distribution annually and has a dividend yield of 1.27%.

View the current price, volume, performance and top 10 holdings of EWT at ETFU.com.

The fund’s top five holdings are Taiwan Semiconductor Manufacturing Co Ltd, 22.28%; Hon Hai Precision Industry Co Ltd, 8.64%; Cathay Financial Holding Co Ltd, 2.69%; Chunghwa Telecom Co Ltd, 2.62%; and Formosa Plastics Corp, 2.46%.

Taiwan currently has a quasi-developed economy that is growing at a good rate. If you believe in the strength of Taiwan’s economy, I encourage you to look to the iShares MSCI Taiwan Capped ETF (EWT) as a possible addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Your Year-End Financial Checklist

The year is nearly over, and that means now is the time to think about what to do with your investments, and your current financial disposition.

But the question is, where do you start?

To answer that important point, I’ve put together a short list of action steps to take that can get you on the right track to tidy up your current issues in 2016, so that you can be ready to hit the ground running at full sprint in 2017.

1) Review your asset allocation. Do you know what percentage of your money is in stocks, bonds, cash and cash alternative such as gold or silver? The first step toward knowing where you want to go is to know where you are now.

2) Tax-loss harvesting. If you have some losing, dead-money stocks or ETFs in your portfolio, then now is the time to consider a little tax-loss selling in your taxable accounts. Doing so can take the edge off a big tax bill come April 15.

3) Take advantage of a Roth IRA conversion. A Roth IRA is a great way to keep more of what you have after you retire. Consider converting a traditional IRA into a Roth IRA as possibly the easiest way to do that — if your personal situation is right.

4) Give to those you love. Did you know you could give the gift of Roth IRA’s to your adult children and grandchildren? Have you set up a 529 education savings plan for your kids or grandkids yet? How about giving to the charity of your choice? Each of these ways can reduce your overall tax burden, and now is the time to give before the calendar turns.

5) Plan your income streams in 2017. Where will you get your income from in 2017? Will it be from your job, a business, dividend income, annuities, real estate, etc.? Now is the time to make sure you are clear on how much revenue you’ll have coming in next year. Knowing that will help you plan on how much you can afford to spend, and what you can afford to save.

On Casting Your Shadow

“We cast a shadow on something wherever we stand.”

— E. M. Forster

The great novelist knew the importance of one life, as we all make a difference, and we all cast a shadow over the people and circumstances in our lives. Keep this thought in mind the next time you face an important decision. Remember, your shadow matters to the world.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter article from last week about the international markets’ reactions to Trump’s proposed policies.