Fed Chair Serves Up a Surprise

What’s driving markets right now? Simply put: The Fed.

We know that because, during Tuesday’s Humphrey Hawkins testimony, new Federal Reserve Chairman Jerome Powell served up the first surprise of his nascent reign at the central bank by making some “hawkish” comments about the future of interest rate hikes.

The remarks took the major equity averages down hard, with the S&P 500 tumbling about 1.3% after Powell’s comments.

So, what did Powell say that made equity investors nervous enough to sell stocks, and bond traders worried enough to send the 10-year Treasury spiking above 2.90%?

During the Q&A period of his Congressional testimony, Powell said that his personal outlook on the economy had strengthened since December, and that the Federal Open Market Committee (FOMC) will “reevaluate” the projections for rate hikes in March.

Of course, the FOMC “reevaluates” its projections at every meeting, but clearly, the Fed Chair understood the connotations of his comments (at least, I hope he did!).

According to my friend who also happens to be one of the smartest macro analysts on Wall Street, Tom Essaye of the Sevens Report (a publication I highly recommend):

“This market is still trying to determine how to view future Fed policy, and that process will create volatility. Yesterday’s market reversal and subsequent sell-off is just part of this process, as the market adjusts to a new era of a rising inflation and a not-perma-dovish Fed.”

Essaye went on to tell me, “Beyond the short term, though, nothing in Powell’s remarks constituted a bearish gamechanger, as his outlook on the economy remained strong, which is equity positive. Also, inflation appears to be rising, which is equity positive at least in the early stages. Finally, interest rates rose but not too badly (the 10 year didn’t hit a new high). So, despite the short-term weakness (and keep in mind stocks were overbought leading up to Tuesday) the medium/longer-term outlook for stocks remains positive.”

I agree with Tom here on the medium/longer-term outlook for equities, as the tailwinds he mentioned continue to blow in a bullish direction.

However, this market now faces an inflection point, as many investors have been lulled to sleep by the past decade of near-zero interest rates and ultra-accommodating Fed policy. And the current setup here means that whether fast or slow, bond yields (i.e. long-term interest rates) are rising. That means you need to put strategies in place to benefit from this inevitable trend.

Those strategies can be found in my Successful Investing advisory service. In fact, my readers have already been rotating away from interest-rate-sensitive sectors and into sectors likely to benefit from economic reflation and rising interest rates.

To find out how we’re doing that, including specific portfolio recommendations for both growth and income investors, I invite you to check out my Successful Investing advisory service, today!

P.S. I’m going to be at the Las Vegas MoneyShow, May 14-16, 2018, giving two presentations. My first talk, “Listening to the Music of the Markets,” is going to be on May 16 at 8 a.m. My second talk, “Invest Like a Renaissance Man,” will also be that day but in the afternoon at 2:15 p.m. I look forward to seeing you there! For more details, click here.

***********************************************************

ETF Talk: Easy Exposure to the Commodities Market

The PowerShares DB Commodity Index Tracking Fund (DBC) is the first exchange-traded fund (ETF) that we will cover in a series of commodity-themed funds.

A commodity is defined as a raw material or agricultural product that can be traded. In financial terms, a commodity includes energy products such as oil and natural gas, metals such as gold and silver, agricultural products such as wheat and all types of meat and livestock.

The most popular way to invest in commodities is through a futures contract, which is an agreement to buy or sell, in the future, a specific quantity of a commodity at a specific price, according to Investopedia. Direct investment in commodities is possible in most brokerage accounts.

However, the commodities futures market can be very volatile, with big price swings not an uncommon occurrence, making it challenging for even experienced traders to do well. This is where ETFs come in. They offer investors a convenient way to gain exposure to the commodities market and reduced volatility (thanks to diversification) in one package. Some investors hedge against inflation with commodity funds. DBC caps its portfolio exposure to energy at 60% and invests around 20% each in agricultural products and metals.

By far the largest of the commodities ETFs, DBC tracks an index of 14 of the most heavily traded and important physical commodities in the world. It currently has roughly 70% of its $2.60 billion in assets invested in commodities in North America and the United Kingdom. DBC also has a relatively low expense ratio of 0.85% and strong liquidity, with a daily trading volume of $3.2 million.

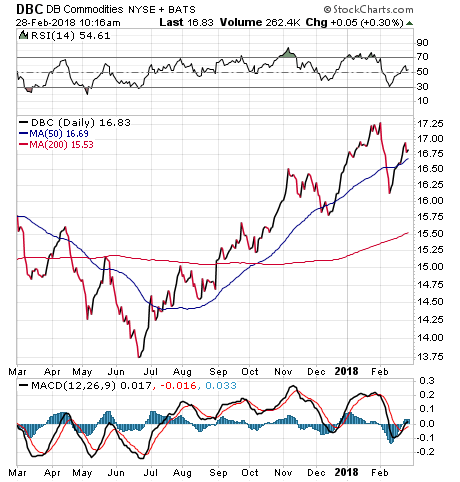

The chart below shows that DBC has been on a downward trend for the first half of 2017, but then moved higher starting in July. Year to date, DBC has returned 2.95%. The volatile nature of commodities can be seen in the past performance of the fund: -27.6% in 2015, 18.6% in 2016 and 4.86% in 2017.

DBC’s top holdings are WTI Crude Futures (March 19), 6.80%; Brent Crude Futures (Jan. 19), 6.39%; Ny Harbor ULSD Futures (June 18), 6.30%; Gasoline RBOB Futures (Jan. 19), 5.97%; and PowerShares Treasury Collateral ETF, 4.84%.

For investors who are seeking a convenient way to make a play on the overall commodities market, I encourage you to look into PowerShares DB Commodity Index Tracking Fund (DBC). Please note that the nature of commodities means that DBC carries with it a higher degree of risk than many other funds on the market.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************************

Get Ready to Achieve Economic Freedom

“Economic freedom is available to every American.”

This is the positive message direct from the mind of my friend, colleague and former editor of the Weekly ETF Report, Doug Fabian. Now, longtime readers of this publication might remember that it was just about a year ago that Doug handed the reins over to me, along with the editorship of the Successful Investing advisory service.

Given the approximate one-year anniversary of my taking control of this publication, I thought I would give readers a treat by presenting you with some highlights of a conversation I recently had with Doug.

We start off with a discussion of the markets, including his thoughts on the recent bout of hyper-volatility. We then addressed how investors should approach the current market, and what they should be doing now with their portfolios.

Finally, we talked about Doug’s new project, a new podcast and website called The Science of Economic Freedom. I am very excited to tell you about this, as I think Doug’s uber-positive message has the potential to help millions of people define, and then achieve, their vision of economic freedom.

So, let’s dig in!

Jim Woods (JW): Doug, tell me what you think about the recent bout of market hyper-volatility. Is this something investors should be worried about, or is this all part of the natural ebb and flow in financial markets?

Doug Fabian (DF): We went through an extended period of low-volatility in markets. Since the presidential election, we went nearly 16 months without a single down month for stocks. I can’t remember a time we’ve ever seen that kind of constant, stair-step rise in markets, and that’s what was unusual.

Yes, we hit an air pocket in late-January/early February, and while there were plenty of reasons why, those reasons aren’t as important as the fact that markets normally ebb and flow. It’s also my opinion that we are going to continue to see more bouts of volatility as the year unfolds, and that’s chiefly because we are in a rising interest rate environment, and because stock valuations have climbed to the higher-end of their historical norm.

JW: What do you suggest readers do right now, in general, to prepare themselves and their money for a year of increased volatility and a rising rate environment?

DF: I think people should make sure that they look at their money is terms of different “buckets.” You should have a safe-and-secure bucket where you hold cash and cash alternatives. Then you have your taxable account bucket, and your retirement account bucket. Depending on where you are age wise, you should define your risk profile, and then you should seek the highest returns associated with that risk.

If your time horizon and risk profile allow it, you should use bouts of volatility such as the recent market pullback to your advantage. That means adding capital to the best stocks, exchange-traded funds (ETFs) and mutual funds out there. Finally, we are in tax season, and that means we should all be taking steps to minimize our tax liability. Taxes matter; and managing your tax situation with respect to your investments in an often overlooked, but critically important, part of your overall investment strategy.

JW: You have a new project you’ve just kicked off, and I love the title. It’s called The Science of Economic Freedom. It’s both a podcast and a website, and I am really excited to introduce it to my readers. Tell us more about this project, what it’s goal is, and how readers can benefit from your wisdom on these matters.

DF: The Science of Economic Freedom is something that I’m extremely excited about, as I think it has the potential to positively affect thousands, if not millions of people if I do it right. You’ve heard me talk before about my personal passion in life, and that passion is to be a positive influence on the lives of the people I touch. With The Science of Economic Freedom podcast, I get a chance, thanks largely to the help of my partners at Mercer Advisors, to present a free educational initiative to the audience designed to not only educate, but also to help provide the requisite information and motivation to the audience to help them with their investing endeavors.

Much of the reason why I started this new project is because of the overwhelming lack of financial literacy in the country. I’ve read statistics showing that some 70% of people in the United States don’t know how to handle money. That’s an appalling statistic I’d like to improve, and one that this podcast and website is dedicated to changing.

More importantly, The Science of Economic Freedom is not just about investing. It’s also about basic money and personal finance concepts. Concepts such as how to manage taxes, estate planning, insurance planning — and yes, investing concepts such as asset allocation are covered as well. Just about everything that contributes to achieving economic freedom is a topic of conversation.

And yes, economic freedom is available to every American, but few people actually achieve that freedom because they haven’t been taught how. Many people unknowingly make the same mistakes over and over again, and this is a situation I feel compelled to correct.

I think that with the proper knowledge, and the proper motivation, every American can live out his or her own version of economic freedom — and that’s what the new podcast and website is all about.

JW: Thanks Doug.

I strongly encourage you to check out the great audio content, articles and resources at The Science of Economic Freedom website. You can start anywhere, but I recommend starting out with Episode 1 and listening to each episode in order. Doing so will provide you with the essential basic concepts of how to think about, and ultimately achieve, economic freedom.

I really think you’ll find it a valuable resource, and a great adjunct to what you read in this publication, and to the information you’ll find in my Successful Investing, Intelligence Report and Fast Money Alert advisory services, all of which can be found at JimWoodsInvesting.com.

And once again, a big thanks to Doug Fabian for his wisdom and insights.

*********************************************************************

On Pleasing Profoundly

“The more one pleases generally, the less one pleases profoundly.”

— Stendhal, “Love”

The French novelist’s 1830 masterpiece, “Le Rouge et le Noir,” or in English, “The Red and the Black,” is a must-read for any true Renaissance Man. Yet the above quote is from his novel “Love,” another great work that scholars say reveals the author’s own experience of unrequited passion. The lesson here is that if you try to make everyone love you through your actions, you aren’t likely to find those who truly love who and what you are. A modern, and far less literary, way of putting it is that you can’t please everyone, so you’ve got to please yourself. In doing so, you just might please another profoundly.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.