Excuse Me, MacKenzie, You Forgot Something

- Excuse Me, MacKenzie, You Forgot Something

- ETF Talk: Consider a Stable Investment in Corporate Debt

- I Want to Be in This Club

- Little Changes

***********************************************************

Excuse Me, MacKenzie, You Forgot Something

Sometimes a headline really grabs your attention. Here’s one such headline that I read yesterday that made me pause: “MacKenzie Scott gives away another $2.7 billion to charity.”

“Another $2.7 billion” is the notable verbiage here, because since July 2020, MacKenzie Scott, the woman better known as MacKenzie Bezos, ex-wife of Amazon.com (AMZN) founder and CEO Jeff Bezos, has announced she’s donated some $5.9 billion to a variety of charities, including $1.7 billion in donations to historically black colleges and universities, along with other groups, and another $4.2 billion to hundreds of organizations she and her philanthropic team want to support.

Now, think about these numbers for just a moment: $1.7 billion, then $4.2 billion, then another $2.7 billion. My simple math tells me that’s $8.6 billion in charitable contributions, an unbelievable sum that represents a stunning act of generosity and good intentions.

Yet in looking deeper into Ms. Scott’s latest charitable effort, I was dismayed to read what she wrote in a blog post about her announcement. Here’s the language that roiled my blood:

“… we are all attempting to give away a fortune that was enabled by systems in need of change.”

Let’s break that down for a moment, as there is much subtext there that requires a Deep Woods peeling of the onion skin. To understand this, we need to know that MacKenzie Scott acquired her fortune as a result of being Mrs. Jeff Bezos.

In their 2019 divorce settlement, MacKenzie became one of the world’s wealthiest women, as she was awarded a 4% stake in Amazon stock. At their current value, that makes the former Mrs. Bezos worth about $59 billion.

Now, returning to her own language, she says in her post that her fortune was “enabled by systems in need of change.”

Hmmm, what “systems” would those be? Does she mean the “systems” that brought about one of the greatest, most innovative, most efficient and most brilliant companies in human history?

Does she mean those “systems” that have created billions in shareholder value over the years? Or does she mean those “systems” that allowed America to be quarantined in our homes for nearly a year, while still being able to get the goods we needed — goods that mostly weren’t safe to go out and get due to a once-in-a-century global viral pandemic?

Or, does she mean those “systems” that enable her to live a life of luxury, and to sit back and decide who and what charities and organizations she wants to support with her spare billions?

The way I see it, those “systems” are what have profoundly changed the world to the immense benefit of us all. For that, perhaps Ms. Scott could have added a little bit more to her blog post that I think would have resonated with me, and many others I have spoken with about this, a little more positively.

How about this for a little addition to MacKenzie’s blog post: “I would like to thank the brilliance, intelligence, vision and hard work of my former husband, Jeff Bezos, for creating the company that makes my life as a philanthropist possible.”

Of course, MacKenzie Scott doesn’t need my unsolicited advice. She can do what she wants with the fortune she acquired as the result of being Mrs. Jeff Bezos. Yet don’t you think it would have been at least a bit gracious, and at least a nice gesture, to acknowledge where and how that immense wealth that she can distribute so easily was created?

I mean, MacKenzie, aren’t you forgetting something?

I think you are. And so, on behalf of your former spouse, allow this admittedly not-so-humble editor to offer his own thanks in the following fashion: “Hello Jeff Bezos, thanks for making your ex-wife’s charity possible. Thanks for creating so much wealth; thanks for changing the world profoundly with your ideas. Most of all, thanks for that next-day delivery on my chow chow’s favorite treats. The world owes you a debt of gratitude for those ‘systems’ that made it all possible.”

***************************************************************

ETF Talk: Consider A Stable Investment in Corporate Debt

Investors in exchange-traded funds (ETFs) can choose from a vast number of different themes that they can use.

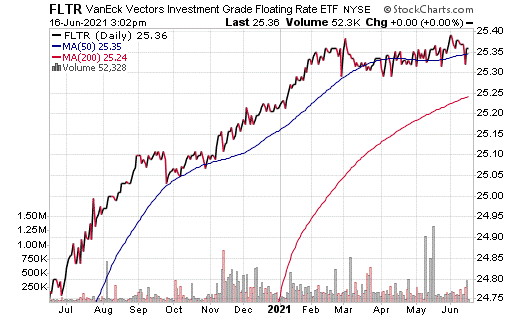

Corporate debt is one category that is sometimes overlooked in investors’ decisions about how to distribute their money between stocks, bonds and cash. An exchange-traded fund (ETF) that offers a chance to invest in corporate debt is VanEck Vectors Investment Grade Floating Rate ETF (FLTR).

This fund focuses on a market-value-weighted portfolio of U.S. investment-grade corporate debt. Holders can be paid a small dividend for owning shares of this fund, with a current dividend yield amounting to just under 1%.

The dividend is paid on a monthly basis, which may be an attractive feature for income seekers. The fund’s holdings are chosen based on risk and return characteristics, as well as limited to floating-rate debt. It holds debt that is not due to mature for at least six months.

FLTR currently has an expense ratio of 0.14%, and its assets under management total $608 million. Because the fund invests in debt, it tends to have stable returns and not respond strongly to market events. Its chart tends to look quite flat. Although it declined during the pandemic, it did not have nearly as dramatic a dip as traditional stocks.

Given all this, it is unsurprising that FLTR is up just 1.58% in the last 12 months and 0.3% year to date. This is very much not the type of investment for those looking for a lot of variance or risk in their returns, but rather could be viewed as more of a safe haven that pays better than cash.

Among the top companies whose debt is held partly by FLTR are Morgan Stanley (MS), Wells Fargo & Co. (WFC), JPMorgan Chase (JPM), HSBC Holdings plc (HSBC) and Goldman Sachs (GS). Nearly 75% of assets are allocated to financial sector companies.

Investors looking for another option to protect their cash while earning a small return may benefit from researching VanEck Vectors Investment Grade Floating Rate ETF (FLTR).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

I Want to Be in This Club

I’m not usually the type of man who wants to be in a “club.” In fact, I generally eschew membership in social organizations, political parties and other artificial constructs that humans create to feel kinship with one another.

However, there is one club of sorts, or more specifically, a list of individuals, that I want to count myself a member of. That club, if you will, is the group of individuals profiled in what is being described as a “bombshell” story by investigative journalism organization ProPublica.

Here’s the headline of the article lovingly capturing the attention of the mainstream media, as well as progressive and populist websites around the globe: “The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax.”

The story, which is an interesting read for a variety of reasons, is basically an analysis of the taxes paid by the richest Americans. The analysis is based on the private tax returns that ProPublica says it received from an “anonymous source.” The organization also claims that disclosing this very private information about American citizens is in the greater “public interest,” and this, they’ve concluded, outweighs privacy considerations.

So, who is in this “club” of the richest Americans, and what’s all the fuss about?

Here are some of the top names mentioned in the ProPublica article: Jeff Bezos, Elon Musk, Warren Buffett, Carl Icahn, George Soros, Michael Bloomberg, Bill Gates, Rupert Murdoch and Mark Zuckerberg. According to the report, the tax data “shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.”

The article goes on to claim that “taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share, and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.”

Okay, let me unpack that statement, because it’s riddled with a few bad insights.

First, as my friends at Reason.com point out, “For the 2018 tax year, the last year for which we have data, the top 1 percent paid over 40 percent of federal income taxes, despite earning just under 21 percent of total adjusted gross income (AGI). The bottom 50 percent of taxpayers earned 11.6 percent of total AGI, but paid less than 3 percent of income taxes.”

So, while the elite club of richest Americans profiled in the article show that they often paid very little or no income taxes in some years, the wider point is that the oft-vilified “top 1 percent” pay far more into the federal tax system than any other group. So, in a way, the ProPublica article unwittingly got it right in the sense that this is definitely not “fair,” i.e., not fair to the top 1 percent of Americans who pay far more into the system than other groups.

The other point here from ProPublica is that the records show that the wealthiest can pay “income taxes” that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

The problem here is that the growth of one’s fortune via such things as share price appreciation of assets, including shares in a company, or real estate or a business, is not “income” until those assets are sold. And then it is not the same as ordinary income, but rather more like a capital gain.

Here again, I’ll let Reason.com do the explaining:

“ProPublica, however, tries to make the case that the wealthy are getting away with murder through the tax code, so they do a calculation that has never been done before, comparing growth in wealth over the course of a year to taxable income. They use this to calculate an individual’s ‘true tax rate,’ which is sort of like handing out wins in a baseball game in the middle of the early innings and calling it the ‘true outcome’ of the contest.

“It’s hard to overstate how nonsensical this comparison is (which is perhaps why it’s never been done before). Our tax system rightly does not tax growth in one’s wealth until it is realized as income. After all, the alternative is a monstrously complex and unfair system of wealth taxation that developed countries have avoided.”

Ah, but you see, here is where the progressive and the populist dream “wealth tax” comes in, one where the most successful among us are taxed on our investment prowess and our ability to accumulate appreciating assets. That tax would not just be on our incomes, but on what we own. We know this, because Senators Elizabeth Warren and Bernie Sanders have already piggybacked on the ProPublica article to buttress their argument in favor of a wealth tax.

But let’s put this into perspective that most of us can relate to. A wealth tax would, in effect, consist of tax authorities coming to you and taking an annual inventory of your stock portfolio, 401(k), home value, automobile values, collectibles, art, furniture, etc., and then determining a figure of how much you are worth. Then, they would send you a tax bill on that amount each year. It doesn’t matter that you haven’t sold these items. The tax is just based on their overall value.

In essence, the ProPublica “exposé” is, in my view, just another attempt to try and vilify the rich for doing what we all should be doing — using the money we’ve accumulated via our productive achievement and investing that money in appreciating assets that can flourish into enormous wealth.

So, one day I hope to be in that exclusive club, the club where my tax returns reveal that I paid little or no taxes in a given year on income because all of my wealth was tied up in the best stocks, real estate and business investments that I made with the expert knowledge of the markets that I’ve accumulated over the years.

To me, the ProPublica article was a financial form of a Tony Robbins seminar, one that has motivated me to be a subject of the next ProPublica on how the super-rich legally avoid paying Uncle Sam.

If you want to come alongside me as a future member of this exclusive club, then I invite you to check out my investment newsletters, Successful Investing and Intelligence Report, as well as my Bullseye Stock Trader advisory service and the Fast Money Alert trading service that I co-edit. Together, we can get on our way to being the subject of a ProPublica piece.

P.S. Wouldn’t it be fantastic to listen to some brilliant minds that have the opposite views of those in the ProPublica piece? How about if those views were packed into a four-day event right under the nose of Mt. Rushmore? Well, reality has delivered, and it comes to us in the form of FreedomFest 2021. This year’s theme is “Healthy, Wealthy & Wise.” The conference takes place July 21-24, in Rapid City, South Dakota. Keynote speakers include JP Sears, Ayaan Hirsi Ali, Dave Rubin, John Mackey, Dr Drew Pinsky, Jo Jorgenson, Larry Elder and many more. I will also be there as a speaker and as a podcaster, and I will be joined by friend and colleague Dr. Mark Skousen. So, if you are looking for a place to celebrate freedom and to immerse yourself in pro-human, pro-reason and pro-wealth ideas, then FreedomFest is for you! To see the full schedule, go here!

*****************************************************************

Little Changes

So far from okay

Tongue-tied and afraid

The big things stay the same

Let us make, little changes

–Frank Turner, “Little Changes”

Sometimes, the best solution to a complex problem is not to do a wholesale about face, but to start by making little changes that are relatively easy to implement. So, let’s say you are getting a little bit too heavy, and you decided you need to lose a few pounds. What do you do first? Should you change your entire diet completely? No, you shouldn’t, because for most that’s a prescription for failure.

A better way is to start by cutting back on the extra, empty calories you consume such as soft drinks, juices, coffee drinks, and especially high-calorie, high-sugar alcoholic beverages such as beer and wine. Instead, replace those calories with some sparkling water and/or performance water, such as my preferred brand, Alkaline88.

Making a few little changes in all aspects of your life is a much better strategy for successful and sustained improvement than trying to overhaul your life in one fell swoop. So, go out and make some little changes.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods