Don’t Squander the Now

- Don’t Squander the Now

- ETF Talk: Invest in U.S. Banks with This Fund

- This Greek Philosopher Taught Me to Trade Options

- Have A Why

***********************************************************

Don’t Squander the Now

Life can be a cruel mistress.

You can love her, take care of her and be truly good to her, but the next thing you know, she delivers you a heart-crushing blow.

Allow me to get personal here for a moment, as recent events in the lives of those close to me have prompted me to share them with you today. And in doing so, I hope to illustrate a couple of important points about life that can help us all through pain, sadness and struggle that are an inextricable part of existence.

Yesterday, I received word that a good friend of mine from my Army days was diagnosed with a heart problem. This problem is one that will require surgery and the installation of a pacemaker. Now, this man is in his early 50s, doesn’t smoke, hardly ever drinks and generally leads an active life. Why was he afflicted with this heart ailment? We don’t know, but he is, and that is what he must deal with now.

After giving me the downbeat news about his situation, my friend proceeded to tell me that his circumstance was “the good news.” He then told me about what he considered the actual bad news in his life, which was that his wife of nearly three decades had just been diagnosed with stage 2 breast cancer. To combat this disease, she will have to undergo chemotherapy, surgery and then more chemotherapy.

As you might imagine, a shadow crossed my heart when I heard this double-dose of bad news. Unfortunately, the tales of pain and loss weren’t nearly over for the day.

Just a few hours later, another friend of mine told me that she was feeling overwhelming sadness, because it was one year ago today that her husband of 32 years had died due to complications from COVID-19. Her husband also was in his 50s, was very healthy and had no known comorbidities that anyone could identify.

Now, I wish I could tell you this was the end of the woe for the day, but it wasn’t. Late last night, another very good friend and I were reflecting on the sadness he felt regarding his recent separation and impending divorce. I knew that the chief reason for the dissolution of his 20-year marriage was his wife’s struggle with drug and alcohol abuse, which led to her mental and physical deterioration into a person he no longer recognized.

As I slept on the events of the prior day, I woke with a jumble of thoughts that I wanted to put down. The reason why is because I hope that my conclusions can illuminate not only my approach to the world for you, but hopefully they can help you if you are struggling with any of these difficulties. And even if you aren’t dealing with these now, life isn’t likely to let you off the hook.

There’s a great line in the novel “Fight Club” by Chuck Palahniuk that says: “On a long enough timeline, the survival rate for everyone drops to zero.”

Well, on a long enough timeline, and no matter who we are or how well we’ve managed to organize our lives, nearly all of us will experience profound sadness, crushing loss, deep disappointment and likely intense physical pain that becomes both all-encompassing and debilitating.

Moreover, every one of us, if we haven’t already, will likely have to deal with the pain, hurt and loss associated with the death of either a grandparent, a favorite aunt or uncle, a mother, a father, a brother, a sister, a close friend or even what is said to be the most difficult loss to bear, the loss of a child.

What’s even more intense is that, as humans, we know that we are mortal. We know we are going to die, and we know that everyone we know living today also is going to die.

For me, knowing this allows me to focus on what I am doing right now — in this very moment. Because all we are sure of is that we have this moment. And this moment. And this moment.

This realization that life is now prompts me to ask myself why anyone would ever want to squander the now.

Why would you ever allow yourself to consciously live in a state of negativity, one replete with unhappiness, anger, distress, discontent and malaise over trivial things you have no control over? And let’s face it, nearly everything in our lives we have little-to-no control over.

Of course, that’s not to say we should feel something other than deep sadness over pain, loss and other adverse circumstances. It is proper to feel these emotions, and you do not want to shut them down or cut them off, as that would be a form of squandering the now.

Yet, think about all of the times we do squander the now by not paying close enough attention to our own minds.

We get mad when someone cuts us off on the freeway. We get upset if the barista gets our coffee order wrong. We become angry because one of the stocks we own slides after the company announces downbeat earnings guidance. But, if you realize that it is your reaction to these things which is the cause of your sadness, and not the actual events themselves, you realize that with a little effort, you can alter your mental state.

The first step in doing this, at least for me, is recognizing that thoughts are the root cause of all of our emotional states. Indeed, the ideas you have in the now are what is affecting you right now. So, if you can consciously identify those thoughts, process them and either let them go, change them or integrate them for future use, you will be much better off when the inevitable wave of life’s sadness slams into your own shore.

By knowing your own mind, and by cultivating a self-awareness capable of identifying thoughts as the root cause of all discomfort, pain and pleasure, arousal and peak experience, you can avoid squandering the now.

Instead, you can embrace the now for what it is, and you can become better at dealing with the good, the bad and the ugly — because life is replete with all of these elements, and that isn’t going to change.

So, do not let your head wander its way into despair. Take control of your thoughts, which one can do via practices such as mindfulness meditation and other active efforts to recognize the content of one’s own mind.

By recognizing the “you” in there, and the content of your inner life, you will put yourself on the path to making sense of the kind of day I had yesterday, and the gloriously happy days I know I will experience in the future — and everything in between.

***************************************************************

ETF Talk: Invest in U.S. Banks with This Fund

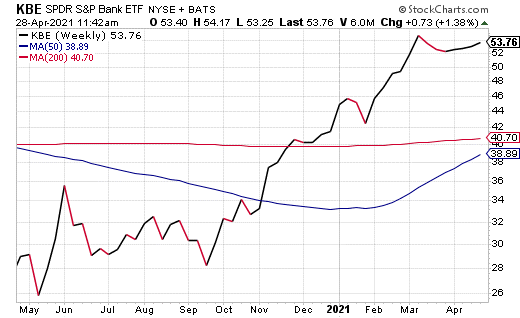

The SPDR S&P Bank ETF (KBE) tracks an equal-weighted index of U.S. banking stocks and generally will invest at least 80% of its total assets in such financial services companies.

The index represents the bank segment of the S&P Total Market Index and comprises the following sub-industries: Asset Management & Custody Banks, Diversified Banks, Regional Banks, Other Diversified Financial Services and Thrifts & Mortgage Finance. The index is also equally weighted at each quarterly rebalancing, which puts giant banks on equal footing with smaller ones (at rebalance at least) and increases the emphasis on smaller firms overall than a market-cap-weighted fund.

KBE fills a niche market by providing exposure to a broad selection of banks in an equal-weighted manner. The ETF has amassed an impressive $4 billion in assets under management. With a 0.35% expense ratio, the fund is relatively inexpensive to hold in relation to other ETFs.

Source: StockCharts.com

The fund trades around $53-54 and has an attractive 2.23% distribution yield. As the chart above shows, KBE’s share price has grown a whopping 80% over the trailing 12-month period to beat its index’s 21.99% return during the same time. The fund also is up 21.91% so far this year, compared to a gain of 7% for its index.

The top three holdings in the fund, and their percentage of KBE’s assets, are MGIC Investment Corp., 1.65%; Essent Group Ltd., 1.64%; and Wells Fargo & Co., 1.61%. The fund holds a total of 96 equities.

With strong fundamentals and a seasoned management team, this fund is poised to continue growing higher. However, I do urge all interested investors to exercise their own due diligence in deciding whether this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

This Greek Philosopher Taught Me to Trade Options

Alright, I know what you’re thinking. How the heck did a Greek philosopher teach me to how to trade options?

Well, if you’ve been a reader of The Deep Woods for even just a short time, you likely know that I am a huge advocate of cultivating and integrating all kinds of knowledge about the world — and not just knowledge that’s directly related to stocks, bonds, exchange-traded funds (ETFs) and options.

The way I see things, it’s important to cultivate and integrate knowledge from wherever you find it, including from sources such as pop culture, literature, science, religion, music, history, art, biology, psychology — and especially philosophy.

Doing so makes you a better, well-rounded human and I think it also makes you a better investor. The reason why is because the more you know about why you’re doing things, the better you get at actually doing them.

Still, what do I mean when I say a Greek philosopher taught me how to trade options? Well, to understand this, we must go back about 2,500 years ago to pre-Socratic Greece and learn about the man named Thales of Miletus.

Thales was a brilliant philosopher and one of the first real Western thinkers and scientists (although “scientist” wasn’t a term that was used at the time). He is best known for his thesis that “all things are water,” which we know now to be erroneous, but was a groundbreaking thought, given the scientific infancy of 6th century B.C.E. Greece.

Moreover, Thales was among the first thinkers to make hypotheses that were testable and falsifiable, both bedrock principles of scientific inquiry today, but absent among his fellow thinkers at the time.

According to the Internet Encyclopedia of Philosophy, none other than the great Aristotle identified Thales as the first person to investigate basic principles, the first to question the origins of substances and matter and, therefore, the founder of the school of natural philosophy.

Among his accomplishments was the successful prediction of an eclipse of the sun that occurred on May 28, 585 B.C.E. Although it’s not known exactly how Thales was able to predict this event, the most likely explanation is that he studied the solar and lunar cycles.

Yet still, what did I learn about trading options from Thales?

To answer that, we must realize that Thales was a philosopher and a man not particularly concerned with the accumulation of monetary wealth. And because of his lack of finances, he often was criticized by the elites of Athenian society. To prove the elites wrong, and to demonstrate the power of reason and natural philosophy, Thales did something that should put him in the investing history books.

Based on his study, assessment and knowledge of the Greek climate, Thales reasoned that there would be a particularly good harvest for olives one year. But rather than sit on this information, Thales had taken the next step and put deposits down on all the olive presses in Miletus over the preceding winter.

Thales basically cornered the market on olive presses for a small investment. Stated in modern trading terms, Thales bought call options on olive presses and paid a small amount for the right to control those presses (i.e., he paid a small premium for the option).

When his prediction of a bountiful olive harvest did indeed come to pass, Thales’ bet paid off handsomely. The boom harvest created heavy demand for the olive presses, and because Thales held a virtual monopoly on these presses, he was able to rent them out at a huge profit.

In my opinion, this was perhaps one of the most important events — not only in market history, but in the whole of human history.

The reason why is because Thales demonstrated that “science” and the accumulation of wealth really are connected. And, as the old saying goes, knowledge is power. He also demonstrated that if you know what your competition doesn’t, you will have a tremendous advantage over them.

It is for this life lesson, as well as the accompanying investing lesson of Thales and the olive presses, that we should be thankful for the man from Miletus.

I know I am thankful for him, as his foresight and virtual creation of the concept of options trading has allowed me to help investors make some serious profits. And that’s precisely what we have done in my Bullseye Stock Trader advisory service, as we’ve consistently banked multiple double-digit- and triple-digit-percentage profits using a combination of buying the right common stocks along with out-of-the-money call options, at precisely the right time.

To find out more about my Bullseye Stock Trader service, simply click here.

Finally, the next time someone asks who taught you about investing, instead of saying something conventional like Warren Buffett, Ray Dalio or John Templeton, tell them about Thales of Miletus.

*****************************************************************

Have A Why

“He who has a why to live can bear almost any how.”

— Friedrich Nietzsche

One key to overcoming life’s inevitable sadness is to have a really passionate and productive purpose at the center of your existence. This purpose is different for nearly everyone, and only you can determine what that is for yourself. But regardless of your age, social status or life experience, having a “why to live” will help you to endure any discomfort life can dish out.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods