Divided We Stand to Profit

- Divided We Stand to Profit

- ETF Talk: Be Your Own Electronic Gaming HERO with This Fund

- Cultivating A Survival-Based Combat Mindset

- Crushing Krugman’s Crash Caricature

- On Differences of Belief

***********************************************************

Yes, I’ve been up all night watching and analyzing the election results, but I’m not the least bit tired. The reason why is because when it comes to seminal events that matter in life, I’m all about being 100% present.

Another way to describe how I feel is what Jesse Ventura’s character said in the sci-fi classic Predator. After being shot in the arm and still fighting, a fellow soldier says, “You’re hit, you’re bleeding, man.” To which Ventura replies, “I ain’t got time to bleed.” So, in that warrior spirit, I say — I ain’t got time to be tired.

Oh, and you know what else ain’t got time to be tired? The stock market.

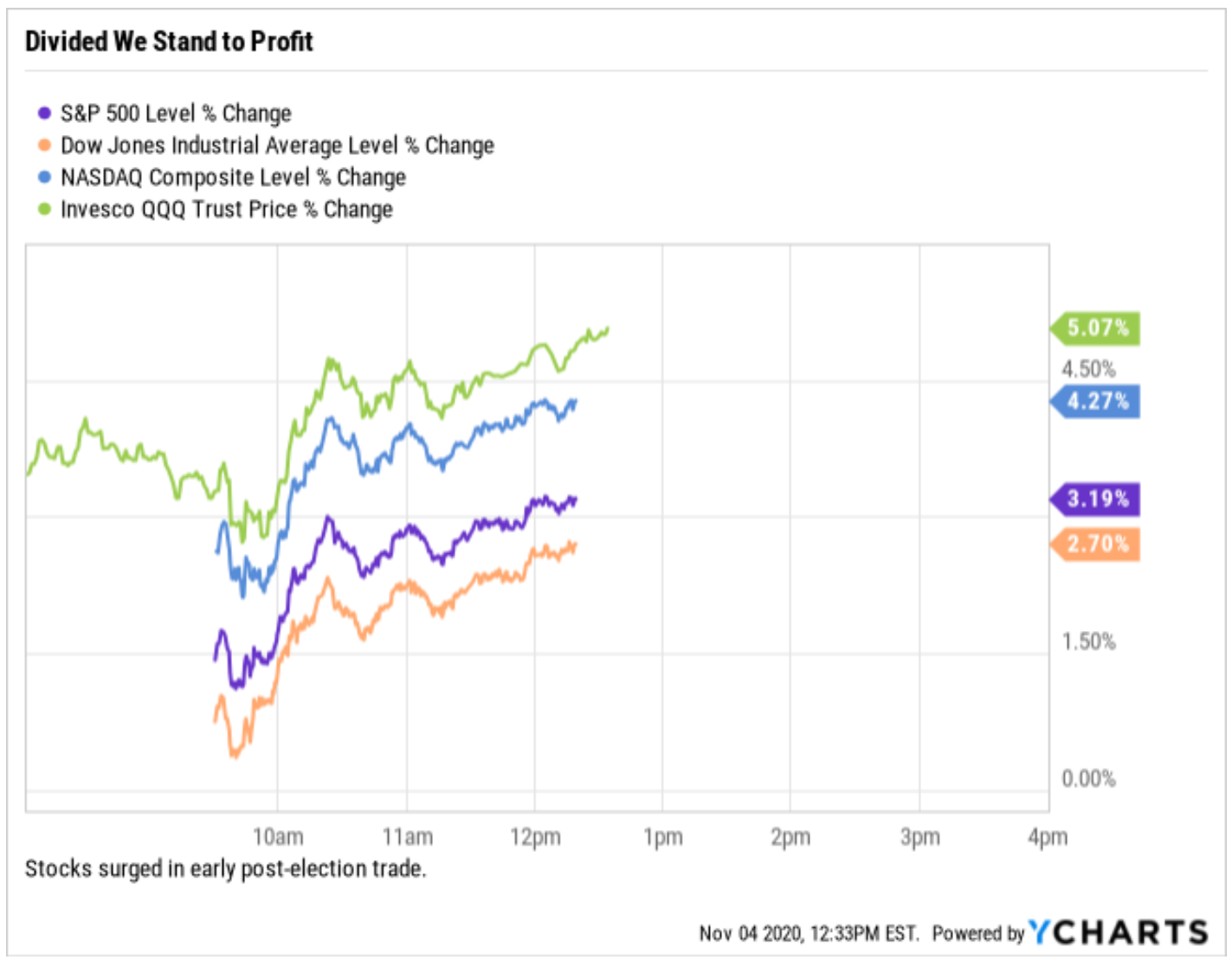

After the first three hours of post-election Wednesday trading, stocks were up huge. The Dow was up some 2.70%, while the S&P 500 jumped 3.19%. The real spike was in the tech-heavy NASDAQ Composite, which was up 4.27%. Now, that’s what I call a post-election surge! That surge was even more prominent in the NASDAQ 100, or QQQ, which was up more than 5% in early trading on Wednesday.

The reason for the big surge in the QQQ is because of the big price gains in super-cap technology stocks. I have been bullish in those stocks for a long time, and I am still very bullish on them.

So, the question I’ve been answering all throughout the morning to my friends, subscribers and colleagues is: Why are stocks, and especially tech stocks, up so much when we don’t know yet who will be the next president of the United States?

The answer to that lies in a little twisting of the phrase, “United we stand, divided we fall.” Because when it comes to the markets, it is more a case of, “Divided we stand to profit.”

I say that, because “divided” here does not refer to a divided society. Yes, we definitely have that, and evidence of that is clear in this “too close to call” election. Yet what we also have evidence of this morning is that as it stands right now, we will almost certainly have a Republican Senate and a Democrat House of Representatives.

Also, as it stands right now, the trend in the key remaining undecided swing states (Michigan, Pennsylvania and Wisconsin) is in favor of a Joe Biden victory.

We should know the results relatively soon, as many of these states will complete their vote counts sometime today or tomorrow. And if Biden wins, then we will have a divided government with one party in control of the White House and a split Congress.

Now, historically speaking, that is a win for stocks.

According to data from CFRA Research, the best market performance takes place when there is a Democrat president and a split Congress, with Republicans controlling one chamber. That performance, incidentally, was an average calendar year total return of 16% on the S&P 500.

I don’t know about you, but I would be pretty happy with an S&P 500 averaging 16% annual gains over the next four years.

Of course, we don’t know the exact outcome of the election just yet, and because this is 2020, any crazy development seems to not only be possible, but very likely. Still, if we do end up with a divided government, history tells us that it will be good for our portfolios.

So, however you feel about this likely election outcome, at least from a pure market perspective, things are starting off to be much better than expected. And in this crazy COVID-19 year, I’ll take any form of better than expected I can get.

Oh, and as for super-cap tech stocks, one big reason why they are surging is because with a split Congress, there will almost certainly not be a big tax increase on capital gains of the sort Biden wants. The threat of a big rise in capital gains taxes was holding back the buying in the already bid-up tech leaders, because if there would have been a capital gains hike in 2021, investors would have sold before the year was out to protect profits from the pilfering palms of politicians.

So, if you have gains in big tech, like we do in my newsletter advisory services, we won’t be forced to sell to avoid Uncle Sam’s (or Uncle Joe’s and Auntie Kamala’s) greedy pockets.

Finally, I want to close today’s issue with a beautiful observation written by my good friend and “brother from another mother,” Rich Checkan of the highly recommended precious metals firm Asset Strategies International:

No matter the final outcome, I am proud to live in a country where change can happen, or things can remain the same, as a result of a peaceful (for the most part) process, where the will of citizens is measured and accepted.

Whether it be in a few days or a few weeks, we will have our answer, and we will move forward together as a nation. And, if we don’t like the outcome, we have a voice we can raise four years from now.

I heard a quote the other day, and I can’t remember where, but I’m going to share it anyway…

“In the end, nothing that happens in the White House has as much impact on you or those you love as what happens in Your House.”

Live well. Treat your friends and your enemies with respect. Make a difference through your shining example to those you hold most dear.

Hey, I couldn’t have said it any better myself.

*****

P.S. The presidential election is over, but the results are very much in question. That’s why it is critical that you attend our Post-Election Summit, which is just two days away!

This private, in-person, “off the record” financial summit sponsored by the Investment Club of America. This confidential meeting will take place on Friday, Nov. 6 and Saturday, Nov. 7, in an undisclosed location in Las Vegas.

If Biden/Harris do in fact win the White House, and if the Republicans retain control of the Senate, what will the best investments be for the years ahead? More importantly, what will be the sectors to avoid so that you don’t get caught investing in the least-likely winners?

To help make sense of it all, we have brought together some of the world’s top experts to discuss the outcome of the November elections, including Mark Skousen, Hilary Kramer, Bryan Perry and yours truly, to name just a few.

Due to legal restrictions, attendance at the Post-Election Global Financial Summit will be limited. We urge you to register now and not be disappointed.

To learn more about the conference, go to https://globalfinancialsummit.co/.

***************************************************************

ETF Talk: Be Your Own Electronic Gaming HERO with This Fund

Esports and gaming are one of the hottest market themes right now.

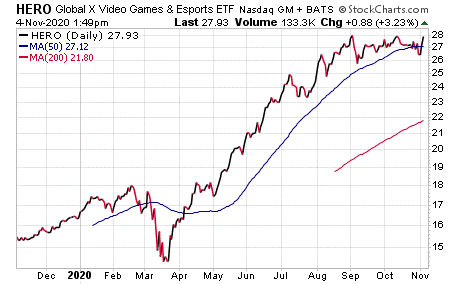

A number of different exchange-traded funds (ETFs) have cropped up to provide investors with a way to invest in a swath of companies in the area. One of these is Global X Video Games & Esports ETF (HERO).

The fund’s investments are in companies primarily or significantly invested in the video games and esports industries. Because of the nature of this requirement, companies such as Microsoft (MSFT), which has a large gaming arm but gets most of its revenue elsewhere, are not included. In addition, there is a market-cap requirement for inclusion in HERO. It is market-cap-weighted, so the largest companies will form a larger percentage of its portfolio.

This industry and fund have powered way ahead this year, possibly due in part to COVID-19 somewhat improving sales for gaming companies. HERO is up 72.75% this year, putting it substantially ahead of the similarly themed fund Wedbush ETFMG Video Game Tech ETF (GAMR) with its 59.25% gain and light years ahead of the S&P 500’s roughly 10% gain over the same period.

The expense ratio for this fund is 0.50%, and it pays a tiny yield of 0.15%. Assets under management total $367 million. The most recent three months also have been a strong period of performance for the fund, showing a gain of 10.2%.

Chart Courtesy of www.stockcharts.com

HERO currently has just 41 holdings, which are spread among a number of countries. The United States, Japan and China hold the largest shares, but the fund is diverse in terms of country distribution.

The top 10 holdings add up to 54% of the fund’s assets. They include Sea Ltd. (SE), 7.76%; Nintendo Co. Ltd., 6.56%; NVIDIA Corp. (NVDA), 6.54%; Activision Blizzard (ATVI), 5.15%; and NEXON Co. Ltd., 4.95%.

For investors looking to get into the world of gaming with a fund that has posted strong recent returns, Global X Video Games & Esports ETF (HERO) should receive strong consideration.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Cultivating a Survival-Based Combat Mindset

Combat is a serious business.

If you ever have to confront an assailant in a life or death physical struggle, what do you need to know to survive?

In the new episode of the Way of the Renaissance Man podcast, I speak with expert combatives instructor Troy Coe, founder of Reality Defense Training, an Arizona-based self-defense academy that emphasizes what’s called a survival-based approach to martial arts.

In this fascinating discussion, we talk about the nature of combat, why scenario-based combat training is a must to prepare you for a real-world confrontation and why you need to experience an “adrenaline dump” to learn how to manage the physiological stresses that occur during combat situations.

If you value your life and the lives of those you love, it is incumbent upon you to learn how to protect and defend life. Troy Coe is a man who can help you do just that, and you’ll discover the myriad ways how in this deep dive into the martial mindset.

****************************

In case you missed it….

Crushing Krugman’s Crass Caricature

Perhaps it’s the warrior sheepdog in me, but when someone attacks a person I love and falsely accuses him or her of mass murder, well, you can bet you are going to get an aggressive response. Oh, and when that abhorrent allegation comes from the New York Times, well, then it’s even more incumbent upon me to unsheathe my rational sabre and begin thrusting.

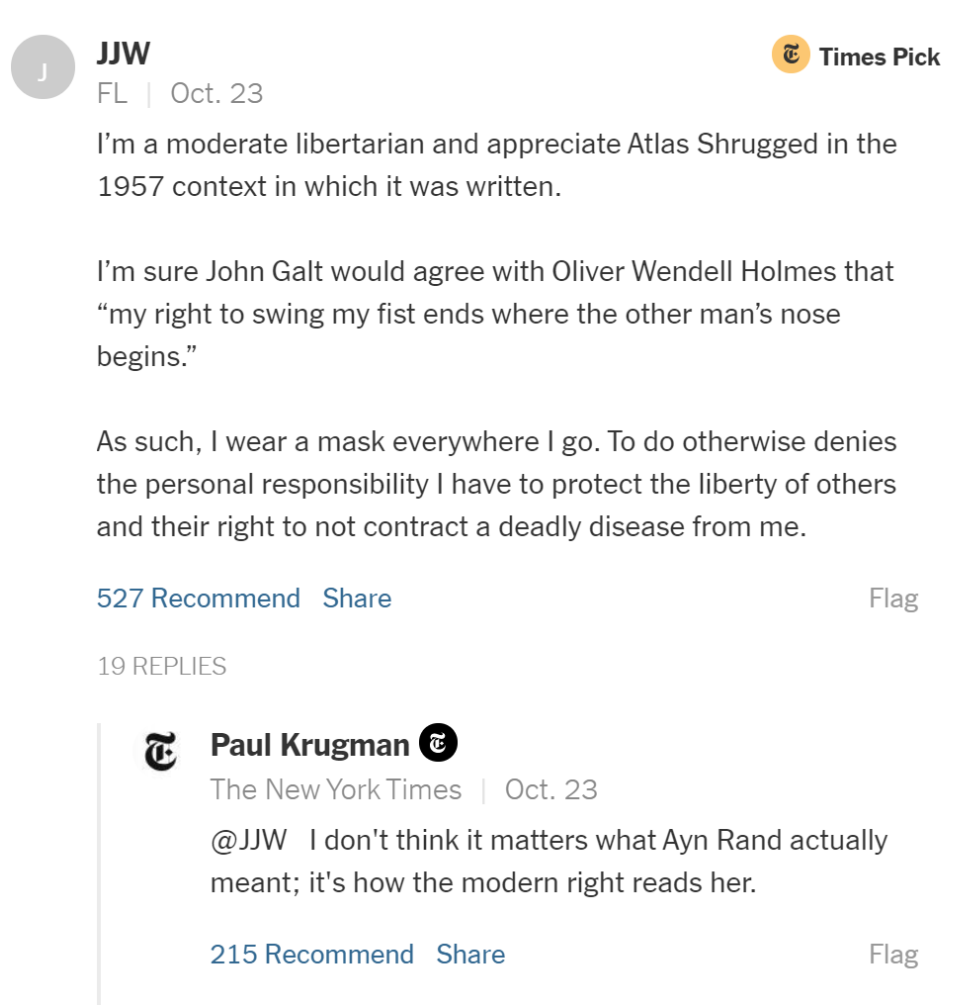

In his column on Oct. 22 column, originally titled, “How Many Americans Will Ayn Rand Kill?,” opinion writer and Nobel Laureate Paul Krugman blamed Rand’s ideas on freedom as being at the root of the coronavirus pandemic and its increasingly high U.S. death count in the United States. I say, “originally titled,” because even the New York Times realized, after pressure from those with views such as mine, that this was a disgusting smear of a headline. The new title is the much more benign as it states, “When Libertarianism Goes Bad.” While this is also a false accusation, it is far less accusatory.

Here’s how Krugman mentions Rand in the article, alongside an obligatory slight to President Trump, after chronicling the recent rise in coronavirus case counts in many parts of the country:

“But why does this keep happening? Why does America keep making the same mistakes? Donald Trump’s disastrous leadership is, of course, an important factor. But I also blame Ayn Rand — or, more generally, libertarianism gone bad, a misunderstanding of what freedom is all about.”

Krugman goes on to imply that Rand’s views are somehow equivalent to “science denial,” and that concepts such as “freedom” and “personal responsibility” are at the heart of the devastating damage from COVID-19.

This is such an inaccurate caricature of Rand’s ideas that even Krugman himself had to back off on this point, effectively admitting as much in one of his replies to a reader comment on the New York Times website. Here, Krugman replies to a thoughtful comment (see below) by saying, “I don’t think it matters what Ayn Rand actually meant; it’s how the modern right reads her.”

My response here is that it absolutely does matter what Ayn Rand actually said, what she stood for and what her ideas actually mean. What doesn’t matter, at least from the perspective of objective reality, is what leftist smear mongers such as Krugman want to twist her ideas into.

Of course, it does matter, from a societal standpoint, and from an intellectual battle perspective, but try as Krugman may to distort them, Rand’s powerful views are out there for all the world to see for themselves in her best-selling novels, “The Fountainhead” and “Atlas Shrugged,” as well as in her many works of non-fiction that cover metaphysics, epistemology, ethics, economics, politics, aesthetics and the application of her views to the current events of her time.

This grand an undertaking is something that I suspect Krugman fears, because he is smart enough to know that out of all the voices that stand in opposition to his worldview, Rand’s is the most important and most threatening. Why? Well, because as Rand scholar Onkar Ghate, senior fellow at the Ayn Rand Institute, commented during a video presentation with fellow Ayn Rand Institute scholar Elan Journo:

“He [Krugman] knows the one thinker that opposes him on moral grounds, that challenges his whole moral framework, that in America we should not be living for the common good, we should not be sacrificing our interest but rather pursuing our own happiness, she [Rand] is the only one that makes the moral argument against a mixed economy, against the welfare state, and that’s an argument he doesn’t want to face head on, he doesn’t want to face that someone is challenging him morally that what we are doing is all wrong.”

Indeed, this isn’t the first time Krugman has gone out of his way to mention Rand in his work. This fact is quite revealing. Of course, today’s mention of Krugman in this column also isn’t my first takedown of his views. Almost three years ago today, I blasted Krugman on his criticism of the Trump tax plan. While Krugman was lamenting that the plan favors the rich, I argued that this shouldn’t be a lament. Instead, it should be a salient virtue. Here’s how I framed it:

“Indeed, one of the most aggravating accusations levied against the Trump administration and the GOP’s tax reform proposals is that it favors the rich. I say aggravating, because that criticism is analogous to saying that the lunch special at the Chinese buffet favors those who eat a lot. Of course, the tax plan, i.e. tax cuts, are going to favor the rich. That’s because it’s the rich who pay the taxes.”

As I mentioned in that piece, Krugman knows that the overwhelming majority of income tax revenue that is collected by the federal government comes from the richest Americans. But he just thinks that, rather than a tax cut to those who pay the most, tax policy should be aggressively punitive, and that the money that is collected should then be redistributed via the government bureaucracy to the projects, policies and political goals of those who hold power.

And herein lies the essence of the dueling viewpoints between Rand and Krugman.

Rand believes that you own your own life and that you should keep the products of your mind. Krugman believes that your life is not your own, that your identity is much more a function of the collective, that you should be subservient to the group and that you should consent to the relinquishing of the products of your mind.

Now, if I am wrong about Krugman’s views, then I invite the professor to come debate me on the subject and tell me why I’m wrong. And if he’s up for debate, he also should accept the invitation from my friends at the Ayn Rand Institute, who have invited Krugman to come out from behind his smears, and debate any Ayn Rand Institute scholar of his choice regarding Rand’s ideas and the culpability of those ideas as it pertains to the coronavirus deaths.

Finally, and just for the record, Ayn Rand said just the opposite of what Krugman claims her views are. Here’s a quote from Rand during the Q&A session from her 1963 lecture, “America’s Persecuted Minority, Big Business”:

“If someone has a contagious disease against which there is no inoculation, the government would have the right to require quarantine.”

Hey, New York Times and Paul Krugman, if you are listening, print that!

*******************************************************************

On Differences of Belief

“Toward no crimes have men shown themselves so cold-bloodedly cruel as in punishing differences of belief.”

–James Russell Lowell

As the poet poignantly puts it, humans are at our worst when we confront opposing beliefs. And while strong beliefs are always worth fighting for, in civil society that fighting must be done in the intellectual and political sphere, and not the physical sphere. Yes, sometimes we have to fight bad ideas with physical force (e.g. Nazi Germany, Soviet expansionism, radical Islamic jihadists).

But save for those ideas that mobilize force against us, disputes over beliefs about tax policy, policing, education, health care, etc., need to be fought out in the only arena that rational men should fight in — the arena of conversation and debate.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods