Digesting a Tide Pod

- Digesting a Tide Pod

- ETF Talk: Seeking Solace in an Equal-Weight Cybersecurity ETF

- A Thirst-Quenching Conversation

- Some Kind of Wonderful

- Our Adolescent Lens

***********************************************************

Digesting a Tide Pod

A few years back, the mainstream news was packed with the absurdity of a new game being played by adolescents called the “Tide Pod Challenge.”

This “game” involved kids eating the Tide laundry detergent pods, despite the fact that eating them was poisonous, dangerous and even lethal. Moreover, they filmed themselves doing it. Aww, such is the nature of wannabe celebrity culture.

Of course, the kids who were playing the game knew that it was dangerous, but that was the whole point. You see, the adolescent brain can be a source of glorious wonderment or downright stupid exploration. In the Tide pod case, it was clearly the case of the latter.

But why, do you ask, am I bringing up the subject of the Tide Pod Challenge today?

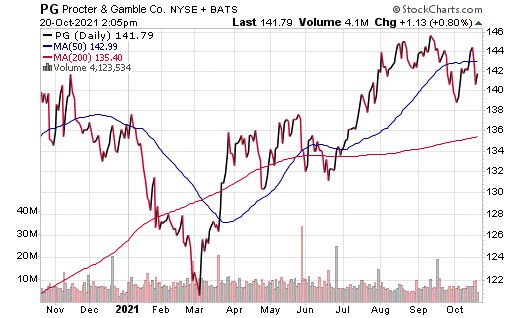

The reason why is because Tide is one of the many brands made by consumer staples giant Procter & Gamble (NYSE: PG).

Now, PG is a core holding in my Intelligence Report newsletter advisory service, and on Tuesday, the company reported a telling, and very significant, fiscal Q1 earnings report.

Here is what we told subscribers to the “Eagle Eye Opener” morning briefing about the significance of the PG earnings release, and what it portends for the rest of this all-important earnings season.

***

Of all the earnings reports yesterday (and probably this week), the Procter & Gamble earnings results are perhaps the most useful, and they offer some cautious optimism on margins and earnings. Here’s why:

PG reported much stronger-than-expected headwinds from commodity prices and supply chain disruptions. In July, PG estimated that higher commodity prices and supply chain issues would result in a cost increase of $1.9 billion. But in just three months, PG revised those costs sharply higher, estimating that higher commodity prices would result in a $2.1 billion increase in costs, while transportation and freight accounted for an additional $200 million dollar increase in costs. This totals $2.3 billion, or more than 20% higher than the July estimate!

Yet, despite those substantial increases, PG was able to maintain the July guidance and still expected earnings to rise between 3% and 6% next year, with revenue growing 2-4% next year. And they will do that via supply chain management, improved efficiency (meaning cost cutting) and, most importantly, price increases.

We think that there are two notable takeaways from the PG report. First, inflation isn’t going away anytime soon. The fact that the maker of such staples as Tide is passing on these elevated costs means that higher consumer inflation will be with us for the foreseeable future, and while that doesn’t mean that inflation will stay at the current 4-5%, it does make it much more likely it will settle closer to 3% than the previous 2%.

Second, we can be cautiously optimistic that while rising costs are very real, U.S. corporate management has the tools to handle it (for now). Point being, PG was one of the firms most susceptible to supply chain issues and commodity costs increases, and the fact it held its guidance is encouraging for similar companies. However, it’s still far too early to declare earnings season a success (although this is a good indication).

From a market standpoint, this reinforces what we already know, i.e., the general direction of stocks over the medium term is still higher. Tactically, we want to stay long inflation-linked assets, because inflation is going to stay buoyant, and yields will likely continue to rise. So, we remain interested in banks, commodities, natural resource stocks, consumer discretionary, industrials, and value stocks more broadly.

Bottom line, it’s too early to say that markets are “in the clear” for this earnings season, but so far, the spike in costs is not translating into earnings reductions. If that can continue, it’ll remove a significant source of anxiety for investors.

***

The above analysis is the kind of look “under the market hood” that we provide in the “Eagle Eye Opener,” and we do it every single trading day at 8 a.m. Eastern.

If this is the kind of insight you’re looking for, and you should be, then I invite you to check out the “Eagle Eye Opener” daily market briefing right now.

***************************************************************

ETF Talk: Seeking Solace in an Equal-Weight Cybersecurity ETF

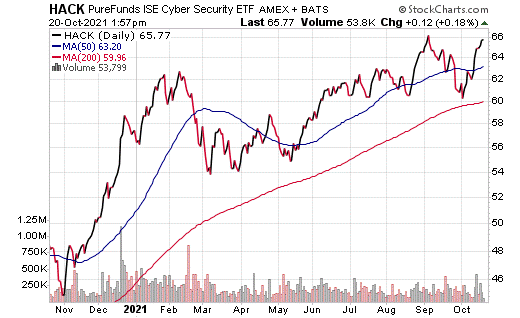

This article is the fifth in a series exploring equal-weight ETFs.

After a plethora of cybersecurity-related incidents perpetrated by both state and non-state actors around the globe against the United States, Europe and beyond, the importance of cybersecurity defenses and countermeasures in both national and corporate security has been thrust into the limelight.

As a result, cybersecurity likely will remain a hot issue that the public and private sectors will have to address for some time to come. Cybersecurity stocks previously appeared mainly in exchange-traded funds (ETFs) that are dedicated to technology or software stocks, but ETFMG Prime Cyber Security ETF (NYSEARCA: HACK) is believed to be the first equal-weighted ETF solely devoted to the growing technology field of cybersecurity.

HACK tracks a tiered and equal-weighted index that targets companies that provide cybersecurity technology and services. The ETF categorizes the companies as developers of hardware or software and providers of cybersecurity services. Also, while this is an equally weighted fund, HACK’s portfolio is slightly different than the standard definition of “equally-weighted ETF.” Each of the fund’s segments is weighted proportionately by its market capitalization in comparison with the cumulative market capitalization of both segments.

Currently, the fund’s top holdings include Cloudflare Inc. (NYSE: NET), Cisco Systems Inc. (NASDAQ: CSCO), Darktrace PLC (OTCMKTS: DRKTF), Palo Alto Networks Inc. (NYSE: PANW), BlackBerry Ltd. (NYSE: BB), Fortinet Inc. (NASDAQ: FTNT), Splunk Inc. (NASDAQ: SPLK) and Tenable Holdings Inc. (NASDAQ: TENB).

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Oct. 19, HACK has risen 1.66% in the past month and 8.86% for the past three months. It is currently up 14.31% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $2.44 billion in assets under management and has an expense ratio of 0.60%.

In short, while HACK does provide an investor with a way to profit from cybersecurity stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************

A Thirst-Quenching Conversation

The Way of the Renaissance Man podcast is all about conversations with interesting people who have a true passion for what they do.

In the latest episode, I speak with just such a person, and she is Nermine Rubin, Founder & CEO of Water 4 Mercy.

Water 4 Mercy is a nonprofit organization with a mission to provide a “One-Two-Three Solution” to permanently end thirst, hunger and poverty in our world.

Through the use of innovative technologies and partners, and with a whole lot of love and passion, Water 4 Mercy provides clean water, agriculture and educational solutions to areas in Africa that need it most.

In this interview, you will see for yourself how passion, dedication and knowledge can be focused to solve a very serious problem. And in doing so, you’ll see how one person can spearhead a movement that makes the world a better place.

I really enjoyed this heartfelt conversation with Nermine Rubin, and I suspect you will too.

*****************************************************************

In case you missed it…

Some Kind of Wonderful

Last week, I watched something wonderful.

That something was the second space flight of Blue Origin, Jeff Bezos’ company that is dedicated to making space travel a commercial venture for individual citizens, not just professional astronauts.

One citizen of note on this flight was a man who’s acutely associated with space, and he is Captain Kirk himself, “Star Trek” actor William Shatner.

The crew: Chris Boshuizen, Glen de Vries, Audrey Powers and William Shatner. Photo courtesy of Blue Origin.

Shatner is an extremely engaging man. I found that out firsthand a few years ago, as he was one of the keynote speakers at the FreedomFest conference, the annual celebration of free minds and free markets that I implore you all to attend. It is by far the best week of every year.

I recall Shatner speaking passionately to me about horsemanship, as we share a common love of knowing how to direct our steeds to behave in precisely the way we want by using just the right amount of subtle rider persuasion. Learning this difficult skill takes time, effort and passion, and it was nice to find that we shared this equine love.

Based on my past engagement with Shatner, it came as no real surprise to me that he was brilliant and engrossing immediately after exiting the Blue Origin capsule upon its return to Earth. Here’s what he told Jeff Bezos after the two exchanged an emotional embrace:

“What you have given me is the most profound experience I can imagine. I hope I never recover from this.”

I don’t know about you, but I want to feel that wonderful, too.

And as Shatner added, “Everybody in the world needs to do this. Everybody in the world needs to see it.”

I agree. And, when the time comes that I get the opportunity to take a Blue Origin flight, you had better believe I am going to suit up and be first in line for the ride.

Now, the emotional power of Shatner’s words really stuck with me, and the reason why is because everything about this event is what makes humankind so great.

First and foremost, the launching of a manned rocket into space, and then the safe return of both the rocket booster and the capsule containing the crew is the quintessence of reason in action.

Think about the time, mental calculations, capital, knowledge, scientific discoveries, human ingenuity, courage and grit it takes to accomplish such a feat. To achieve this task is a validation of man’s ability to command nature, reorder and reorganize its constituent parts, then recreate reality based on his values.

In this case, it is the value of democratizing space flight. It’s also the value of laying the groundwork for offering space flight — and making it a profitable venture in the long term.

In my mind, this is a concretization of all that’s right with humanity. And given that most of the mainstream news is an orgy of negativity, anti-human values on display, anti-man attitudes in society and anti-capitalist bromides, it is something truly wonderful to witness man’s mind triumphing the way it did via Blue Origin.

If you are the type of person who laments the current state of society, as I am, for much of its obvious absurdity, today’s Blue Origin flight should serve as a glowing tribute to what’s possible when mankind is at its collective best.

So, to Jeff Bezos and Captain Kirk, thank you for showing us some kind of wonderful.

Thank you for demonstrating man at his best, the man of the mind, the man of reason, and of reality, of science and of achievement.

I raise my glass in a toast to this “kind of wonderful.”

*****************************************************************

Our Adolescent Lens

“Adolescence is a time in which you experience everything more intensely.”

— Edward Zwick

No matter our age, I think we should often try to look at the world through our remembered adolescent lens (and no, this doesn’t mean eating Tide pods). By doing so, we can experience life with the raw intensity of youth. And while that can be both positive and negative, the point is we can connect with the power of life unfiltered by the tarnish of age. Just try it some time. After you do, I suspect you’ll thank me for the suggestion.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods