Dear Uncle Sam, Please Stay out of My Mouth

You would think that when it comes to what you put in your mouth, government would generally not have much jurisdiction. Yet, that’s definitely not the case, and it’s especially not the case when it comes to one instrument used to help facilitate the consumption of liquids.

Behold the case of the Uncle Sam straw ban.

Yes, you read that correctly. Straws now have become the demon seed of society, a plastic plague on the environment that no self-respecting, caring or compassionate person can allow to continue damaging Mother Earth and her progeny.

In a recent article at Reason.com, free-market warrior John Stossel, a man I’ve admired for decades, described the current push to place plastic straws on the endangered species list:

If environmental zealots and sycophants get their way, you won’t be allowed to sip it through a plastic straw.

Actress Nina Nelson and other celebrities made a video claiming that plastic straws kill sea life: “In the USA alone, over 500 million straws are being used every single day, most of which are going into our oceans.”

“I will stop sucking,” vowed the celebrities.

In obedient response, Seattle banned plastic straws, and other places plan to follow. Starbucks, Hyatt, and Hilton are all abandoning straws.

Katy Tang, of San Francisco’s Board of Supervisors, says, “We are no longer going to allow for plastic straws here.”

New York City Mayor Bill de Blasio agrees: “Their time has come and gone.”

Yep, you just can’t make this stuff up! As if that weren’t enough, this campaign even has its own social media hashtag: #stopsucking.

In this campaign, there is a claim that in the U.S. alone, we use 500 million plastic straws every day, many of which end up in the ocean.

What’s interesting about the straw ban movement, and what also is very typical about so many environmental and “feel good” societal movements, is that a simple digging into the facts often obliterates its proponents’ central claims.

As Stossel points out, while plastic pollution in the oceans is a real problem, the bulk of that pollution comes from Asian countries. Moreover, he makes the point that of the small amount of plastic waste that does come from America, only a tiny fraction of that is due to plastic straws.

As it turns out, the 500 million straws per day claim came about by the rigorous academic work of a nine-year-old boy who made a few telephone calls to straw manufacturers.

As Stossel writes, “Because the boy is cute, the media put him on TV. Now the media, environmental activists and politicians (is there a difference?) repeat ‘500 million straws used daily… many end up in oceans,’ as if it were just fact. The real number is much lower.”

Even if the number was 500 million, though, is that reason enough for the government to ban a product that citizens choose to use each day? What about the unintended consequences? If the plastic straws are banned, what will replace them?

According to the straw-bad activists, paper and bamboo straws would be better options. However, the problem with this is that paper and bamboo straws don’t work as well as plastic straws, and they cost much more to make. Stossel notes that paper straws cost about eight times as much as your typical plastic straw.

Clearly, the environmental warriors haven’t factored in the potential costs of their solution, but hey, who can be worried about such trivial issues as cost when you are trying to save the oceans from straws?

Now, in The Deep Woods, we don’t just look at an issue from the standpoint of cost, or emotions, or even practicality. In this publication, we peel back the layers of the onion skin on issues to get into the core of the matter. Here, the core principle is the initiation of government force.

Should the government have the right to impose its will on citizens to ban a product where the alleged damage it does is based on murky science and feel-good sentiment from celebrities?

My answer is a big, emphatic… NO!

So, the next time you hear about a plastic straw ban, or if there is a movement in your area to impose a regulation as meddlesome as this is, stand up for your rights and just say enough is enough. Don’t permit your freedom, however seemingly small, to be taken away from you in the name of the “greater good.”

The time has long since passed for Uncle Sam to stay out of our mouths.

Upcoming Appearance

I am scheduled to moderate a fiery debate between Mark Skousen and Mike Turner on “Buy and Hold vs. Market Timing,” Aug. 23-25, at the San Francisco MoneyShow. I also will be doing a presentation titled, “How to Invest Like a Renaissance Man.” I hope to see you there!

**************************************************************

ETF Talk: Seeking Dividend Income from Overseas in Turbulent Times

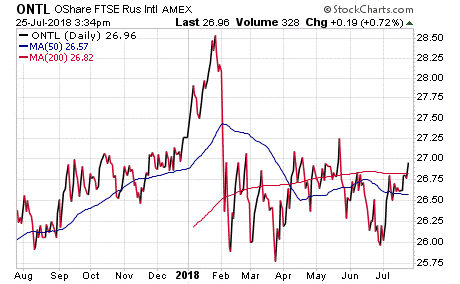

This week’s featured exchange-traded fund (ETF), the O’Shares FTSE Russell International Quality Dividend ETF (ONTL), reaches out to international companies in pursuit of dividend income.

ONTL is a multi-factored fund designed to reflect the performance of publicly listed, large-capitalization and mid-capitalization, dividend-paying issuers outside of the United States that exhibit high quality, low volatility and high dividend yields. The fund maintains a diversified portfolio by limiting each holding to no more than 5% of its total, as well as by rebalancing each quarter.

For this exposure, ONTL charges an expense ratio of 0.48%, which is in line with the segment average. ONTL’s portfolio exhibits a bias towards European countries due to the outstanding dividend stability that many European companies have shown. As of June 30, 2018, ONTL was 17.58% invested in the United Kingdom, 12.86% in Switzerland, 10.98% in France, 10.74% in Japan and 8.10% in Australia.

Year to date, ONTL is down 3.75%. This performance is correlated to the widespread poor returns of many international stock markets, which have come under pressure from slowing growth and political unrest. The FTSE 100, for example, which is an index that measures the 100 companies listed on the London Stock Exchange with the highest market capitalization, has fallen by 0.4% for the year. The Swiss Market Index, consisting of 20 of the largest Swiss blue-chip stocks, is down 4.5%. Japan’s market is down 3.7% year to date. These are some of the countries to which ONTL has the highest degree of exposure.

Since its inception on March 22, 2017, ONTL has returned 8.81%. The fund offers a distribution yield of 3.05% and pays monthly. Management has advised investors that the fund’s combination of reduced volatility, high quality and strong dividend track records are geared towards providing long-term profits.

Top holdings in the fund are Nestle, 3.62%; Roche Holding, 3.26%; Novartis, 3.25%; GlaxoSmithKline, 2.40%; and Total S.A., 2.35%.

Because the fund’s objective is to seek out dividend income, it places a heavier weighting on sectors such as health care and real estate than technology. A detailed breakdown of ONTL’s sector allocation shows 16% in health care, 15% in industrials, 15% in consumer staples, 9% in consumer discretionary and 8% in real estate.

For investors who are looking for stable dividend income from overseas, make sure to do due diligence on O’Shares FTSE Russell International Quality Dividend ETF (ONTL) before committing any money.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*******************************************************************

Don’t Fear the Yield Curve? Really?

By Tom Essaye, Editor, Sevens Report

Is it 2006 or 2018?

That seems like a silly question, but the similarities between the two years are starting to worry me.

Consider:

- The S&P 500 hit an all-time high in 2006 and 2018.

- Oil surged to multi-year highs in 2006 and 2018.

- Inflation accelerated in 2006 and 2018.

- The Fed raised rates to multi-year highs in 2006 and 2018.

- The yield curve inverted in 2006, and it is close to inverting in 2018.

- Former Fed Chairman Bernanke dismissed the yield curve inversion in 2006 saying it didn’t warn of a recession, and he just did the same thing in an interview last night!

“There’s an argument that maybe inversions aren’t the signal they once were because long-term interest rates are unusually low.” — Ben Bernanke, July 17, 2018

“I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come.” — Ben Bernanke, March 20, 2006

Look, I’m not trying to scare anyone, and I don’t think we’re steam rolling into another financial crisis. However, you have to admit the similarities between the two years are somewhat concerning, and that is because the single most important question investors need to answer correctly is: “When is the economic expansion (and bull market) over?”

Getting that question answered correctly will mean the difference between outperforming over the longer term vs. potentially getting caught in a 20% or 30% market decline.

We are focused on getting that answer right, and that’s why we’ve been talking about the flattening yield curve for over a year!

I believe, due to my experience living through it (twice), that an inverted 10’s-2’s yield spread is a harbinger of a recession sometime in the next six to 24 months. So, I find it both unnerving and disconcerting that I’m now reading multiple explanations from very qualified individuals who assure me that, this time, the yield curve inverting isn’t a harbinger of a recession (and eventually lower stock prices).

This is exactly what happened in 2006 when the curve inverted.

This latest effort came from a Federal Reserve Research Paper titled: (Don’t Fear) the Yield Curve.

It has created some buzz in the world of economics and it’s making the rounds, so I addressed this paper in a recent paid edition of the Sevens Report, because I consistently want to remind my subscribers that, once again, it’s not different this time — and that a yield curve inversion is a warning sign for investors.

The thesis of the paper is that measuring the spread between 18-month and three-month Treasuries is a better leading indicator of a recession than 10’s-2’s. And, that spread is not sending the same worrisome signal that 10’s-2’s is currently sending.

The general argument here is that shorter-duration Treasuries aren’t subject to global growth estimates that can distort yields. As such, they eliminate the potential for a false signal from an inversion.

Put in plain English, the implication is that the 10-year Treasury yield is being distorted by European buying, and as such is not as accurate as in the past (i.e., it’s different this time).

Instead, the paper’s authors (both Fed staff economists) assert that the 18- three-month spread is a better indicator of looming economic slowdowns because it has more accurately reflected, over time, when the market expects the Fed to cut rates within a year.

Logically, if the Fed is cutting rates, then we’re facing an economic slowdown. So, this could be a predictor of that loss of economic momentum. And, that makes sense, as you’d see the 18-month yields fall as investors buy the higher yield ahead of lower Fed funds in 12 months.

But, here are the two problems with this analysis:

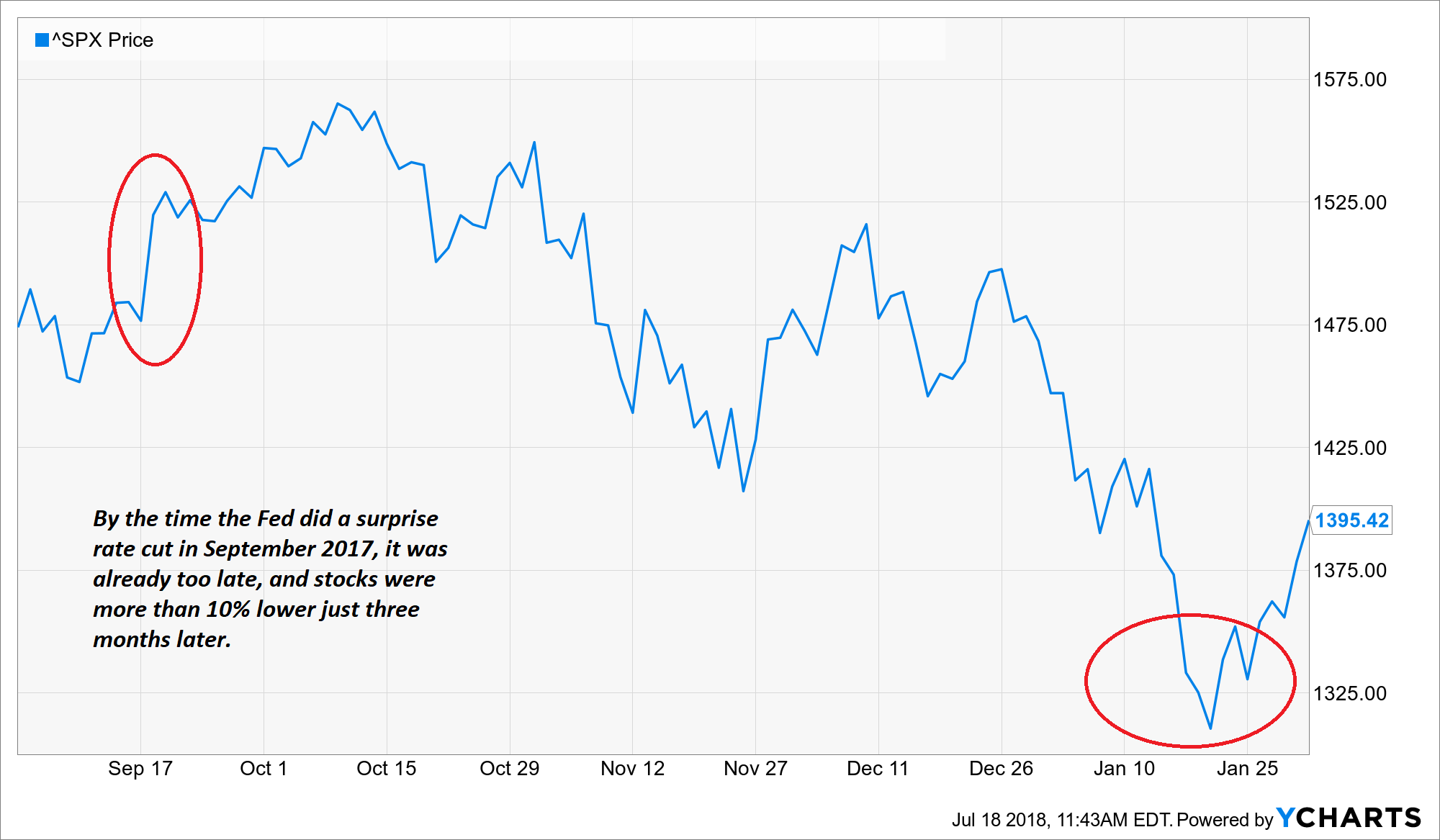

First, by the time the Fed is cutting rates, it’s too late. The Fed is always reactionary — both on the way up (waiting for proof of inflation) and on the way down (waiting for proof of a slowdown). Meanwhile, stocks are discounting mechanisms — they predict the future (sometimes inaccurately) before it happens.

Take 2007.

The Fed did a surprise 50-basis-point cut in September of that year — and within three months, stocks were 15% off their all-time highs.

Trying to determine allocation levels or manage money based on market expectations of a Fed rate cut is like playing bumper cars with a blindfold on — you need to turn the car to avoid a collision before you feel the impact, not after!

Second, trying to manage money based on predicting recessions is a fool’s errand. Again, stocks are discounting mechanisms, while recessions are usually dated long after the market has declined (and sometimes bottomed).

Take the last recession.

The National Bureau of Economic Research, which declares recessions, has the Great Recession starting in December 2007, when stocks were already 10% off their highs, and ending in June 2009, just three months after stocks had bottomed.

Bottom line, I’m not trying to throw garbage on the work of either of these gentlemen, because I’m sure they are both far more intelligent than I. But the fact that we now have Fed employees actively working on explanations on why “It’s Different This Time” regarding a 10’s-2’s inversion is sounding longer-term alarm bells in my head. Between that and a lot of other anecdotal observations, it is making me more and more convinced we are closer to the end of this expansion than the beginning.

Now, to be clear, that doesn’t mean I’m reducing stock exposure today. Because as I will keep saying, when the curve inverts, we traditionally have six-to-24 months of equity gains ahead. But the case that we are close to the end of this expansion continues to build, and I’m going to continue to relay those observations.

*******************

Thanks to Tom Essaye for this great analysis. And, if you want to see more of Tom’s research, you can find a supplemental each month in my Intelligence Report advisory service. You also can find much of Tom’s thinking throughout my Successful Investing and Fast Money Alert advisory services, and directly at Tom’s Sevens Report.

*********************************************************************

On Questions and Answers

“I would rather have questions that can’t be answered than answers that can’t be questioned.”

— Richard Feynman

Dogma is rightly said to the be the enemy of truth. The way I see it, if you want to continue to learn, continue to integrate concepts with reality and continue to be a more complete human, then you must be willing to live with questions that can’t be answered — and to sometimes admit that you just don’t know.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.