Crushing Krugman’s Crass Caricature

- Crushing Krugman’s Crass Caricature

- ETF Talk: ESPO Looks to Score in the World of Investing

- Cultivating a Survival-Based Combat Mindset

- A Bad Parent

***********************************************************

Crushing Krugman’s Crass Caricature

Perhaps it’s the warrior sheepdog in me, but when someone attacks a person I love and falsely accuses him or her of mass murder, well, you can bet you are going to get an aggressive response. Oh, and when that abhorrent allegation comes from the New York Times, well, then it’s even more incumbent upon me to unsheathe my rational sabre and begin thrusting.

In his column on Oct. 22 column, originally titled, “How Many Americans Will Ayn Rand Kill?”, opinion writer and Nobel Laureate, Paul Krugman, blamed Rand’s ideas on freedom as being at the root of the coronavirus pandemic and its increasingly high U.S. death count in the United States. I say “originally titled,” because even the New York Times realized, after pressure from those with views such as mine, that this was a disgusting smear of a headline. The new title is the much more benign as it states, “When Libertarianism Goes Bad.” While this is also a false accusation, it is far less accusatory.

Here’s how Krugman mentions Rand in the article, alongside an obligatory slight to President Trump, after chronicling the recent rise in coronavirus case counts in many parts of the country:

“But why does this keep happening? Why does America keep making the same mistakes? Donald Trump’s disastrous leadership is, of course, an important factor. But I also blame Ayn Rand — or, more generally, libertarianism gone bad, a misunderstanding of what freedom is all about.”

Krugman goes on to imply that Rand’s views are somehow equivalent to “science denial,” and that concepts such as “freedom” and “personal responsibility” are at the heart of the devastating damage from COVID-19.

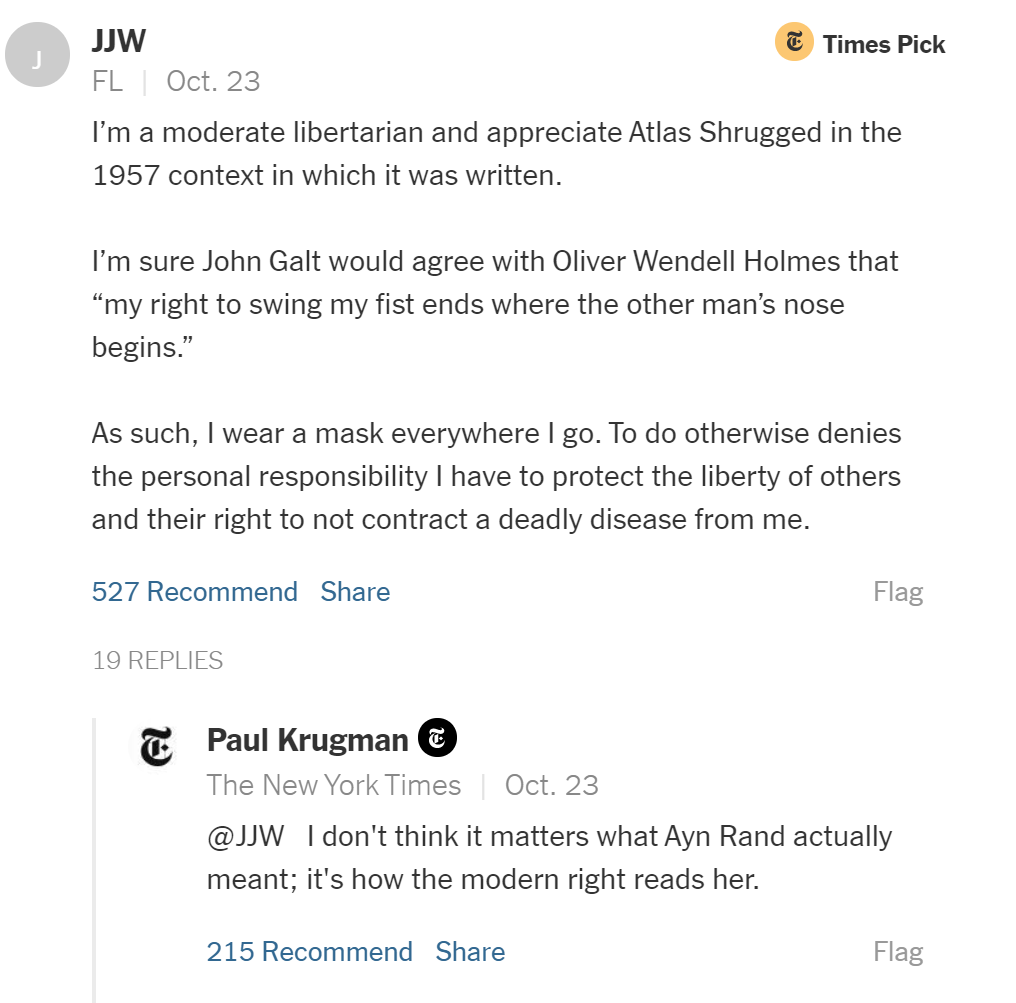

This is such an inaccurate caricature of Rand’s ideas that even Krugman himself had to back off on this point, effectively admitting as much in one of his replies to a reader comment on the New York Times website. Here, Krugman replies to a thoughtful comment (see below) by saying, “I don’t think it matters what Ayn Rand actually meant; it’s how the modern right reads her.”

My response here is that it absolutely does matter what Ayn Rand actually said, what she stood for and what her ideas actually mean. What doesn’t matter, at least from the perspective of objective reality, is what leftist smear mongers such as Krugman want to twist her ideas into.

Of course, it does matter, from a societal standpoint, and from an intellectual battle perspective, but try as Krugman may to distort them, Rand’s powerful views are out there for all the world to see for themselves in her best-selling novels, The Fountainhead and Atlas Shrugged, as well as in her many works of non-fiction that cover metaphysics, epistemology, ethics, economics, politics, aesthetics and the application of her views to the current events of her time.

This grand an undertaking is something that I suspect Krugman fears, because he is smart enough to know that out of all the voices that stand in opposition to his worldview, Rand’s is the most important and most threatening. Why? Well, because as Rand scholar Onkar Ghate, senior fellow at the Ayn Rand Institute, commented during a video presentation with fellow Ayn Rand Institute scholar Elan Journo:

“He [Krugman] knows the one thinker that opposes him on moral grounds, that challenges his whole moral framework, that in America we should not be living for the common good, we should not be sacrificing our interest but rather pursuing our own happiness, she [Rand] is the only one that makes the moral argument against a mixed economy, against the welfare state, and that’s an argument he doesn’t want to face head on, he doesn’t want to face that someone is challenging him morally that what we are doing is all wrong.”

Indeed, this isn’t the first time Krugman has gone out of his way to mention Rand in his work. This fact is quite revealing. Of course, today’s mention of Krugman in this column also isn’t my first takedown of his views. Almost three years ago today, I blasted Krugman on his criticism of the Trump tax plan. While Krugman was lamenting that the plan favors the rich, I argued that this shouldn’t be a lament. Instead, it should be a salient virtue. Here’s how I framed it:

“Indeed, one of the most aggravating accusations levied against the Trump administration and the GOP’s tax reform proposals is that it favors the rich. I say aggravating, because that criticism is analogous to saying that the lunch special at the Chinese buffet favors those who eat a lot. Of course, the tax plan, i.e. tax cuts, are going to favor the rich. That’s because it’s the rich who pay the taxes.”

As I mentioned in that piece, Krugman knows that the overwhelming majority of income tax revenue that is collected by the federal government comes from the richest Americans. But he just thinks that, rather than a tax cut to those who pay the most, tax policy should be aggressively punitive, and that the money that is collected should then be redistributed via the government bureaucracy to the projects, policies and political goals of those who hold power.

And herein lies the essence of the dueling viewpoints between Rand and Krugman.

Rand believes that you own your own life and that you should keep the products of your mind. Krugman believes that your life is not your own, that your identity is much more a function of the collective, that you should be subservient to the group and that you should consent to the relinquishing of the products of your mind.

Now, if I am wrong about Krugman’s views, then I invite the professor to come debate me on the subject and tell me why I’m wrong. And if he’s up for debate, he also should accept the invitation from my friends at the Ayn Rand Institute, who have invited Krugman to come out from behind his smears, and debate any Ayn Rand Institute scholar of his choice regarding Rand’s ideas and the culpability of those ideas as it pertains to the coronavirus deaths.

Finally, and just for the record, Ayn Rand said just the opposite of what Krugman claims her views are. Here’s a quote from Rand during the Q&A session from her 1963 lecture, “America’s Persecuted Minority, Big Business”:

“If someone has a contagious disease against which there is no inoculation, the government would have the right to require quarantine.”

Hey, New York Times and Paul Krugman, if you are listening, print that!

*****

P.S. The presidential election, and more importantly, our Post-Election Summit is just about one week away!

This private, in-person, “off the record” financial summit sponsored by the Investment Club of America. This confidential meeting will take place on Nov. 6-7 (right after the elections) in an undisclosed location in Las Vegas.

As it stands today, the election betting odds favor the Democrats. If the Biden/Harris ticket wins and the Democrats take over the House and the Senate, what will that mean for investors, entrepreneurs and the citizens of America? What happens if President Trump is re-elected, but the Democrats take control of both houses of Congress?

To help make sense of it all, we have brought together some of the world’s top experts to discuss the outcome of the November elections, including Mark Skousen, Hilary Kramer, Bryan Perry, and yours truly, to name just a few.

Due to legal restrictions, attendance at the Post-Election Global Financial Summit will be limited. We urge you to register now and not be disappointed.

To learn more about the conference, go to https://globalfinancialsummit.co/.

***************************************************************

ETF Talk: ESPO Looks to Score in the World of Investing

For investors captivated by the world of gaming, VanEck Vectors Video Gaming and eSports ETF (NASDAQ:ESPO) may be of interest for those who are looking to score in the market.

ESPO is an exchange-traded fund (ETF) that tracks the overall performance of companies involved in video game development, esports and related hardware and software. The fund’s portfolio is made up of stocks related to video gaming and esports.

To be eligible, these stocks must generate at least half of their revenue from relevant industries, such as those mentioned above, and streaming services as well. For investors who prefer the esports side of the gaming world, ESPO also holds companies that are involved in esports events, including league operators. This gaming-focused ETF has a global reach, as its primary focus is on well-known game developers and hardware companies from the United States, Japan, China and Korea.

ESPO has an expense ratio of 0.55% and a yield of 0.14%. It has amassed $567.61 million in assets under management.

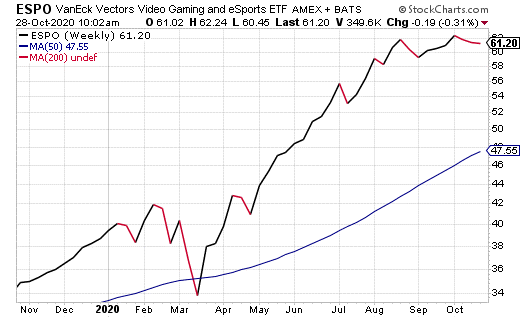

Along with many stocks and funds across nearly all sectors, ESPO dropped sharply in mid-March, but recovered fast in early April. In fact, its 200-day moving average (MA) hit an all-time high on April 17, with an opening price of $43.23. As is evidenced by the chart below, the fund’s 50-day MA has continued to climb steadily, even across the COVID-19-clouded lows in March.

Chart courtesy of www.stockcharts.com

As this ETF is focused on all things related to the gaming and esports industries, 77.21% of its portfolio is made up of holdings in the Communications Services sector. 17.72% of the portfolio is in the Technology sector. Its top five holdings include NVIDIA Corp. (NVDA), 8.22%; Tencent Holdings Ltd. (00700), 8.02%; Advanced Micro Devices Inc. (AMD), 6.77%; Nintendo Co. Ltd. (7974), 6.56%; and Sea Ltd. ADR (SE.SI), 6.28%.

The fund’s ticker, ESPO, also may conjure up recollections for many investors of the nickname for NHL Hockey Hall of Fame center Phil Esposito, a teammate with the great defenseman Bobby Orr in the 1970s. They won two Stanley Cup Championships together with the Boston Bruins in 1970 and 1972. Esposito, inducted into the Hockey Hall of Fame in 1984, is sixth in NHL career goals, with 717, and 10th in points (goals and assists), notching 1,590.

In sum, VanEck Vectors Video Gaming and eSports ETF (NASDAQ:ESPO) is a strong competitor in the Global Video Games and Esports segment. With a worldwide reach and portfolio packed with gaming-related holdings, it may be worth considering for investors ready to take a deeper plunge into the world of virtual games and esports.

However, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Cultivating a Survival-Based Combat Mindset

Combat is a serious business.

If you ever have to confront an assailant in a life or death physical struggle, what do you need to know to survive?

In the new episode of the Way of the Renaissance Man podcast, I speak with expert combatives instructor Troy Coe, founder of Reality Defense Training, an Arizona-based self-defense academy that emphasizes what’s called a survival-based approach to martial arts.

In this fascinating discussion, we talk about the nature of combat, why scenario-based combat training is a must to prepare you for a real-world confrontation and why you need to experience an “adrenaline dump” in order to learn how to manage the physiological stresses that occur during combat situations.

If you value your life and the lives of those you love, it is incumbent upon you to learn how to protect and defend life. Troy Coe is a man who can help you do just that, and you’ll discover the myriad ways how in this deep dive into the martial mindset.

*******************************************************************

A Bad Parent

“A strong conviction that something must be done is the parent of many bad measures.”

— Daniel Webster

Sometimes you should act. At other times, you shouldn’t. This is true of nearly all aspects of life, but particularly when it comes to investing. And though “not acting,” i.e. not making any rash decisions with your money and staying the course, is itself a form of action, what you really want to avoid is overreacting to one-day slides in the market. You also want to avoid big bets on binary events such as presidential elections. So, be judicious and remember that often “doing something” can lead to bad decisions and bad outcomes.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods