Celebrating the John Galt Line

- Celebrating the John Galt Line

- ETF Talk: Accessing European Companies with a History of Stable Dividend Growth

- Do Stocks Go Down Anymore?

- Don’t Flatter Yourself

***********************************************************

Celebrating the John Galt Line

It’s July 22, and for lovers of literature, and specifically those who love the work of novelist/philosopher Ayn Rand, today’s date has a certain glorious significance.

In Rand’s magnum opus, Atlas Shrugged, July 22 is the date that the John Galt Line is officially opened.

Now, if you’re not familiar with the novel, just start reading it today. You can write and thank me in about a month when you’ve finished.

If you are familiar with this masterpiece, you know that the John Galt Line is the transcontinental railroad that is built by the protagonist, Dagny Taggart. The fact that this transcontinental railroad is made with a new kind of metal, Reardon Metal, which lasts three times longer than any other metal and which costs less to produce than other metals, allows its inventor, Hank Reardon, to capture huge profits.

Here’s an excerpt from the novel. In this scene, Dagny announces the opening of the John Galt Line:

“Now I must tell you about the opening of the John Galt Line,” said Dagny. “The first train will depart from the station of Taggart Transcontinental in Cheyenne, Wyoming, at four p.m. on July twenty-second. It will be a freight special, consisting of eighty cars. It will be driven by an eight-thousand-horsepower, four-unit Diesel locomotive — which I’m leasing from Taggart Transcontinental for the occasion.

(An extended, and quite beautiful, dramatic reading of this passage by voiceover artist and producer Heather Wagenhals can be found here).

So, aside from the coincidence of today also being July 22, what’s so important about the launch of the John Galt Line?

The significance of the John Galt Line in Rand’s novel is that it represents man’s victory and mastery over nature in the pursuit of a concrete physical goal. In this case, the goal was to traverse the continent in a train that is faster and more capable than any before it. To achieve this, the lead characters had to use their only tool for survival, and the only tool humans have to alter, to enhance and to celebrate their existence, the tool of reason.

The building of a transcontinental railroad is a perfect example of man’s ability to achieve greatness, so it’s not surprising to me that Rand used it as a plot device to demonstrate man’s mind at its best. Yet, we don’t have to visit the pages of Atlas Shrugged to celebrate real-world railway achievements.

In fact, in May 2019, I wrote about the 150th anniversary of the completion of the Transcontinental Railroad (which occurred on May 10, 1869).

The so-called “Golden Spike” event took place in Utah, and to help commemorate the occasion, the Union Pacific Corporation (UNP) sent its historic steam locomotive “Big Boy No. 4041” to the event. Here’s what I wrote about this anniversary last year:

Now, you may think this event is just a quaint little remembrance of things past or a nostalgic reminder of the country’s expansion into the West. But I don’t think of it that way. I think of it as a chance to celebrate reason, reality and the victory over matter and molecules in the pursuit of a concrete physical goal — a goal to explore and settle new territory and to enhance human existence.

The way that I see it, the construction of the Transcontinental Railroad is the quintessence of human achievement.

Now, when it comes to having reverence for reason and human achievement, Rand is unequaled. In another passage from the novel, we can see Rand’s worship for human values and human achievement, while also destroying those who regard achievement and the pursuit of values in the physical world as an “ignoble concern” or a “surrender of man’s spirit to his body.”

She looked at the cab around her. The fine steel mesh of the ceiling, she thought, and the row of rivets in the corner holding sheets of steel sealed together — who made them? The brute force of men’s muscles? Who made it possible for four dials and three levers in front of Pat Logan to hold the incredible power of the sixteen motors behind them and deliver it to the effortless control of one man’s hand?

These things and the capacity from which they came — was this the pursuit man regarded as evil? Was this what they called an ignoble concern with the physical world? Was this the state of being enslaved by matter? Was this the surrender of man’s spirit to his body?

She shook her head, as if she wished she could toss the subject out of the window and let it get shattered somewhere along the track.

In addition to the brilliant writing on display here, Rand’s not-so-subtle critique of those who scorn rational achievements in the real world as some sort of reprehensible aspect of human nature also is on display. As an advocate of laissez-faire capitalism being not only the most effective social system, but also the most moral social system, Rand always connected the purpose of human life with living a rational, achievement-oriented existence here on Earth.

In fact, Rand informally called her ideas, “a philosophy for living on Earth,” as those ideas venerate our existence and our nature, qua man.

So, today is July 22, the date of the maiden voyage of the John Galt Line. And on this day, I am going to celebrate by venerating man’s distinguishing characteristic, and the one that makes all other values possible, the power of reason.

**************************************************************

ETF Talk: Accessing European Companies with a History of Stable Dividend Growth

(Note: Third in a series on Europe-focused ETFs)

During times of market tumult, many investors choose to purchase shares in companies that have a history of stable dividend growth to secure reliable dividend payouts.

Studies by Ned David Research, among others, have lent empirical support to this strategy as scholars have found that both domestic and international companies whose dividends increased year-over-year for the past 20 years outperformed companies whose dividends either remained flat or decreased. A problem with this plan is discovering the companies that have such a history, as predicting which ones are best suited to endure the unpredictable shocks that the world generates without cutting or eliminating the dividend payouts.

While it seems like everyone has his or her own strategy with regards to finding these companies, no one has the panacea to this problem. If finding domestic companies with such a history is difficult, finding companies beyond the borders of the United States is even more so.

Part of the problem is that many foreign companies that fit the bill are far from household names, at least in the United States. Thus, they may lack the reputation that a stable-dividend-paying American company may have.

Thankfully, an exchange-traded fund (ETF) called the ProShares MSCI Europe Dividend Growers ETF (BATS: EUDV) exists to simplify such an undertaking. EUDV tracks an index of European companies that have a history of stable dividend growth.

To avoid excessive risk-taking as a result of having a limited amount of holdings, all of the assets in EUDV’s portfolio are given equal weight. Some of this fund’s top holdings include UCB S.A. (OTCMKTS:UCBJF), SEB SA (OTCMKTS:SEBYF), DSV Panalpina A/S 1.75% 20-SEP-2024, Ashtead Group plc (OTCMKTS:ASHTF), Partners Group Holding AG (OTCMKTS:PGPHF), Legal & General Group Plc (OTCMKTS:LGGNY), St. James’s Place Plc (OTCMKTS:STJPF) and SSE plc (OTCMKTS:SSEZY).

This fund’s performance has risen after the recent market downslide. As of July 21, EUDV has been up 4.99% over the past month and 22% for the past three months. It currently is down 3.59% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $7.86 million in assets under management and has an expense ratio of 0.55%. It offers a current dividend yield of 1.59%.

While EUDV does provide an investor with a chance to tap into European companies with a history of stable dividend growth, this kind of exchange-traded fund may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************

In case you missed it…

Do Stocks Go Down Anymore?

Are stocks ever going to go down again?

That’s a question many people are wondering these days, especially after what we’ve seen in the market over the past month.

Of course, we know that stocks can and will go down at some point. But over the past month, every time that stocks have faltered even the slightest bit, they’ve come roaring back — and that’s despite the continuous rise of coronavirus cases throughout many of the “hot spot” states such as Arizona, California, Florida and Texas.

My friend, macro analyst extraordinaire and contributor to my Successful Investing and Intelligence Report newsletters, Tom Essaye of Sevens Report Research, was literally asked that question over the weekend by a friend. And though his friend was only kidding, the sentiment behind the question here is understandably a good topic to ponder now that we have entered what I think is a crucial inflection point for stocks.

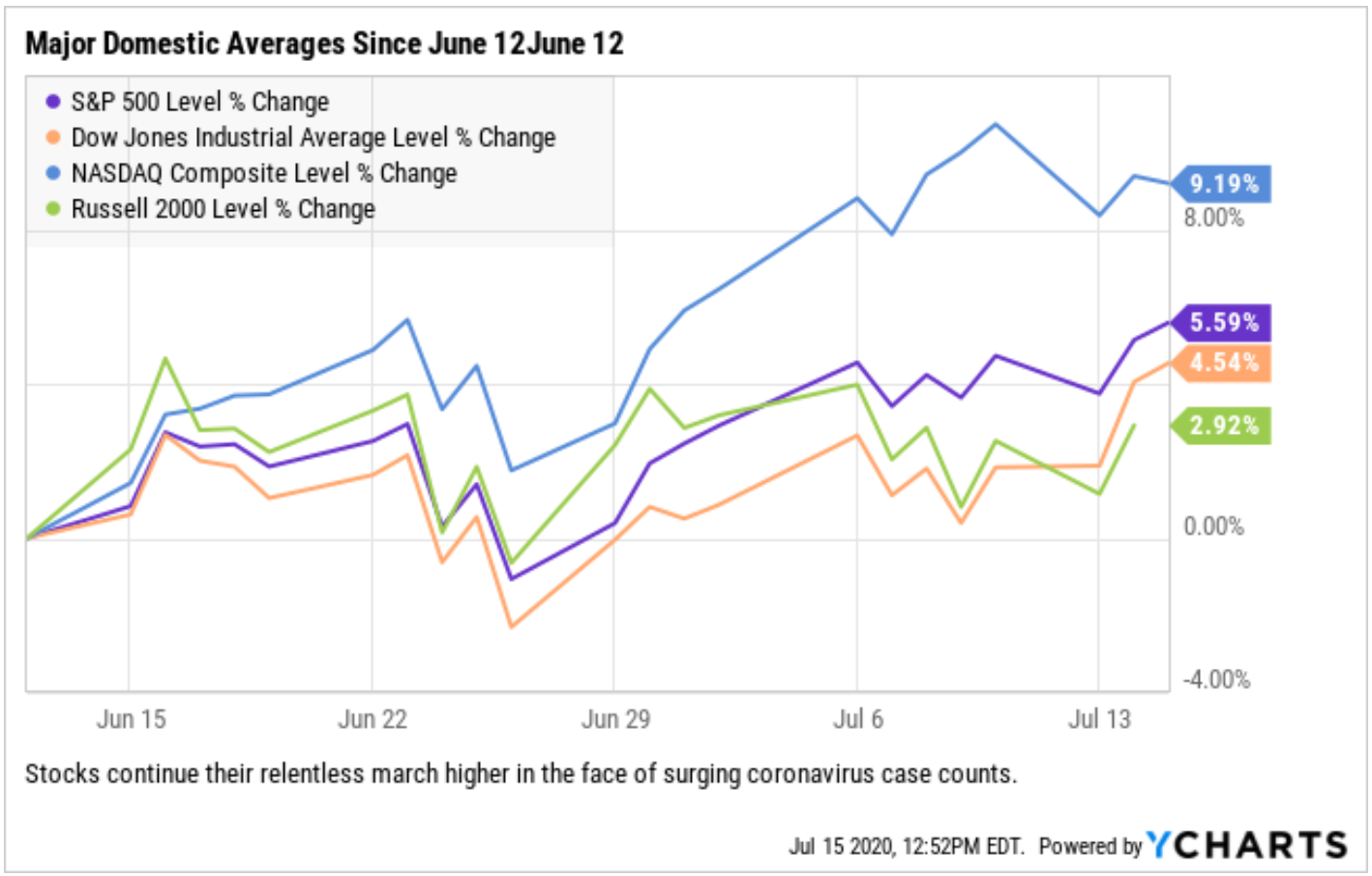

As you can see by the chart of the major domestic averages since June 12, stocks have been remarkably resilient. This is most impressive, especially when you consider the downbeat coronavirus headlines we’ve seen over that time. There’s been an alarming surge in the number of coronavirus case counts nationwide and a new uptrend in the amount of hospitalizations and deaths due to the virus.

More importantly, and from purely a market-centric point of view, the new coronavirus metrics have caused many states to pause, and/or reverse their economic reopening.

Where I live in Southern California, we had enjoyed a few weeks where we could go back to bars and restaurants, gyms and hair salons. This week, however, Governor Newsom moved to close gyms and hair salons, put the kibosh on indoor dining and shut down bars. Similar circumstances are occurring in Arizona, Texas and Florida.

Yet so far, the market has basically looked past these shutdowns because traders don’t believe that there’s going to be a full-blown, nationwide lockdown of the sort that was imposed upon us earlier this year. Yet if the coronavirus counts continue their disturbing rise, we will see more and more restrictions on economic activity.

But, will that cause the stocks to go down again?

Logically, it should. However, conventional logic in this COVID-19 market doesn’t really apply. Let me explain.

Right now, there are two primary reasons why it seems like stocks are never going to go down again. As Essaye explains, “The first reason is that markets are assuming that a vaccine (or a game-changing therapeutic) will come to market relatively soon. The second reason is something that market watcher Mohamed El-Erian of Allianz stated last week, the government is looking to ‘socialize’ the downturn.”

Regarding the first reason, well, that’s easy to understand. A vaccine and/or a pharmaceutical therapeutic will allow the world to go back to “normal” (remember what that is?). Moreover, the encouraging vaccine headlines over the past several days from companies such as Moderna (MNRA), Pfizer (PFE), BioNTech (BNTX), Johnson & Johnson (JNJ), Gilead Sciences (GLID) among others have been fueling the bull run. “As long as one of them is successful within a year or so, then we should see a relatively quick economic bounce back in 2021 and 2022,” said Essaye.

The second reason, what El-Erian calls “socializing the downturn,” simply means that governments around the world have stepped up their activity to ameliorate the financial pain of the coronavirus shutdown. In fact, they’ve done so in a very big way via central bank intervention, stimulus checks, loans to businesses (the Paycheck Protection Program), increased unemployment checks, lines of credit, etc.

“Instead of standing by and letting the downturn hit the economy in a traditional way, the government is essentially giving citizens money and in turn taking on massive debt, i.e. socializing the downturn. This limits the economic pain for citizens, but the risk is we create massive debt and deficits,” Essaye remarked.

While the threat posed by massive debt and deficits is a real and long-term issue that could wreck the U.S. economy at some point, from a market standpoint, it represents a tailwind that can keep stocks pushing higher.

So, will stocks ever go down anymore?

While the real answer is yes, of course, stocks can and will go down eventually, the short- and medium-term fate for equities that are being driven by the euphoric cloud of vaccine hopes and a socialized downturn can keep the bulls running a lot longer than anyone suspects — so invest accordingly.

*********************************************************************

Don’t Flatter Yourself

“Don’t flatter yourself that friendship authorizes you to say disagreeable things to your intimates. The nearer you come into relation with a person, the more necessary do tact and courtesy become. Except in cases of necessity, which are rare, leave your friend to learn unpleasant things from his enemies; they are ready enough to tell them.”

— Oliver Wendell Holmes Sr.

While I would rather learn about my inequities and unpleasant things as soon as possible, instead of when they are presented by my enemies (so that I can fix them), I do love the idea of the growing importance of tact and courtesy the closer you become to someone. If we want to cultivate mutually satisfying relationships, we have to treat those in our lives with tact, courtesy and tenderness. Sure, we can provide “tough love” when appropriate, but tough love has a way of quickly morphing into resentment and anger.

So, the next time you feel the desire to be critical, or to say something disagreeable to someone you value, pause for a moment and try not to flatter yourself into thinking you have permission, because you probably don’t.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods