Celebrating 75 Years of ‘The Fountainhead’

Can reading a novel make a real difference in one’s life?

I know that for me, the answer is an unequivocal “yes.” And, I know I’m not alone, because many people have said that reading that same novel profoundly altered their perspective, deeply challenged their thinking and also inspired them to become who they really wanted to be.

The novel I’m referring to here is “The Fountainhead” by Ayn Rand.

If you don’t know about “The Fountainhead,” it’s the story of Howard Roark, an innovative architect who, as the author once described him, “struggles for the integrity of his creative work against every form of social opposition.” That struggle for the integrity of his work is really the struggle of the individual vs. the collective, not just in society or politics, but in a single individual’s soul.

As the events of the novel play out and, in what is a brilliant integration of both plot and theme (the two most essential components of a novel), protagonist Roark faces constant challenges from those who are threatened by his genius and who are afraid of his uncompromising independence. That independence runs so deep for Roark that when a building he designed on the one condition that no changes be made to it is, in fact, changed, he takes matters into his own hands and physically destroys the creation of his own mind.

For those who haven’t read the novel, I’ll stop there, as I don’t want to spoil the profound pleasure that awaits you. Yet the reason I bring the novel up is because this week, Monday, May 7, fans, like myself, of the “The Fountainhead” celebrated the 75th anniversary of its publication.

While some people I know took time to post accolades to social media sites, others I know held “The Fountainhead” parties. I chose to celebrate this life-changing work by discussing its significance with fellow fans, and by talking about the role it has played in so many lives.

That discussion also happened to be recorded, and it’s the latest episode of The Atlasphere podcast.

The Atlasphere is a website designed to connect admirers of “The Fountainhead” and Ayn Rand’s other game-changing novel, “Atlas Shrugged” (hence the site’s name).

The Atlasphere podcast is hosted by my friend Heather Wagenhals, who also happens to host the highly recommended and extremely popular Unlock Your Wealth radio show. Like me, Heather has a love of money, prosperity and helping readers/listeners achieve economic freedom. Also like me, Heather has been profoundly influenced by the works of Ayn Rand.

On this podcast, we were joined by Ed Hudgins, research director of The Heartland Institute, a great organization dedicated to discovering, developing and promoting free-market solutions to social and economic problems. Before Ed was with The Heartland Institute, he was a senior scholar at The Atlas Society, an organization that promotes the philosophy of reason, freedom and individualism espoused in the works of Ayn Rand.

I really enjoyed my conversation with Heather and Ed, and I think readers who are interested in literature, the works of Ayn Rand, the primacy of reason, the morality of capitalism and the eminent virtue of independence portrayed so exquisitely in the character of Howard Roark will find this discussion both interesting and uplifting.

So, if you want to celebrate a great intellectual achievement that has been influencing people for some 75 years, I invite you to do so with me.

**************************************************************

ETF Talk: Avoiding Sector Uncertainty with Factor-based Investing

Technology stocks were the clear market leaders in 2017, but the turbulence so far this year has made it difficult to find a truly strong sector among U.S. equities. Investors who are tired of trying to pick the next sector champion may want to consider “factor investing.” The Fidelity Core Dividend ETF (FDVV) is one fund that employs this strategy.

Unlike traditional stock, index and sector investing strategies, factor investing focuses on specific key equity attributes, including: value, size, momentum, quality and volatility. The strategy promotes portfolio diversification, but in a less defensive manner than is typical.

Rather than just trying to minimize risk through a good spread of investments, diversification through factor investing also offsets potential risk by targeting time-honored and broad drivers of historical returns. In theory, investors have less chance of a loss and a greater chance of more gains.

FDVV was launched in September 2016 along with six other brand new Fidelity factor-based exchange-traded funds (ETFs), and targets “large- and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends.” The fund takes the 1,000 largest stocks by market capitalization and calculates a score based on the following factors:

- Dividend Yield: 70%

- Payout Ratio: 15%

- Dividend Growth: 15%

While this score leans heavily on an individual company’s trailing dividend yield, the 30% of this score that is devoted to payout ratio and dividend growth serves to help weed out unhealthy companies that don’t have sustainable dividend payments.

In the two-and-a-half years since its launch, FDVV has garnered over $129 million in net assets. Though by no means a huge amount, the fund has clearly received some mainstream attention.

Its lifetime return, as of March 31, 2018, was 11.74%. Year to date, the fund is below its one-year high of $30.41 set on Jan. 26 and is about breakeven for the year. FDVV offers a reasonably cheap expense ratio of 0.29% and a 3.6% yield, one of the higher yields among well-known dividend ETFs.

FDVV is well diversified across market sectors, but the fund’s biggest investments are in Financials, 32.77%; Technology, 15.01%; and Energy, 12.63%. The top 10 holdings make up 28.16% of all assets and read like a “Who’s Who” of household names. Some of the biggest investments include: Apple, Inc. (AAPL), 3.53%, Verizon Communications (VZ), 3.07%; and AT&T (T), 2.90%.

Until the market establishes a definite new trend — either bearish or bullish — volatility and uncertainty will continue to rule the markets. Factor-based investments like the Fidelity Core Dividend ETF (FDVV) could be a solid play for investors who are looking to balance risk management and potential gains in unexpected areas.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*************************************************************

This is My New Favorite Economic Indicator

As an investor, newsletter writer and market commentator, I’m always on the lookout for a new way to look at the macro picture that will give me greater insight.

And while many of the tried-and-true indicators (moving averages, gross domestic product, 10s-2s spread, relative price strength) do a good job of telling us where markets are, and where they might be headed, there’s always a place for better, more precise (and more concise) tools.

Today, I am proud to introduce what is already my favorite new economic indicator, and it comes to us from my friend, colleague and macro-analyst extraordinaire, Tom Essaye of the Sevens Report.

Tom’s publications are required reading for any serious investor, and they are especially important for financial professionals who need to be able to explain to their high-net-worth clients what’s going in stocks, bonds, interest rates, commodities, currencies… and just about any major macro trend influencing the financial markets.

And because Tom has been spot-on over the years in his biggest calls, he’s someone who needs to be heard. So, when he introduced me to his latest invention, I had to share it with you.

The new indicator is called the Sevens Report Economic Cycle Index, and it’s a tool that gives us insight as to where we are in the economic cycle.

Indeed, one of the biggest question marks facing investors is whether we are at the end of an economic expansion or at the beginning of an economic slowdown.

Interestingly, it was last week’s comment by Caterpillar’s (CAT) management during the earnings call, where they said that profits had reached a “high-water mark” for the year, that brought this question to the forefront. The answer to this key question is critical, since it largely will dictate what we can expect from stocks, bonds and currencies over the next 12-24 months.

Now, as a bit of background, there are basically four stages of the economy: Contraction (when economic activity is falling), Recovery (when economic activity has bottomed and is starting to get less bad), Expansion (when the economy begins to grow again), and Slowdown (when economic growth loses momentum and growth begins to decline).

For the purposes of this discussion, we can forget about “Contraction” and “Recovery” because we’re not in those phases. Instead, the biggest question is whether we are nearing (but not yet at) the end of an expansion, or whether we are at the start of a slowdown.

Tom and I think there is a good case that can be made for both scenarios. Those who believe we are in an expansion will cite such things as solid absolute economic growth, rising earnings, rising inflation, still negative real interest rates and strong consumer confidence.

Those who believe we’ve just entered the start of a slowdown will cite things such as the Fed removing accommodation, economic growth losing forward momentum and a potential peak in earnings growth as inflation rises and, therefore, cuts into margins.

Up until Caterpillar’s “high-water mark” comments, the “Slowdown” argument largely seemed premature, given a lack of evidence. But the CAT comments provided the first anecdotal confirmation of that fear which, like a big endorsement for a fringe political candidate, has increased this idea’s credibility.

To be clear, getting this question answered correctly is very important. If we’re still in an expansion, then an eventual run towards S&P 3,000 isn’t out of the question. Conversely, if we are in a slowdown, the question is how long support at 2,550 will hold.

In developing the Sevens Report Economic Cycle Index, Tom wanted to try and determine the answer to this question by monitoring the facts, both economic, macro and markets based.

The tool he came up with is something I think provides a clear set of indicators that will help tell us, in real time, whether the economy still is in an expansion or if we’ve entered a slowdown.

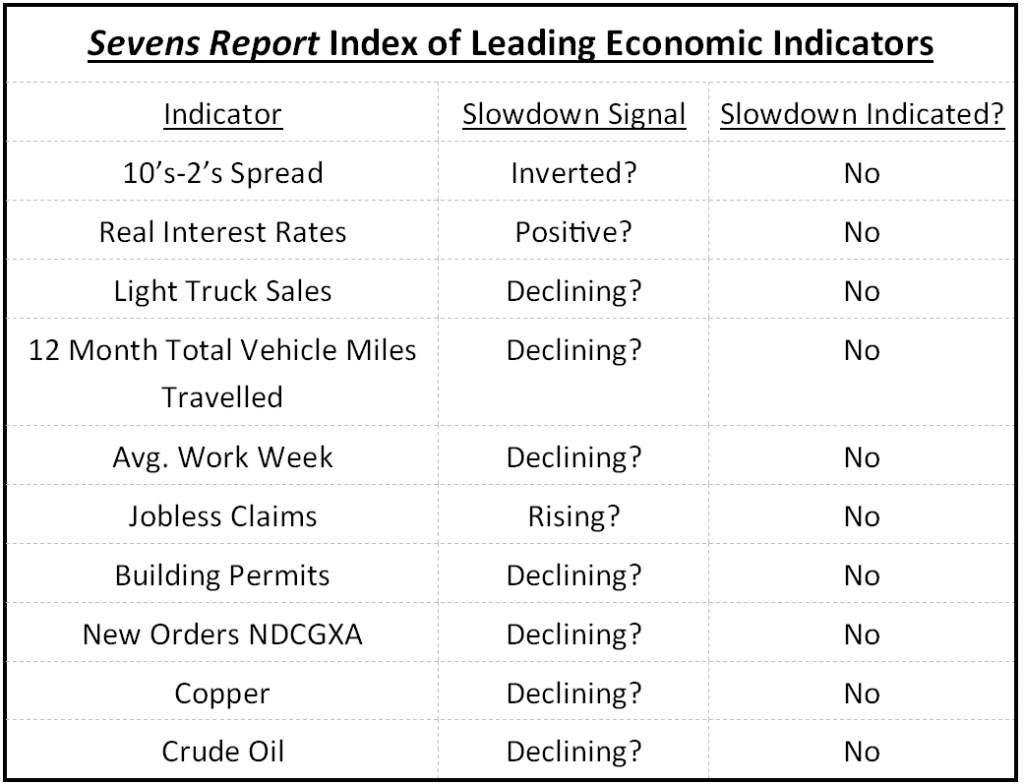

This index is comprised of 10 indicators, some macro based, some using hard economic data and some market based, that Tom believes will tell us when the economy has started to slow down. For the macro indicators (10s-2s, Real Interest Rates), we should be looking for violation of recession signals (inverted/positive).

For economic indicators (Light Truck Sales, 12 Month Total Vehicle Miles Traveled, Avg. Work Week, Jobless Claims, Building Permits, New Orders for Non-Defense Capital Goods Ex Aircraft), we should be looking for consecutive monthly declines in the data. And for market-based indicators (Brent Crude Oil, Copper), due to their volatility, we should be looking for multi-month lows (greater than three months).

Tom then assigns a score based on an aggregate signal, i.e., the more indicators that are indicating a slowdown, the greater the concern that we are transitioning out of an expansion and into a slowdown.

Looking at the inaugural edition of this index, you can see that none of these indicators are suggesting that the economy is in a slowdown.

Of course, this doesn’t mean that stocks can’t go down, especially over the near term. There are plenty of other factors (earnings, geopolitical tensions, Mueller investigation) that can stymie stocks in the short run. And, just because all these indicators aren’t signaling a slowdown, it doesn’t mean stocks can’t test recent lows.

Yet for medium- and longer-term investors, the set of indicators here in the Sevens Report Economic Cycle Index does provide us with a clear, fact-based mix of macro indicators, economic numbers and market-based measures of growth that both Tom and I believe will tell us when we transition from an expansion into a slowdown.

And when that transition occurs (and it always does), you’ll begin reading about it first in this publication, as well as my Successful Investing, Intelligence Report and Fast Money Alert advisory services.

*********************************************************************

The Wisdom of Fellow Readers

“As long as you work for your money, you will ALWAYS work for your money.”

— Garnette B.

This wisdom gem comes to us from reader Garnette B., who wrote in to tell me that he used this quote (his own) to teach his two children and his grandchildren about the merits of investing a portion of their earned income. Most of us have to work hard to make money. Yet we also must make sure that money works for us. And to do that, we must always invest wisely.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.