Breaking Up Is Hard to Do (Another Defense of ‘Economic Bigness’)

- Breaking Up Is Hard to Do (Another Defense of ‘Economic Bigness’)

- ETF Talk: Regulatory Threats Temporarily Slow This Telecom ETF

- Two Anniversaries That Must Forever Be Remembered (An Update)

- Harper on Forever

***********************************************************

Breaking Up Is Hard to Do (Another Defense of ‘Economic Bigness’)

What do President Trump and Democratic presidential hopeful Sen. Elizabeth Warren have in common (aside from both wanting to be elected president in 2020)?

The answer is that both have it out for “Big Tech,” and both appear to want to punish companies such as Facebook (FB) and Amazon.com (AMZN) for what essentially amounts to the ostensible “sin” of being too successful and too good at what they do.

President Trump’s opposition to Big Tech isn’t exactly anti-trust based the way it is with Sen. Warren, although it comes close. Rather, the president sees social media sites such as Twitter (TWTR) as “not treating him fairly,” as he told CNBC’s Joe Kernan on Monday.

Now, there is no doubt the president is correct if he is saying that social media sites skew to the left ideologically, and that a lot of voices of dissent from the right, or voices that are not politically “woke” about progressive social and racial issues, end up getting banned. That seems to be the fallout from Facebook’s recent crackdown on so-called “extremism” and “misinformation.”

And while not calling for a direct break up of Big Tech, the president seemed to suggest that his administration could go after these companies by using the power of law, and extract fines from them via lawsuits the way the European Union does.

Here’s precisely what the president said in that CNBC interview:

“Every week you see them [the European Union] going after Facebook and Apple and all of these companies, that are, you know, great companies but something is going on. But I will say the European Union is suing them all the time. We are going to be looking at them differently. We have a great Attorney General; we are going to look at it differently.

“When they give the European Union $7 billion and $5 billion and $2 billion, and you know, Apple gets sued for $10 billion. And you know, right now, it is going on, but they’ll end up settling. They get all this money. We should be doing that — they’re our companies, so they’re actually attacking our companies. But we should be doing what they’re doing.”

So, there you have it, the President of the United States is saying that America should use the long arm of the law to punish and fine Big Tech the way EU regulators are doing, because by doing so the government will be able to get money out of them. Sort of like milking a cash cow via the threat of government force.

Now, when it comes to Sen. Warren, she straight up thinks these companies are too big (i.e. too profitable) to escape the vice grip of her socialistic idea of corporate governance. Here’s Sen. Warren in her own words, accusing Big Tech of being too successful, having too much power, and in need of her remedy for their economic bigness.

“Today’s big tech companies have too much power – too much power over our economy, our society and our democracy,” Sen. Warren said. “They’ve bulldozed competition, used our private information for profit and tilted the playing field against everyone else. And in the process, they have hurt small businesses and stifled innovation… That’s why my administration will make big, structural changes to the tech sector to promote more competition — including breaking up Amazon, Facebook and Google.”

Forget for a moment how inaccurate Warren’s claims are about these companies hurting small business and stifling innovation. She just can’t stand the idea that there are some companies that appear to be more “powerful” than Big Government.

So, what we have here is the president, who wants to punish Big Tech via its pocketbook (take that, shareholders!) while Sen. Warren wants to tell each of the companies how they have to run their businesses, how big they can get, what decisions they can make, etc. Because after all, Sen. Warren knows how to run these businesses better than Jeff Bezos, Mark Zuckerberg and Sundar Pichai.

This whole notion of having the government tell these companies what to do, and/or fining them because they are acting “unfair,” according to politicians, is outrageous. It also is an abrogation of the principle of freedom the country was founded on.

Now, in November, I wrote a column here in The Deep Woods titled, “In Defense of Economic Bigness.” In that column, I took on an idea promulgated by Columbia University law professor Tim Wu, who claims that the problem of “Economic Bigness” can lead to a rise in fascism such as we saw in 1930’s Germany. And no, I am not making this stuff up!

I want to repost that piece here today, as it’s a good way to address the prevailing zeitgeist among both sides of the political aisle that want to unleash the wrath of government on companies that became big only because nearly all of us want to use their respective products. Keep that in mind when you read this, and when anyone tells you that Big Tech needs to be punished for the “sin” of being too successful.

(The following was originally published on Nov. 14, 2018.)

In Defense of Economic ‘Bigness’

There’s an op-ed in the New York Times that has been getting some buzz over the past few days. It is written by Tim Wu, a law professor at Columbia University, one of the most outspoken advocates for harsher and more intrusive antitrust laws.

In his latest piece, “Be Afraid of Economic ‘Bigness.’ Be Very Afraid,” Wu makes the argument that monopoly and excessive corporate concentration can lead to what Supreme Court Justice Louis Brandeis once called the “curse of bigness.” Wu also argues that this “bigness” was a key component that led to the rise of Hitler, and that it was part of the economic origins of fascism.

What is that they say about an argument… if you have to resort to a Hitler reference, you’ve already lost?

Now, I don’t quite view Professor Wu’s argument in such simplistic terms. I do, however, think it ironic that fascism — which is just another form of big-government collectivism where the state is in control of the economy — is somehow the result of big business.

To be fair, Wu says it was the German economic structure, which was dominated by monopolies and cartels, that was essential to Hitler’s consolidation of power. And while it’s true that dictators throughout history nationalized industries and businesses under the threat of violence for their own nefarious purposes, it seems to me that blaming “big” industries for those nefarious purposes is a woefully misguided case of putting the cart before the horse.

But Wu doesn’t stop with just a look back at Nazi Germany. Instead, he applies the fear of bigness to what’s going on in the economy now, and particularly in places such as Silicon Valley, to argue that we need more invasive government and more antitrust law enforcement to rein in the bigness.

Here’s Wu’s basic thesis, in his own words:

“There are many differences between the situation in 1930s and our predicament today. But given what we know, it is hard to avoid the conclusion that we are conducting a dangerous economic and political experiment: We have chosen to weaken the laws — the antitrust laws — that are meant to resist the concentration of economic power in the United States and around the world.”

But are antitrust laws really designed to resist economic concentration of power, or are they more like legal means to give the government more power over a free society?

According to novelist/philosopher and free-market champion Ayn Rand, antitrust laws were “allegedly created to protect competition.” Yet Rand argued that these laws were based on the “socialistic fallacy” that a free market will inevitably lead to the establishment of coercive monopolies. She further argued that it was government that was the cause of monopolies, not free markets.

As Rand wrote, “Every coercive monopoly was created by government intervention into the economy: by special privileges, such as franchises or subsidies, which closed the entry of competitors into a given field, by legislative action… The antitrust laws were the classic example of a moral inversion prevalent in the history of capitalism: an example of the victims, the businessmen, taking the blame for the evils caused by the government, and the government using its own guilt as a justification for acquiring wider powers, on the pretext of ‘correcting’ the evils.”

Well, Wu certainly wants to correct what he sees as these evils, and he wants the government to do so much more than it has been doing.

“In recent years, we have allowed unhealthy consolidations of hospitals and the pharmaceutical industry; accepted an extraordinarily concentrated banking industry, despite its repeated misfeasance; failed to prevent firms like Facebook from buying up their most effective competitors; allowed AT&T to reconsolidate after a well-deserved breakup in the 1980s; and the list goes on,” writes Wu.

Note the term “we have allowed,” as if government was the moral arbiter of one group of individuals and the free exchange of ideas, capital and cooperation with another group.

Wu even doubled down on the Facebook (FB) and Silicon Valley consolidation trends in an interview with CNBC, saying, “I think it could be very important, for example, to take action against Facebook to break up some of their illegal mergers, especially Instagram and WhatsApp, to kind of recharge the innovation environment.”

Recharge the innovation environment? Really?

I don’t know if Mr. Wu has visited Silicon Valley lately, but I can assure him that there is no shortage of innovation among tech startups. In fact, many are those startups would love to be acquired by the likes of Facebook or Alphabet or Apple or any number of bigger suiters.

Oh, and who wins from such mergers? Well, it’s usually customers who get convenient access to better products, and shareholders of firms that are monetizing these acquisitions. Facebook, for example, has seen its share price surge some 200% over the past five years. And while it’s not always the case that consumers or shareholders win when an industry consolidates, it usually always is the case that consumers lose when big government comes in and dictates the winners and losers.

Now, this is The Deep Woods, and in this publication, we dig into the deeper principles of an issue. Here, the principle involved is the proper jurisdiction over free peoples.

By what right, I ask you, does the government claim to legislate the free actions of individuals that make up corporations and companies?

These entities are freely associating with others, and using capital to make sound business decisions such as acquisitions, mergers, etc. We must assume here that these individuals are acting in what they consider to be their own mutual best interests, even if those choices ultimately turn out to be wrong.

The answer, of course, is the government has no right, and these companies are violating no laws. So, the government had to make up a new right, and that’s what they call antitrust laws.

Finally, the only real danger in the history of humanity from “bigness” is the rise of big government, i.e. the rise to power of those who wield the swords, guns and missiles — and, of course, the big laws they have restricting the freedom of citizens.

*******************************************************************

It’s Almost Time to Get Buck Wild in Las Vegas!

The time to get intellectually wild is almost here. Yes, I am referring to this year’s FreedomFest conference, and this year’s theme: “The Wild West.”

This conference has been called “The World’s Largest Gathering of Free Minds,” and for good reason, with more than 2,000 attendees and some 250 speakers and workshops.

I cordially invite you to join me, as well as some of the world’s most renowned and celebrated heroes of the liberty movement, such as Penn Jillette, John Mackey, Congressman Justin Amash, Dr. Mark Skousen, Glenn Beck, Charles Murray and scores of others on July 17-20, at the Paris Resort, Las Vegas. Use the promo code EAGLE50 for a special discount offer of $50 off the “Full Conference Pass” price of $595 per person. So, that’s $545 per person/$845 per couple.

Come find out how those of us who love liberty celebrate this virtue, and how we get buck wild in Las Vegas!

**************************************************************

ETF Talk: Regulatory Threats Temporarily Slow This Telecom ETF

(This is the first in an 11-week series on the Select Sector SPDR Funds).

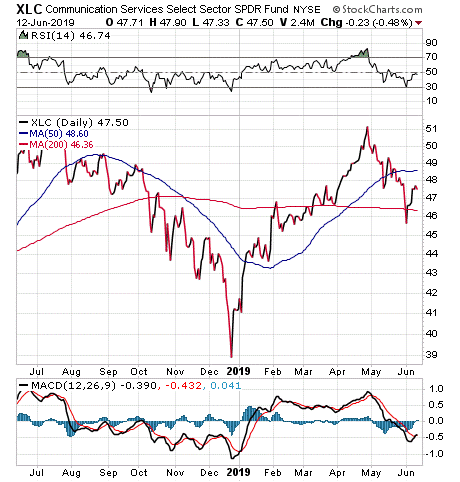

The Communication Services Select Sector SPDR Fund (NYSE: XLC) has taken some damage to its share price recently due to threats of antitrust investigations into some of the companies that are part of the exchange-traded fund’s holdings in telecommunications stocks.

The fund recently has begun to recover, despite U.S. regulators looking into antitrust concerns about some of XLC’s biggest positions, including Facebook (NASDAQ: FB) and Google’s parent company Alphabet (NASDAQ: GOOG). XLC’s share price subsequently slid in the past six weeks after reaching its 52-week high of $52.11 on April 29, prior to falling almost 9% since then.

Regulatory authorities at the Federal Trade Commission and the U.S. Department of Justice could begin an antitrust investigation over political bias at Facebook and Google, respectively, The Wall Street Journal reported. The threats of antitrust lawsuits might be overblown, but the news has created volatility for some of the companies held in the fund. A recent Morningstar report claimed that the regulatory risks already have been accounted for in the share price of those stocks.

It appears that investors have priced in the regulatory threats, as XLC is up more than 5% since its one-month low of $43.35 a share on June 3. The impact of the threats from U.S. authorities dwarf in comparison to the overall market correction in December 2018. However, the fund’s share price then dropped to its 52-week low of $38.97. Even so, the share price has risen to $47.60, up solidly with a 15.84% year-to-date return to sit at a price of about $47.60, as shown in the chart below.

Chart courtesy of StockCharts.com

As an ETF, XLC sometimes invests all, or at least 95%, of its assets in its holdings. The fund was created in June 2018 and began paying a dividend the following September. It paid a $0.132 dividend on September 21, 2018, a $0.134 dividend on December 21, 2018, and a $0.083 dividend on March 15, 2019. Its ex-dividend date is June 21, 2019.

With more than $5 billion in assets under management, XLC invests in blue-chip companies that are directly involved in telecommunications. Its top 10 holdings, which comprise 75.99% of total assets, include Facebook (NASDAQ: FB), 19.54%; Google’s parent company Alphabet Inc. Class C (NASDAQ: GOOG), 11.29%; Alphabet Inc. A (NASDAQ: GOOGL), 11.02%; The Walt Disney Co. (NYSE: DIS), 6.15%; and Charter Communications (NASDAQ: CHTR), 5.05%. The final five in that group of holdings are Comcast Corp. (NASDAQ: CMCSA), 4.86%; Activision Blizzard Inc. (NASDAQ: ATVI), 4.67%; AT&T Inc. (NYSE: T), 4.62%; Netflix Inc. (NASDAQ: NFLX), 4.44%; and Verizon Communications Inc. (NYSE: VZ), 4.35%.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*******************************************************************

Two Anniversaries That Must Forever Be Remembered (An Update)

Last week marked two seminal anniversaries in the history of humanity that must forever be remembered, as each represents a peak in the moral landscape of battling tyranny, collectivism and big government.

The first anniversary was June 6, as 75 years ago that day Allied forces launched D-Day, the largest amphibious military invasion ever undertaken and the battle that laid the foundations for the defeat of Germany in World War II.

The massive operation involved tens of thousands of troops from the United States, the United Kingdom, France and Canada, and the landing took place on five stretches of the Normandy coastline. It is estimated that approximately 132,000 men landed on the beaches that day.

The operation also involved some 24,000 Allied troops who parachuted in behind enemy lines shortly after midnight on the day of the invasion in a move that is close to my heart, since the job of paratrooper was the specialty I chose as a member of the U.S. Army.

To give you a sense of scale here, consider that on D-Day alone, 4,414 Allied troops were confirmed dead, with more than 9,000 wounded or missing. And while the exact number of German casualties that day will never be known, the number is estimated to be between 4,000 and 9,000.

This bloody day in history was fought for one main reason — to defeat the forces of National Socialism, a.k.a. Nazism. Another way to describe those forces is a regime that would impose top-down control on the entire world based on two of the most repugnant ideas in human history — racial superiority and wholesale allegiance to the state.

Fortunately, the forces of freedom prevailed, largely thanks to the men and women who so bravely and so effectively faced down the guns of tyranny and the ghastly ideas of National Socialism at the philosophic root of this evil.

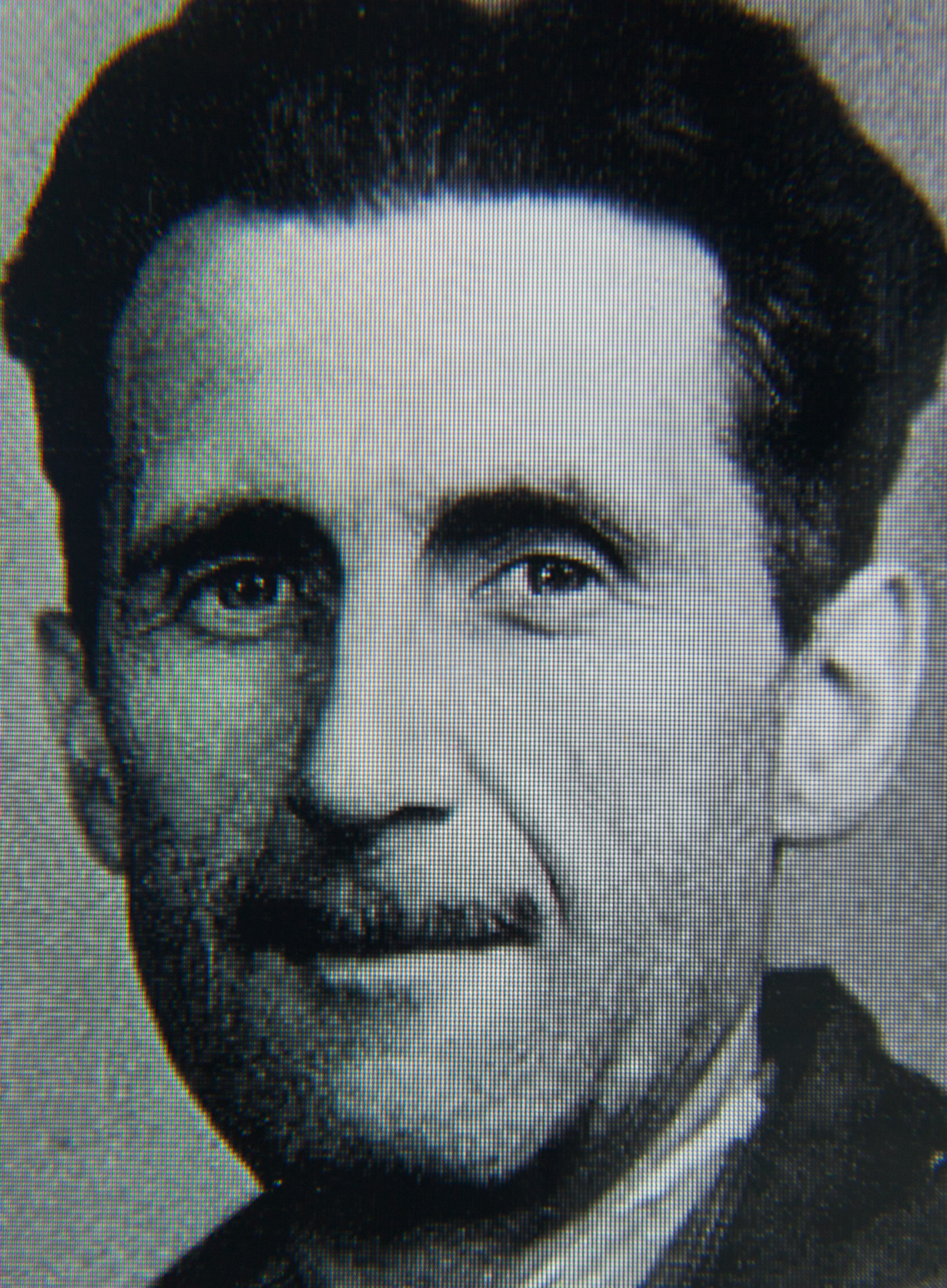

The other anniversary happened on June 9, and it is literary, as the world marked the 70th anniversary of George Orwell’s dystopian masterpiece, “1984.”

Written in the aftermath of World War II, Orwell wanted to depict a society of complete and total government control. Not just control over the political aspects of society, but control within the minds of every individual in that society. As Orwell put it, a world where the state declares, “TWO AND TWO MAKE FIVE” and everyone actually believes it.

The brilliance of “1984” can be found in its darkness, and the utter lack of hope and despair one feels when reading about the life of protagonist Winston Smith. Smith’s brief encounter with a modicum of freedom is quickly crushed by “Big Brother,” who is ALWAYS watching.

Other unforgettable creations by Orwell in “1984” include terms and concepts used today to describe all sorts of propagandist evils. Concepts such as “Newspeak,” “Doublespeak” and “Thought Crime” have become quick ways of relating the worst aspects of political authority and its invasion into lives.

Then, of course, there’s the technology of having the “telescreen” watching you at every moment of your life. This invasion of spying technology by the state is a reality in collectivist countries, and even in free countries — and often in free countries by permission of the citizenry in exchange for enhanced “security.”

Yet the true achievement of “1984,” and the reason why its anniversary should be remembered as a high point in civilization’s battle against collectivism, is that the novel portrays the logical conclusion and full realization of the ideas at the root of Nazism, Communism and, yes, socialism.

The horrors of complete control over the mind and body of citizens by Big Brother, and in service of Big Brother, is the endgame of socialism. And, no dressing it up in compassionate packaging the way some American politicians have done can negate that fact.

If the state, or the collective, or Big Brother owns your life, then you, too, can become just like Winston Smith — complete with a visit to the bowels of the “Ministry of Love” and the dreaded “Room 101.”

I hope you got a chance to acknowledge and celebrate these two seminal events in the history of mankind’s fight against government tyranny. I know I did.

In fact, I even held a small “1984” party at home, but instead of sitting around watching sports or Netflix on the “telescreen,” my fellow “comrades” and I sat around a table with a bottle of 18-year-old Scotch and Cuban cigars and toasted the blessings of liberty — liberty that came to us via the efforts of the heroes at D-Day and the pen of George Orwell.

*********************************************************************

Harper on Forever

Like a hand-less clock with numbers, an infinite of time

No not the forever found, only in the mind

Forever always seems to be around when things begin

But forever never seems to be around when things end…

— Ben Harper, “Forever”

The genius of singer/songwriter and musical chameleon Ben Harper cannot be overstated. If you want some beautiful, passionate and emotionally gut-wrenching art, check out the multi-decade body of work by this musical tour de force. And, a good place to start is his gem of a song, “Forever.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you want me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods