Bow Down to the Dow

It is midday Wednesday, Oct. 18, and as I write this week’s e-letter, the Dow Jones Industrial Average has just hit another major milestone.

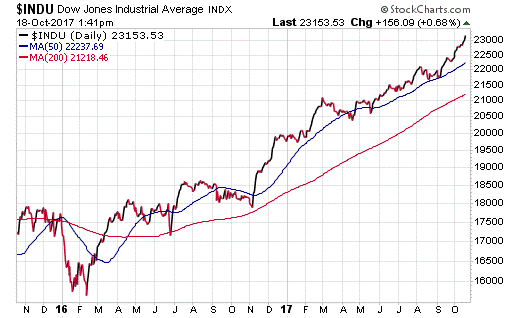

This time it’s the 23,000 mark — a number that was almost unthinkable just nine years ago. Look below at a two-year chart of the Dow to see its remarkable resilience since early 2016.

We also can see that except for a brief pullback below the 200-day moving average in June 2016 due to the “Brexit” scare, the Dow has been in a confirmed bull market since basically March 2016 — or more than 18 months!

To this I say we must pause, bow down to the Dow… and give it respect.

I say that, because this has been the most unloved bull market in my professional lifetime, and one that’s been haunted by the ghosts of the Great Recession, as well as a near-oppressive cloud of skepticism over what’s driven stocks higher.

The main driver, of course, has been the Federal Reserve and its money printing scheme that’s artificially inflated equity prices. While I certainly understand the skepticism brought about by the unprecedented moves by the central bank to pump excess liquidity into the system via the numerous quantitative easing permutations, the fact remains that if you had put money to work in the Dow as that money printing began, you would have more than doubled your money.

Yet the reason the Dow (i.e. the broad market) deserves to be bowed down to is because despite the Fed’s return to rate normalization, 2017 has been one of the best-performing years in recent memory.

The Industrial Average is up over 27% year to date, and that’s been a direct result of the Trump pro-growth hope trade, improving economic data and surprisingly strong corporate earnings.

And, those gains have come despite the Fed hiking rates, and signaling more rate hikes later this year, after announcing its intentions to start reducing its balance sheet.

Yes, there are those elusive “animal spirits” pushing investors into equities this year. Many on the Street (particularly the merchants of doom, who always see a black cloud on the horizon) think those animal spirits are both irrational and too exuberant (Hello, Mr. Greenspan).

Yet until this market proves, via objective price action, that it no longer has the will to continue moving higher, we must continue to bow to the Dow (and the S&P 500, the NASDAQ Composite, the Russell 2000, the NASDAQ 100, semiconductors, super-cap internet, etc., etc., etc.…).

If you’d like to find out how we determine when to be in stocks and, more importantly, when it finally makes sense to be out of stocks, then I invite you to check out my Successful Investing advisory service.

Hey, it’s not like we have a proven track record of winning market calls for the past four decades… oh wait, we do!

*************************************************************

ETF Talk: Well-Rounded Aerospace and Defense Fund Delivers Targeted Exposure

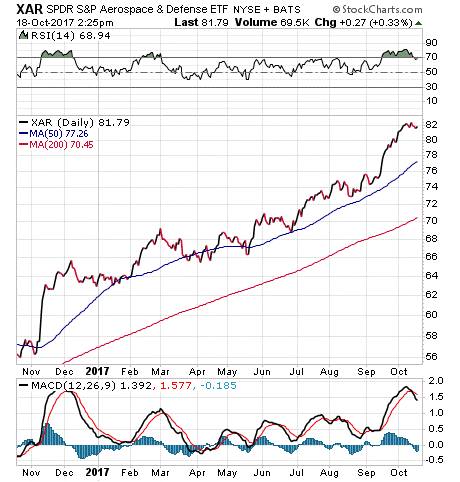

This week’s featured exchange-traded fund (ETF), the SPDR S&P Aerospace & Defense ETF (XAR), tracks an index of U.S. aerospace and defense companies.

The fund currently has $1.01 billion assets under management and invests at least 80% in its holdings. Unlike some of its peer aerospace and defense funds, which tend to focus more on large-cap companies and often the very largest names, XAR aims to achieve a 40/40/20 weighting composition for large-, mid- and small-caps, respectively.

This mix of holdings allows XAR to deliver targeted coverage within the aerospace and defense sector to its investors. Although XAR does not offer options, it has attracted the attention of block traders with its strong underlying liquidity and a reasonable fee of 0.35%.

The fund has quarterly distributions and a dividend yield of 1.09%. This is relatively low when compared to competing funds like ITA (which is also more than four times the size of XAR), but XAR seeks a performance advantage with its focus on relatively smaller companies.

The defense sector has had a strong rally for the year, fueled by President Trump’s avowed support for the military and by threatening missile tests and words against the United States from North Korea’s dictator. XAR has been well-positioned to take advantage with its concentrated approach.

Year-to-date, XAR has returned 26.79%, beating out the S&P 500’s return of 14.16%. Analysts at State Street Global Advisors have put together a projected 3-5 year earnings per share growth estimate of 13.10% for XAR.

XAR currently has 35 holdings. The top five are Orbital ATK Inc., 4.37%; Triumph Group Inc., 4.29%; KLX Inc., 4.11%; Huntington Ingalls Industries Inc., 3.96%; and Hexcel Corporation, 3.94%.

For those seeking a fund to increase their exposure to the aerospace and defense segment, I encourage you to look at SPDR S&P Aerospace & Defense ETF (XAR).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**************************************************************

Power and Hypocrisy in Tinsel Town and the Media

Growing up in Southern California, and doing my undergraduate work at the University of California, Los Angles (UCLA), I have always been surrounded by the entertainment industry. I have friends “in the business,” including actors, writers, directors and those in back-office production roles.

The people I know in the industry either love their jobs or really like their jobs. They’re well-compensated, and they help produce a product that the world generally loves.

Yet I have never met a person in the entertainment industry that’s ever denied the reality that there’s widespread misuse and abuse of power by those at the top. And, I have never met anyone who hasn’t acknowledged there’s widespread, blatant hypocrisy practiced on the part of so many elitist Hollywood liberals who generally advocate for liberal/progressive ideas, but whose own behavior falls far short of their stated ideals.

Now, abuse of power and blatant hypocrisy isn’t unique to Hollywood. Every industry, and every segment of society has its nefarious practitioners. Yet when it comes to the entertainment industry, the high-profile, worldwide platform it enjoys makes it especially ripe for egregious hypocritical behavior.

The latest example here is that of Harvey Weinstein.

By now, I suspect most people have read about the allegations levied against the mega-producer, which include a decades-long history of sexual misconduct, harassment and even sexual assault.

If you want to get a look into the details of this rather harrowing tale, I highly recommend The New Yorker article by Ronan Farrow, “From Aggressive Overtures to Sexual Assault: Harvey Weinstein’s Accusers Tell Their Stories.”

Warning, however, you may find yourself in need of a shower after reading about Weinstein’s alleged misbehavior.

Yet perhaps not surprisingly, Weinstein was revered by many on the political left, as he was a big donor to many high-profile campaigns, including those of President Obama, President Bill Clinton and two-time presidential loser Hillary Clinton.

Weinstein also was an outspoken advocate of progressive causes, and a harsh critic of conservatives and Republicans.

The hypocrisy here is that Weinstein apparently was the epitome of a smarmy man who used his power and influence to get what he wanted from women — women whose careers he knew he could make or break at any moment.

So much for the progressive values of equality in the workplace, women’s rights, a hostility to the “white-male power structure,” etc.

Weinstein’s alleged sexual misconduct, even sexual crimes, spit in the face of these values, all while he spent millions of dollars to help foist these ideals into the public conscience.

Yet what also disturbs me, perhaps even a bit more than the alleged Weinstein behavior/hypocrisy, is what now appears to be an attempt by NBC News to scuttle the Farrow piece. Surely an iconic media organization such as NBC News would want to report on a famous, influential, politically connected and undeniably newsworthy figure like Harvey Weinstein.

But apparently, that wasn’t so. In fact, according to one report, NBC News President Noah Oppenheim made a judgment this past summer that Farrow’s reporting on the Weinstein story wasn’t ready for prime-time.

In an interview on MSNBC’s “The Rachel Maddow Show,” Farrow disputed that claim, and he did so vehemently. Maddow asked Farrow: “NBC says that the story wasn’t publishable, that it wasn’t ready to go at the time that you brought it to them.”

Farrow retorted by saying: “I walked into the door at The New Yorker with an explosively reportable piece that should have been public earlier. And immediately, obviously, The New Yorker recognized that. And it is not accurate to say that it was not reportable. In fact, there were multiple determinations that it was reportable at NBC.”

In my opinion, the alleged actions of NBC News seem to represent another form of hypocrisy, even cover up. That hypocrisy is one where you conceal an ugly truth to protect someone in your ideological camp.

Now, to MSNBC’s credit, which is an NBC Universal property just like NBC News, the topic was discussed. Also to Maddow’s credit, the host brought up the subject. I don’t often agree with Ms. Maddow’s political views, but one thing you cannot accuse her of here is hypocrisy, and for that she deserves respect and acknowledgment.

If there’s any good to be taken from the Weinstein episode, and from similar episodes in recent years, it is that sexual harassment and the abuse of power must not be tolerated. It is truly a scourge on society, as it nullifies the victim’s rational pursuit of career, and turns a mutually beneficial employer/employee situation into an ugly sexual power play.

There’s no room for it America. Full stop.

***************************************************************

No Special Talent

“I have no special talent. I am only passionately curious.”

— Albert Einstein

I think one of the biggest intellectual sins a person can commit is to not be curious. Given the near-limitless amount to learn, integrate and discover, how can anyone ever be bored? Curiosity may have killed the cat, but I’d rather take the chance on dying from curiosity than living in ignorance. So, be passionately curious. You’ll be in smart company.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.