Ask Me Anything

- Ask Me Anything

- ETF Talk: Invest in ‘Earth’ with This Sustainable Fund

- Don’t Hate, Celebrate

- Feel Like Missing You

***********************************************************

Special Announcement from the Publisher

I am thrilled to announce the launch of our Eagle Investing Network YouTube Channel. You’ll find lots of great videos to help you navigate the markets and become a better investor. Click here now to check it out — and be sure to subscribe so you don’t miss any new videos, as we will put them up at least on a weekly basis.

********************************************

Ask Me Anything

I’ve noticed a growing trend in the alternative media and podcast world where authors are doing a segment called, “Ask Me Anything.” This is where the author responds to reader inquiries about virtually any subject on readers’ minds. I love these segments, as I find myself wanting to know the opinion of thinkers I admire and/or who provoke a different perspective in me.

This week, I’m announcing a new, periodic feature in The Deep Woods called, simply, “Ask Me Anything.” This is where you can write in and ask me literally any question you want about any subject you want. Logically, I get a lot of inquiries about the markets and the economy, as that is largely our professional focus here. And this week I’ll be responding to a couple of market questions I’ve received lately.

But when I say “anything,” I mean just that. From what I think about the latest trends in music, literature, pop culture, sports, politics, fashion, ufology, art, horsemanship, pet care, cars, diet and exercise, martial science, cosmology, philosophy, Porsches, Jeeps, relationships — if it’s a subject I’m curious about, and know something about, I will be happy to engage in conversation about it.

Now, with that said, let’s begin our first “Ask Me Anything.”

Mark C. writes: “Jim, I heard you were personally acquainted with the novelist Salman Rushdie. Is that true? Also, do you have any insight on his medical condition after the heinous stabbing attack? And why haven’t we seen that much in the media about this and why hasn’t there been a greater outcry over this attack?”

Jim: Mark, the answer is yes, I am privileged to be personally acquainted with Salman. I met him on a couple of occasions through some mutual friends in the fashion and TV world, where his ex-wife was a well-known personality. Unfortunately, I don’t have any personal pipeline into his current condition aside from what is known publicly, but the latest reports are he is off a ventilator and “articulate,” according to one recent report.

As for why we aren’t hearing a lot about this situation and why there hasn’t been a greater outcry, well, here the answer is, sadly, predictable. It is the cowardice of many media outlets, and the generally apologetic nature of their stance toward violence spawned from radical Islam. To this day, the “fatwa” calling for Salman’s murder is still in place, and until the world gets serious about calling out this evil for what it is, i.e., theocratic bullying that threatens free minds everywhere, I suspect these horrific ideas will continue to plague the world.

Jonathan R.: “What is your opinion of Bitcoin and cryptocurrencies now that they’ve been slammed this year?”

Jim: I remain a fan of Bitcoin and the concept of cryptocurrencies in general despite the “crypto winter” of 2022. I think that Bitcoin should be a small portion of your long-term portfolio along with traditional assets such as gold, fixed income, and of course, equities.

I recently had investor and “Shark Tank” star Kevin O’Leary on my podcast, and he mentioned that the real catalyst for the next big boom in cryptocurrencies is going to be, somewhat paradoxically, the rise of regulation. O’Leary explained to me that once cryptocurrencies officially become a regulated asset class, then big money players such as pension funds and sovereign wealth funds will be permitted to embrace the asset class. Once they do, even if it’s just for a small percentage of the massive assets they hold, it will fuel the next big leg higher in the value of this emerging assets. So, if you own Bitcoin here, I say continue doing so.

Crystal C. writes: “Cat or dog? Which kind of person are you, and why?”

Jim: “Those who know me know that I am a proud owner of a fierce and princely chow chow dog. Yet I also am the owner of a persnickety Persian feline, who I consider the real queen of the castle. And while I love dogs, I must admit I am more of a cat person. To learn why, I refer you to a line from a fun comedy movie that I recommend called, “Meet the Parents,” starring Robert DeNiro and Ben Stiller.

I love dogs, but I’m more of a cat person.

In an exchange between the two, DeNiro’s character “Jack” asks Stiller’s character “Greg” why he doesn’t like cats. When Greg says he doesn’t not like cats, but rather just prefers dogs, Jack responds by saying. “So, you prefer an emotionally shallow animal? You see, Greg, when you yell at a dog his tail will go between his legs and cover his genitals and his ears will go down, a dog is very easy to break. But cats make you work for their affection, they don’t sell out the way dogs do.” Yes, it’s humor, but often the truest ideas are conveyed best via comedy.

James W. writes: “Do you think Donald Trump should run again for president, and if so, would you support him?”

Jim: I DO NOT think Trump should run again, and I do not think he is the best chance Republicans have of winning back the White House. Here, I agree with my colleague, the great Dr. Mark Skousen, who recently wrote, “Trump faces huge legal and political obstacles. Not only will he need to overcome possible criminal charges, but he will have to convince a large group of Democrats to switch sides and overcome a very large group of ‘Never Trump’ voters. The fact is that the Republicans are living up to their reputation as the ‘stupid party.’ Their candidate may win the party nomination but then lose in the general election.”

A much better Republican alternative, in the opinion of both Mark and I, is Florida Gov. Ron DeSantis. As Mark writes, “He (DeSantis) is a graduate of Yale and Harvard law; a Navy veteran who spent time in Iraq; a former U.S. Congressman (2013-2018), a good family man with three children, and governor of the third most populous state in the union — and who is so popular he will likely be re-elected by a landslide? Like Trump, he is forceful in defending his principles and taking on the establishment media, but unlike Trump, he does not personally attack fellow Republicans.”

Mark even offered readers a poll to see what they thought of the idea that DeSantis would be the best Republican candidate for 2024. As of this morning, more than 71% of respondents agreed with Mark and I in thinking DeSantis would be the best candidate. If you would like to participate in this poll, simply click here.

Charles R. writes: “Do you think stocks will make a comeback and finish the year higher, or will the selling pressure continue to keep markets down?”

Jim: “While I think there are plenty of known headwinds that can keep markets trading lower for longer (Federal Reserve rate hikes, quantitative tightening, inflation, geopolitical unrest, oil prices, earnings contraction, GDP contraction, etc.), I am of the opinion that the bulls are itching to run. We witnessed that from mid-June to last Friday, and the reason why was because Wall Street was basically pricing in a “Fed pivot” toward a less-hawkish monetary policy.

Well, Fed chair Jerome Powell disabused us of that “Fed pivot” notion, indicating instead that we are in for some “pain” ahead. Now, when a Fed chair warns of pain, it behooves us to listen. Yet the resilience of the bulls is something that cannot be counted out, and if the Fed just does what everyone thinks it will do between now and the end of the year (i.e. it raises rates as expected and refrains from any more hawkish surprises), then I suspect the bulls can wrestle back control of things over the next several months.

As for “finishing the year higher,” well, that would be a bold call that I am not prepared to make as we enter September. I do, however, say that stocks will be higher in the second half of the year, and I say that because historically speaking, whenever there is big selling in the first half of the year, there has been big buying in the second half of the year. And while history doesn’t always repeat itself, it does have a charming tendency to rhyme.

If you have a question and/or comment for me, and would like it to be featured in my next “Ask Me Anything” issue, I invite you to do so here.

Hey, life is basically just one long conversation with reality, and the more insight we can gain from that conversation, the better humans we will be. So, be the best human you can and let’s converse.

Speaking of which, I’m excited to announce that I’ll be speaking at the W3BX conference Oct. 10-13 in Las Vegas. Join some of the biggest names in the industry, including my colleagues Bryan Perry and Jon Johnson, along with our Publisher Roger Michalski, to learn more about investing in blockchain, cryptos, NFTs, the Metaverse, mining and all things Web 3.

The Web 3 sector is expected to grow from $3.2 billion to $81.5 billion by 2030. The more you know about it, the more potential money you can make from this explosion.

Click here now to learn more about the conference and be sure to enter the code “EAGLE” when you register to save 20%. I’ll see you in Vegas!

***************************************************************

ETF Talk: Invest in ‘Earth’ with This Sustainable Fund

Congress recently passed the Inflation Reduction Act that includes provisions favorable to the sustainable energy trend.

This only reinforces what has been clear for some time now that the trend toward sustainable energy keeps gaining power. The United States will continue regardless of geopolitical conflicts or economic uncertainty.

Given the recent focus on this sector and its continued popularity among investors, this column is introducing several exchange-traded funds (ETF) in the sustainable energy space. Today is the first of several that I plan to identify in the coming weeks to highlight top ETFs for core exposure.

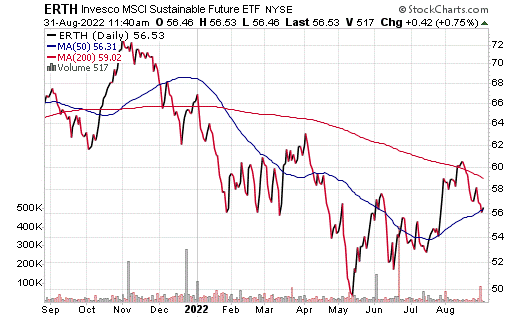

The Invesco MSCI Sustainable Future ETF (ARCX: ERTH), formerly Invesco Cleantech ETF (PZD), provides an index of global companies that are involved in making the economy more environmentally conscious. Themes present in these companies include alternative energy sources and efficiency, sustainable building projects, agriculture and water practices, as well as pollution management.

Companies to be included in this fund pass an environmental, social and governance (ESG) screen, which some investors view as important, particularly in this sector.

ERTH is down 16.34% in the last year, making its pullback greater than that of the S&P 500. This may make for an attractive entry point. It is also down 4.8% in the last month. Its performance over the long term looks a bit better, ringing up a 11.43% average annual increase over the last five years.

Chart courtesy of www.StockCharts.com

The ETF does offer a small dividend yield of just under 1%, which accounts for its 0.55% expense ratio with room to spare. Assets under management total $368 million, making this fund relatively small.

However, ERTH holds 265 different companies. These holdings are based in a variety of nations, most prominently the United States (34.25%) and Hong Kong (20.19%).

Top holdings include Tesla Inc. (NASDAQ: TSLA), 5.71%; NIO Inc. ADR (NYSE: NIO), 5.20%; Digital Realty Trust (NYSE: DLR), 4.95%; Vestas Wind Systems (XCSE: VWS), 4.87%; and Enphase Energy (NASDAQ: ENPH), 3.96%.

For investors seeking a way to profit from the trend towards alternative energy sources, Invesco MSCI Sustainable Future ETF offers one possibility.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Don’t Hate, Celebrate

Haters gonna hate.

That’s a little youthful slang for the notion that, no matter how successful, accomplished or good someone is, there are always going to be those “haters” out there that want to denigrate their achievement.

Sadly, I saw quite a lot of this “hater” sentiment in the days leading up to, and after the outcome of, Super Bowl LV (this was the one held on Feb. 7, 2021, and I bring it up here because the 2022 NFL season is coming soon!).

That hatred was directed toward one Thomas Edward Patrick Brady Jr., also known as the “G.O.A.T” or the Greatest Of All Time, when it comes to NFL quarterbacks. As you likely know, Brady was then fresh off his seventh Super Bowl victory. That’s more than any other player in NFL history. Heck, that’s more Super Bowl wins than any other franchise in NFL history.

Yet, this column isn’t about football. In fact, I’m not really all that into football or sports in general, although I do like watching the best at what they do battle it out for on-field supremacy. Rather, today’s column is about philosophy, and more specifically, a destructive attitude that permeates society. It is best encapsulated by what philosopher/novelist Ayn Rand calls a “hatred of the good for being the good.”

The concept can be found in Rand’s essay, “The Age of Envy,” which is part of a collection of essays I highly recommend titled, “The Return of the Primitive: The Anti-Industrial Revolution.” The premise here is that people tend to hate those who achieve their values, and those who are able to deal with reality on a level that others simply cannot, or that have not. Yet, perhaps it’s best to let Rand herself elaborate on this issue, and here I quote:

“This hatred is not resentment against some prescribed view of the good with which one does not agree… Hatred of the good for being the good means hatred of that which one regards as good by one’s own (conscious or subconscious) judgment. It means hatred of a person for possessing a value or virtue one regards as desirable.”

Image courtesy of www.shutterstock.com

Now, I don’t know about you, but if you look at things honestly and objectively, wouldn’t we all like to be Tom Brady? I don’t mean that literally, of course, but wouldn’t we all want to possess the man’s attributes? Here are just some of the values he embodies, at least from all the accounts I’ve read about the man.

He’s a supremely hard worker, and he pushes himself to achieve the highest levels of his profession. He demands the best from those he works with. His presence and work ethic uplift and inspire his co-workers to be their best. He is handsome, fit, disciplined and supremely focused. He’s wealthy, and that wealth has been earned through the blood, sweat and tears of more than two decades in one of the toughest and most violent sports around. Finally, he is married to one of the most beautiful women on the planet, and one who is equally successful in her profession as Brady is in his.

Yet, for the haters, the aforementioned values and virtues Brady embodies is why they like to engage in sniping, criticism or in joyfully witnessing his defeats. I even read social media posts that openly pined for Brady to be injured during the Super Bowl, because he doesn’t “deserve” another Super Bowl victory. Other posts I read were rejoicing in the notion that Brady would be “dethroned” by rival quarterback Patrick Mahomes of the Kansas City Chiefs.

Well, I got news for you, the same hatred of Brady’s success would then be transferred onto Mahomes, because for a certain element of society where envy, jealousy and a hatred of the good for being the good is a dominant characteristic, whomever embodies the values they wish they had will become the living example of what they’ve failed to achieve.

Ralph Waldo Emerson once said, “People do not seem to realize that their opinion of the world is also a confession of character.” For Tom Brady haters who don’t like him because he embodies attributes they wish they had, well, then what does that say about their character — or lack thereof?

My recommendation to the haters is as follows: Don’t hate, celebrate.

Doing so will liberate you from the ugliness of envy, and it will save you from descending into the abyss of the hatred of the good for being the good. And who knows, celebrating another’s virtues might just get you ready to focus on celebrating and cultivating your own virtues — and that might actually help you be the kind of person you really want to be.

*****************************************************************

Feel Like Missing You

I feel like missing you today

Sometimes I just get this way

Seems like everything I see

Brings back another memory

I feel like missing you today…

–Todd Snider, “Missing You”

Missing someone or something that matters to you isn’t easy. That deep longing and remembrances of things past, along with the powerful sense memories that trigger them, are the epic musings of Proustian prose. And while missing and longing are powerful purveyors of sadness, they also can be powerful tools to elicit positive memories.

Think about it, in most cases you miss someone or something because you equate it with the someone or something good. And the fact that life is finite, fleeting, and ever-changing means that you always should cherish that good whenever fate decides to bless you with it. By looking at things through this grateful lens, the missing can be turned from a longing to a feeling of bliss. So, the next time you feel like missing, just let it happen.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods