Are Buybacks Responsible for the Rally?

- Are Buybacks Responsible for the Rally?

- ETF Talk: Gain Exposure to Leisure and Entertainment Stocks with This Fund

- Philosophy, Business and the Danger of Zero-Sum Thinking

- A Native American Honor

***********************************************************

Are Buybacks Responsible for the Rally?

“This market is being fueled mostly by financial engineering schemes such as share buybacks.”

That’s what a friend of mine told me during a dinner gathering on Saturday. This friend is often a skeptic of “the system,” and though he can be a bit of a curmudgeon, he is extremely intelligent and well read. So, when he brought up the issue of stock buybacks, I thought that it was a subject worthy of deeper exploration.

So, are financial engineering techniques such as stock buybacks responsible for the equity market rally? Are they responsible for most of the earnings per share (EPS) growth we’ve seen as of late? Perhaps more importantly, if share buybacks are responsible for the rally, what would happen if they were to suddenly slow or stop?

To answer these important questions, I turned to my trusted and brilliant colleague, Tom Essaye of Sevens Report.

Here’s a dialogue I had with Tom that addresses these important questions. As you’ll soon find out, the answers are something investors need to be concerned about.

Jim Woods (JW): Tom, for the past two years, there has been an acceleration in corporate share buybacks and there has been a lot of chatter about how buybacks are really responsible for the latest move higher in stocks. So, are share buybacks an important factor in the rally and in the related earnings growth we’ve seen in markets over the past couple of years?

Tom Essaye (TE): Buybacks have been a factor in the market over the past couple of years. Basically, buybacks occur when a company uses cash (either its own or borrowed money) to purchase shares of stock in the open market. A company then essentially “retires” that stock, thereby taking it out of circulation, which reduces or “floats” the total number of shares outstanding. This is important, because buybacks do increase a company’s earnings per share without the company actually making more money. The reason why is that if you buy back shares, you lower the denominator of the EPS (earnings/number of shares) equation (i.e. shares outstanding). By default, the value of the remaining shares rises absent earnings growth.

JW: How prevalent have buybacks been over the past two years, particularly since the corporate tax law changes in 2017?

TE: According to data I just read in U.S. News and World Report, the contribution of buybacks towards earnings has surged since the beginning of 2018. In Q1 2018, EPS rose by 26.8% thanks to the change in corporate tax rates. Buybacks, i.e. share reduction, accounted for 0.8% of that increase, so almost nothing. But by Q2 2019, EPS rose just 2.1% and buybacks, i.e. the reduction in share count, accounted for 100% of earnings growth. Stated differently, without buybacks, and if we just counted aggregate earnings, corporate earnings would have outright declined year over year in Q2 2019.

JW: Wow, that is significant. So, it does seem that it is a fair critique of corporate earnings to say that earnings growth in 2019 is a bit deceptive, as the value is being financially engineered by corporate finance departments, not organic core-business growth. Also, that tells me that companies aren’t making any more money than they did in 2018, they just have a smaller share count to spread the money over, so EPS are rising.

TE: Yes, that’s accurate.

JW: So, is this a big problem for equities and corporate earnings growth going forward? What are your concerns on this front?

TE: In addition to the lack of core growth, a second concern I have is how corporations are paying for their share buybacks. Companies without significant cash reserves are also buying back shares at a record pace along with issuing debt. In fact, global corporate bond issuance hit an all-time high in September, as fixed income investors continue to chase riskier debt for higher yield. Now, given we are in such a low interest rate environment, it makes sense for many companies to “pad their stats” and buy back stock, thereby boosting EPS by funding it with cheap corporate debt. According to Goldman Sachs, for the first time since 2007, the amount corporations spent on buybacks exceeded their free cash flow. The ratio of money spent on buybacks to free cash flow rose to 104% for the 12 months that ended Q1 2019. By comparison, in 2017 the level was 82%.

JW: The reach for yield in recent years has pushed fixed income investors into lower-quality bonds, and that’s leading us to elevated credit risks, especially for those corporate bonds that will likely be downgraded to junk in the next economic downturn. Is this a risk, in your opinion?

TE: It definitely is. Then there is the risk of elevated leverage by U.S. companies (with revenues likely declining sharply for most companies in the next recession, debt service will become an issue for some) and ultimately elevated liquidity risks, as so many holders of corporate bonds are likely to “run for the door” at the same time that the next slowdown begins in earnest. Bottom line, borrowing cheap money to buy back shares is a genius short-term move to boost stock prices. However, over the long-term it increases leverage — and we all know how that can work out in a downturn.

JW: Yes, anyone in the market in 2008 knows all too well the dangers of too much leverage. So, can share buybacks continue to support stocks? And what if the pace of share buybacks slows? Will that remove an incremental buyer for stocks?

TE: While 2019 should see a record level of buybacks (over $1 trillion according to Goldman, up from $806 billion in 2018 and nearly double the previous peak of $589 million in 2007), the pace appears to be slowing as buybacks declined in Q1 2019 for the first time in seven quarters. Second, with stock prices at all-time highs, the “value” argument of buying back stock becomes more difficult to sell versus investing the money in expansion or research and development.

JW: It seems to me that there also are political concerns to worry about, as the whole issue of buybacks has become a target of populist Democratic presidential candidates such as Senators Elizabeth Warren, Cory Booker and Bernie Sanders, all of whom have proposed bills to either limit or put preconditions on buybacks.

TE: I totally agree. And, here’s a fun fact reminder for your readers — corporate buybacks were illegal before 1982, so the precedent for limiting them isn’t as farfetched as it might seem.

JW: So, overall, would you agree that corporate buybacks have been a key underlying engine of stock market gains in the last few years?

TE: Yes, after looking at the details and the “corporate plumbing” behind the record amount of share buybacks, that is the case. Moreover, the associated risks going forward seem to outweigh the potential for continued upside in this late-stage bull environment. However, I think that, given the current bullish environment, momentum certainly is to the upside in stocks. And, the path of least resistance in the stock market is decidedly higher. Just keep in mind that there are a few concerning points regarding corporate buybacks and their impact on the broader health of the global financial markets.

JW: Thanks Tom. Your insight and expertise are a huge benefit to me and The Deep Woods readers.

So, my takeaway from this discussion with Tom, and after digging a bit deeper into the data on share buybacks, is that they are something we should watch closely going forward — but they are not something that should cause us to “sell and go away” right now.

Indeed, the momentum in this market is higher, and until that materially ceases, you want to be fully invested in the equity markets.

Yet when do you know that it really is the right time to exit the market? That’s what my Successful Investing advisory newsletter is all about. If you want to find out how we navigate treacherous market waters, check out Successful Investing right now.

**************************************************************

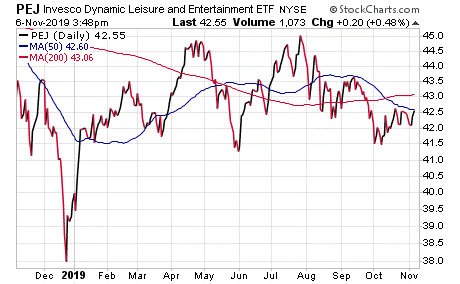

ETF Talk: Gain Exposure to Leisure and Entertainment Stocks with This Fund

(Note: Second in a series of ETF Talks on the Millennial generation).

The Invesco Dynamic Leisure and Entertainment ETF (PEJ) tracks a multifactor, tiered equal-weighted index of U.S. entertainment and leisure industry stocks.

The exchanged-traded fund (ETF) is based on the Dynamic Leisure & Entertainment Intellidex Index. PEJ normally will invest at least 90% of its total assets in common stocks that comprise the Index.

The Intellidex Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment criteria that include price momentum, earnings momentum, quality, management action and value. The underlying Index is comprised of common stocks of 30 U.S. leisure and entertainment companies.

These companies are principally engaged in the design, production or distribution of goods or services in the leisure and entertainment industries. The fund and the Index are rebalanced and reconstituted quarterly in February, May, August and November.

PEJ aims to pick winning stocks rather than deliver a market-cap-weighted basket that reflects the industry. Its stock selection process is a bit opaque beyond the broad descriptions of its screens: fundamental, timeliness, valuation and risk. Some might see value in this diversification, which mitigates single-stock risk, while others might see a lack of focus. In terms of firm size, the fund strays significantly away from large-caps.

The fund’s top sectors and their weighting in its portfolio include Restaurants & Bars, 41.26%; Airlines, 21.50%; Leisure and Recreation, 12.49%; Hotels, Motels & Cruises, 8.47%; and Food Retail & Distribution, 5.64%.

PEJ’s top holdings are United Airlines Holdings, Inc. (NASDAQ:UAL); Booking Holdings, Inc. (NASDAQ:BKNG); Delta Air Lines, Inc. (NYSE:DAL); Yum China Holdings, Inc. (NYSE:YUMC); and Chipotle Mexican Grill, Inc. (NYSE:CMG).

Chart courtesy of StockCharts.com

Up 5.85% year to date, PEJ has done well to weather the many market corrections in 2019. It has 31 holdings, an average spread of 0.13% and an expense ratio of 0.63%, meaning it is relatively expensive to hold compared to other exchange-traded funds.

PEJ provides investors with exposure to Leisure and Entertainment stocks but their performance can be cyclical and based on economic strength. As always, please conduct your own due diligence, as you would with any investment, before deciding whether this fund fits your own individual portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Philosophy, Business and the Danger of Zero-Sum Thinking

Fans of Ayn Rand’s magnum opus “Atlas Shrugged” will know the character Hank Rearden. He’s the business executive who runs his company by the principles of reason and rational self-interest.

In the new episode of the Way of the Renaissance Man podcast, I speak with a man I consider to be a modern-day Hank Reardon: Jay Lapeyre.

Mr. Lapeyre is the president of Laitram, LLC, a diversified global manufacturer of plastic conveyor belting, shrimp processing equipment and space-saving stairs. In addition to running his company, Jay also is a member of the Tulane University Board of Administrators and he is also the Board Chair of The Atlas Society in Washington, D.C.

Photo Courtesy of Unlock Your Wealth TV

In this episode, you’ll learn about Jay’s intellectual awakening while playing college basketball at the University of Texas. You’ll also learn about his life-long journey of integrating philosophy with business, and how he sees the two as inextricably linked.

The discussion then goes on to Jay’s work with the Atlas Society and how he lends his passion to the organization by helping to promote and disseminate Ayn Rand’s revolutionary ideas. We also talk about current events, what Jay sees as the real damage that is being done by the current U.S.-China trade war and why the concept of zero-sum thinking is so destructive.

It was a true pleasure to be able to speak with the always-engaging Jay Lapeyre, and after listening to this episode, I know you’ll agree.

*********************************************************************

A Native American Honor

“I call you: ‘Light of the Woods.’”

–“Moon Owl,” Chiricahua Apache

I was recently given a Native American name by a member of the Chiricahua Apache tribe, the same tribe whose ancestors include valiant and fierce warriors such as Cochise and Geronimo. The name I was given was “Light of the Woods.” This name was bestowed upon me due to the “light” I was told I shine on many different subjects, including the subjects covered in The Deep Woods. I am extremely honored to have been given this name, and it is a moniker I will wear with pride until I take my final breath.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods