And the Winner is… America

In the fantastically entertaining, although mostly unrealistic, modern film classic, “Wall Street,” the unforgettably unctuous villain Gordon Gecko famously made a speech where he proclaims, “Greed is good.”

Today, I’ve decided to channel my inner Gecko and make a similar proclamation regarding last night’s midterm election results, and it is… “Gridlock is good.” Yes, gridlock in Washington is back, and that means that the real winner this morning is America.

I say that because through my libertarian-tinted glasses, the less that “gets done” in Washington, the better. Stated differently, the fewer new laws that rob Americans of their liberty and their property, the better off everyone will be.

With the Democrats soon to be in control of the House of Representatives, and the Republicans still firmly in control of the Senate and the White House, we have a potent prescription for gridlock of the sort that freedom-loving Americans should embrace.

What gridlock means in today’s context is no threat to the Trump tax cuts. Unfortunately, it means no further tax cuts are likely, but further tax reform isn’t what most experts thought was on the agenda anyway.

Gridlock also likely means no big spending legislation over the next two years. The one caveat here comes if Democrat and Republican leaders get together with President Trump to pass some big-government infrastructure spending bill. A huge infrastructure spending bill means a lot of debt, and likely a lot of inefficient use of our tax dollars.

For Wall Street, at least historically, gridlock has been a very good thing. An article today at MarketWatch cited some eye-opening statistics from Bank of America showing that since 1928, stocks in the S&P 500 have produced an annual average return of 12% in years when a Republican president held office and Congress was split.

That research also showed that in the year following a midterm election that resulted in a Republican president and a split Congress, returns for the S&P 500 have averaged more than 20%.

The data here shows the historical validity of my “Gridlock is good” thesis, but the reason why I think markets are in a good position going forward this year is because now markets can get back to focusing on what really matters — i.e. fundamental drivers of equity prices such as corporate earnings growth, economic growth and monetary policy.

So far, corporate earnings growth continues to be strong, and that’s despite the relatively high number of high-profile earnings and outlook disappointments we saw in Q3. Moreover, broad macroeconomic data continues to be strong (GDP growth, employment data, sentiment surveys) despite a few points of weakness (housing, building permits).

As for monetary policy, the Federal Reserve’s Open Market Committee (FOMC) just happened to begin its two-day policy meeting today. And while no change in interest rates is expected this month, what the markets want to see is if there will be any alteration to the “hawkish” rhetoric we’ve been hearing for the past couple of months.

Recall that one of the reasons for the equity market volatility in October was the hawkish comments from Fed Chair Powell, when he said that rates were likely a “long way” from neutral, implying a lot more rate hikes to come. If the Fed fails to mention the recent volatility in stocks in tomorrow’s FOMC statement, markets will perceive that failure as the Fed remaining very hawkish.

Finally, there is one more seasonal trend that deserves mention here that isn’t even correlated to the “Gridlock is good” thesis, but that nevertheless happens to be true an amazing 100% of the time.

This indicator was brought to my attention by Tom Essaye of the Sevens Report, who cited research showing that since 1946, there have been 18 midterm elections. And, in the 12 months following each of those elections, the stock market has rallied sharply. In fact, Tom shows that fully 100% of the time, stocks have been higher 12 months after a midterm election by an average of 17%.

Additionally, the average gain from the lows of the year during the midterm (so today that means about 2,530 in the S&P 500) was 32%. And as Tom points out, “Those two numbers equal 3,223 in the S&P 500 (a 17% gain from Tuesday’s close) and 3,340 (a 32% move from the 2,530 2018 low). So, not only is gridlock good — but for markets, the 12 months after the midterm also happen to be very good, 100% of the time!

I don’t know about you, but to me, that sounds like America is the real winner today.

**************************************************************

ETF Talk: This Fund Could Counter Fed’s Inevitable Rate Hike

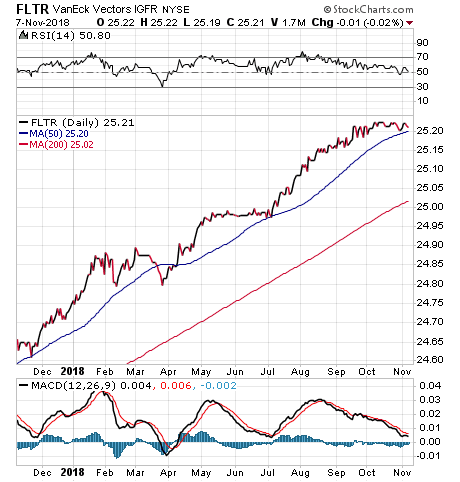

The VanEck Vectors Investment Grade Floating Rate ETF (FLTR) is an exchange-traded fund (ETF) that concentrates its holdings in U.S. corporate issues through slightly riskier debt than typical investment grade issues.

In addition, FLTR is more tilted towards debt with lower credit ratings by design and many of its bonds are often in the BBB to A- investment-grade range. But that additional credit risk is somewhat mitigated by higher yield to maturity (YTM).

In contrast to its peers like SPDR Barclays Capital Investment Grade Floating Rate ETF (FLRN) and iShares Floating Rate Bond ETF (FLOT) (both of which were covered in previous ETF Talks), FLTR is much smaller, with only $620 million in assets under management. Morningstar classifies FLTR as an Ultrashort Bond because it almost exclusively holds bonds with a duration of less than one year. AA, A and BBB bond ratings comprise 98.82% of this ETF.

FLTR was described as an effective investment in September when the Fed began talking about raising interest rates. As we saw, the Fed had increased the federal funds rate from 2% to 2.25% at the end of September and very likely will increase it again it to 2.5% in December.

With that said, investing in FLTR could be yet another effective investment to counter the Fed when it raises interest rates. Bond investors ought to consider incorporating fixed income ETFs like these in their portfolios.

Yields on floating-rate notes are comparable to fixed-rate, short-term bond yields, but with much lower interest-rate duration. In addition, floating rate note coupons reset quarterly, adjusting automatically with rates while maintaining a near-zero duration profile, according to VanEck.

The fund has a 2.14% one-year total return. FLTR has a relatively low expense ratio of just 0.14% and pays a monthly distribution. FLTR nearly doubled its distribution from 2017 to 2018. Its last distribution was paid out on Oct. 31 in the amount of $0.0583 and its next distribution date is on Nov. 30.

Chart courtesy of stockcharts.com

FLTR’s holdings are mostly in U.S. corporations. As of Nov. 6, top holdings include AT&T (T), 1.99% of assets; Morgan Stanley (MS), 1.68%; Goldman Sachs (GS), 1.45%; and JPMorgan Chase & Co. (JPM), 1.13%.

Investors seeking an inexpensive play in the floating-rate bonds field can consider VanEck Vectors Investment Grade Floating Rate ETF (FLTR) as a potential candidate.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Shooting the Breeze with an FBI Counterterrorism Expert

Have you ever wondered what it’s like to be on the frontlines of America’s war on terror?

I did, and that’s why I wanted to have a conversation with one of the leading experts on counterterrorism in the country, retired FBI Special Agent John Iannarelli.

Not only did John spend more than two decades as an FBI agent and member of the FBI’s elite SWAT Team, he’s also the author of the book, “How To Spot A Terrorist: Before It’s Too Late.”

In the latest episode of the Way of the Renaissance Man podcast, I spoke with John to get his thoughts on why it’s incumbent upon all of us to be prepared for the unlikely, yet potentially catastrophic, act of violence and terror.

In this fascinating conversation, we also talked about:

What the FBI looks for as “suspicious activity” to prevent catastrophic events such as acts of terrorism.

What it was like at “Ground Zero” during the Las Vegas shooting rampage.

The steps John took to fulfill his childhood dream of becoming an FBI agent.

What John means when he says, “I’ve never learned anything by doing it right.”

Plus, much more.

If you ever wanted to peek into the brain of an elite member of America’s premier law enforcement agency, then today’s episode of the Way of the Renaissance Man podcast is for you.

Finally, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

*********************************************************************

Safe-Harbor Wisdom

“A ship in harbor is safe, but that is not what ships are built for.”

— John A. Shedd

Safety and security are important. As humans, these are some of our most-basic requirements for life. Yet when it comes to really living a life you want, safety should be secondary. The reason why is because, like ships, humans aren’t built for mere safety. We’re built for discovery, adventure and we come complete with an unquenchable intellectual curiosity that’s allowed our species to thrive throughout the planet — and one day, perhaps, even on multiple planets. So, seek adventure in life — you’re built for it. Hat tip to Sir Richard Branson for alerting me to this great quote.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods