America IS Enlightenment Now

Today is America’s birthday. It was 242 years ago that the world witnessed the official creation of a country based on Enlightenment values. I say that, because America is the byproduct of the supreme value of the Enlightenment — reason.

The principles embraced in her brilliant Constitution were written there by men of the Enlightenment. Those men realized that reason and its political corollaries of individual rights and freedom from government coercion were all necessary components of the optimal state, in which citizens had the best chance to thrive.

Well, nearly two and a half centuries later, America remains the epitome of what Dr. Steven Pinker calls “Enlightenment Now,” i.e. a country based on reason and respect for the individual.

So, on this Fourth of July, I’ve decided to reprint a story originally published on March 21, which provides further detail on the Enlightenment values presented in Dr. Pinker’s book and how these values are at the core of what has always made America great.

**************

The Best of Times Is Right Now

What do you get when you put a Harvard psychologist on stage at the same Hollywood venue where they hold the Academy Awards?

The answer is one gigantic dose of feel good. That was my takeaway after attending a discussion given by Harvard University Professor Steven Pinker, a psychologist and best-selling author who just released a new book, “Enlightenment Now: The Case for Reason, Science, Humanism, and Progress.”

The central thesis of this work is that by nearly every metric that matters — health, lifespan, inequality, environment, knowledge, safety, quality of life, happiness and especially wealth — the world has never been better than it is right now.

The cause of this human progress, argued Pinker, is the embrace of Enlightenment values, chiefly reason and science, and the real-world application of these principles toward enhancing human existence.

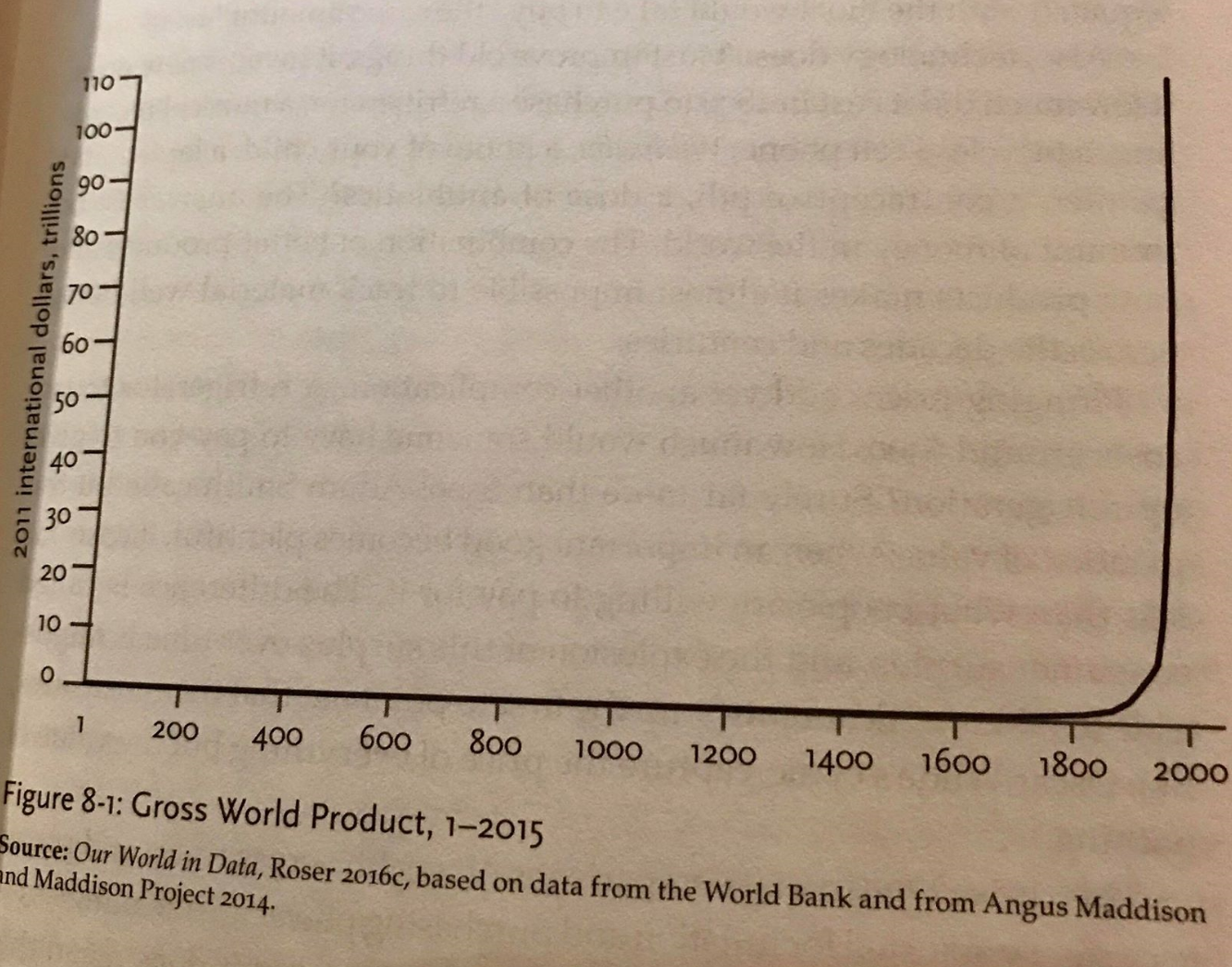

In one truly dramatic chart from the book, Pinker shows the rise of Gross World Product from the year 1 through 2015. Here’s a snapshot of that chart that I took from my own copy.

As you can see, up until the late 1800s, the world made little to no progress in terms of economic growth.

Then, the graph goes parabolic, as the rise of capitalism, the industrial revolution and the growth of cities creates an undeniable and stunningly dramatic surge in economic flourishing.

It is charts like this one, some 75 of them, that make this book so beautiful, and so uplifting.

It is not often that you get to see how great human beings are, and how well we’ve done with our world. And despite all our Shakespearean flaws, bellicose urges and tribal tendencies, we’ve managed to continually improve, enhance and recreate our societies in an onward march toward more human flourishing.

Yes, there are some things we haven’t got right along the way (two world wars in the 20th century, for example). But the evidence of progress is undeniable, and it’s presented brilliantly in this must-read work.

So, in the spirit of Professor Pinker’s work, consider that over the past 12 months, the Dow jumped more than 20%, while the S&P 500 climbed nearly 17%. The NASDAQ Composite has surged some 27.5%.

Looking further back, the Dow soared 72% over the last five years, while the S&P 500 gained 77%. The NASDAQ Composite spiked 129% in that span.

I could go back further, and the results would be even better, but I’ll stop here for now as I suspect you get my point.

The thing to realize here is that while there is no guarantee that human progress, and equity market progress, will continue in an upward trajectory, history clearly shows we’ve done a stellar job of making fools of the purveyors of doom and gloom.

Keep this in mind whenever you hear from those warning about the next devastating market crash.

If you want to learn how I apply Enlightenment values, the chief of which is reason, to help my newsletter subscribers win big in the markets, then I invite you to check out my Successful Investing, Intelligence Report and Fast Money Alert advisory services, today, on this most-glorious of all holidays.

***********************************************************************

FreedomFest Update

News is breaking that FreedomFest keynote speaker Senator Mike Lee is on the short list to become the next U.S. Supreme Court justice. He will tell us all about it on Saturday, July 14, in the Rivoli ballroom, Paris Resort, Las Vegas.

We will also have three great legal authorities joining the conversation at FreedomFest about the recent dramatic Supreme Court decisions and new appointment to the Supreme Court: Fox News Legal Analyst Andrew Napolitano, Harvard Law Professor Alan Dershowitz and Georgetown University Law Professor Randy Barnett. This is a hard to beat trio!

The entire agenda is posted online! We have an incredible lineup of big-name speakers and experts, panels and debates. Go to https://www.freedomfest.com/agenda-3/. There is nothing like it in any conference anywhere.

To register, go to https://www.freedomfest.com/register-now/, or call toll-free 1-855-850-3733, ext. 202. You’ll be glad you did.

Plus, if you’re at FreedomFest this year, be sure to check out media row, as I will be debuting my new lifestyle website and podcast, “Way of the Renaissance Man.” For more information on this project, and for advance notice on any updates, be sure to sign up today.

**************************************************************

ETF Talk: Offering Cost-Effective Solutions to International Investing

Starting this week, we will feature a series of rule-based exchange-traded funds (ETFs) that are managed by O‘Shares Investments.

Today’s featured fund, O’Shares Global Internet Giants ETF (OGIG), is the newest addition to O’Shares’ growing list of ETFs that are focused on long-term wealth management. All of the O’Shares ETFs are listed on the New York Stock Exchange and can be easily located using their respective tickers.

O’Shares Chairman Kevin O’Leary shared an example of the rule-based active management at work at O’Shares when the Trump tax cuts took place. To tap the opportunity, O’Shares management took advantage by rebalancing holdings towards a heavier allocation in strongly profitable small-cap companies that had the majority of their revenues in the United States, as opposed to overseas, since these were the companies that stood to gain the most.

With the explosion of advancements in e-commerce and internet technology, O’Shares rolled out OGIG on June 5, 2018, and it could hardly have come at a more appealing time. OGIG’s focus is on internet-related companies that exhibit certain growth and quality characteristics.

More specifically, the fund measures quality using a monthly “cash burn rate,” or how much investor capital is spent per month. It also measures growth primarily by revenue growth rate. OGIG screens the 1,000 largest U.S.-listed companies, the 500 largest European companies, the 500 largest Pacific basin companies and the 500 largest emerging market companies for stocks that best match the aforementioned quality and growth characteristics.

As part of its investment strategy, OGIG believes in the potential of the Chinese internet companies. In a recently released report, O’Shares revealed that e-commerce sales in China hit $1.1 trillion in 2017, which represents more than 21% of the $5.6 trillion in total retail sales. Furthermore, in the last three years, e-commerce in China has grown over 145%.

After its inception, OGIG’s share prices soon hit a high of $26 before retreating to the $24 level. Keep in mind that OGIG only has been in existence for less than a month, so looking solely at the numbers can be misleading, especially since technology and e-commerce companies have come under pressure lately due to the possibility of a trade war. The fund has an expense ratio of 0.48%.

A one-month chart of OGIG’s performance is below:

Chart courtesy of Stockcharts.com.

The current top holdings for OGIG are: Facebook (FB), 6.41%; Amazon.com (AMZN), 6.24%; Alphabet (GOOG), 6.18%; Tencent Holdings, 5.71%; and Alibaba Group Holdings (BABA), 5.65%.

From a sector perspective, OGIG is 74% invested in information technology and 25% in consumer discretionary. As far as country exposure goes, some of the biggest are the United States, 55%; China, 31%; and the United Kingdom, 5%.

For investors who are looking to hold a stake in the growing internet technology and e-commerce sectors, consider buying shares in O’Shares Global Internet Giants ETF (OGIG).

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*************************************************************

Whiskey, Tailpipes and Tribalism: Singing the ‘Trade War Blues’

Since early March, equity markets have been singing a faint, yet increasingly loud, song that is giving the bulls reason to pause.

That song probably should be titled “Trade War Blues,” and the latest verse includes whiskey, tailpipes and a whole lot of economic tribalism. Last week, stocks traded sharply lower in a completely rational reaction to a development I’ve been warning readers about for months.

That warning is all about tariffs and a potential trade war, and the heated rhetoric from the Trump administration, China and Europe. That talk of tariffs caused the Dow Jones Industrial Average to suffer its biggest one-week decline since March.

Not coincidentally, March also is when the original “Trade War Blues” jam started to be heard on the corner of Wall and Broad in Manhattan.

Now, from a purely global and domestic economic growth standpoint, tariffs are never a positive. Markets know this and last week, and again on Monday, it looked like markets were really starting to take the prospects of a profit-killing trade war seriously.

The way I see it, trade wars are a misguided form of tribalism in economics that are, ironically, bad for all tribes. Tariffs only serve to punish a country’s citizens via increased taxation on goods and/or services, and via higher prices of goods and services.

And though there are some companies/individuals who benefit from specific tariffs and/or trade decisions, they do so at the expense of other companies, other industries and nearly all consumers. And, many, many more individuals are harmed via higher product costs, higher taxes, more government and less economic freedom.

Of course, every good blues song needs a lyric or two about a favorite way to drown your sorrows, and that way usually involves whiskey. In the “Trade War Blues,” we’re drinking the ultimate Tennessee whiskey, Jack Daniel’s.

Last week, Brown-Forman Corp. (BF-B), makers of the iconic libation, announced it would be raising prices by 10% on its flagship brand that is sold in many European countries. The stated intent is to combat the 25% tariffs imposed by the European Union (EU) on U.S. bourbon.

Oh, and why did the EU impose those tariffs? It did so to combat the original tariffs placed on steel and aluminum imports to the United States by the Trump administration.

Then we have another favorite of the blues song genre, motorcycles.

I’m referring here to another American icon, Harley-Davidson (HOG). The Wisconsin-based motorcycle maker announced plans to move some of its production overseas to avoid the EU’s retaliatory tariffs.

According to Harley-Davidson, the EU tariffs on the company’s motorcycles increased to 31% from 6% and will raise the cost of the average motorcycle to the EU from the United States by about $2,200. The company also announced it expects the tariffs to cost about $30 million to $45 million for the rest of 2018 and could cost $90 million to $100 million on an annual basis.

Here again, we have another verse in the “Trade War Blues” that means damage to an iconic American company’s bottom line, as well as fewer jobs here in the United States.

This is the kind of negative fallout from the economic tribalism of tariffs and a trade war. And, you know it’s tribal based on the reaction from the head of the tribe… President Trump himself.

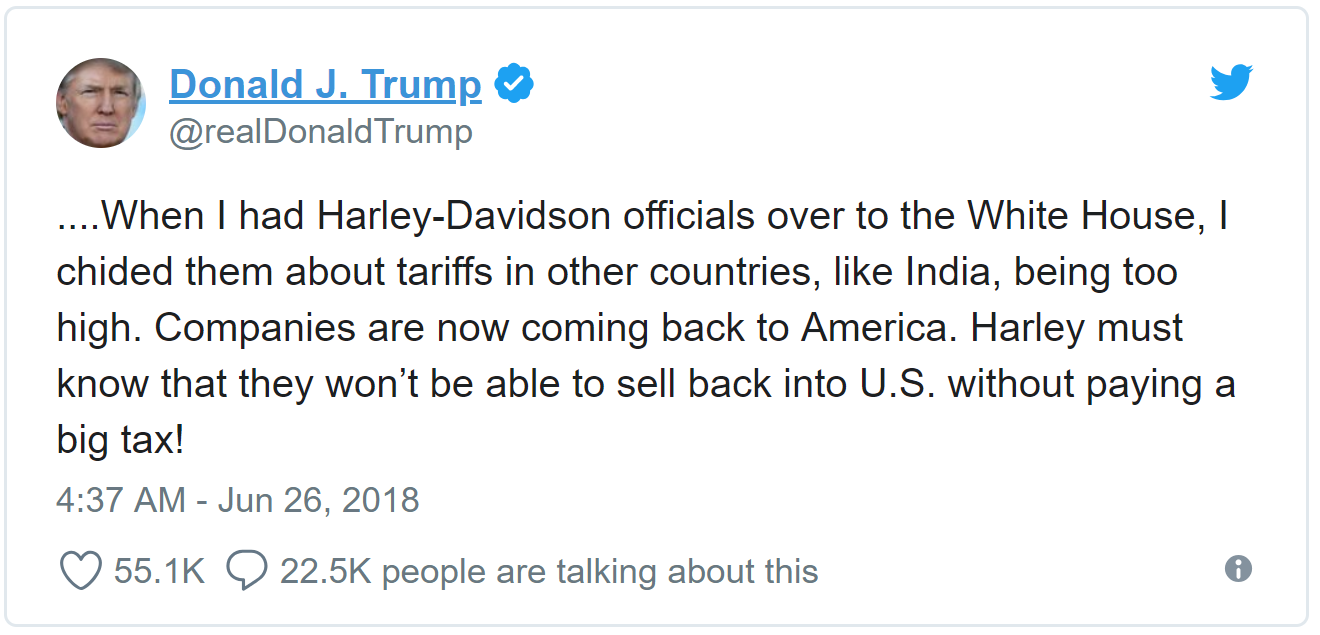

In a series of Twitter (TWTR) posts reacting to the Harley-Davidson announcement, the president essentially scolded the company’s management for “surrendering” and “quitting” with its decision to do what’s in its financial best interest.

Check out the disturbingly granular tweet, which essentially threatens the company for making a business decision based on financial merits, as its management sees it:

I consider this a disturbing form of tribalism, because the threat is designed to make Harley-Davidson act in what the president thinks is in the best interest of the country.

Well, Mr. President, Harley-Davidson and its shareholders demand that the company act in its best fiduciary interest, not in the interest of the tribe — even if that tribe is the America you would like to make great again.

All this said, I am a fan of much of what the president has done for the economy, for the business community and for individual taxpayers. The tax bill passed late last year was outstanding, and companies now can breathe easier with a lower corporate tax rate. Moreover, the reduction of regulations has been a much-needed and much-appreciated development that wouldn’t have come to pass without President Trump leading the charge. For that, the president deserves to be commended without equivocation.

Unfortunately, I think Mr. Trump stands to undo much of the progress from tax cuts and deregulation with the heightened tariff and trade war talk. Still, the saving grace here, at least from a market perspective, is that most of the tariff and trade war talk has, thus far, been just that — talk.

However, if the president follows through by moving ahead and imposing more tariffs (the latest idea being floated is another $400 billion on Chinese goods at a 10% rate, and another 20% tariff on all European auto imports), and more restrictions on foreign investment in technology (a policy he threatened), the “Trade War Blues” won’t just be sung on Wall Street — it will be belted out loud the world over.

*********************************************************************

On Hanging Together

“We must, indeed, all hang together, or most assuredly we shall all hang separately.”

— Ben Franklin

The Founding Father said this at the Continental Congress, just before signing the Declaration of Independence in 1776. I thought this was a fitting quote for this week, because some 242 years later, it seems we need to digest the message “all hang together” perhaps more so than any time since the polarizing late 1960s. Will we have the gumption and wisdom to all hang together? I say yes, we will, and my money is on the United States!

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.