All You Have Is Now

- All You Have Is Now

- ETF Talk: Invest in High-Yield Companies with This Fund

- Kevin O’Leary Enters My Shark Tank

- Here’s When the Selling Will Stop

- Man the Mosaic

***********************************************************

All You Have Is Now

Today, right now, in this very moment, you have an incredible opportunity to do something so sublime, and yet so ordinary, that you may not even realize its power or its importance.

You see, right now, you have the ability to “just begin again.”

That is the advice from philosopher and neuroscientist Sam Harris, whose book “Waking Up,” along with his brilliant app of the same name, is one of my most highly recommended resources for enhancing your personal well-being.

Both the book and the app provide essays and instruction on how to implement mindfulness meditation in your life. Broadly defined, mindfulness meditation is simply a mental training practice that teaches you to slow down racing thoughts, let go of negativity, and calm both your mind and body.

There’s nothing “woo-woo” about the practice, and you don’t have to buy into any pseudoscience or mystical silliness to make it a part of your life. That’s because mindfulness is basically just cultivating and enhancing your innate ability to be fully focused on “the now.”

Being aware of “the now” and all that this entails truly is one of your superpowers as a human. The reason why is because being mindful of the now means you can acknowledge and accept your thoughts, feelings and sensations in the moment.

And in case you haven’t yet fully realized it, “the moment” is all that any of us ever have.

My view from atop Catalina Island is a stunning location for mindfulness meditation.

Perhaps a few thoughts on this subject directly from Sam Harris will help further illustrate this point:

Take stock of how you’re feeling in this moment. And think about how you’ve spent the last few minutes, or last hour. What has your mind been like? Has it just been chaos in there? Take a moment to start the day again, and just rest your mind.

Everything that’s already happened is well and truly gone, and the future hasn’t arrived. So simply embrace this moment. It’s crucial to recognize that no one can do this for you. But no one can prevent you from doing it either. Where you stand, this bright corner of the universe, there is no one to enjoy it but you.

The beauty here of being mindful is that in any given moment, no matter what is going on within you, you have the ability to pause, reflect and just begin again.

Or as Harris puts it: “However good or bad things seem, nothing lasts. Everything you’ve done, or not done, is now just a memory. And everything you’re telling yourself about the future is a half-truth at best. This present moment is your opportunity, your only opportunity, to connect with your life — and that will always be the case.”

If you want to reboot your thinking and upload a new, enhanced operating system to your mind, then try some mindfulness meditation — because all you have is now, so why not be fully present for it?

***************************************************************

ETF Talk: Invest in High-Yield Companies with This Fund

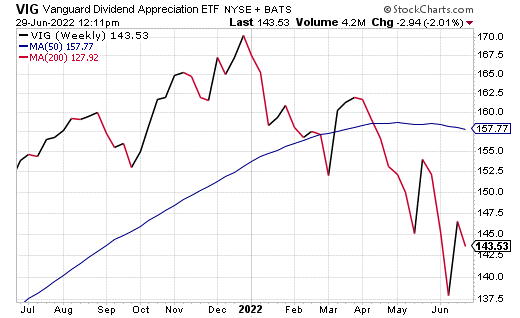

The Vanguard Dividend Appreciation Index Fund (NYSEARCA:VIG) seeks to track the performance of a benchmark index aimed at matching the return of common stocks for companies that increase their dividends over time.

VIG primarily focuses on dividend growth. The fund specifically selects U.S.-listed firms that have increased their dividend payments for the past 10 years, while excluding the top 25% highest-yielding companies based on indicated annual dividend yield (IAD).

This results in a portfolio that typically carries a relatively high yield. Holdings are market-cap weighted with individual security weights capped at 4%. The index reconstitutes annually.

Overall, VIG’s investment strategy provides a sustainable growth play based on dividends.

Chart courtesy of www.StockCharts.com

The adviser employs an indexing investment approach designed to track the performance of the index, which consists of common stocks for companies that have a record of raising dividends. The adviser attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index. Each stock is held in approximately the same proportion as its weighting in the index.

The fund has an average weighted market cap of $256 billion and a 1.95% distribution yield. Its average spread is 0.02%. The ETF has 288 holdings and an expense ratio of 0.06%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Kevin O’Leary Enters My Shark Tank

Cryptocurrencies are getting crushed.

Consider that Bitcoin, the largest and most heavily traded cryptocurrency, recently plummeted by 26%. That is an astounding decline in such a short period, and it illustrates not only the inherent volatility of this asset class, but also the precarious nature of putting money to work in this still-nascent market segment.

Yet despite the decline in cryptocurrencies of late, the sector remains populated with high-profile investors who see huge opportunity in the space going forward. One such investor is “Mr. Wonderful” himself, Kevin O’Leary.

I suspect you know Kevin O’Leary from his starring role in the CNBC show “Shark Tank,” a favorite TV program of mine, and of just about every entrepreneurial type that I know. Yet O’Leary is far more than just a TV “shark.” He’s also the creator of the O’Shares family of exchange-traded funds (ETFs), several of which I have recommended in my newsletter advisory services.

One of O’Leary’s newest ventures is a company called WonderFi, a cryptocurrency trading platform that Mr. Wonderful says will provide a compliant and transparent place for institutional and individual investors to trade cryptocurrencies.

According to O’Leary, what Bitcoin and other cryptocurrencies really need to flourish is, ironically, real industry regulation. And as he puts it, “that’s when the real money is going to come into it.”

O’Leary explained all of this to me in the latest episode of the Way of the Renaissance Man podcast.

In this interview, Mr. Wonderful enters the Renaissance Man shark tank, as I let him “pitch me” on the reasons why investors should consider WonderFi.

Along with WonderFi CEO Ben Samaroo, O’Leary explained that despite the hype of cryptocurrencies, the big money players such as pension funds and sovereign wealth funds have yet to embrace the asset class. He also attributes cryptocurrency volatility to the relatively small amount of money invested in the asset class relative to stocks, bonds, commodities and other currencies.

This interview took place on the cusp of an interesting time for cryptocurrency, as the huge June 2022 swoon in the price of Bitcoin and other cryptos has rattled investors, along with many companies in the industry.

So, is there a future for Bitcoin and cryptocurrencies? Is there likely to be a rebound in the segment? If so, could the catalyst be what O’Leary thinks it will be?

To find out the answers, and to decide for yourself, I invite you to watch/listen to the new episode, “Investor Kevin O’Leary Enters the Renaissance Man’s Shark Tank,” today.

*****************************************************************

In case you missed it…

Here’s When the Selling Will Stop

This morning I received an inquiry from a subscriber (thank you, Scott M.) who asked me what I thought would be the market bottom on the Dow Jones Industrial Average.

Here’s what I told him in response:

“A numerical value on a Dow bottom is nearly impossible to peg with any real certainty. That said, it would not surprise me to see the Dow fall much more from here. If we had another 10% pullback from the current value of 30,395, it would put the Dow at 27,355. And considering we’re down about 17% from the all-time high here on the Dow, another 10% down would be well within traditional bear market metrics.”

Yet what I also told him is that perhaps the more important question is when the market will bottom, and what events would cause a market bottom. Here I referred to my “Three Keys to a Bottom,” which are the brainchild of my “secret market insider” that I partner with to bring you my daily market briefing, the “Eagle Eye Opener.”

Here’s the most-recent analysis on the “Three Keys to a Bottom.” Unfortunately, none of these factors has been triggered yet.

Last week, stocks fell to new 52-week lows (as measured by the major domestic indices). So naturally, the question here becomes, “When will this market form a bottom?”

Of course, nobody knows that answer definitively, but what we can say is that there are several key events that need to happen before we can expect to see any real bottom in stocks. Let’s take a quick look at each of these three keys to a market bottom.

1) Chinese Lockdowns Ease and Growth Recovers. Chinese authorities are hesitant to admit they’re wrong about the pernicious zero-COVID-19 policy, so we can’t expect them to publicly abandon it. Yet in recent weeks, the Chinese government relaxed lockdowns in Shanghai and Beijing. Unfortunately, they reimplemented some of the restrictions at the first sign of a few COVID-19 cases. If the Chinese can finally abandon this policy, markets can start to breathe more bullishly when considering global economic growth.

2) Inflation Peaks and Declines and the Fed Eases Off. Based on the latest Consumer Price Index (CPI) data, the idea that inflation has peaked has yet to come to fruition. However, CPI is a backward-looking indicator. If the Fed’s recent rate hikes can start to put a dent in inflation, that peak might not be too far away. If that happens, and if the Fed starts to be a bit less hawkish than it has been recently, and we saw some evidence of that at the June Federal Open Market Committee (FOMC) press conference, then stocks can begin to form a bottom.

3) Geopolitical Tensions Decline. Understanding what “improvement” will look like in the Ukraine war is very difficult, and at this point a ceasefire remains unlikely. The conflict now seems to be devolving into a stalemate that could last for months, quarters or even years more. The war is a tremendous human tragedy, but from a market standpoint it’s the spike in commodities that’s causing headwinds on earnings and increasing the chances of a global recession. The bottom line here is this situation needs to improve before we can see a real bottom in stocks.

So, there you have it, my assessment of what it will take for stocks to make a material bottom, and for the overwhelming bias in the stock market to go from bearish to bullish (or at least back to neutral).

P.S. If you’d like to get this kind of expert market analysis delivered to your inbox every trading day at 8 a.m. Eastern, then I invite you to check out my daily market update, the “Eagle Eye Opener.” The way I see it, if you aren’t subscribing to this publication, then your market eyes aren’t fully opened. And as a thinking investor, you know that when you fly with impaired vision, it’s really easy to crash.

*****************************************************************

Man the Mosaic

“Every piece makes a whole, a man is a mosaic.”

–Ewen Montagu, “Operation Mincemeat”

Today’s quote was sent to me by a loyal reader who knew that this sentiment would resonate deeply with me. The line is from a film called “Operation Mincemeat,” which tells the wild and true tale of a British MI5 operation to deliver false intelligence to the Nazis during WWII. I have yet to see this film, but I plan to over the July 4th holiday. And though I’ve only been privy to this quote from the film, the notion that a man is the sum of his collective ideas, experiences, and actions — a collection that resembles a physical, intellectual and spiritual mosaic — is certainly at the heart of my worldview.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods