Jamie Dimon’s Cry for Freedom

The concept of freedom may seem easy to understand, as it basically just means the absence of coercion from others. In political terms, it means the absence of coercion from government.

In economic terms, freedom means the absence of government intrusion on the free exchange of money, ideas, goods and services conducted by individuals, companies, countries, etc.

I subscribe to a “libertarian,” free-market mindset that argues that the freer the economy, the more prosperous the economy is. I’m not alone here, of course, as many of my colleagues (particularly my friend Mark Skousen) subscribe to similar views.

On Thursday, I will be making the trek to Las Vegas for Mark’s annual FreedomFest conference, which has become the premier gathering of free-market-oriented thinkers in the world.

At FreedomFest, I’ll be surrounded by extremely smart, like-minded individuals dedicated to advancing the cause of freedom and to stunting the growth of big government.

One person who I don’t think will be at FreedomFest, but who perhaps should be, is JPMorgan Chase (JPM) CEO Jamie Dimon.

Dimon is known for being brash and outspoken, and as someone who doesn’t mince words when he has strong views on an issue. Those views came out rather blatantly recently, as the banker offered this blunt criticism during last Friday’s JPMorgan earnings call:

“It’s almost an embarrassment being an American citizen traveling around the world and listening to the stupid s— we have to deal with in this country… And at one point we all have to get our act together or we won’t do what we’re supposed to [do] for the average Americans.”

Dimon added, “Since the Great Recession, which is now 8 years old, we’ve been growing at 1.5 to 2 percent in spite of stupidity and political gridlock, because the American business sector is powerful and strong… What I’m saying is it would be much stronger growth had we made intelligent decisions and were there not gridlock.”

The JPM chief then topped off his comments by saying the United States has become “one of the most bureaucratic, confusing, litigious societies on the planet,” and that “it’s hurting the average American that we don’t have these right policies.”

Now, one can differ on what the “right policies” are. I suspect Mr. Dimon’s policy proscriptions are far less free-market than mine would be, or than most liberty lovers’ would be. However, these comments do accurately reflect the frustration out there among the CEO class, frustration that Washington is in the way of economic progress… and, by extension, standing as an obstacle to more economic freedom.

I suspect that the more outspoken and powerful folks such as Jamie Dimon are in the effort of shaking Washington out of its paralysis, the more likely it is that at least a modicum of additional freedom can be achieved.

For that, I salute this Dimon cry for freedom.

*************************************************************

Are you registered yet for my colleague Mark Skousen’s annual FreedomFest, July 19-22, 2017, at the Paris Resort, Las Vegas? If not, why not? This is the event the Washington Post has called the “greatest libertarian show on earth.”

I’ll be there moderating a debate between two of the most colorful investors in the business, Peter Schiff and Jim Rogers. I’ll also be participating in a panel discussion titled, “Can You Beat the Market?” If you’re at FreedomFest, be sure to come up to me and introduce yourself. I love the face time with readers.

To sign up, go to www.freedomfest.com, or call 1-855-850-3733, ext 202 and talk to Karen, Jennifer, Heather or Amy. You won’t regret it.

*************************************************************

ETF Talk: Regional Bank Fund Offers Nationwide Potential

Investors looking at the financial sector with a discerning eye these days may be wondering whether it is a good idea to invest in banks that still have some growth potential. For investors pondering just such a question, the SPDR S&P Regional Banking ETF (KRE) removes the uncertainty of which specific ones to invest in by granting exposure to a cluster of regional banks in one single investment.

Regional banks are usually smaller companies than national banks, which can mean that they have more room to grow and expand while still providing strong profits for shareholders. For example, one holding in this fund that pursues an “expansion” strategy is BB&T Corporation (BBT), which recently acquired financial services corporation National Penn for $1.8 billion dollars.

According to Seeking Alpha, BB&T also is one of the banks that has reached a new high in this market cycle. Alternatively, CIT Group (CIT) is the fund’s biggest holding and is up by more than 40% in the last 12 months.

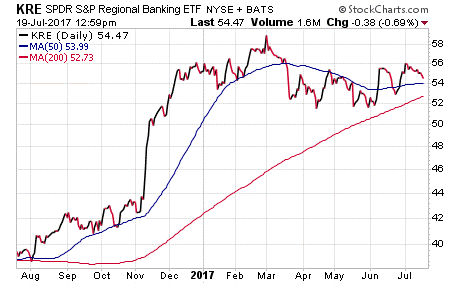

As the chart below shows, this sector has been no slouch over the past 12 months, as KRE has risen 35.8% in that time. However, after being on fire in late 2016, the fund’s year-to-date performance has been less impressive, amounting to a 1.91% loss, and underperforming the broader financial sector.

As always, smaller companies also carry greater risk and this year has certainly had its share of volatility. The fund’s 1.41% yield adds a small incentive for potential owners, and more than pays for the 0.35% expense ratio.

KRE holds more than 100 companies, giving it a strong claim to diversity throughout the industry. Top holdings for KRE include CIT Group Inc. (CIT), 2.41%; Fifth Third Bancorp (FITB), 2.34%; Zions Bancorporation (ZION), 2.34%; Huntington Bancshares Inc. (HBAN), 2.33%; and PNC Financial Services Group Inc. (PNC), 2.31%. The top 10 holdings account for approximately 23% of the fund’s assets.

Investors in search of a cost-effective way to gain a foothold in the regional banking sector may not need to look much further than the SPDR S&P Regional Banking ETF (KRE).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

************************************************************

What to Watch in Second-Half 2017 (Update)

I was recently asked by a subscriber if I could provide him a “short-hand” characterization of what happened in markets during the first half of the year. After thinking about it for a few minutes, I responded with the following: “A low-volatility grind higher based on hope.”

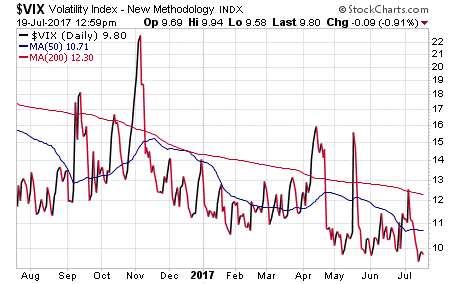

The low volatility part is rather obvious, as the CBOE Volatility Index ($VIX) has stayed in a very tight range throughout most of the first half of the year.

In fact, there have only been a few times where we’ve seen the VIX spike this year, and each time it did it has come back down swiftly. The measure of volatility or “fear” in the market now is near historic lows.

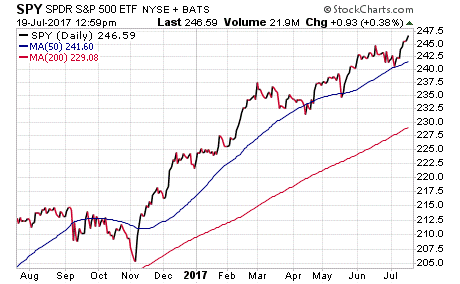

Meanwhile, the Dow Industrials, S&P 500 and NASDAQ Composite now trade at or near all-time highs. And interestingly, those new highs have come on a steady ascent that’s largely followed along with the 50-day moving average. That’s the “grind higher” part.

The “hope” part of my short-hand characterization is largely based on the idea that President Trump and the Republican Congress can implement a pro-growth agenda that includes regulatory reform, health care reform, infrastructure spending and, most importantly, corporate tax reform.

Unfortunately, the health care reform issue now seems dead. Yet I think this could actually turn out to be a positive, especially if Congress and President Trump pivot to what the markets really want… tax reform.

Regarding taxes, the Trump administration has said it would have a specific tax plan to Congress by the time members return from the August recess on Sept. 5. If there isn’t concrete progress by then, the idea of tax reform being accomplished in early 2018 (which is what the market expects) will become difficult to achieve.

The reality here is that markets still expect corporate tax cuts, and in the first quarter of 2018. If Congress and the Trump administration fail to deliver on the hope of tax reform, then investors will likely re-assess owning stocks at current valuations… and that could mean the first big market correction in years.

Of course, if we do get progress on this issue that will be bullish for stocks, and today’s levels in the broad market may be looked upon nostalgically as a time when stocks were “much lower.”

***************************************************************

Rand on Economic Freedom

“Political freedom cannot exist without economic freedom; a free mind and a free market are corollaries.”

— Ayn Rand

This week’s quote by the great novelist/philosopher Ayn Rand is appropriate, especially in light of the recent Jamie Dimon comments. It’s also appropriate due to my upcoming trek to FreedomFest. You see, I think spreading the meme of freedom is crucial if we are going to improve society and make the world a better place for all. And though one person can only play a small role in the wider struggle for more freedom, I consider it incumbent upon me as a rational man to do whatever I can to further this most-noble cause.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.