ETF Trader’s Edge

Current Hotline

Jobs, Politics and Money… and New Buys

I was gambling in Havana

I took a little risk

Send lawyers, guns and money

Dad, get me out of this…

–Warren Zevon, “Lawyers, Guns and Money”

Whenever I think about things in “threes,” like jobs, politics and money, I inevitably think of the trio title from the Warren Zevon classic, “Lawyers, Guns and Money.” Hey, I like all three of those things, as you never know what best might get you out of a jam!in

In today’s market, it’s all about jobs, politics… and, of course, money.

On the jobs front, this morning we learned the economy created 209,000 new non-farm payroll jobs in July. We also saw an unemployment rate of 4.3%, which ties for the lowest number in 16 years.

On the all-important wage front, average hourly earnings rose 2.5% from a year ago. That’s not great, but it will serve to keep inflation in check… and that means the Federal Reserve won’t be returning to the “hawkish” rhetoric it used earlier this year.

I expect the Fed to do what it has been signaling of late, and that is to begin to unwind its balance sheet in September, and then hike interest rates by another 25 basis points in December (barring any outlier data between now and then).

Markets seemed to take the news in stride, as stocks edged higher midday Friday while bond yields ticked higher. The rise in yields caused the dollar to climb, and the rising greenback sent gold prices lower. Hey, when it comes to money, there is no such thing as a vacuum — it’s all connected.

Unfortunately, politics these days also is intimately connected to money and markets.

Consider the bullish run in stocks since Election Day. Indeed, there have only been two breaches of the 50-day moving average on the Dow Industrials since November 8, 2016.

When you see things from that technical perspective, you realize just how resilient the broad market has been over the past nine months.

That resilience largely has been rooted in political hope… hope that President Trump can get his pro-growth economic agenda implemented. That agenda includes regulatory reform; Obamacare repeal/replace, an infrastructure spending plan, and, most importantly, tax reform that includes a substantive cut in the corporate tax rate.

Well, so far, we’ve had some good regulatory reform via executive order, but that’s largely been on the margins. It is a good start, but nothing that would justify this sustained bull.

As for Obamacare, well, that must be looked upon as an epic fail by not only President Trump, but also by Republicans in Congress. Despite having majorities in both chambers, the GOP failed to deliver on one of its key platform positions of the past seven years.

Yet interestingly, the failure to repeal/replace Obamacare still didn’t stop this bull market. Nor has the lack of any progress on an infrastructure spending plan. In fact, infrastructure has rarely been mentioned by the White House despite all of the campaign rhetoric about building a “big, beautiful” border wall, and rebuilding the nation’s roads, bridges, dams, etc.

So, it seems like the only real hope that has yet to be tarnished is tax reform.

On that front, the president and his economic team, along with Congressional leadership, have been painting broad brush strokes on a plan. In a recent joint statement from administration officials, congressional GOP leaders and the chairmen of the tax-writing committees presented the broad goals for tax legislation. However, the statement lacked the nuts-and-bolts details of the plan, which have yet to be finalized.

I think the president and GOP Congressional leaders had better get their collective act together on tax reform. If they fail to shoot this gun and hit the target, i.e., if they fail to get legislation signed into law that brings taxes down corporate bottom lines enough to justify the market’s very high multiples… then this bull market is sure to stumble.

Yet despite the potential political headwinds, markets march on… and that’s been great for our Income, Growth and Aggressive Portfolio holdings. In fact, all our holdings are firmly in the black, with many sporting double-digit percentage wins!

Today, we are going to add some targeted sector exposure in the Growth Portfolio, and in the Aggressive Portfolio.

In the Growth Portfolio, I want you to take the following action:

Buy a 10% Growth Portfolio allocation to the First Trust Dow Jones Internet Index Fund (FDN), after the first hour of trade on Monday, Aug. 7 (10:30 EDT). Our official buy price will be based on the price of the ETF at that time.

As its name suggests, FDN is packed with internet, e-commerce and social media stocks. Big names in the fund include Facebook (FB), Amazon.com (AMZN), Netflix (NFLX) and Alphabet (GOOGL) to name just a few. This sector has been a standout performer in 2017, but recently it has seen a slight amount of profit taking.

Yet the recent pullback in FDN means we can get in on this great sector at a good entry point, so let’s do that Monday with a 10% Growth Portfolio allocation.

In the Aggressive Portfolio, I want you to take the following action:

Buy the Guggenheim Frontier Markets ETF (FRN), after the first hour of trade on Monday, Aug. 7 (10:30 EDT). Our official buy price will be based on the price of the ETF at that time.

FRN gives us exposure to what’s known as “frontier markets,” which are defined as markets more developed than the least developing countries, but too small to be generally considered an emerging market. The top five countries represented in FRN are Kuwait, Argentina, Pakistan, Vietnam and Romania.

The upside in these countries is big (FRN is up 23% year to date), but so too is the potential risk when investing in such markets. That’s why FRN is to be bought within the Aggressive Portfolio portion of your overall investment picture.

And remember, as for allocation in the Aggressive Portfolio, we leave that to your discretion. Yet as a general guideline, try not to put more than 5-10% of your overall portfolio in the Aggressive Portfolio (and that means spreading that 5-10% out among all the current Aggressive recommendations).

We’ll have more on the new buys, as well as exit points for each, in next week’s Hotline. Until then, make your move into FDN and/or FRN… and let’s keep getting money!

In the name of the best within us

Jim Woods

Editor-in-Chief

Successful ETF Investing

**********************************************************************

(Note: All pricing/performance data is as of market close, Thursday, Aug. 3)

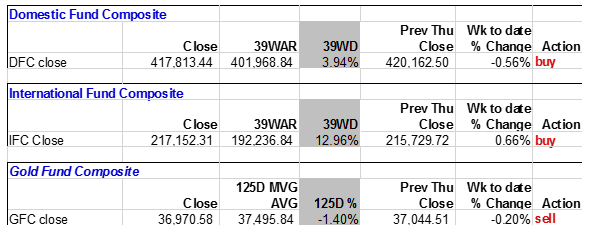

How to read the table. The “Close” column is the value of each composite figure as of Thursday’s closing value. The “39WAR” is the 39-week moving average, and the “125MVG AVG” is the 125-day moving average. The “39WD” is the percentage above/below the 39-week average. The “125D%” is the percentage above/below the 125-day moving average. “Prev Thu Close” is the previous Thursday closing value. The “Wk to date % change” is the percentage change from the prior week. “Action” is the status of the plan as “Buy” or “Sell.”

Current Income Portfolio: 10% Vanguard International Dividend Appreciation ETF (VIGI), 10% WisdomTree Emerging Markets High Dividend Fund (DEM), 10% PowerShares Senior Loan ETF (BKLN), 10% iShares Mortgage Real Estate Capped ETF (REM), 10% O’Shares FTSE US Quality Dividend ETF (OUSA), 10% Guggenheim Multi-Asset Income ETF (CVY), 10% iShares U.S. Preferred Stock ETF (PFF), 20% SPDR DoubleLine Total Return Tactical ETF (TOTL) and 10% cash.

Income Performance:

SPDR DoubleLine Total Return Tactical ETF (TOTL), 6.38%

iShares U.S. Preferred Stock ETF (PFF), 9.92%

Guggenheim Multi-Asset Income ETF (CVY), 24.03%

O’Shares FTSE US Quality Dividend ETF (OUSA), 16.53%

PowerShares Senior Loan ETF (BKLN), 3.02%

iShares Mortgage Real Estate Capped ETF (REM), 16.89%

WisdomTree Emerging Markets High Dividend Fund (DEM), 14.74%

Vanguard International Dividend Appreciation ETF (VIGI), 18.22%

Income Exit Points:

TOTL: $48.50

PFF: $38.00

CVY: $19.00

OUSA: DFC sell signal

BKLN: $20.77

REM: $42.50

DEM: $39.00

VIGI: $56.00

Current Growth Portfolio: 10% First Trust Dow Jones Internet Index Fund (FDN), 10% Vanguard FTSE Europe ETF (VGK), 10% Vanguard FTSE Pacific ETF (VPL), 5% iShares U.S. Aerospace & Defense (ITA), 20% Vanguard FTSE Emerging Markets ETF (VWO), 10% First Trust North American Energy Infrastructure ETF (EMLP), 25% Vanguard Total Stock Market ETF (VTI) and 10% money market (cash).

Growth Performance:

Vanguard Total Stock Market ETF (VTI), 24.61%

First Trust North American Energy Infrastructure ETF (EMLP), 6.76%

Vanguard FTSE Emerging Markets ETF (VWO), 19.78%

Vanguard FTSE Europe ETF (VGK), 18.84%

Vanguard FTSE Pacific ETF (VPL), 13.76%

iShares U.S. Aerospace & Defense (ITA), 17.56%

First Trust Dow Jones Internet Index Fund (FDN), N/A

Growth Exit Points:

VTI: DFC sell signal

EMLP: $21.94

VWO: $38.00

VGK: $50.00

VPL: $64

ITA: $150.00

FDN: TBD

Current Aggressive Portfolio:

PowerShares Dynamic Biotech & Genome ETF (PBE), 8.42%

ProShares Ultra QQQ (QLD), 20.78%

ProShares Ultra Financials (UYG), 5.51%

PureFunds ISE Big Data ETF (BIGD), 2.02%

Guggenheim Frontier Markets ETF (FRN), N/A

Aggressive Exit Points:

PBE: $43.50

QLD: $55.00

UYG: $83.00

BIGD: $24.50

FRN: TBD

Next Regular Update: Friday, August 11, 2017

Current Recommendations

ETFs

| Fund | Ticker | Buy Date | Buy Price$ | Current Price$ | Total Return | Exit Point$ | Comments |

|---|---|---|---|---|---|---|---|

| Van Eck Vectors Gokd Miners ETF | GDX | Dec 16, 2016 | 22.38 | 19.34 | -13.58% | 15.00 | Place a 5% trailing stop once GDX reaches $23. |

| SPDR Gold Shares ETF | GLD | Dec 16, 2016 | 118.95 | 107.93 | -9.26% | 100.00 | Place a 5% trailing stop once GLD reaches $120. |

| PureFunds ISE Junior Silver ETF | SILJ | Dec 7, 2016 | 13.79 | 11.32 | -17.91% | Buy. |

Options

| Option | Ticker | Entry Date | Entry Price$ | Comments |

|---|---|---|---|---|

| iShares Silver Trust ETF February $17.50 calls | SLV170217C00017500 | Dec 7, 2016 | 0.32 | Buy. |

| iShares Silver Trust ETF February $15.50 Puts | SLV170217P00015500 | Dec 7, 2016 | 0.37 | Sell to open. |

| iShares Barclays 20+ Year Treasury Bond January $115 Puts | TLT170120P00115000 | Nov 16, 2016 | 0.82 | Sell to open. |

| iShares MSCI Emerging Markets Index January $36 Calls | EEM170120C00036000 | Nov 11, 2016 | 0.69 | Buy. |

| iShares Barclays 20+ Year Treasury Bond January $129 Calls | TLT170120C00129000 | Nov 11, 2016 | 0.91 | Buy. |