5 Market Catalysts to Determine the Rest of 2018

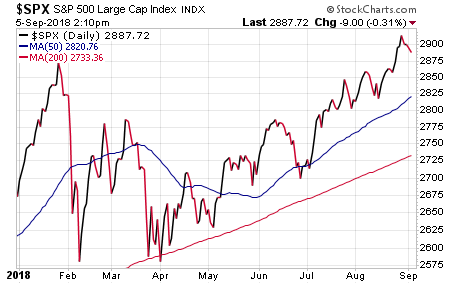

In the investment business, Labor Day is traditionally the unofficial end of summer and the start of the sprint into the year’s end. This year, things are no different. As we began the week, we also stepped into the final third of the year for markets. And as things sit here, the S&P 500 is trading just slightly below its all-time high.

Now we need to ask ourselves what the next market catalysts might be that can either A) Result in a continued rise in stocks that vaults the S&P 500 above the psychologically significant 3,000 level, or B) Cause a sharp reversal of this rally.

I was speaking to my friend and colleague Tom Essaye of the Sevens Report about this very subject last week, and we came up with what we think are five key catalysts the markets will have to negotiate between now and the year’s end. And, to help make sense of these catalysts, I’ve included a “Bullish If/Bearish If” scenario analysis.

Here are the five catalysts, ranked by importance (i.e. the ability to cause a rally or pullback).

1) A U.S.-China Trade Deal. This should come as no surprise to anyone as being the most-important potential catalyst facing markets between now and the year’s end. Simply put, whether the United States and China resolve the growing trade dispute has the potential to “supercharge” the rally — or potentially put an end to it.

Bullish If: The U.S. and China agree to a new trade deal and the threats of tariffs cease. Importantly, what’s in the trade deal isn’t really that important (from a market standpoint). The key is the cessation of trade hostilities between the two countries.

Bearish If: There is no trade deal struck and more tariffs go into place. This is especially negative for the market because of the far-reaching implications. First, emerging markets will resume their declines from earlier in the year. Second, the dollar will surge. Third, higher tariffs will be a headwind on U.S. economic growth. Fourth, the stronger dollar will erode U.S. corporate earnings. Put simply, an all-out trade war threatens to undermine virtually every bullish support pillar holding up this market.

Next Key Event/Date: Sept. 6. This is the end of the comment period for the proposed 25% tariff on $200 billion in Chinese exports. The market seems very comfortable with the idea these tariffs won’t go into effect, so if they do, that will almost certainly cause a pullback.

Chart courtesy of Stockcharts.com

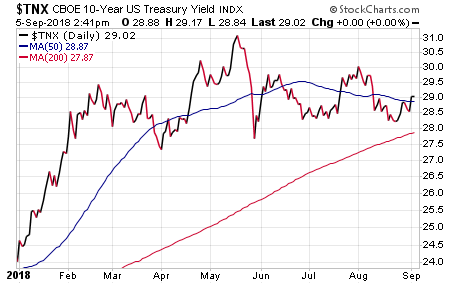

2) December Fed Rate Hike. Very quietly, people are starting to think the Fed is close to taking a pause on its rate-hike cycle. Recently, both the Federal Open Market Committee (FOMC) minutes and a speech by Fed Chair Powell were slightly “dovish” in tone, and with the yield curve about to invert, there is a growing expectation (but not consensus) that the Fed may pause for a bit after the September hike.

Bullish If: The Fed hikes in September but then pauses in December. Until the long end of the yield curve starts to move higher, doubts about the longevity of U.S. economic growth will rise, and in this environment, a Fed pause on hikes will be welcomed by the market.

Bearish If: The Fed hikes in September and December and materially inverts the yield curve, as that will be a signal from the bond market that the Fed has gone past the “neutral” rate.

Next Key Event/Date: Sept. 26. That’s the next Fed meeting where the Fed will hike 25 basis points. The unknown at this meeting is whether the Fed will drop the word “accommodative” to describe policy. If they do, doubts about a December hike will grow.

Chart courtesy of Stockcharts.com

3) U.S. Dollar. The importance of the recent trend higher in the U.S. dollar cannot be understated. And, whether we break this recent uptrend remains a major unknown for markets.

Bullish If: The U.S. Dollar Index closes below 94.20. Whether it happens because the Fed signals a pause in the rate hike cycle or foreign economies finally pick up some speed, the reason isn’t too important. Either catalyst will be positive for stocks in the near term.

Bearish If: The Dollar Index makes new highs. That will signal still-lackluster foreign growth combined with emerging market concerns, and the stronger dollar will eat into corporate earnings, which puts this entire bull market at risk.

We need to break through that 94.20 level to signal the multi-month uptrend is over, and the threat of new highs has been diminished.

Chart courtesy of Stockcharts.com

4) Q3 Earnings Season. Jeff Saut, Chief Investment Strategist at Raymond James, has said in several of his recent media appearances that this rally is primarily earnings-driven. I agree. That means earnings growth needs to continue if we’re going to see material new highs in stocks.

Bullish If: The full-year S&P 500 EPS expectations for 2019 ($179/share) and 2020 ($196/share) are maintained through the Q3 reporting season.

Bearish If: Expectations of earnings growth begin to be dialed back for any reason at all (stronger dollar, lack of economic momentum, tariffs, pull-forward growth from tax cuts). Then this market will quickly develop a valuation problem. And, given concerns about the economy being closer to the end of this economic cycle than the beginning, that will likely cause investors to de-risk.

Next Key Event/Date: Oct. 8, as this week kicks off the Q3 reporting season.

5) Midterm Elections. In my opinion, the midterm elections are likely to result in a split Congress and a stalemated government, which isn’t a bad thing for markets, historically speaking. However, the political environment in this country is extremely divisive (to put it politely), and between now and Election Day, we should have a lot more clarity on whether President Trump will come under any serious legal peril from Special Counsel Mueller’s investigation.

Bullish If: Status quo continues. The market doesn’t have a political opinion and doesn’t care about the drama as long as that drama doesn’t interfere with market-friendly legislation. And, since there is no important market-friendly legislation pending in Congress right now, the status quo will remain favorable to a market rally.

Bearish If: President Trump is found criminally liable for actions taken during the campaign (or anything else). That doesn’t mean automatic impeachment and removal from office, but it would plunge the country into a deep political drama not seen since the early 1970s, and the market likely could not escape that pernicious political uncertainty.

Next Key Event/Date: Election Day, Nov. 6.

Finally, as we enter the last third of the year, the two underlying support pillars of this rally remain in place — i.e., strong economic data and robust corporate earnings. However, there are five legitimate threats to those support pillars, and how these catalysts resolve themselves will largely determine whether we are talking about the S&P 500 being above 3,000 come the holidays or a flat return on stocks for the year.

Do you want to learn how my subscribers are ready to profit from either a breakout, or a breakdown, in the markets as a result of these five catalysts? If so, then I invite you to come aboard and subscribe to my Successful Investing advisory service, right now!

**************************************************************

ETF Talk: Invest in Natural Resources with This Large Fund

Today, we begin a new series on exchange-traded funds (ETFs) with a focus on natural resources.

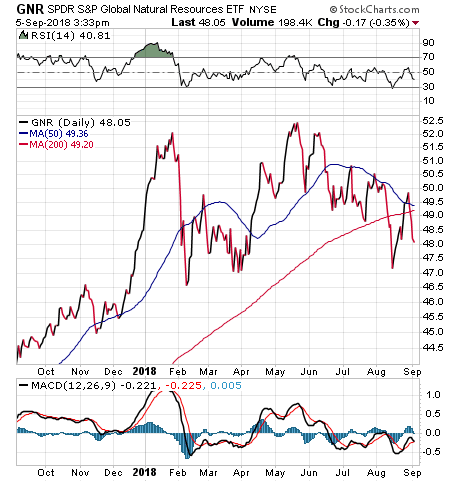

The first of those funds is the SPDR S&P Global Natural Resources ETF (GNR), which seeks to provide exposure to a number of the largest market cap securities in three natural resources sectors — agriculture, energy and metals and mining. GNR divides its $1.62 billion in total assets roughly equally in each of the three sectors.

We previously have covered ETFs that offer investors exposure to commodities through futures that feature potentially attractive returns. However, that approach has its disadvantages as well, including the lack of dividends, heighted volatility and large expense ratios.

From a technical perspective, GNR is one of the cheapest vehicles for exposure to global natural resources. The fund has an expense ratio of just 0.40% and has an average daily trading volume of $5.25 million, which is sufficient for most investors to get in and out of holding the fund as they wish.

Chart courtesy of Stockcharts.com

According to ETFChannel.com, for the week ending on Aug. 31, GNR experienced a $64.2 million inflow, a 4.2% increase week over week, indicating that more institutional investors have recently been adding GNR to their portfolios.

GNR’s one-year return was a market-beating 18.07%. Year to date, GNR has returned 4.35%. In addition, the fund boasts a dividend yield of 2.54%. The consensus 3-5 year earnings per share (EPS) growth estimate is 12%, which is an aggregated analysis result from firms such as FactSet and Reuters.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*******************************************************************

Real Men Check out of the Hanoi Hilton

What’s the definition of a “real man?”

Is it war heroics under unfathomably horrendous conditions? Is it the ability to carry yourself with grace, humility and optimism through magnificent professional victory as well as heartbreaking loss?

Is it the consistent fight in defense of your principles, even when those principles aren’t always the popular viewpoint among your own tribe? Or, is it the waging of a courageous battle against one of nature’s most malignant diseases?

Well, it’s all these things… and John McCain was all these things.

The Arizona Senator died last Saturday at age 81, and he died as he lived, as a real man who faced his fate — a fate we all shall one day meet — with the characteristic class, humor and fighting spirit he displayed throughout his 36 years in Congress, and throughout five-and-a-half years as a prisoner of war.

Senator John McCain shakes hands with the crowd at a presidential campaign rally in O’Fallon, Missouri — photo courtesy of Shutterstock.com

Yet for me, what made John McCain a “real man” was something we all get a chance to do in life, albeit in a far less grandiose fashion, and under far less agonizing circumstances.

What I think made John McCain a real man was his ability to mentally check out of the “Hanoi Hilton.”

Yes, that was the name American G.I.s had for the infamous North Vietnamese prison, a place where torture, humiliation, cruelty and the darker angels of mankind’s nature flourished. And, despite John McCain’s literally torturous experience, the man refused to let his mind and his life be crushed by that evil.

Although John McCain’s body was permanently broken from the blows of his jailers, his mind and his spirit remained intact. And though he undoubtedly had to work through the psychological nightmare inflicted upon him, chief of which was the coerced “confession” extracted by his captors, he managed to do just that.

Indeed, John McCain’s ability to check out of the Hanoi Hilton led him to a productive life of public service, not only for his home-state constituents, but for the entire nation.

I think the true lesson of John McCain is the lesson of how a real man (or real woman) responds to the worst adversity in their lives.

We can either submit to the fact that we are trapped by our captors, or we can work to free our spirits from the bondage of those darker angels and lead a life of heroism, love, honor and productive achievement.

The choice is ours to make… if we have the valor to check out of our own Hanoi Hiltons.

*********************************************************************

Speaking with ‘The Dollar Vigilante’

Have you ever wanted to pick the brain of an “anarcho-capitalist?” I did, and I must say I found the experience extremely interesting.

I am referring here to the latest episode of the Way of the Renaissance Man podcast, an interview with “The Dollar Vigilante” himself, Jeff Berwick.

Jeff is an extremely passionate man who takes life seriously and who also has a lot of fun doing so. Now, if that seems like a contradiction, it’s not. You see, to really enjoy life, we need that productive passion to pulse through our very DNA.

Understanding this concept, and integrating it into one’s life, is something that Jeff does with his various ventures, including his “Anarchapulco” conference, an event he bills as the world’s premiere conference for “Voluntaryist” thinkers and activists.

I really think you’ll enjoy my discussion with Jeff, as we dig into topics such as Bitcoin, the future of cryptocurrencies, what drives a well-lived life and what one can do to integrate and celebrate your passions with others.

To listen to the podcast, click here.

*********************************************************************

Clearing the Way for Better

“I tell you that as long as I can conceive something better than myself I cannot be easy unless I am striving to bring it into existence or clearing the way for it.”

— George Bernard Shaw

One of the most influential dramatists ever, the Nobel Prize winner wrote with incredible passion and intelligence. Shaw also was politically and culturally active, and though I vehemently disagree with his views on many subjects, there’s no denying he lived the principles woven into this week’s quote. If we really want to create a better world, we should always be striving to bring that world into existence.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.