The Financial Chemo Hasn’t Started Yet

Sometimes, remembrance of things past can serve as an excellent tool to help illuminate a current situation. This is true not only for our personal lives, but also for the life of those organisms we call the financial markets and the economy.

Today, I wanted to present you an excerpt from the April 12 edition of my daily market briefing, Eagle Eye Opener. In it, my partner and “secret market insider” in this venture shared a heartfelt anecdote about a very difficult time for him personally, and he uses it to provide what I think is one of the most powerful analogies about what the market and the economy face going forward.

So, without further preamble, here are the powerful thoughts from the Eagle Eye Opener…

One of the biggest lessons I’ve learned from studying markets for over two decades is that experiences in real life, both positive and negative, can provide valuable insights into the assessment of risks and opportunities in the economy and the market.

I was reminded of that again this weekend, as I was trying to explain to some friends why I was nervous about the U.S. economy and the markets — not right now or in the next few weeks, but instead in the coming months and quarters. I was trying to explain that, while everyone knows the Fed is hiking rates and dialing back accommodation, we haven’t even started to feel the pain from these actions — and we shouldn’t be lulled into a sense of security.

To help better explain this situation, I revisited a difficult period for my family from years ago, when my mother was diagnosed with cancer. Surprisingly, I found that experience provided a clear analogy as to why I am nervous about the economy in the months ahead.

Now, before I begin that analogy, let me be crystal clear: I am in no way equating the tragedy of cancer with economic matters. People are more important than money, and I know firsthand the carnage and tragedy that cancer can unleash on a family. That said, I think the analogy of my experience some years ago and my current concern for the economy are apt, and the analogy helped my friends understand my concern, and I hope you do as well.

In the mid-2000s, my mother was diagnosed with breast cancer. The diagnosis was a shock, as she was healthy and vibrant. As far as we could see, nothing was wrong. But clearly there was something wrong.

Notably, when the cancer was diagnosed, that’s when we all emotionally braced for what was to come. It was like we expected everything to turn bad right then. But at first, it wasn’t so bad. My mother didn’t feel bad. She had to go to numerous follow-ups that impacted her schedule and obviously there was anxiety about the future, but life generally carried on as normal while her doctors formulated a treatment plan.

As we all went through that process, with my mother still feeling fine, we were anxious, but life was mostly normal — just talks about what was to come and dealing with the doctors, etc. And, at times, we remarked to ourselves that it wasn’t so bad, and we were making the best of it.

Then the chemo began.

Chemotherapy is a necessary evil in the fight against cancer, but what damage it can do! In many ways, my family walked into the chemo part of the treatment naïve. Yes, we had heard it would be bad, but my mother was a New Yorker, and she was tough!

It was awful for her and us, and while, in the end, the chemo did its job and my mother thankfully became cancer free, those months were brutal for all of us.

Turning to the economy, it’s become infected with a cancer of sorts, i.e., inflation. If left untreated, it will destroy savings, make the less fortunate even poorer, reduce corporate profits, increase unemployment and slow consumer spending. If left unchecked, inflation will end an economic expansion.

Like cancer, inflation largely goes unnoticed at the beginning. But it has now been diagnosed by the Federal Reserve and monetary officials, and the Fed has been formulating its treatment plan for the past several months. While the Fed has been formulating its treatment plan, there’s anxiety about what will be done: Rate hikes, quantitative tightening (QT), etc. However, life is continuing generally as normal, and it’s not that bad right now.

But the financial chemo hasn’t started.

Just like real chemo was a necessary evil to rid my mother of cancer, “financial chemo” (rate hikes and QT) is a necessary evil to rid the economy of inflation. But the economy hasn’t started treatments yet, and just like my family was taken aback by how hard those chemo treatments were first on my mother but also all of us, so too am I nervous the economy isn’t prepared for how hard this financial chemo might be for the U.S. consumer and the economy. The problem has been identified and the treatment plan formulated, but the real hard stuff hasn’t even started yet.

That’s why I’m nervous about the economy in the future. The market has not priced in the impact of all this Fed tightening and QT. Hopefully, my fears are overblown. But I worry that they are not, and while I still think we could see stocks rally short term if we get some good news on inflation (peaking), earnings (solid) or geopolitics (Russia/Ukraine cease fire), we must be cautious here, because the financial chemo to rid the economy of inflation hasn’t even started yet.

***

If you want to get access to this kind of unique market analysis every trading day, directly to your inbox at 8 a.m. Eastern, then I invite you to check out my Eagle Eye Opener right now. There’s no time like the present to gain more market insight.

***************************************************************

ETF Talk: Drilling for an Oil and Gas ETF

The energy market is facing what is popularly called a “Catch-22.”

While the worldwide desire to shift to cleaner sources of energy to preserve the standard of living that people have grown accustomed to has put pressure on energy stocks, the global supply-chain shortage caused by Russia’s war against Ukraine and new outbreaks of COVID-19 around the world have sent energy stocks still higher. As a result of this paradox, investors will likely remain interested in energy companies for the foreseeable future.

While many exchange-traded funds (ETFs) in the oil and gas sector focus on futures contracts or companies that provide the equipment and services that are needed for the oil and gas fields to operate, others focus on the exploration and production that is necessary to bring “black gold” out of the ground. One such ETF is the SPDR S&P Oil & Gas Exploration & Production ETF (NYSEARCA: XOP).

Specifically, XOP tracks an equally weighted index, namely the S&P Total Market Index, in the U.S. oil and gas production space and includes companies that engage in the exploration, refining and marketing parts of the oil and gas production process. While the fund’s weighting strategy avoids overexposure to the big-name stocks in the field, the flip side of this decision is that the fund favors mid-cap and small-cap stocks.

Currently, the fund’s top holdings include EQT Corporation (NYSE: EQT), Southwestern Energy (NYSE: SWN), Antero Resources Corp. (NYSE: AR), Hess Corporation (NYSE: HES), Range Resources Corp. (NYSE: RRC), CNX Resources (NYSE: CNX), Centennial Resource Development Inc. (NASDAQ: CDEV) and Coterra Energy Inc. (NYSE: CTRA).

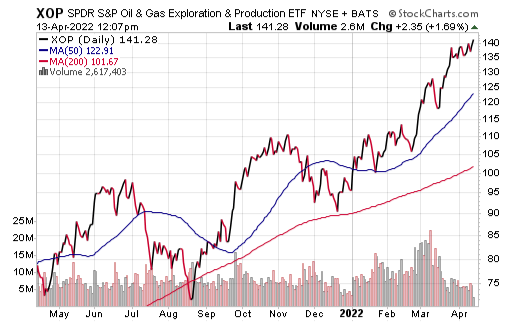

As of April 13, XOP has been up 10.39% over the past month and up 27.01% for the past three months. It is currently up 45.46% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $5.64 billion in assets under management and has an expense ratio of 0.35%.

While XOP does provide an investor with a way to profit from oil and gas companies, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

How To Park Your Car Like a Renaissance Man

Note: This article is written by my friend, colleague and bona fide “Renaissance Human” Heather Wagenhals. Here, the author tells us how a relatively simple task such as parking a car can be used to help focus your actions on success in any life pursuit.

How a Renaissance Man does anything is how a Renaissance Man does everything. This includes how one parks his car. For a Renaissance Man, even this seemingly mundane task reflects his approach to life.

A Renaissance Man considers every action, especially those repetitive actions that become habits and eventual behaviors. He decides for himself if they add or subtract value. I have observed through my own behavior that how one parks a vehicle tends to reflect how he manages his life. Let me explain.

For some, parking styles evoke strong feelings. Family friend, racing legend and arguably the greatest NASCAR engine builder of all-time, the late Robert Yates, had very strong opinions on how one parks.

Robert viewed any employee of his who parked backward as someone, “too itching to get out of work.” So, any employee he observed parking backward at his shop he would summarily fire and help them out the door.

A Renaissance Man’s view is different. He parks “tail-in,” and for specific reasons.

First, backing into a parking space is safer, and the chief reason why is because when you leave that space, you’re already entering the flow of traffic going forward. If you consider this approach as a wider metaphor for life, that means you’re always “going forward” — and that is a key principle in cultivating a successful life.

Let’s explore the opposite view here to illustrate the importance of forward motion to one’s approach to life. If you are going into the flow of traffic backward, you will necessarily creep into it, and usually with some heightened level of trepidation. And when you back up out of a parking space and into traffic, you also have less time available to execute any maneuvers before that traffic arrives. Invariably, you have blind spots. You will constantly be looking from side to side, relying on secondhand information from mirrors or passengers telling you what they see and what obstacles are in your path.

This is the approach I consider “backing into your life.” And, with this approach, your chances of being blindsided are far greater than if you were looking forward. Moreover, your judgment is necessarily impaired by limited information.

In contrast, when entering the flow of traffic moving forward, a Renaissance Man has the full view of his surroundings right in front of him. And though the terrain further down the road may still be unknown, going forward allows you to clearly watch the territory unfold as you proceed down your chosen path.

What’s behind you doesn’t matter and almost becomes irrelevant, because you’ve already dealt with it when you originally backed into your parking spot.

In life, this approach means you’re tackling your “issues,” i.e., your past, and you’ve proactively chosen to make it a known quantity. And, even if dealing with this past is really hard, your decision to confront life’s dragons on your terms gives you the upper hand.

The author always parks her McLaren 570S Spider “tail in.”

By choosing to embrace the initial awkward or uncomfortable tasks to get a better view of the future, a Renaissance Man increases his ability to observe reality and to cleanly apply his full powers of critical thinking and reasoning to determine the best course of action.

Finally, by choosing the opposite and parking head-in, which also forces you to back into the flow of traffic, you put yourself at a disadvantage physiologically. Your primitive brain is going to feel vulnerable with your back exposed while entering into “danger.” Yet when you enter into danger from a tail-in position, you know that you’ve already “covered your back,” and that you are in a much better position to confront reality with eyes forward and with a greater degree of confidence — regardless of how scary the unknown may be.

When you park like a Renaissance Man, you are prepared to handle anything because you’re able to see reality with eyes wide open. And let’s face it, your decisions are only as good as the quality of information you have to make those decisions.

So, the next time you pull into a parking lot, remember that seemingly little decisions in life — i.e., how you park your car — really do have a wider context. Because how a Renaissance Man does anything is how a Renaissance Man does everything.

Heather Wagenhals is a best-selling author, FOX News Contributor, Founder and Host of the Web TV Series “Unlock Your Wealth Today” and has been featured in numerous publications, radio and television. Heather notes with pride for the last 30 years, she has parked “tail-in.”

*****************************************************************

The Sweetness of Sad

“Our sweetest songs are those that tell of saddest thought.”

— Percy Bysshe Shelley

It is my opinion that one should never discount the power of sadness. Without sadness, our happiest moments wouldn’t mean much. Besides, as humans there’s no way to escape sadness. It’s part of the game. Knowing this is important, because as you live, don’t hide from the pain, discomfort and sadness that takes up so much of it. Rather,

“embrace the suck,” as the expression goes, and allow yourself the sweetness of sad.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.