A Runner’s High is Freedom’s Low

Freedom is serious business, and whenever I see this cherished value threatened, I feel compelled to run to its rescue. And “run” here is the appropriate word because the issue at hand is that one runner’s “high” is what I consider an example of freedom’s low.

Last week, American sprinter and perhaps the fastest woman on the planet, Sha’Carri Richardson, was suspended and effectively banned from competing in the Tokyo Olympics. The reason why was she tested positive for marijuana at the Olympic trials. More specifically, and the specifics matter here, Richardson tested positive for an inactive THC metabolite during U.S. Olympic Team Trials on June 19.

Translation for those who aren’t familiar with the science: that means Richardson wasn’t “high” while she competed. It means that her blood had traces of the psychoactive ingredient, tetrahydrocannabinol, or THC, which can remain in the bloodstream for days and even weeks after use.

Still, Richardson didn’t deny her drug use. In fact, she admitted it and then apologized for what she knew was a violation of the rules. In a tweet following the positive drug test, Richardson wrote that she was sorry she couldn’t be our Olympic champ this year, but she promised to be our world champ next year. Hey, I love this woman’s confidence.

Of course, there are those who crassly criticize Richardson for violating the rules, saying that she is guilty of “smoking her opportunity away in violation of the eligibility rules.”

Yet to me, this isn’t an example of someone defying the rules. Rather, it is an example of bogus, unfair and silly restrictions on personal freedom being imposed on individuals by inconsistent, irrational laws and overzealous governing bodies.

Consider that in Oregon, where Richardson smoked marijuana, recreational marijuana use has been legal since 2014. Moreover, there are now 18 states, plus Washington, D.C., that allow both recreational and medical marijuana use. Oh, and just in case you were wondering, those states are Alaska, Arizona, California, Colorado, Connecticut, Illinois, Maine, Massachusetts, Michigan, Montana, New Jersey, New Mexico, Nevada, Oregon, Vermont, Virginia and Washington.

So, if you are fortunate enough to live in one of these states, at least you have slightly more freedom than you otherwise would have if you lived elsewhere.

Yet apparently, that freedom doesn’t apply to Sha’Carri Richardson.

You see, her life and her freedom are further subject to additional rules set under the 2021 World Anti-Doping Code, rules enforced by the U.S. Anti-Doping Agency (USADA), which is the official testing organization for the Olympics. Under these rules, THC is considered a “substance of abuse,” and according to the organization, it is because THC is “frequently abused in society outside of the context of sport.”

Yet as Jacob Sullum writes at Reason.com:

“Counterintuitively, Richardson’s infraction had nothing to do with ‘doping,’ as it is usually understood, since the USADA concedes that her marijuana use was ‘unrelated to sport performance.’ Nor does her positive test result indicate that she was under the influence of marijuana during competition, since the THC metabolite cited by the USADA can be detected in a cannabis consumer’s urine for days or weeks after the last dose.”

So, let’s get the facts correct here.

Richardson engaged in a legal act of marijuana consumption per the laws of the state of Oregon. Moreover, her drug use was unrelated to her winning performance at the Olympic Trials, as marijuana is not considered a “performance enhancing drug” per USADA regulations.

Now I ask you, does her suspension from competing in her sport seem at all to be fair, just or rational to you?

Yet still, even though these arbitrary and irrational rules exist, Richardson did know she was violating the rules when she decided to smoke marijuana. So, why would she do this? Well, according to her, she used the drug after learning about her biological mother’s death.

So, a 21-year-old coping with the sadness of her mother’s death by using a legal substance is the reason for her being banned from doing what she is arguably the best in the world at doing.

Does that seem right to you? It doesn’t to me. In fact, it seems preposterous.

I submit that you have to be insensitive, callous and/or lack any sense of compassion if you are ready to vilify Richardson for this. Oh, and keep in mind that if she had chosen to cope with her mother’s death by drinking alcohol, her choice would have had zero impact on her athletic career.

This whole episode is a microcosm of what’s wrong with our drug laws, and with the arbitrariness of irrational rules imposed on our freedoms by governments and by organizations that appear to delight in levying control.

The way I see it, if you care about your liberty, you should support Sha’Carri Richardson. I know I will be rooting for her future success, and the future of freedom.

P.S. If you want to revel in a real celebration of freedom this summer, then join me, Dr. Mark Skousen, Ayaan Hirsi Ali, John Mackey, Dr. Drew Pinsky, Jo Jorgenson, Larry Elder, Heather Wagenhals, Rich Checkan and a host of other luminaries in just two weeks, live, right under the nose of Mt. Rushmore? That’s right, it’s time for the best week of the year, FreedomFest 2021. This year’s theme is “Healthy, Wealthy & Wise.” The conference takes place July 21-24, in Rapid City, South Dakota. So, if you are looking for a place to celebrate freedom and to immerse yourself in pro-human, pro-reason and pro-wealth ideas, then FreedomFest is for you! To see the full schedule, go here!

***************************************************************

ETF Talk: Real Potential Protection with ETF RLY

COVID-19 has swept the country, with rising interest rates and inflation now sweeping the market.

In an economy mired in uncertainty, many investors are wary of squandering their investable funds, and risky investments may seem more frightening than thrilling. However, the following exchange-traded fund (ETF) may be able to afford investors some peace of mind.

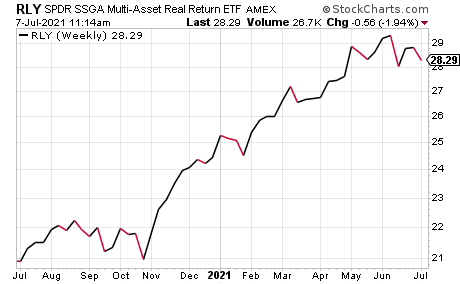

That fund is the SPDR SSGA Multi-Asset Real Return ETF (NYSE:RLY), a unique fund that takes a multifaceted approach to combating inflation. RLY combines exposure to inflation-linked bonds with real estate, commodities, Treasury Inflation-Protected Securities (TIPS) and natural resource companies.

Through a fund-of-funds (FOF) structure, RLY aims to achieve real return consisting of capital appreciation and current income. Through its unique structure, the fund manager considers real return to be a rate of return above the rate of inflation. As it is structured as a fund of funds (FOF), the ETF invests in multiple mutual funds, rather than only single stocks, which can be beneficial as it helps to spread out investment risk even more than owning one mutual fund.

RLY has an expense ratio of 0.50% and a 1.93% dividend yield. The fund has $131.08 million in assets under management and an average daily volume of $1.28 million. Though the fund fell to a low in November 2020, it has progressed steadily higher and is now at the high end of its 52-week range.

RLY’s top five holdings include Invesco Optm Yd Dvrs Cdty Stra No K1 ETF (PDBC), 25.16%; SPDR S&P Global Natural Resources ETF (GNR), 24.61%; SPDR S&P Global Infrastructure ETF (GII), 21.75%; SPDR Blmbg Barclays 1-10 Year TIPS ETF (TIPX), 8.51% and SPDR Dow Jones REIT ETF (RWR), 4.02%.

The fund’s underlying portfolio is evenly balanced, and exposure is split fairly equally among each of the aforementioned asset classes. Though it is not an ETF that is expected to deliver sky-high gains, SPDR SSGA Multi-Asset Real Return ETF (NYSE:RLY) may be a good tool for investors who are worried about preserving their capital, as inflationary pressures are mounting. Still, investors whose interest is piqued should conduct their due diligence and decide whether or not the fund is an appropriate choice for their investment needs.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Insider’s View on Infrastructure

Infrastructure. It is the big legislative issue in Washington, D.C., and it’s a potentially big issue for the economy and the equity markets, depending on how the situation plays out.

As of this writing, there are multiple confusing issues coupled with a lack of clarity on just what might happen, and what it will actually mean for financial markets going forward — and what that means for us, as investors.

So, how do we make sense of all of this? Well, fortunately, I have a Wall Street insider tapped into the machinations in Washington on this issue. And he also happens to be an expert on interpreting this situation from the market’s perspective. Best of all, I get my insider’s views on this, and just about every major market issue, every trading day well before the market opens.

In a moment, I will tell you how you can get this same inside market intelligence along with me, and in a five-minute read each morning, but first, let me share with you what my insider has to say about the state of the infrastructure bill…

***

The market has experienced infrastructure headline whiplash over the last few trading days, so I want to take a few minutes to update 1) What has happened, 2) If an infrastructure bill is likely and 3) What it all means for markets.

First, as a bit of background, the market “cares” about infrastructure because the federal government spending money to build roads and bridges amounts to economic stimulus. More stimulus means a likely stronger economic recovery, and that is positive for cyclical stocks and value, which is why they rallied last week on the infrastructure news — and why they dropped on Monday amidst more infrastructure confusion.

However, I want to be clear that while infrastructure is essentially more stimulus, it doesn’t compare, at all, to the COVID-19 stimulus bills. The current infrastructure bill is around $1 trillion in total, but only about $600 billion in new spending, spread over five to eight years.

The key point is that the infrastructure bill isn’t going to produce anything close to the economic benefit we’ve seen with the COVID-19 stimulus bills, so we shouldn’t expect it to materially boost the recovery, although clearly it will add more fuel to the economic fire. The bottom line is if the current infrastructure proposal actually passes, it’ll be an incremental positive for the economy, but not anything close to a bullish gamechanger.

So, what is the current state of the negotiations? In a word, muddled.

Late last week, President Biden walked back the “we have a deal” sentiment when he said he would not sign the bipartisan infrastructure bill unless it was accompanied by a “human infrastructure” bill that addresses social issues but also will likely increase corporate taxes (and maybe capital gains taxes). Biden hedged that condition over the weekend, but at this point it is unclear if Republicans will support the bipartisan bill unless there are guarantees it can pass on its own. If not, it is unclear if Democrats will pass the bipartisan bill and the human infrastructure bill on their own.

Here’s why that matters. From a market standpoint, the best outcome is for the bipartisan infrastructure bill to pass on its own, and not have the human infrastructure plan pass. I say that because the net economic impact would be more stimulus (increase infrastructure spending) but no tax increases.

The second-best outcome for markets would be for nothing to happen at all. No bipartisan infrastructure bill and no human infrastructure bill. I say that because while the economy would not get additional stimulus, companies and consumers would not get a tax increase either.

Finally, the worst outcome, again from a market standpoint, is that both the bipartisan bill and the human infrastructure bill pass. I say that because while the bipartisan bill would provide some economic boost, it would not be material and it would be spread over the next several years. Conversely, the increase in corporate taxes designed to fund the human infrastructure bill would immediately reduce expected 2022 earnings (and perhaps expected 2021 earnings, if the bill was retroactive). And that would be a new, unanticipated headwind on stocks.

To be clear, I don’t think this outcome, by itself, would cause a correction. But if it was later complemented by a more-hawkish-than-expected Fed and an uptick in the COVID-19 Delta variant, then we would have the recipe for a correction in the coming months.

***

The analysis here is outstanding, and it is what you can expect each day from my market insider.

If you already subscribe to one or more of my newsletter advisory services, you know that I put a lot of research into each issue, and that I back up our investment decisions with that in-depth research. Well, a lot of my knowledge is bolstered by my market insider, as he is not only a friend, but he is also one of the smartest and wisest Wall Street analysts I know.

Most importantly, he has earned my trust over the years with his spot-on analysis and wise counsel.

And now, I am proud to share that expert analysis and wisdom directly with you via my new publication, the Eagle Eye Opener.

This publication comes out every trading day at 8 a.m. Eastern Time, and the best part about it is it only takes about five minutes each morning to read. That’s right, in just five minutes in the morning (maybe 10 minutes if you are like me and prefer to read slowly and methodically), you can gain an edge on the markets using the same institutional-level intelligence the pros on Wall Street use to make their big-money decisions.

Perhaps most importantly, the Eagle Eye Opener will help you avoid getting blindsided by market developments not covered deeply in the mainstream financial media.

Think of this publication as a kind of intel playbook. So, if you read it every day, you’re going to know what’s driving the market. You’ll know which way the markets are likely to go… and what to do when that happens.

You’ll also know what to do if it does the opposite.

That means you’ll know what to do ahead of time, whichever way the market swings… and you’ll know why and where the profit zones are.

Now, I am not claiming that this information is some kind of crystal ball, as there is no such device. However, it is the best tool I’ve found, and it’s the same information that Wall Street elites have at their fingertips each day — and now you can have it, too.

Once again, when you subscribe to Eagle Eye Opener, every trading day at 8:00 a.m., I’ll send you proprietary intel that was once for institutional investor eyes only. The intel covers breaking opportunities in:

- Stocks

- Exchange-traded Funds (ETFs)

- Bonds

- Currencies

- Commodities

You’ll also get the latest economic data impacting investors in the market, as well as special features and analysis, such as the infrastructure insights you just read, that take a deeper dive into certain market sectors or developments — and you can get all of this information for under $1 per day!

For me, the content in the Eagle Eye Opener gives me the confidence of being forearmed with this information before the opening bell… all in just about five minutes of your time.

For more about the Eagle Eye Opener, and how it can do for you what it does for me and thousands of other Wall Street pros each morning, I invite you to check it out right now.

As you know, knowledge is power. And with the Eagle Eye Opener, that power translates directly into profits.

*****************************************************************

On Freedom and Rebellion

“The only way to deal with an unfree world is to become so absolutely free that your very existence is an act of rebellion.”

–Albert Camus

The philosopher, author and journalist Albert Camus is known for his “absurdist” views, which he said arose from the fundamental disharmony between the individual’s search for meaning and the meaninglessness of the universe. Yet in my view, an individual’s search for meaning is their personal search about what their life means to them, and not some cosmic meaning “out there” in the universe. Yet, as I think Camus rightly remarks here, if we can be absolutely free in an unfree world, we can celebrate that freedom as an act of rebellion. And so, let the rebellion begin!

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.