Buying the Wuhan Virus

- Buying the Wuhan Virus

- ETF Talk: Invest in Disruptive Stocks with this Fund

- Reminiscences of Intellectual Activism with a Fellow Idea Warrior

- A Shadow Crossed My Heart

- Hold the Restless Dreams of Youth

***********************************************************

Buying the Wuhan Virus

On Tuesday, we saw modest declines in the stock market that were driven by fears of an economic fallout from the rapidly spreading Wuhan coronavirus. As of this writing, there have been 17 confirmed deaths and some 540 cases of infection, and that number is bound to soar in the days and weeks to come.

Undoubtedly, the sensationalism in the media over the possible threat of a global pandemic will spike, because there is no more eyeball-grabbing headline than the threat of Armageddon. So, considering the situation remains in the nascent stages, I wanted to assuage any fears you might have about this situation. And because this publication is committed to peeling off the top layers of the onion skin on any issue, I’m also going to provide you with some ways that you, as an investor, can make money buying the Wuhan virus.

To do that, I enlisted the expert help of my friend, macro analyst extraordinaire, and contributor to my Intelligence Report and Successful Investing newsletters, Tom Essaye, founder and editor of the highly recommended Sevens Report.

The following is a conversation I had with Tom last night regarding the Wuhan virus and its market implications.

Jim Woods (JW): Based on my reading, the Wuhan coronavirus is a strain of the more common coronavirus that gives us mild upper respiratory infections. That sounds very similar to the SARS virus that became a big threat in 2003, and the MERS virus that caused a scare in 2012.

Tom Essaye (TE): It sounds like a case of viral déjà vu to me. The only reason it’s called the Wuhan coronavirus is because it originated in Wuhan, China, and all the cases in other countries have been traced back to people who visited Wuhan recently. Scientists think the virus was alive in an animal (probably a fish) and made the jump to people there.

JW: That’s scary, but that’s also nature.

TE: Yes, it is. It also scared markets, because the spread of the virus and the implication that it might be transmitted through human contact is what hit stocks on Tuesday. That fear is compounded by the fact that the Chinese New Year is on Saturday, and travel within China around the New Year is similar to the week of Thanksgiving here in the United States, so there is the possibility this virus could spread rapidly.

JW: From an economic standpoint, fears of an epidemic are definitely not good. I think that’s likely the reason stocks were down on this news.

TE: The concern here is that people in China might sit out the New Year for fear of getting sick, which will hurt the Chinese economy and make a global economic rebound (which is priced into stocks) less likely.

JW: Well, if the virus does spread globally, that would make the negative economic impact much larger and, as you mentioned, given that a global economic rebound is priced into stocks, that would obviously be a headwind for markets.

TE: I agree. Yet you know me, I’m always looking for a silver lining in any situation, and a way for investors to seize the opportunity.

JW: Yes, I know, and that’s why I love you.

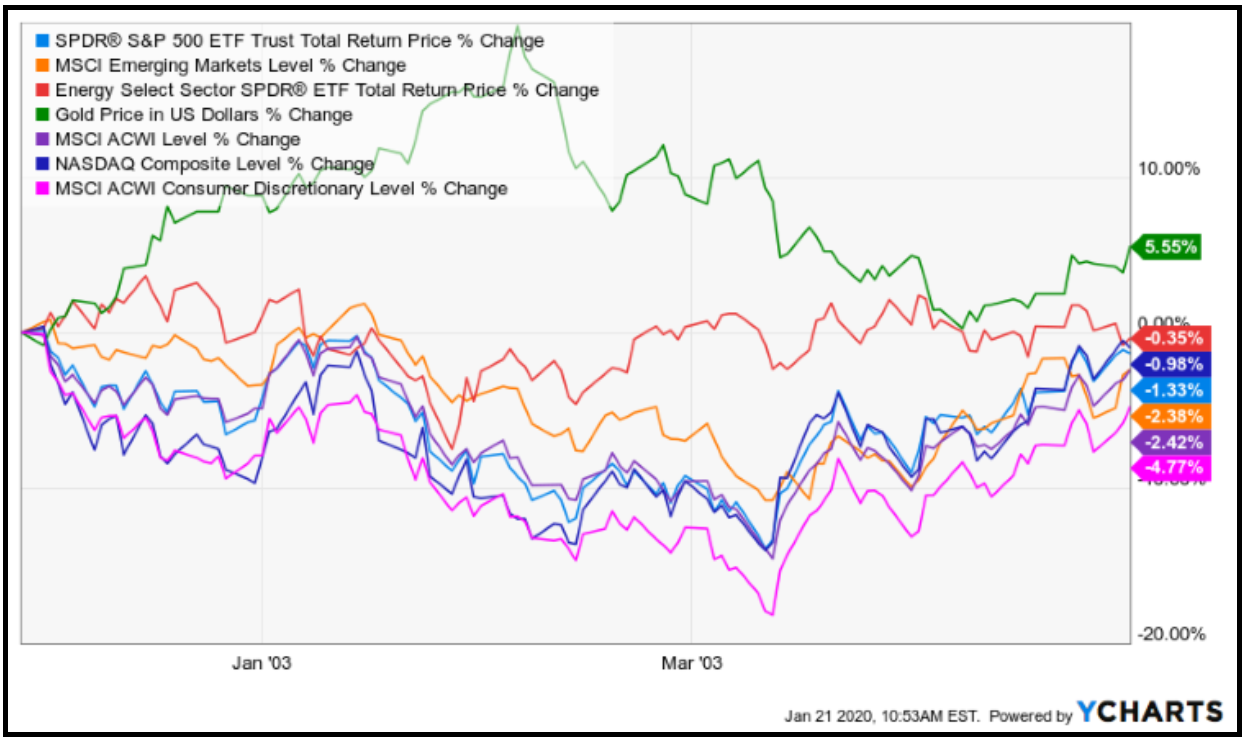

TE: (Laughs). In all seriousness, since this disease is closely related to SARS, I think the market reaction to the SARS outbreak gives us a good template to follow. That’s why I went back and looked at market returns during the SARS scare, which I dated roughly from December 2002 through April 2003. I then looked at cross asset returns to see what fared the best.

JW: I remember that period well. I was freelancing as a writer/book editor then, and I was happy that I didn’t have to do any overseas travel. I was also happy that I was trading gold during that time, as it was one of the few asset classes that held up to the scare.

TE: That’s exactly right. In fact, gold gained nearly 6% over that time frame and rallied nearly 20% at the highs on a general risk-off move in markets. Moreover, during that five-month period anything related to discretionary spending or the emerging markets/China underperformed, which is exactly what we’d expect. Global consumer discretionary stocks fell nearly 5%, while emerging markets and global stocks fell 2.5%. The S&P 500 and Nasdaq both saw smaller declines, but it’s important to note that the lows over that period were substantially worse than the final result, as all of those indices (S&P 500, Nasdaq, ACWI, Emerging Markets, Global Consumer Discretionary) each fell more than 10%. So, there was volatility over that time period.

JW: So, besides gold, where do you see the opportunities for investors if the Wuhan virus does turn out to be a SARS-like event?

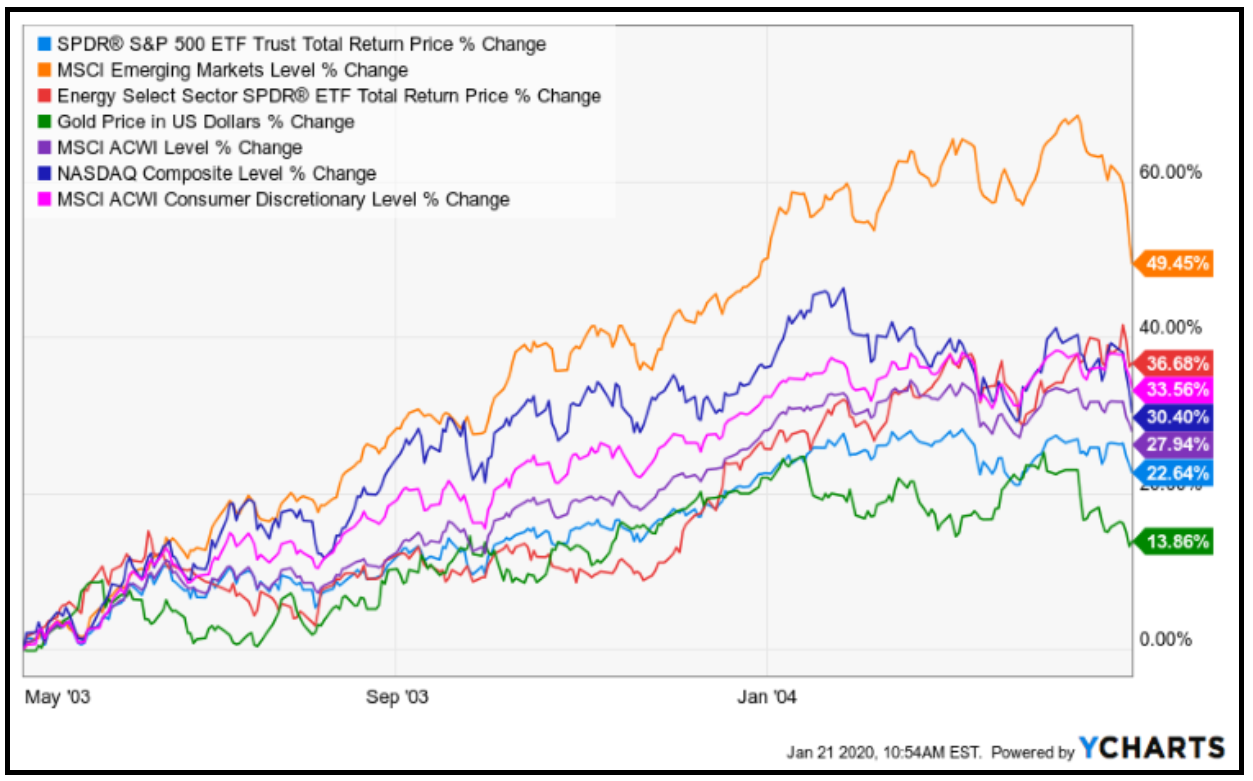

TE: I’m glad you asked that, because I also took a look at the same basket of indices and sector performance over the ensuing 12 months (May 2003 through May 2004), and emerging markets were the clear winner. While all the major indices rebounded, the MSCI Emerging Markets index returned more than 49% over the next year and traded as high as 60% over the following year.

JW: That’s very interesting, particularly because the current risk/reward in emerging markets is very positive. I’ve already mentioned this to my readers, but I currently see a bullish confluence of factors when considering emerging markets, e.g. low valuations, Chinese fiscal stimulus, the phase one trade deal between the U.S. and China and the resulting expectation of a global growth rebound. Together, I think these factors support the bullish case for emerging market equities such as those in the iShares MSCI Emerging Markets ETF (EEM).

TE: I agree. And notably, EEM fell 2.5% on Tuesday due to Wuhan virus fears. To me, that pullback is likely to represent a very good opportunity for investors to begin to “leg into” an emerging market position over the next few days/weeks on any extended EEM weakness. And though Wuhan does look scary, looking through my lens it just looks a lot like SARS. And as I just told you, emerging markets were the contrarian play out of the SARS scare back in 2003/2004, and that could definitely be the case again.

JW: Thanks, Tom. Whenever I need a smart opinion, it’s comforting to know that I can chat you up.

TE: Anytime, Jim. Now stop thinking about markets and go feed your horses.

**************************************************************

ETF Talk: Invest in Disruptive Stocks with this Fund

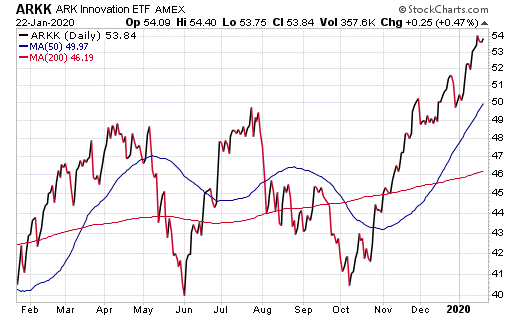

The Ark Innovation ETF (NYSE Arca: ARKK) is an actively managed exchange-traded fund (ETF) that targets companies poised to benefit from disruptive innovation in one of three areas: industrial innovations, genomics or Web x.0.

ARKK, named ETF.com’s 2017 ETF of Year, launched in 2014 and currently has $1.86 billion in assets. In fact, the ETF is up 32 percent in the past 12 months.

The fund follows an active, all-of-the-above approach. Investing over 99 percent of its assets in stocks (more than 75 percent of which are based in the United States), ARKK is full of cutting-edge firms, such as Tesla (NASDAQ:TSLA), Twitter (NYSE:TWTR) and Alibaba (NYSE:BABA). That said, ARKK’s mandate is so broad that it includes almost any company that might benefit from new technologies, such as Disney (NYSE:DIS) and Charles Schwab (NYSE:SCHW).

The ETF’s top 10 holdings include Tesla Inc. (NASDAQ: TSLA), 9.39%; Square Inc. A (NYSE: SQ), 7.20%; Illumina Inc. (NASDAQ: ILMN), 6.79%; CRISPR Therapeutics AG (NASDAQ: CRSP), 6.12%; Invitae Corp. (NYSE: NVTA), 5.72%; Stratasys Ltd. (NASDAQ: SSYS), 5.29%; Intellia Therapeutics Inc. (NASDAQ: NTLA), 4.61%; 2U Inc. (NASDAQ: TWOU), 4.11%; Editas Medicine Inc. (NASDAQ: EDIT), 3.92%; and NanoString Technologies Inc. (NASDAQ: NSTG), 3.23%.

Chart courtesy of StockCharts.com

ARKK’s top holding, Tesla Motors, is poised to potentially become a $4,000 stock, according to the “bull” case presented by Catherine Wood, ARK Invest’s investment firm’s chief executive officer and chief investment officer, in an interview on CNBC. Tesla’s stock price is currently about $589.

“This is a five-year time horizon,” Wood said on CNBC’s “ETF Edge” last March 4. “Four-thousand dollars is the bull case, $700 is the bear case. It’s rare for us to a have a stock that meets our minimum hurdle rate of return in the bear case, so it’s north of 15 percent compound annual rate of return to get to our bear case target.”

The Ark Innovation ETF (ARKK) previously has been a recommendation in my Successful Investing growth portfolio, which you can subscribe to by clicking here. As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Reminiscences of Intellectual Activism with a Fellow Idea Warrior

When two friends who’ve known each other for more than three decades get together to reminisce about their mutual passion for ideas, literature, career and living the Renaissance Man ethos, you know you’re in for an auditory treat.

And that’s exactly what you get in this episode of the Way of the Renaissance Man podcast, as I speak with my good friend, writer, filmmaker and intellectual activist Stewart Margolis.

During this discussion, you’ll learn how Stewart and I began our adventures in idea advocacy while students at UCLA, and how we’ve continued to promote those ideas throughout the decades.

You’ll also learn about Stewart’s years living the life of a financier in Bermuda; his various film and screenwriting projects, and his work with the Ayn Rand Institute.

If you’ve ever wanted to eavesdrop on two friends ruminating on their mutual love of reason, passion and staying in the moment, then this episode was made for you.

******************************************************************

In case you missed it…

A Shadow Crossed My Heart

Suddenly, you were gone

From all the lives you left your mark upon…

— RUSH, “Afterimage”

On Friday afternoon, I learned of the death of one of my real-life heroes. And after the initial wave of incredulity subsided, I felt a shadow cross my heart.

Perhaps not surprisingly, those precise words, “I felt a shadow cross my heart,” are lyrics from the song “Nobody’s Hero” by my favorite rock band, RUSH. Those lyrics also happened to be written by that real-life fallen hero, the band’s virtuoso drummer and lyricist Neil Peart.

Peart is a rock and roll legend. He’s inarguably one of the greatest drummers in music history, and at age 31, he was the youngest drummer ever to be inducted into the Modern Drummer Hall of Fame. Decades later, he and his RUSH bandmates, bassist-vocalist Geddy Lee and guitarist Alex Lifeson, would be inducted into the Rock and Roll Hall of Fame.

Yet, “The Professor,” as he was referred to by the legions of RUSH fans around the world, was more than just a genius behind the drum kit. And, he was much more than just someone with a penchant for turning a lyrical phrase.

Peart was a man who helped shape my mind, and my existence, with the profundity of his prose and the intensity of his thought.

His intellectual genius can only really be appreciated within the full context of the band’s 19 studio albums, 11 live albums and 33 music videos, not to mention the thousands of shows the band played over the course of its incredible 40-year career. Yet today, I will attempt to reveal a glimpse of the man’s mind with a sampling of a few of my favorite lyrics from his epic body of work.

After you read them, along with my thoughts on the lessons they convey, you’ll get a better sense of what was so profoundly influential for me about Peart’s work. I also suspect you’ll get a much deeper look at the man that I am, and the man I continually aspire to be.

Photo by Matt Becker

Hold your fire

Keep it burning bright

Hold the flame

’Til the dream ignites

A spirit with a vision

Is a dream with a mission

–“Mission”

The lesson here is that man requires a productive life purpose, and the key to achieving that purpose is carrying out your vision with passion and persistence.

From the point of ignition

To the final drive

The point of the journey

Is not to arrive

–“Prime Mover”

Life isn’t about the endpoint of attaining a goal. Life is much more about the doing, and the experience, of action in the moment.

The most endangered species: the honest man

Will still survive annihilation

Forming a world, state of integrity

Sensitive, open and strong

–“Natural Science”

The virtue of honesty is hard to adhere to, but one must always pledge fealty to truth. Doing so allows you to live in a state of integrated calm. Another way of saying this is that the moral is the practical.

You don’t get something for nothing

You can’t buy freedom for free

You won’t get wise with the sleep still in your eyes

No matter what your dream might be

–“Something For Nothing”

The only way to learn is by engaging with the world; however, doing so comes at a price. Let’s face it, it’s damn hard to really think things through. Yet as humans, we have no other choice but to think, and no amount of denial will make that fact go away.

Philosophers and Ploughmen

Each must know his part

To sow a new mentality

Closer to the Heart

–“Closer To The Heart”

We all have a responsibility to ourselves to be as happy as we can be, whatever our role is in this grand play we call life might be. Doing so not only helps us achieve happiness, it helps the world be a little bit better place for everyone.

He’s a writer and arranger

And a young boy bearing arms

He’s got a problem with his power

With weapons on patrol

He’s got to walk a fine line

And keep his self-control

–“New World Man”

There’s a constant struggle in each of us to maintain calmness of mind and spirit, and to keep our self-control in a world that’s so often seemingly out of control. Yet the truth is that all we can have control over is ourselves, and we must struggle to achieve that. It is this battle that rages within every human, and it’s one that first must be recognized and acknowledged in order to be won.

Now, I could go on for volumes here with an analysis of significant RUSH lyrics and their deep meaning, but I think you’ve already got a clear sense of how much Peart and his work mean to me. And, I can’t properly convey the influence Peart had on my life without mentioning his love of literature and philosophy, which he weaved brilliantly via direct references into his lyrics.

Perhaps the most-influential of these references for me was his dedication, “To the genius of Ayn Rand,” in the liner notes to the concept album “2112.” As a very young man listening to that 1976 album, I had no way of knowing the immense influence Rand would have on my own life. Yet a seed was planted there by Neil to investigate Rand’s unique mind further, and I did just that with intellectual gusto.

Finally, I will conclude this tribute with a reflection on my own personal interaction with Neil, and it came, of all places, behind the wheel of a sportscar.

It was October 2010, and I was at Willow Springs International Raceway in Southern California. The legendary track is home to many pro and amateur sports car and motorcycle races. It’s also a place where motorsports enthusiasts can bring their own cars and motorcycles to do some performance driving on a real track.

On that day, I was there testing my own sportscars. I was also there to help coach some of the “newbies” at the track to make sure they were safe and to help them gain more confidence behind the wheel at high speeds.

Much to my amazement, one of the attendees at Willow Springs that day was Neil Peart.

Now, as you might guess, for me, this was a surreal moment burned into my consciousness. I mean, it’s not often you meet a real-life hero of yours in the flesh. It’s also pretty rare to have that hero ask you about how fast, and in what gear, he should be taking the notoriously difficult Turn 9 at Willow Springs.

Neil Peart strolling through the pits at Willow Springs (Photo by Jim Woods)

Yet that is what Neil did. He asked me for advice on how to be a better driver.

I happily gave him that advice, and I also allowed him to follow me around the track so I could point out to him the proper turn-in points, “apexes” as we call them, so that he could improve his lap times.

After helping Neil Peart improve as a driver, I felt compelled to tell him how he helped me become a better human through his music and lyrics.

Peart was flattered by my confession, but I could also tell he felt characteristically uncomfortable with my fanboy, tearful praise of his work. I mean, I even had a RUSH patch on my driving suit!

Upon seeing the patch, Peart said to me, “Well, I hope it brings you luck.”

What Peart didn’t realize was that he had already brought me the greatest luck a man could ever have — the luck of discovering the beauty, passion and intensity of his brilliant achievements.

*********************************************************************

Hold the Restless Dreams of Youth

Any escape might help to smooth

The unattractive truth

But the suburbs hold no charms to soothe

The restless dreams of youth

–RUSH, “Subdivisions”

I could draw from Neil Peart’s prodigious body of work for years, but I promise I will be judicious in my use of “The Professor’s” wisdom. Yet because the wound of his passing remains raw in my heart, I thought I’d give you an excerpt from one more lyrical passage that helped shape my mind as a young man.

Upon hearing the band’s brilliant critique of social conformity in the song “Subdivisions,” I knew that I had to go out and explore what the world had to offer me. Perhaps that’s why I’ve tried my whole life to be a Renaissance Man, and to do many different things as well as I can. And though I am middle aged now, my restless dreams of youth continue to fuel my passion for life. May that spirit also animate you on your life’s journey.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods