A ‘Game of Thrones’ Shaming on the Pay Gap

- A Game of Thrones Shaming on the Pay Gap

- ETF Talk: Tap the Future of the Automobile Industry with This ETF

- How A Pre-Socratic Philosopher Taught Me Options Trading

- On Physical Training

***********************************************************

A Game of Thrones Shaming on the Pay Gap

“Shame! Shame! Shame!”

That’s a memorable line and story development from the widely popular television series “Game of Thrones.” Now, I admit that I have never actually watched a full episode of the series, which certainly puts me in a minority among my peers.

Yet, one would have to be culturally illiterate not to know something about the series. One of the things I know is that the themes of morality, shame and atonement are strong threads sewn throughout the show.

One portion of the show I did see was in Season Five, Episode 10. This also happens to be considered one of the most-powerful scenes in the series, at least according to the “GoT” fans I spoke with. This scene involves Queen Cersei Lannister, who has committed adultery and must atone for her infidelity before she can resume life in the royal palace.

Her punishment is a “walk of shame,” where she is humiliated by being stripped nude, having most of her hair cut off, and then paraded through the streets to be jeered at and spat on. She also is surrounded by people shouting obscenities and cries of the repeated, “Shame! Shame! Shame!”

Now, while public shaming in “GoT” is certainly a powerful social tool in discouraging immoral and anti-social behavior, shaming is alive and well today in the real world. Case in point is the attempt to publicly shame companies into rectifying the so-called “gender pay gap.”

In fact, my very own U.S. Senator, Kamala Harris (D-Calif.), who also happens to be making a run for the Democratic Party’s presidential nomination, is the spear at the head of an effort to essentially shame companies into correcting employee pay disparities by forcing them to disclose salary data by gender.

As Peter Suderman writes in a recent Reason article, “Kamala Harris Wants to Force Companies to Report Pay Data to the Federal Government — and Fine Them If They Don’t Offer Equal Pay,” Sen. Harris wants to “force companies with over 100 people to disclose salary data by gender in order to get an ‘equal pay certification’ from the Equal Employment Opportunity Commission, an arm of the federal government that enforces workplace civil rights. She also wants to fine companies for discrepancies in pay.”

Suderman continues, writing, “If a company fails to prove that it meets the standards of equal pay, it would be fined 1 percent of its profits for every 1 percent of the gap between what men and women are paid.”

So, Harris has taken it upon herself to determine what a private employer should pay his or her employees. And, if there is a pay discrepancy that Harris deems inappropriate, then she is going to use the power of government force to punish a company for its shameful transgression.

What’s next, stripping CEOs naked, chopping their hair off and walking them down the corner of Wall and Broad to be spat upon by a jeering socialist mob?

Unfortunately, the truth of that last statement isn’t too far off from what some on the regressive left would literally like to see done. And while I am not accusing Sen. Harris of having such morose intentions, I do find it repugnant that she wants to wield the government’s scythe on companies which she determines are guilty of paying some employees a little too much more than others.

Only a business owner has the right to determine what he or she pays his or her employees. The government should have zero say in determining a “gender price gap,” or a “living wage” or even a “minimum wage.”

In a true free-market capitalist system, companies should have the right to pay their employees based upon the value those employees provide the company. Full stop.

Moreover, employees have the right to either accept or reject an employer’s compensation. Freedom from coercion means that no third party or governmental agency has the right to interfere with the price of labor or with the willing exchange of money for labor between two consenting adults.

It is the principle of free exchange that is under attack by those who have determined there is some kind of shame involved in the inherent inequities of what one employee brings to an employer vs. another.

As I’ve said many times before in this column, the essence of the battle between capitalism and socialism is that capitalism maintains that you own your own life and that you can sell your labor to a willing party for what that labor will bring.

By contrast, socialism maintains that society/government essentially owns your life, and that you are therefore unable to sell your labor to a willing party both without society’s approval and without whatever restrictions the bureaucrats in charge think a person should be paid.

When stated in these terms, it’s not hard to see that socialism is a perfect prescription for telling us all what to do, what to think… and what to feel.

So, don’t let this encroachment stand. Be vigilant, and challenge bad ideas on principle, and with principled thinking that goes beyond mere politics. Indeed, we must be willing to challenge bad ideas down to their root. Because until we pull the roots out of the ground, the foliage of bad ideas will continue to grow.

**************************************************************

ETF Talk: Tap the Future of the Automobile Industry with This ETF

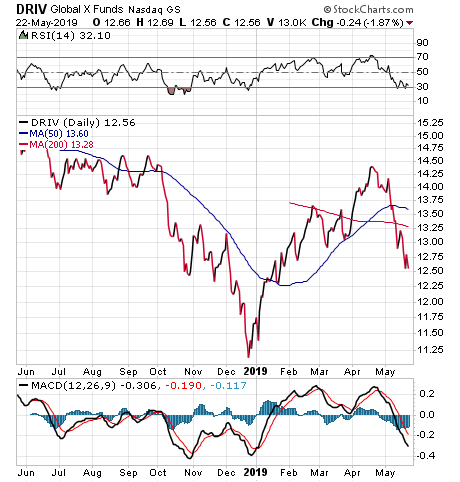

This exchange-traded fund (ETF) uses a proprietary algorithm to identify companies with exposure to electronic vehicles, electric vehicle components and autonomous vehicle technology.

The Global X Autonomous & Electric Vehicles ETF (NASDAQ: DRIV) is a non-diversified, open-ended fund that was launched on April 13, 2018. The ETF has a average market cap of $70 million and currently has $13 million in assets.

Shortly after the fund’s NASDAQ listing DRIV reached its all-time high of $15.78. Since then, its stock price fell 20%, although it has made solid gains in 2019 and is up 11.35% year to date.

With a 0.68% expense ratio, DRIV is considered a competitive fund in its industry according to ETF.com. The fund also holds a 2.32% dividend yield and recently paid out a $0.325 dividend on Dec. 28. Its next ex-dividend date is June 27.

DRIV is managed by Global X, a brand worth more than $9 billion, which manages a number of funds that I have featured in my ETF Talk series, including Global X Internet of Things ETF (NASDAQ: SNSR) and Global X FinTech ETF (NASDAQ: FINX).

The fund has 73 holdings with exposure to at least one of three segments: electronic vehicles, including motorcycles/scooters and electric rail; electric vehicle components, including drivetrains, lithium-ion batteries and fuel cells; and autonomous vehicle technology, including sensors, mapping and ride-share platforms.

People who live in or near a large city have, without a doubt, either used or seen a product or service of a company that DRIV includes among its holdings. Those companies not only feature those that engage with electric vehicles but also others that provide popular ride-sharing apps and electric scooters.

DRIV’s top 10 holdings are safe, blue-chip stocks. Their names and their weighting in the fund are Apple (NASDAQ:AAPL), 3.53%; Qualcomm Inc. (NASDAQ:QCOM), 3.40%; Microsoft Corporation (NASDAQ:MSFT), 3.38%; Texas Instruments Inc. (NASDAQ:TXN), 3.23%; NVIDIA Corporation (NASDAQ:NVDA) 3.13%; Alphabet Inc. (NASDAQ:GOOGL) 3.02%; Samsung Electronics Co. Ltd. (OTCMKTS:SSNLF), 2.92%; General Electric Company (NYSE:GE), 2.79%; Intel Corporation (NASDAQ:INTC), 2.79% and Toyota (NYSE:TM), 2.60%.

While DRIV offers a chance to invest directly in electric vehicles, since one of its holdings is Tesla, it also provides an even better opportunity to invest in the whole ecosystem of autonomous and electric vehicles, including component and material manufactures. An analogy for this strategy would be investing in the companies that provided the shovels, axes and other tools that were used during the Gold Rush.

Chart courtesy of StockCharts.com

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

In case you missed it…

How A Pre-Socratic Philosopher Taught Me Options Trading

I was in Las Vegas last week to give presentations to MoneyShow attendees and to speak with subscribers about my newsletter advisory services.

In one of my talks, I told the audience my favorite investing story about how a pre-Socratic Greek philosopher taught me how to trade options. This week I want to tell you, The Deep Woods reader, this story, as it will give you a sense of why I think it’s important to cultivate all kinds of knowledge about the world and not just knowledge directly related to stocks, bonds, exchange-traded funds (ETFs) and options.

So, what do I mean when I say a pre-Socratic philosopher taught me how to trade options? Well, to understand this, we must go back about 2,500 years ago to Ancient Greece and learn about a man named Thales of Miletus.

Thales was a brilliant philosopher and one of the first real Western thinkers and scientists (although “scientist” wasn’t a term that was used at the time). He is best known for his thesis that “all things are water,” which we know now to be erroneous, but was a groundbreaking thought, given the scientific infancy of 6th century B.C. Greece. Moreover, Thales was among the first thinkers to make hypotheses that were testable and falsifiable, both bedrock principles of scientific inquiry today, but absent among his fellow thinkers at the time.

According to the Internet Encyclopedia of Philosophy, none other than the great Aristotle identified Thales as the first person to investigate basic principles, the first to question the origins of substances and matter and therefore, the founder of the school of natural philosophy.

Among his accomplishments was the successful prediction of an eclipse of the sun that occurred on May 28, 585 B.C.E. Although it’s not known exactly how Thales was able to predict this event, the most likely explanation is that he studied the solar and lunar cycles.

Yet what can investors learn from Thales?

To answer that, we must realize that Thales was a philosopher and a man not particularly concerned with the accumulation of monetary wealth. And because of his lack of wealth, he often was criticized by the elites of Athenian society during his own life. In order to prove the elites wrong, and to demonstrate the power of reason and natural philosophy, Thales did something that should put him in the trading history books.

Based on his study, assessment and knowledge of the Greek climate, Thales reasoned that there would be a particularly good harvest for olives one year. But rather than sit on this information, Thales had taken the next step and put deposits down on all the olive presses in Miletus over the preceding winter.

Thales basically cornered the market on olive presses for a small investment. Stated in modern trading terms, Thales bought call options on olive presses and paid a small amount for the right to control those presses (i.e. he paid a small premium for the option).

When his prediction of a bountiful olive harvest did indeed come to pass, Thales’ bet paid off handsomely. The boom harvest created heavy demand for the olive presses, and because Thales held a virtual monopoly on the presses, he was able to rent them out at a huge profit.

In my opinion, this was perhaps one of the most important events — not only in market history, but in the whole of human history.

The reason why is because Thales demonstrated that “science” and the accumulation of wealth really are connected. And, as the old saying goes, knowledge is power. He also demonstrated that if you know what your competition doesn’t, you will have a tremendous advantage over them.

It is for this life lesson, as well as the accompanying investing lesson of Thales and the olive presses, that we should be thankful for the man from Miletus.

I know I am thankful for him, as his foresight and virtual creation of the concept of options trading has allowed me to help investors make some serious profits. And, that’s precisely what we have done this year in my Bullseye Stock Trader advisory service.

Since we launched in late December, we’ve had 14 closed trades, with 12 winners. Moreover, many of those options trades have been double-digit or even triple-digit-percentage winners.

To find out more about my Bullseye Stock Trader service, simply click here.

So, the next time someone asks you about who your favorite investor is, forget about Warren Buffett or Ray Dalio or John Templeton. Instead, give Thales of Miletus a shout out.

*********************************************************************

On Physical Training

“No citizen has a right to be an amateur in the matter of physical training… what a disgrace it is for a man to grow old without ever seeing the beauty and strength of which his body is capable.”

–Socrates

The peripatetic protagonist of Plato’s brilliant dialogues believed that every human being has a responsibility to live up to his or her physical potential. I, too, share this belief. The reason why is that we only get one body, one mind and one life on earth. And a fit body and a fit mind allow us to live our lives at peak performance.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods