The Diagnosis From Dr. Copper

When you want to figure out the state of your physical health, you go to a doctor to help diagnose your condition.

And when you want to figure out the state of the market’s health, there’s also a doctor who can help diagnose the condition. The doctor I’m referring to here is “Dr. Copper.”

Just who is this Dr. Copper and what’s his latest prognosis? Well, Dr. Copper is the nickname market watchers have given to the industrial metal’s prognostication abilities. It is sometimes said that copper has earned a PhD in global economics because of its importance in helping determine future conditions.

Today, I have decided to hand over some of the lead-column real estate to my friend and technical analyst extraordinaire Tyler Richey. Tyler is the Co-Editor of the Sevens Report, a daily market news and analysis publication that I strongly recommend.

Tyler also holds the highly respected Chartered Market Technician®, or CMT, professional designation. So, when he analyzes a market sector, I take particularly good notes.

In this analysis, you’ll learn why copper has been a very consistent and accurate leading indicator for stocks, and why the latest action in Dr. Copper could be pricing in rising odds of both a U.S.-China trade deal and a rebound in the global economy.

And now, I give you Tyler Richie and the diagnosis from Dr. Copper.

******

Over time, a discernable relationship has developed between certain commodities such as industrial metals and energy and the broader stock market.

From a macro analysis standpoint, it is a very logical correlation, especially in situations where global growth concerns are a major influence on the market (like right now). And generally speaking, those commodities tend to lead equity markets, in many cases accurately forecasting volatility, which is why we include them as part of our monthly Sevens Report Economic Breaker Panel.

This concept has been especially true for copper in recent years because of how important Chinese growth has become to the health of the global economy. The industrial metal has even been given a theoretical PhD on the street, labeling it “Dr. Copper” thanks to the elevated sensitivity industrial metals have to China’s economy.

Note that China has had at least some sort of influence on most of the bouts of stock market volatility over the last five years. To that point, copper has been a very consistent and accurate leading indicator for stocks, because more often than not, where copper goes, the Chinese economy is going.

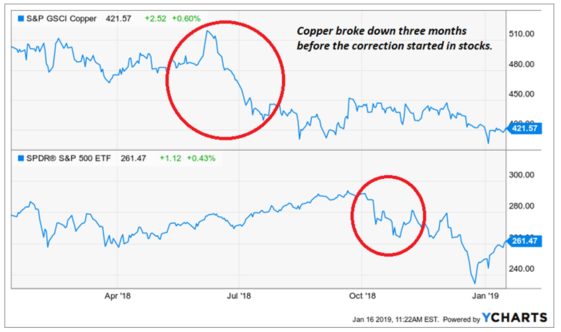

For example, back in summer 2015, copper futures hit fresh multi-year lows in the first week of July before Chinese currency drama sparked a huge wave of selling in the third week of August (a warning signal that turned out to be six weeks prior to the stock market pullback).

More recently, last year copper futures fell sharply to new 52-week lows, again in July, as trade war concerns and the threat tariffs had on global growth continued to be shrugged off, until they weren’t, at the start of Q3 earnings season, and stocks proceeded to get pummeled.

To start 2019, copper again spiked down to fresh 52-week lows, although the calendar was very likely playing a role in the price action as traders rebalanced books into the new year. Futures have since recovered modestly, but copper is still trading at the lower end of a three-month trading range, and again is on the verge of breaking down.

The encouraging part, however, is that futures have not ended a week below the September weekly closing low, and for longer-term chart reading we prefer the weekly time frame for technical analysis. Additionally, the pullback in December was on steadily declining volumes, suggesting a lack of downside conviction.

Bottom line, a material drop below $2.60 would be another warning sign for stocks, maybe not for the immediate future, but for the weeks or even months ahead. For now, copper futures are largely holding the October lows, and if that continues and futures are able to rally to (or even better, through) the top end of the Q3-Q4 trading range (around $2.85), “The Doctor” would be pricing in rising odds of both a U.S.-China trade deal and a (related) rebound in global economic data. –TR.

******

Thanks again to Tyler Richie of the Sevens Report for providing us with his expertise on Dr. Copper. I know I will be watching copper prices closely here to help determine the next intermediate-term direction for markets. And, when a significant trend change develops, I will be sure to share it with you.

**************************************************************

ETF Talk: This ‘Blue Chip’ Fund Is ‘Risk On’

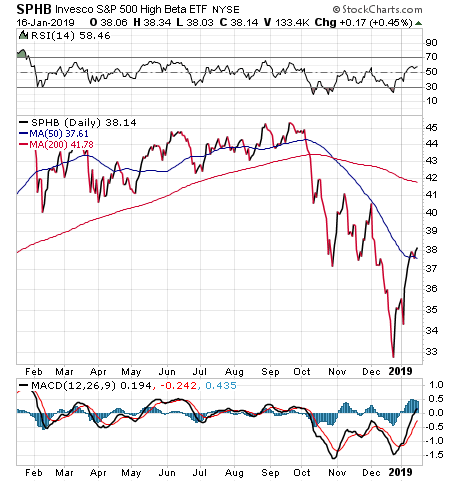

The Invesco S&P 500 High Beta ETF (SPHB) is an exchange-traded fund (ETF) that tracks a benchmark that consists of the most eminent and successful companies in the United States.

Indeed, many of these “blue chip” companies are large-cap household names and have played an important role in shaping the modern American economy. In a way, this is a good thing as these companies are statistically unlikely to suddenly fold or have their stocks lose a substantial amount of their value unless the economy were to undergo a severe fall.

Thus, the level of risk inherent in this ETF is lower than average. “Blue chip” companies also pay out sizable dividends when compared with smaller or less-established companies.

Interestingly, SPHB is used by many portfolio managers to get “risk on,” meaning that when the market is trending higher, we see money move into the fund for general exposure to the markets. Conversely, when markets go “risk off,” money tends to move into other ETFs, and one such fund is the topic of next week’s ETF Talk.

At the same time, the fact that these companies are so massive, largely precludes the possibility that the value of these related stocks will rise dramatically soon. Most of their fast growth occurred in the past and, as Apple (NASDAQ: AAPL) has shown us, one-time growth stock stars can have trouble creating new and innovative products that are on par with the ones that initially launched their explosive growth.

Even though 36% of the fund’s holdings consist of technology stocks, SPHB also has significant investments in the financial, health care, industrial and communication sectors. Virtually all the fund’s holdings are based in North America and the rest are in Europe.

Some of the fund’s top holdings include Netflix (NASDAQ: NFLX), Nektar Therapeutics (NASDAQ: NKTR), Incyte Corp (NASDAQ: INCY), Applied Materials Inc. (NASDAQ: AMAT), Caterpillar Inc (NYSE: CAT), NVIDIA Corp (NASDAQ: NVDA) and Adobe Inc. (NASDAQ: ADBE).

Chart courtesy of Stockcharts.com

The fund currently has $96.68 million in net assets, has a $4.27 million median daily volume and has an average spread of 0.06%. It also has an expense ratio of 0.25%, meaning that it is slightly more expensive to hold in comparison to other exchange-traded funds.

In short, while SPHB does have several advantages over some of its peer funds, its risks are not zero. Interested investors always should exercise their due diligence and decide whether the fund is suitable for their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

Doug Fabian Unveils the Science of Economic Freedom

What’s the real importance of a pivotal person in one’s life?

That’s the lead question in Season 2 of the Way of the Renaissance Man podcast, featuring a name many of The Deep Woods readers already know and love, the great Doug Fabian.

As you likely know, Doug is both a close friend and a long-time business associate. In fact, Doug and I worked together for more than 15 years, first on the flagship investment advisory newsletter Successful Investing, and then with his money management firm.

Doug is currently a vice president at Mercer Advisors, which has been widely recognized as one of the top Registered Investment Advisers in the country. He’s also the host of a podcast I highly recommend called “The Science of Economic Freedom.”

I really enjoyed reminiscing with Doug about our mutual past, but more importantly, I am excited to share with you our conversation, which includes topics such as the importance of active listening; cultivating a commitment to lifelong learning, what books we’re currently reading, and details about his new podcast and why it can help everyone achieve economic freedom.

In this episode, we also discuss:

- What qualities Doug and I value most in our working relationship.

- Why people need to be mindful of their words.

- The one thing Doug and I agree is the most important part of Dr. Jordan Peterson’s “12 Rules for Life.”

- How Doug uses swimming to help him think and stay focused.

- Jim’s first impression of Doug’s bookshelf.

- What the Science of Economic Freedom podcast is all about.

- And much more…

If you’re a long-time reader of this publication, you are probably well aware of Doug and how engaging he is. Well, in this episode of the Way of the Renaissance Man podcast, you’ll experience Doug at his best, i.e. engaged in the art of conversation.

And remember, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

*********************************************************************

Millionaire Madness

“Aww, is the poor millionaire mad because he has to pay taxes?”

–Friend who shall remain anonymous

If you’re successful, you don’t get much sympathy even from your friends when it comes time to send in your quarterly tax payments. And for many of us, Jan. 15, April 15, July 15 and Oct. 15 are the dreaded dates on the calendar where we have to send the U.S. Treasury what we estimate we will owe in taxes for that year.

The sad irony here is that we have to send them what we think we’re going to owe even while lawmakers and the executive fail to get it together enough to fund everyday government operations. So, we still have to pay, but they don’t have to do their jobs. Welcome to 21st-century American dysfunction.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods