What I Wish Mark Zuckerberg Would Say

It’s day two of the Mark Zuckerberg grilling on Capitol Hill. That means it’s another opportunity for grandstanding bureaucrats to attack a businessman for his achievement.

You see, the men and women of Congress all have created multi-billion-dollar businesses that have changed the world, so of course they know better than the Facebook (FB) creator and CEO about how he should run his operation. On Tuesday, Mr. Zuckerberg began his testimony to members of several Senate committees with a statement that I thought was both contrite and accountable for what he admitted was the unintended outcome via the Cambridge Analytica data breach.

I found the Facebook chief’s words to be solid and, of course, understandably apologetic given the vitriol he faces from both sides of the political aisle, as well as from much of the public, over the recent data scandal. That vitriol has caused Facebook shares to fall nearly 15% from their 52-week high set on Feb. 1, an example of what I call the free market policing its own.

Yet that’s not enough for lawmakers. In fact, this whole data breach incident has come with calls for all sorts of government regulation on Facebook (I prefer to call it interference) designed to dictate how the company operates, how it interacts with its users and what it can do with the data it obtains.

Unfortunately, Mr. Zuckerberg seems to have in principle agreed with the need for greater regulation on his company. This is an example that the novelist/philosopher Ayn Rand, one of the most powerful exponents of laissez-faire capitalism ever, called “the sanction of the victims.”

Rand had keenly observed that profit-seeking businessmen, despite conferring huge benefits on society of the sort Mr. Zuckerberg is responsible for, are often the “most hated, blamed, denounced men” in the eyes of much of society, and most particularly the political class. She also noted that these businessmen are complicit in this injustice, as many times they accept their attackers’ moral standards and end up guiltily apologizing for their own productive virtues.

That is what Mark Zuckerberg has done, for the most part, although he stopped short of truly capitulating to his harshest critics. He also largely defended his company and the tremendous good it has created for the world.

Yet I wish Zuckerberg would have gone a lot further in the defense of his brainchild. So, if you’ll indulge me, this is what I would have liked Mr. Zuckerberg to say at the outset of Tuesday’s hearing.

Chairman Walden, Ranking Member Pallone and Members of the Committee,

We face a number of important issues around privacy, safety and democracy, and I know you have your opinions on what the government’s role should be in how Facebook deals with these issues.

And while I am aware of your desire to wield influence on a business that has changed the way the world interacts, I am here to say that you have neither the right, nor the knowledge, nor the permission to interfere with the way Facebook operates.

Facebook is an idealistic and optimistic company. For most of our existence, we focused on all the good that connecting people can bring. As Facebook has grown, people everywhere have gotten a powerful new tool to stay connected to the people they love, make their voices heard and build communities and businesses.

This tool is used voluntarily by those who agree to the terms and conditions of its use before they sign up and create an account. This voluntary agreement allows us to monetize the data that users freely choose to put out to the world on the Facebook platform.

Nobody is forced to use Facebook. Yet if you want the benefits of Facebook, which billions of users around the world have demonstrated they do, then you have voluntarily chosen to allow my company to monetize that data.

Facebook is a for-profit operation. I do not apologize for this; rather, I celebrate it.

Our company has brought into existence tremendous wealth for shareholders, for advertisers and for businesses that use Facebook as a storefront of sorts. That wealth has allowed us to expand our mission and to continue evolving to create even greater value.

Have there been bad actors who have used my creation for nefarious purposes, such as spreading fake news, interfering in foreign elections and promulgating hate speech? Yes, there have. And it is my company’s responsibility to correct this situation, as it has been harmful to our business, our shareholders and to our users at large.

What would be more harmful, however, is for me to accept the premise that my creation is somehow a “public utility” or a “monopoly” that requires the arrogant and uninformed interference of federal lawmakers.

I admit that Facebook didn’t take a broad enough view of our responsibility in this matter, and that was a big mistake. It was my mistake, and I’m sorry for it. I started Facebook, I run it and I’m responsible for what happens here.

It will take some time to work through all the changes we need to make, but I’m committed to getting it right.

I’m also committed to protecting what I and my community of users and advertisers have created from the undue interference of big government.

I thank you for the opportunity to state my case, and with that, I am going to excuse myself from this hearing.

I have a business to run, and shareholders to answer to.

***********************************************************

ETF Talk: Offering a Simple Fund for the Euro

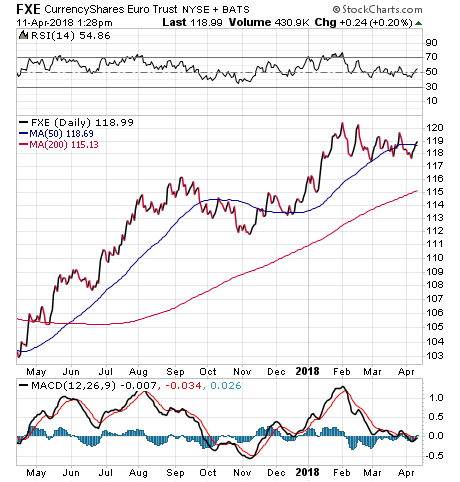

PowerShares CurrencyShares Euro Trust (FXE) is an exchange-traded fund (ETF) that allows investors to invest easily in the euro as a currency.

This fund can be a useful tool for would-be currency speculators who expect the euro to rise. Interestingly, the fund recently moved from Guggenheim to Invesco, which now manages it as part of its CurrencyShares fund line.

The mechanism by which this fund operates is simple. The fund is fully invested in cash in euro form. Owning shares in this fund as an investor is a lot like heading to a currency exchange and swapping some dollars for euros. But buying shares in the fund is more convenient and potentially has less of a fee attached.

Currently, 19 European countries use the euro as their joint currency. The value of the euro is influenced by European economies, as well as the policies of the European Central Bank (ECB) and individual European governments.

Because of the way it operates, FXE does an excellent job of tracking the euro/U.S. dollar exchange rate. It is also extremely liquid and trades heavily each day with a tiny spread. Interested investors need to be aware that share sales of FXE are always taxed as ordinary income. Furthermore, FXE’s physical deposits of euros are uninsured, which means shareholders are exposed to the default risk of JPMorgan.

The value of the euro has climbed in the most recent 12 months, with investors in FXE achieving returns of 15.22%. Investors concerned about currency risk in the dollar may find this fund to be a valuable safe haven. The expense ratio for this fund is 0.40%, which is less than a physical exchange of currency typically would cost. Naturally, this currency fund does not pay dividends.

If market volatility concerns you, cash is a solid place to be, and investing in this fund is a different spin on keeping funds in cash that still allows for potential asset appreciation. If this fund’s focus on the euro sounds like a good idea to you, consider picking up shares in PowerShares CurrencyShares Euro Trust (FXE).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Does Donald Trump Hate Freedom?

The president seems to want a trade war with China.

The president also seems to want a war with Jeff Bezos and Amazon.com (AMZN).

A broader way to say this is that the president seems to want to wage war on you and me.

I say this, regrettably, because what I see coming out of Washington (and, astonishingly, from a Republican administration) is an attack on American consumers, American capitalism and the freedom to choose where we buy goods and from whom we buy those goods.

Now, I would expect a war on capitalism and consumer choice from the left; that’s consistent with their creed. Yet to me, that attack is even more egregious when it comes from the right, and particularly from a president who spent his entire life in the private sector before being elected.

Just take the latest ramp up of the trade war. It first started with steel and aluminum tariffs, which at the time I argued would lead to trouble. When we saw the Chinese retaliate with a rather muted set of their own tariffs on U.S. goods, there was a second round of proposed tariffs from the Trump administration on some 1,300 Chinese goods.

So, what happened next? Well, predictably, China retaliated by announcing a proposed 25% tariff on $50 billion worth of U.S. exports, including some 106 products, such as soybeans, chemicals, automobiles and planes.

Now, administration officials such as newly appointed National Economic Council Director Larry Kudlow, a free trader in his previous life, were quick to come out today and say that this is all a negotiating ploy to get a better trade deal with China.

Kudlow told Fox Business host Stewart Varney that there was “absolutely not” a trade war between the United States and China.

Well, you could have fooled me. One place that is equally un-fooled is Wall Street.

It’s not a coincidence that markets opened last Wednesday’s trading session down nearly 500 Dow points. And though stocks rallied back toward the end of the session as the headline fear subsided, there is no doubt that markets know how pernicious a trade war would be. Indeed, even the threat of big tariff impositions from both sides sends a big “risk-off” signal to markets.

Yet the more important, and the more principled, concept to understand here — a concept that seems to have escaped the Trump administration — is that tariffs, regardless of their intended purpose, raise prices on consumers. They do so via direct taxation on imported goods or indirectly on imports of production goods.

And, I know this is a simple concept, but who pays those taxes? The answer is you and me.

And that brings us to the second front here, the president’s recent storm of tweet attacks on one of the greatest companies in history, online retailer Amazon.com.

Amazon is one of the greatest companies ever because it creates immense value for consumers and for shareholders. The ability to purchase just about anything you can think of, from books to clothes to household goods, including groceries and even web data services, at a competitive price and with ultra-fast, cost-efficient delivery has indeed changed the retail landscape.

Now, some would say Amazon has displaced many industries, the latest being delivery companies, large grocers and, of course, so-called “mom-and-pop” retailers.

Hey, I agree. And you know what I call that? Capitalism.

More specifically, it is what the great Austrian economist Joseph Schumpeter called capitalism’s “gale of creative destruction.”

Of course, those who defend the president’s singling out of Amazon have argued that the company is getting unfair advantages in the marketplace by receiving a bulk rate for package deliveries from the U.S. Postal Service.

Yet Amazon is paying the discounted bulk rate that it qualifies for due to the volume of packages it sends each year. Should Amazon be forced to pay more for this just because the president thinks it’s unfair? I think not.

Finally, ask yourself how Amazon got to be the dominant force in the online retail space. Did they do it at the point of a gun? How did Jeff Bezos become the richest person on earth, according to Forbes?

He did so because of you and me. He did it because consumers freely chose to embrace his company via buying and selling goods on Amazon and because investors freely chose to buy Amazon.com (NASDAQ: AMZN) shares.

I think that anyone who wants to stand in the way of that freedom might rightly be questioned about having a problem with freedom itself.

I hope I am wrong.

*********************************************************************

Businessmen vs. Bureaucrats

“A businessman’s success depends on his intelligence, his knowledge, his productive ability, his economic judgment — and on the voluntary agreement of all those he deals with: his customers, his suppliers, his employees, his creditors or investors. A bureaucrat’s success depends on his political pull. A businessman cannot force you to buy his product; if he makes a mistake, he suffers the consequences; if he fails, he takes the loss. A bureaucrat forces you to obey his decisions, whether you agree with him or not — and the more advanced the stage of a country’s statism, the wider and more discretionary the powers wielded by a bureaucrat. If he makes a mistake, you suffer the consequences; if he fails, he passes the loss on to you, in the form of heavier taxes.”

— Ayn Rand

There was no better advocate for businessmen, and no finer critic of bureaucrats, than the great novelist and philosopher. Here, the author of “The Fountainhead” and “Atlas Shrugged,” two must-read works of literature, summarizes the differences between these two societal camps. And after today’s article, I suspect you know which camp I prefer.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.