The Illuminating Irony of Place, Time and Tax Cuts

Sometimes, the confluence of place, time and global events leaves one with a sense of irony that illuminates the soul.

That’s what a friend and I reflected on last Friday morning while drinking coffee just steps away from the U.S. Capitol. I happened to be in our nation’s capital last week, and the irony of that visit has yet to escape me.

That irony, of course, is that for over a year, I’ve been writing about the main force animating the bullish sprits on Wall Street — the hope for the first real tax reform in some three decades.

Well, on Friday, Congress came to an agreement on the tax bill, finalizing the reconciled House and Senate versions. Then, today, Congress has voted to officially pass tax reform. Within the next day or two, President Trump is expected to sign the landmark legislation into law.

That means the president and the Republican Congress will have delivered on the key pro-growth proposals promised by candidate Trump, and then President Trump, for the past two years.

Yet in another influx of irony enveloping this issue, now that tax cuts are basically a done deal, the market will be forced to recalibrate its catalysts going into 2018. Yes, the markets and the economy will stride into the new year with a tax-cut tailwind firmly at their backs. However, the question then becomes… What next?

After all, the market is notorious for being the ultimate, “What have you done for me lately?” arena, and one that’s perpetually in search of the next big catalyst capable of either vaulting it higher — or slamming it back down to earth.

Figuring this question out is going to be the key to solving the riddle of the markets in 2018. And while this is a task fraught with peril for even the best prognosticators in the business, it is a task I shall embrace vigorously.

The reason why is because getting the market right and helping investors succeed in one of life’s most important facets is something I love, something I feel a calling to do and, frankly, something that I am really good at.

Moreover, I find few things more noble than helping my fellow man increase his/her happiness through smart financial decisions. So, let the process of solving the 2018 riddle of the market begin!

And, as we begin, let’s keep in mind that while some could argue that tax reform passage is already priced into stocks, the official removal of the possibility of failure on tax reform eliminates another obstacle we know has held some investors back this year.

More importantly, I expect tax reform to help corporate bottom lines in the coming quarter. I also expect the economy to continue to grow at a 3%-plus pace. And with earnings strong, the economy growing, unemployment at near-record lows, consumer confidence at near-record highs and what appears to be a predictable Federal Reserve — we have a recipe for another year of gains in the market.

So, will that recipe turn out to cook up another big year for the bulls?

I think it will. However, my skeptical nature forces me to adopt a “show me, don’t tell me” posture towards markets — as well as just about everything else in life.

Let’s just say I am approaching 2018 with a “cautiously optimistic” countenance.

*************************************************************

ETF Talk: A Hassle-Free Play on the U.S. Real Estate Sector

Real estate investment trusts (REITs) have seen a spike in popularity in 2017.

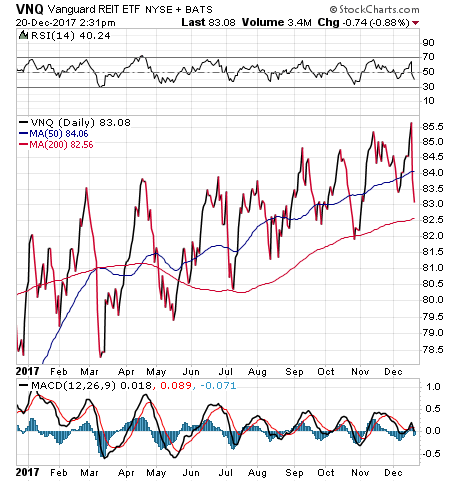

REITs typically purchase office buildings, hotels and other properties to produce income. The Vanguard REIT ETF (VNQ) is a hassle-free play on the U.S. real estate space with a large, well-known investment group.

REITs offer many attractive advantages versus other types of investment vehicles including:

- High yield — The longer-term average for REITs has been trending in the 7-8% range, well above the yield of the S&P 500 index.

- Liquidity — REIT shares are bought and sold on a stock exchange, which is a far more efficient and easy market than buying and selling properties directly.

- Diversification — REITs offer a good way for investors to spread their risk.

- Simpler tax treatments — distributions from VNQ and other peer ETFs are taxed as ordinary income.

VNQ has $35.33 billion in assets and an expense ratio of just 0.12%. The fund holds a deep basket of 152 companies in its portfolio that covers almost all kinds of real estate. VNQ boasts a huge average daily trading volume of $287.12 million and a very low spread of 0.01%.

Yield-seeking investors sometimes compare the yields of REITs to bonds. While it is true that bonds offer income with generally lower risk, REITs have a much higher potential for growth. As a result, VNQ’s share prices tend to rise and fall more sharply than funds that hold bonds, which is evident in the chart below.

Year to date, VNQ has returned 6.90%, compared to a 20.07% year-to-date return of the S&P 500. VNQ has a dividend yield of 4.8%.

The REIT’s top five holdings are: Simon Property Group Inc. (SPG), 5.23%; Equinix Inc. (EQIX), 3.76%; Prologis Inc. (PLD), 3.66%; Public Storage (PSA), 3.47%; and AvalonBay Communities Inc. (AVB), 2.60%.

If you are seeking a way to get into the REIT space, consider Vanguard REIT ETF (VNQ) as a potential investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*************************************************************

How to Invest at 168 MPH

Some people play golf. Some people play tennis. And while I certainly understand the appeal of these great activities, I prefer to engage in recreational activities that are, shall we say, a little more extreme. Another way to describe my proclivities is the way many of my friends and family do, and that is to just say that, “Well, Jim’s just a little bit crazy.”

Now, I know what my friends and family mean when they say I’m a little crazy. And I know that they don’t mean that in the clinical sense. What they do mean is that the recreational activities I engage in are usually relatively high-risk and often come with an intensity factor that’s a little bit high on the extreme scale.

Tactical marksmanship, Brazilian jiu-jitsu and high-intensity training to build muscular size and strength are some of these activities. Yet there are even more extreme arrows in my recreational quiver.

I bring this up because some of the greatest insights I’ve gleaned about myself, including insights on risk taking, risk management — even the meaning of life itself — have come to me while engaged in extreme pursuits.

Moreover, these insights have helped me become a more skillful writer, entrepreneur and especially a better investor. Perhaps most importantly, I suspect some of these insights can help you do the same, especially when it comes to the investing part.

For many years, I was really into motorcycles, and not just riding motorcycles around on the weekends exploring the country. My motorcycle pursuits involved sport bikes and, in particular, road racing bikes. These are the bikes that go really, really fast, and the bikes that require you lean off of them and drag your knee on the ground to go really fast around turns. In other words, the kind of motorcycle that can get you into a lot of trouble with if you don’t know what you’re doing.

So, when I decided to buy my first road racing bike in the mid-2000s, I didn’t just go to the dealership, jump on the prettiest model and ride off the lot with abandon. Instead, I did my research on what was the best model of road race bike for riders just getting into the sport.

Then, I researched which training facilities were considered the most effective, and the ones that stressed safety first. I also made sure I researched the right safety equipment, including which brands offered the best protection in the event of the inevitable crash.

It was only after doing this due diligence on what the sport requires to be able to excel, stay relatively safe and really enjoy the experience that I actually embarked on the motorcycle road race journey. It is this kind of thorough due diligence that I bring to my work here at Eagle Financial Publications via the Intelligence Report, Successful Investing and Fast Money Alert services. It’s also a discipline that I bring to all my personal and professional life.

Yet aside from the lesson of proper due diligence, I think the real lessons one learns in life are those garnered under heavy stress. You see, it’s the presence of stress — literally life-threatening stress — that teaches us a lot about ourselves, our resolve and our ability to focus our minds on a singular task.

That’s the lesson I learned after participating in several motorcycle road racing “track days.” This is where you go out with a group of riders of similar experience, and try to do your best lap times around a professional race track. The track where I really learned a lot was the Auto Club Speedway in Southern California. This track has one of the longest straightaways in road racing, and experienced riders regularly reach speeds north of 170 mph.

After several “timid” laps around the track reaching top speeds of 130, then 140, and then 150 mph, I finally felt comfortable enough to open up my machine to see what she could really do. Yet this decision came toward the end of the day, and my brakes weren’t working as well as they had been early in the session.

I found this out quickly, as I spun up the engine on the Honda CBR 1000, hitting an exhilarating 168 mph on the front straight before applying the front brake — only to find that I was getting little response.

Moreover, as I looked ahead there was a pack of riders in front of me who were slowing down for the next turn, a task I should have already done seconds before. I decided there only were a couple of things I could do. I could apply both the front and rear brakes as hard as I could, hoping the bike would slow enough for me to pull off the racing line, or I could dump the bike while going about 160 mph and risk severe injury (but still managing to avoid my fellow riders).

My decision had to be split second. As you can imagine, it was under extreme duress. I opted to trust my equipment, and my training, by pumping the lever that controls the front brake, downshifting into a lower gear to slow the bike down, and gently but steadily applying the rear break to help slow the bike and steady the chassis. The maneuver worked, and I was able to guide the bike — and myself — back into pit lane safely.

That day, I learned to A) Trust my equipment, B) Trust my training and C) Trust my judgment under stress. If I had panicked and opted to get off the bike, the consequences could have been disastrous.

So, the next time you’re faced with a situation where a potential calamity quickly approaches, trust your due diligence, trust your training (i.e. your accumulated knowledge) and, above all, trust your judgment and wisdom.

It is the knowledge of self, and confidence in your own decisions, that will carry you through times of acute stress.

Whether that stress is manufactured by your “crazy” choice to ride a motorcycle really, really fast, or whether that stress is created by an investment you’ve made in the equity markets, or in a business, or anywhere in your personal life. What will get you through is a clear mind, good preparation… and trust in your good judgment.

*********************************************************************

Hayek’s Admonition

“Even the striving for equality by means of a directed economy can result only in an officially enforced inequality — an authoritarian determination of the status of each individual in the new hierarchical order.”

— Friedrich August von Hayek

The brilliant Austrian economist was one of the greatest thinkers in his field. He also rarely failed to point out the absurdity of politics intermingled with economics. Here, he provides a thoughtful retort to any criticism of the tax plan (or any government plans) that strive for the so-called “equality” of outcome. If you want everyone equally badly off, then just allow big-government tyranny to reign.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.