What the Tax Cut Plan Means for Markets

Question: What’s been the biggest driver of stocks since the election of Donald Trump as the 45th president?

Answer: The hope of tax cuts.

Today, that hope got a little bit closer to reality, as Republican congressional leaders unveiled their plan to reform the tax code.

Long-time readers of this publication and my Successful Investing newsletter know that I’ve constantly written about the “hope trade,” in markets, i.e., the hope that the president’s pro-growth campaign agenda would translate into real-world economic and market stimulus.

And while much of that hope has been dashed on many fronts (e.g. health care reform) the one remaining hope, as well as the most important, is tax reform.

Here are some of the key specifics of the GOP plan released today:

- A slash in the corporate tax rate to 20% from 35%

- A cut in the “pass-through” business tax rate to 25%

- A reduction of individual tax brackets to three, with a top rate of 35%

- A doubling of the standard personal tax deduction

- Elimination of the state and local tax deduction

- Elimination of the estate tax and the alternative minimum tax

- Expansion of refundable tax credits for childcare/dependent care

- Allow businesses to accelerate expensing of investments

- Create a one-time repatriation of foreign earnings

My impression of this proposal is… it’s a decent start.

Of course, that comes from my admittedly radical mindset on the tax issue, one that thinks that, morally speaking, all forms of taxation represent government theft.

Yes, I know I am in the minority here when it comes to my purest view, but being in the minority on an issue never stopped me from holding that view. And, just because a view is in the minority doesn’t mean it’s incorrect.

Galileo held a minority view of the cosmos, and he was convicted of heresy by the Catholic Church for his belief that the Earth revolves around the Sun. A view, of course, later validated by reality.

As for markets, the tax proposal offered up by the GOP today could be either a bullish game changer or a bearish game changer, depending on whether its key proposals actually become law (or fail to become law).

From a bullish standpoint, a tax cut (particularly a sizeable corporate tax cut) could easily push the S&P 500 up another 4% (about 100 points, or over 2,600), because that will increase expected 2018 S&P 500 Earnings Per Share to (conservatively) $145/share.

From a bearish standpoint, while tax cuts aren’t fully priced into stocks, there is the expectation something does get done, especially regarding foreign profit repatriation.

If tax cuts, like health care, fail, then we’re now sitting with a market at 18 times next year’s earnings with no identifiable future growth catalyst, and with a Federal Reserve that’s committed to raising interest rates and normalizing its balance sheet (not good for the bulls).

My go-to research source, as well as a provider of research for the Intelligence Report newsletter, Tom Essaye of the Sevens Report, summed up the tax cut situation for me nicely. Here is what Tom says the market expects out of the final tax reform legislation, and how it likely will react to the different tax reform scenarios:

- What’s Expected: Corporate rate cut to around 28%. Likely market reaction: Mildly positive.

- Bullish If: Corporate rate cut below 25%. Likely market reaction: The “reflation trade” sectors (e.g. financials, banks, energy, small caps) outperform.

- Bearish If: Corporate rate doesn’t change. Likely market reaction: Modest decline in equities, but not a bearish game changer.

- Foreign Profit Repatriation Holiday: Expected to pass. Likely market reaction: Positive for super-cap tech stocks and for multi-national consumer companies.

The one wild card to watch here that both Tom and I were surprised and, indeed, encouraged to see was the “pass-through” rate cut proposal.

This is very important to small businesses (including my own). The reason why is that approximately 95% of American businesses are structured as pass-through tax entities, i.e. they are structured as LLCs, S Corps, etc. In this situation, the business owner is taxed at the individual tax rate, far higher than large corporations are taxed.

A cut in the pass-through tax rate lowers taxes for small business, and that could be a potentially significant (and unexpected) positive for the economy (assuming Congress can get its act together and actually pass at least some version of this proposed tax reform).

The bottom line here is that I don’t want you to let either the positive or the negative headlines regarding the tax reform proposals fool you. The fact is that the tax cut battle has only just begun, but how it works out will have potentially significant consequences for the economy… and for the markets.

As the battle unfolds, I will be there for you to make sense of it all, and to provide a little Galileo-esque perspective.

Upcoming Appearances

Dallas MoneyShow, Oct. 4-6: If you’re in the “Big D” in early October, then come by the Hyatt Regency Dallas and see me, as well as many other great industry speakers, at the Dallas MoneyShow. I will be giving a presentation on Friday, Oct. 6, 8:00 – 8:45 a.m., titled, “5 ETFs to Fight the Fake News.” For your complimentary tickets, go to Woods.DallasMoneyShow.com.

*************************************************************

ETF Talk: Taking a Long Look at High-Dividend ETFs

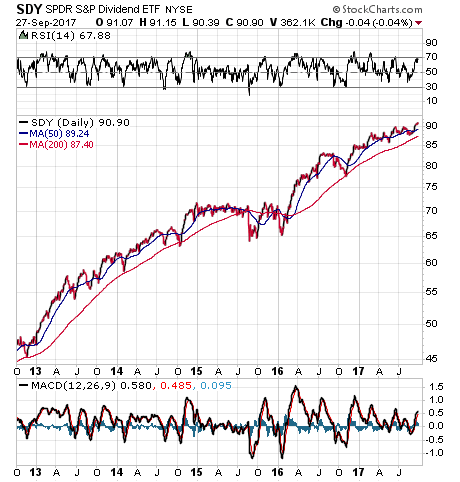

Low-cost, high-dividend exchange-traded funds (ETFs), such as the SPDR S&P Dividend ETF (SDY), can help investors find extra income from dividend payments without the risk of having to choose among individual dividend-paying stocks.

While individual companies often can pay much more tempting yields than an ETF, with some offering dividend yields of between 5-10%, no company and no stock is immune to market volatility. It is a lot riskier to “put all your eggs in one basket” than to spread out risk through a dividend-paying ETF, which can hold several hundred companies in its portfolio that pay dividends.

Simply put, investors who receive dividend payments from multiple companies via an ETF will be only marginally affected when one or even several companies stumble, decrease in share price and potentially fail to deliver on dividend obligations. This fact can make dividend ETFs very attractive to risk-averse investors.

Of course, the major concern facing any dividend-paying stock or ETF is a company cutting or omitting its dividend payment, a real threat in uncertain economic and financial times. While a dividend ETF is less affected by this risk, it is not immune to this problem, especially as these funds offer reduced yields. According to Seeking Alpha, 39 companies announced dividend cuts in July and August 2017 alone, and another 21 omitted a payment.

SDY’s partial solution to the threat of dividend cuts is to screen for stocks that have at least two decades of consecutive dividend increases, as this implies that the companies paying the dividend can back up the payment with capital growth. Remember that S&P 500 stocks that pay dividends for 25 years or more are considered “Dividend Aristocrats.”

In terms of performance, SDY has lagged the S&P 500’s year-to-date gain of 11.5%, generating a gain of only 5.22%. However, while the fund will not be dropping the jaws of market analysts anytime soon, its performance over the last few years has been quite respectable — roughly doubling in share price in five years.

Also, as the chart below shows, there have been no significant and troubling dips during that time. SDY pays a 2.48% yield and has an expense ratio of 0.35%, which is higher than that of other dividend funds, such as those maintained by Vanguard.

With $15.4 billion in net assets, SDY’s portfolio is made up of just over 100 dividend-paying companies with some allocation to all sectors of the market. Its biggest sector holdings are: Financials, 14.75%; Industrials, 14.74%; and Consumer Staples, 14.51%. The fund’s 11% allocation to the struggling Utilities sector may be a concern to some investors.

No position in SDY comprises more than 3% of total assets. The fund’s top holdings show a fair bit of diversification, as well as some household names. They include: AT&T (T), 2.26%; Target (TGT), 2.07%; National Retail Properties (NNN), 1.97%; Tanger Factory Outlet Centers (SKT), 1.96%; and Chevron Corporation (CVX), 1.90%.

Investors looking for a basket of companies with two decades of reliable dividend payments may want to consider the SPDR S&P Dividend ETF (SDY).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

It’s Just a Cleveland Indians Stock Market

If you’re into baseball, you almost certainly know about the remarkable run of consecutive wins that the Cleveland Indians just mounted. An incredible 22 straight victories, just four games shy of the century-long record of 26 consecutive wins held by the 1916 New York Giants.

Now, I must admit I’m not a huge baseball fan, but you don’t have to be to know what’s going on with this story. The reason why is because big winning streaks — whether they be in the world of sports, or in financial markets — tend to attract a lot of attention.

In fact, big winning streaks tend to bring into focus a diverse set of responses that can tell us a lot about ourselves as people, and as investors.

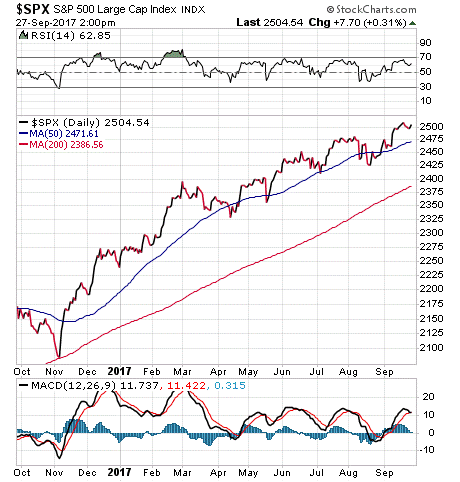

As we all know, the stock market has been on a rocketship ride higher since that little electoral event we had back on November 8, 2016.

The chart here of the S&P 500 Index makes it perfectly clear that stocks have been on a Cleveland Indians-like winning streak since Donald Trump was elected the 45th president.

And what’s been driving this winning streak?

In a word… hope.

The hope that the president’s pro-growth campaign agenda would translate into real-world economic and market stimulus. And while much of that hope has been dashed on many fronts (health care reform, infrastructure spending and even immigration reform) the one remaining hope, as well as the most important, is tax reform.

Specifically, corporate tax reform, i.e., a material cut in the corporate tax rate down to 15% or 20%. That kind of reduction in the corporate tax rate would almost certainly add to the bottom line of corporate results, and if the tax cut is big enough those beefed-up earnings will go a long way toward justifying a market that’s currently trading at about 18 times 2018 EPS estimates.

If, however, we fail to get tax reform. then I suspect the market will begin to look more like football’s perennial losers the Cleveland Browns than baseball’s red-hot Cleveland Indians.

According to the latest news reports, we will get much more detail from Republican congressional leaders on Sept. 25 regarding a tax plan. That’s just over a week from now, so until then, expect this market to keep grinding higher the way it’s done all year long.

Interestingly, when a market winning streak is in place, there tends to be one of three possible reactions. We saw this during the Indians’ winning streak among the various factions that followed that circumstance.

First, there are those who rooted for the Indians to keep winning. Second, there are those who are rooted for the team to lose. And third, there are those who attempted to maintain complete and total impartiality.

It is the same for markets.

There are the “perma-bulls” in markets who always tell you that things are great, and who tell you that you should never flinch when it comes to putting all your money in stocks.

Then there are the “perma-bears” in markets who are constantly warning of impending doom and gloom, and who want you to hunker down in hard assets.

Here I am, seated between two of the world’s most-famous market Cassandra’s, Jim Rogers (left) and Peter Schiff (right), during a debate at this year’s FreedomFest conference in Las Vegas.

While both these gentlemen have interesting thoughts on the markets, the Fed and the future of the global economy, both are bearish on U.S. equities and on the U.S. economy. Both also warn of a coming debt-fueled collapse somewhere down the road.

Now, I do admire both men’s always-strident opinions, and I think much of what they say is interesting theoretically. The issue I have with their ideas is that I think by constantly sounding the gloom-and-doom alarm, they’re missing out on the current opportunities open to all of us to own great companies in a bull market.

Finally, there are those who try to remain objective about markets, and who try to be impartial about what the market is telling us.

I try to be this way when it comes to markets, but when you put your money at risk it’s often very difficult to remain a stoic observer.

Still, a good investor will always attempt to remain objective, and to let the price action in markets dictate the best decisions for his/her money. Indeed, it is only via a respect for objective reality that humans can make progress.

Wishing doesn’t make things so, as any rational adult will tell you. Yet when it comes to markets, sometimes even the most rational adults will turn into irrational children.

So, let’s not let that happen to us. Instead, let’s respect the trends, ride the continued winning streak when our money is long… but let’s always be mindful that stocks can and ultimately will experience pullbacks, corrections and even bear markets.

Hey, that’s just the nature of the game, and the nature of objective reality.

Sometimes we’re Indians, and sometimes we’re Browns. It’s knowing how to handle each circumstance that makes one a perennial winner.

***************************************************************

Remember What Barry Said

“Where is the politician who has not promised to fight to the death for lower taxes, and who has not proceeded to vote for the very spending projects that make tax cuts impossible?”

— Barry Goldwater

The intellectual prowess of the late, great Barry Goldwater cannot be denied, even if you disagree with him on the issues. In this memorable quote, the conservative icon, author, Senator and presidential candidate reminds us that politicians like to make a lot of promises when it comes to tax reform. Yet they also like to spend, spend, spend… which sabotages those promises. Don’t be surprised if that happens again.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.