Don’t Call the Government When the Levee Breaks

Natural disasters just plain suck.

Mother Nature is a cruel matriarch, and she doesn’t much care about you, me or any of the human structures we’ve erected to help combat her occasional wrath.

Indeed, Mother Nature’s caprice and cruelty were on full display over the past couple of weeks, and watching the scenes of the aftermath in Houston, Florida and the Caribbean over the past several days made me sad, mad… and uplifted, all at the same time.

The destruction also reminded me of one of my favorite rock/blues songs, Led Zeppelin’s classic, “When the Levee Breaks.” Here’s the lyric that came to mind:

Mean old levee, taught me to weep and moan;

Mean old levee, taught me to weep and moan.

It’s got what it takes to make a mountain man leave his home.

As we all know, many disaster zone residents were forced to leave their homes. Yet we also know that despite the damage and destruction suffered, many are resolute, strong of mind and already on their way back to clean up, rebuild and return to normalcy.

And, they are doing so with the help of their fellow citizens, many of whom have donated to the charities of their choice (my preferred charity is Upbring.org, and I encourage you to help through this fine organization, if you are able).

In fact, the recent storms have really revealed the true character of America; a rich country that is both generous and compassionate, and one replete with humans reaching out to help other humans in countless ways, including via monetary donations, manpower, equipment, food, shelter… and love and affection for those who are hurting.

Unfortunately, when disasters like Harvey and Irma strike, many people’s first reaction is to turn to political leadership and government for a clue as to what to do, or how to respond, or what kind of help they are likely to get.

But I say that when the levee breaks, don’t call the government… count on yourself first, and second, help your fellow man.

Yes, by all accounts, the response to Harvey and Irma by federal agencies such as FEMA, and by state and local government agencies, has been pretty good. But what’s been even better is the effort of individual citizens acting out of a sense of what’s right.

Investor’s Business Daily, a news source I highly recommend (full disclosure, I worked there for many years in the 1990s), has done a great job in its editorial page detailing the heroes of both Harvey and Irma. And wouldn’t you know it, none of them worked for Big Brother.

Most were just your average, good-hearted Americans stepping up to do their part to assist other Americans.

For example, in an Aug. 29 piece, “If You’re Focused On The Government’s Response To Harvey, You’re Looking In The Wrong Direction,” the op-ed told about the great work done by the so-called “Cajun Navy”:

Over the weekend, dozens of people from Louisiana showed up in Houston as part of what’s become known as the Cajun Navy. This is an all-volunteer group formed during Hurricane Katrina that has grown in size since.

The Cajun Navy was part of what’s been described as an “armada of private boats” that came to Houston to help rescue thousands of people stranded in their homes by Harvey’s relentless deluge.

Nobody ordered it, or organized it, or coordinated it, or directed it. Nobody’s getting paid. But their efforts are a big reason why the death rate from Harvey has been so low.

It’s the same with Irma.

In a Sept. 11 editorial titled, “With Hurricane Irma, Private Volunteers — Not Gov’t — Again Lead Way In Relief,” the newspaper detailed some of the contributions by private companies to the relief effort:

Discount giant Wal-Mart, a frequent and favorite target of the elitist pro-union left for daring to sell things cheaply to low- and middle-income Americans, has pledged $30 million for Irma relief efforts. Other major corporations have kicked in an estimated $160 million, and that amount is growing by the minute.

Home Depot actually runs a staffed Hurricane Command Center in Atlanta, from which it makes sure its stores are stocked with vital goods — including portable generators — needed to survive a major storm and rebuild after it’s over.

Meanwhile, at least 30 utilities across America and from Canada have sent some 16,000 technicians to Florida to help get power there up and running again after the storm has passed. No one ordered them to do it. No one forced them to help. Private groups and businesses such as these did it out of basic decency, the kind that Americans once were known for — and may someday be known for again.

Ah, yes, the key concept here is that no one (especially not government) ordered them to do it, and no one forced them to do it. These people, and these companies, did it because they wanted to make a bad situation better for their fellow man.

It is my view that when unshackled from over-taxation, over-regulation and the encroachment of government into areas where it has no business, Americans would not only do just fine, we would thrive even more than we already do.

That’s true during times of economic, social and cultural prosperity… and it’s especially true when the levees break.

Upcoming Appearances

Dallas MoneyShow, Oct. 4-6: If you’re in the “Big D” in early October, then come by the Hyatt Regency Dallas and see me, as well as many other great industry speakers, at the Dallas MoneyShow. I will be giving a presentation on Friday, Oct. 6, 8:00 – 8:45 a.m., titled, “5 ETFs to Fight the Fake News.” For your complimentary tickets, go to Woods.DallasMoneyShow.com.

*************************************************************

ETF Talk: Low Bond Yields Open the Door to Dividend Funds

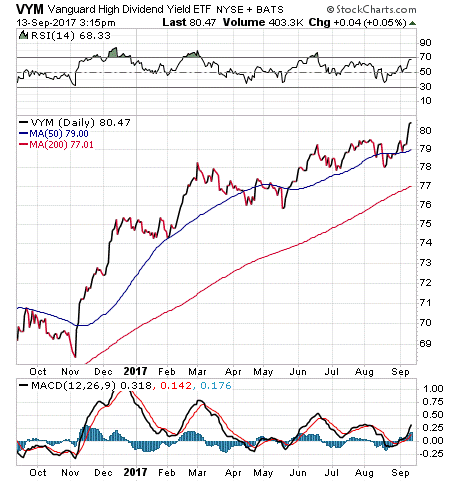

The Vanguard High Dividend Yield ETF (VYM) tracks the common stocks of companies that pay higher-than-average dividends, making it a viable exchange-traded fund (ETF) pick for when market conditions are uncertain.

Two major factors are making dividends a popular investment focus right now. First, with bond yields at historic lows, many investors are turning to dividends as an alternate source of constant income. Second, geopolitical tensions and frustration at the lack of progress on growth initiatives from the Trump administration continue to keep investors in a “wait and see” mentality.

VYM uses a conservative, diversified approach that seeks above-average yields without exposure to excessive risk. This is evident in the fund’s very low 0.01% spread. VYM has a massive $18.82 billion in total assets under management and a very healthy $56.91 million in average daily trading volume.

VYM screens and ranks companies based on the forecast of their dividends over the next 12 months, selecting only those which rank in the top half. The ones that make the cut are then weighted by market capitalization, rather than dividends.

As an additional measure, the fund excludes real estate investment trusts (REITs) because of unfavorable tax rules. As dividend-paying stocks themselves offer some downside protection (since they tend to fare better during corrections and recessions than other equities), investors in VYM may be able to reduce their risk without having to sacrifice extra income in the process.

The fund has an expense ratio of 0.08%, which is 92% lower than the average expense ratio of funds with similar holdings. VYM offers a distribution yield of 2.91%. Overall, the cheap holding cost, the robust liquidity and the excellent tracking makes VYM a decent choice for investors seeking high dividend equity exposure.

Year to date, VYM has returned 6.14%, compared to the S&P 500’s 11.40%. This does not include dividends. However, VYM is up nearly 15% from its low of $69.96 on November 4, 2016.

The fund’s top five holdings are Microsoft Corp (MSFT), 5.8%; Johnson & Johnson (JNJ), 3.8%; ExxonMobil Corp (XOM), 3.6%; JPMorgan Chase & Co. (JPM), 3.4%; and Wells Fargo & Co. (WFC), 2.6%. As a well-diversified fund, VYM holds more than 400 stocks and is about equally invested in technology, consumer goods, financials, health care and industrials.

For those seeking stable high dividend payouts for at least the next year, the Vanguard High Dividend Yield ETF (VYM) may be worth a look.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

When Economic Illiterates Forget about Bastiat

If you’ve been watching the news on the devastating damage wrought by Hurricane Harvey (which is soon to begin all over again with Hurricane Irma), you might get the sense that the 500-year flood event will be one giant economic stimulus package for the country.

Although Harvey is expected to be the costliest storm to ever hit the United States, with damages expected to cost about $190 billion (that’s about 1% of our GDP), there seems to be a never-ending parade of economic illiterates on TV and writing in the national media that seem to think that Harvey will create jobs, raise wages and otherwise be an economic boom to Houston, Southeast Texas and the rest of the country.

The theory here is that a government will spring into action by sending a lot of relief funds to the region, and that will result in a lot of new infrastructure spending. Then there will be a lot of insurance payouts to the victims, and that, in turn, will lead to a lot of consumer spending that will help juice the economy. That’s the theory, at least.

Yet those perpetrating this line of thinking must have failed to study the works of Frédéric Bastiat. The 19th-century French economist, legislator, and writer was a champion of private property, free markets, and limited government (so, not only do I share his French ancestry, I also share his intellectual DNA).

In his famous work, “That Which Is Seen, and That Which is Not Seen,” Bastiat introduces the world to the fallacy of “the broken window.”

In that work, he uses a brilliant example of a shopkeeper whose son accidently breaks a pane of glass, and the unfortunate false reactions to that event. Here’s the broken window fallacy, as explained directly from Bastiat’s pen:

Have you ever witnessed the anger of the good shopkeeper, James B., when his careless son happened to break a pane of glass? If you have been present at such a scene, you will most assuredly bear witness to the fact, that every one of the spectators, were there even thirty of them, by common consent apparently, offered the unfortunate owner this invariable consolation: “It is an ill wind that blows nobody good. Everybody must live, and what would become of the glaziers if panes of glass were never broken?”

Now, this form of condolence contains an entire theory, which it will be well to show up in this simple case, seeing that it is precisely the same as that which, unhappily, regulates the greater part of our economical institutions. Suppose it cost six francs to repair the damage, and you say that the accident brings six francs to the glazier’s trade—that it encourages that trade to the amount of six francs—I grant it; I have not a word to say against it; you reason justly. The glazier comes, performs his task, receives his six francs, rubs his hands, and, in his heart, blesses the careless child. All this is that which is seen.

But if, on the other hand, you come to the conclusion, as is too often the case, that it is a good thing to break windows, that it causes money to circulate, and that the encouragement of industry in general will be the result of it, you will oblige me to call out, “Stop there! your theory is confined to that which is seen; it takes no account of that which is not seen.”

It is not seen that as our shopkeeper has spent six francs upon one thing, he cannot spend them upon another. It is not seen that if he had not had a window to replace, he would, perhaps, have replaced his old shoes, or added another book to his library. In short, he would have employed his six francs in some way which this accident has prevented.

To understand the economics of disasters, both natural and man-made, you must look at what is seen, and what is not seen.

It is only by understanding the concept of what is unseen that we can understand that far from an economic stimulus to the nation, hurricanes, earthquakes, disease, riots and wars are anything but good for an economy. Instead, these events impair economic progress, and they put a damper on human flourishing.

So, the next time you hear anyone on TV talking about how Hurricane Harvey or Hurricane Irma will be good for the economy, you can rightly accuse them of being blind to the unseen.

You also can call them economically illiterate.

********************************************************************

Remember, Always!

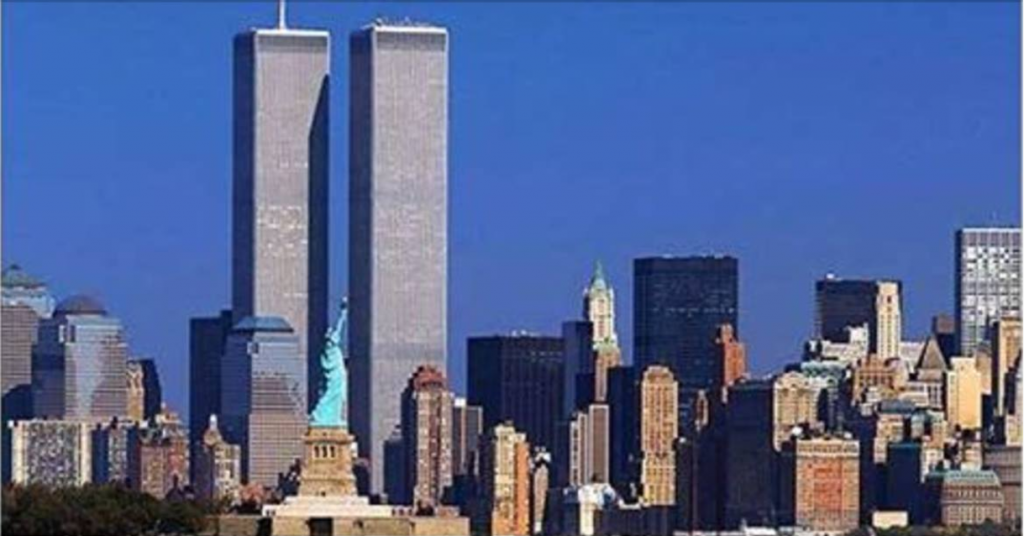

On Monday, the nation paused to remember the horrific events of 9/11. It was 16 years ago, but for me, the memories seem as clear today as they were that September morning.

A lot has happened since then, including a dramatic rebuilding of the former World Trade Center site. Now, perhaps I’m a bit too biased here to be objective, having worked at the World Trade Center in the late 1990s when I was with Morgan Stanley.

Yet despite the brilliance of the new buildings, when I close my eyes and think of the Manhattan skyline, I see the twin brothers of the WTC standing tall, proud… and representing the essence of capitalism and freedom.

Remember, always!

***************************************************************

Buckley on Self-Reliance

“There is an inverse relationship between reliance on the state and self-reliance.”

— William F. Buckley, Jr.

Conservative icon William F. Buckley, Jr. was acutely aware of the distorting nature of a powerful state apparatus when it comes to international affairs and the domestic economy. He was also aware of its distorting nature on the individual, as a big government just tends to make the individual smaller.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.