3 Renaissance Man Rules of Wealth Building

- 3 Renaissance Man Rules of Wealth Building

- ETF Talk: Will This Health Care ETF Help Heal Your Finances?

- Freedom Is the Best Reason for Celebration

- Simple Man Wisdom

***********************************************************

3 Renaissance Man Rules of Wealth Building

One year ago this week, with the help of an amazing and brilliant staff, I launched my lifestyle podcast and website, Way of the Renaissance Man.

I chose the FreedomFest conference as the place to do this, and the reason why is because for a person to fully achieve in life, he or she must first respect and revere the fact that without freedom, no true achievement of values is possible.

That means part of the obligation of a Renaissance Man (and a Renaissance Woman) is to preserve, protect and defend freedom with all his or her might.

Well, I am doing just that right now, as I am here today in Las Vegas celebrating liberty at this year’s FreedomFest. I’ll have a detailed update of the highlights in next week’s The Deep Woods, but today I wanted to reflect on a few key ways to achieve your own personal freedom, and that starts with being financially free by knowing how to build wealth.

Now, counterintuitively, building wealth really isn’t that hard.

The compounding math is there for anyone to grasp, as are the basic concepts. The tough part comes when you deviate from these principles in search of a shortcut, or if you make one or two bad decisions that put you in a big financial hole.

Let’s look at what I call the three Renaissance Man rules for building wealth.

Rule No. 1 — Be Right More Often Than You’re Wrong

Making decisions means taking action. But no matter how smart those decisions, and no matter how much thought or research or effort you put into those decisions, you are still likely going to be wrong many times. Think about this as it applies not just to your investment portfolio, but also to life in general.

If you’re reading this, you’re likely someone who has made many good, as well as many bad, decisions in life. Some of those decisions you are extremely thankful you made, and some you no-doubt painfully regret. Hey, we all make mistakes, and that’s because humans are fallible. Yet we don’t have to be right all the time to be successful in life — or in our wealth building.

The key here is to be right more often than you’re wrong. And, when you’re wrong, to minimize the damage. The latter part of this prescription leads us into our next rule of wealth building.

Rule No. 2 — Win Bigger Than You Lose

Win some, lose some.

This reality is just part of life. And try as we may to always win, we can’t. Indeed, part of being a Renaissance Man is understanding that life has its good days and its bad days. And while the big winning days are fantastic, the big losing days can really, really hurt.

The key for a Renaissance Man, both in life and in the money and investment realm, is to win bigger than you lose.

What I mean by that is you want to ride your stock, bond and commodities wins. Don’t just bail out on a small gain because you have one, or because you want that shiny new car, boat, etc.

As for losing, most of us have been on the wrong side of an investment decision. The key is to not let those losses go from small to large. Just like one or two really bad decisions in life can end up being the difference between happiness and sorrow, one or two catastrophic losses in a portfolio can be the difference between retiring wealthy and living the rest of your life on Social Security.

Remember that investing (as opposed to short-term trading, which definitely has a place) means you build positions in strong assets likely to continue appreciating over time. And, you use the power of compounding and the requisite patience and time, to build your wealth.

Of course, to find those wins in the first place means you have to invest in the right picks from the beginning, and the details of how to do just that are contained within the pages of my Successful Investing and Intelligence Report newsletters.

Rule No. 3 — Seek Income and Capital Appreciation

When you’re investing (as opposed to trading), you ideally want assets that pay you income AND that go up in value.

This may seem simple, but you would be surprised by the number of people I’ve spoken with in my career that think income and capital appreciation are two separate entities. The best long-term wealth-building assets are those that not only appreciate in value, but that also pay you to own them. This means owning a basket of the best, most-stalwart, dividend-paying stocks the market has to offer.

I’m referring here to stocks of companies that have consistently raised their annual dividends each year, and those that have done it for years, decades and, in some cases, more than a century.

This isn’t a quick-fix, get-rich scheme or some kind of real estate flipping strategy. It is investing consistently in the biggest, most-profitable companies that have demonstrated they are committed to growing their business long term and increasing the wealth of their shareholders.

You see, when it comes to the basic Renaissance Man rules of wealth building, simplicity reigns supreme. Once you understand that, you then need to muster up the requisite courage, discipline and willpower to see those rules through to the end.

So, act in your own best interest, and be the hero of your own life.

Be courageous, be disciplined… and be free.

**************************************************************

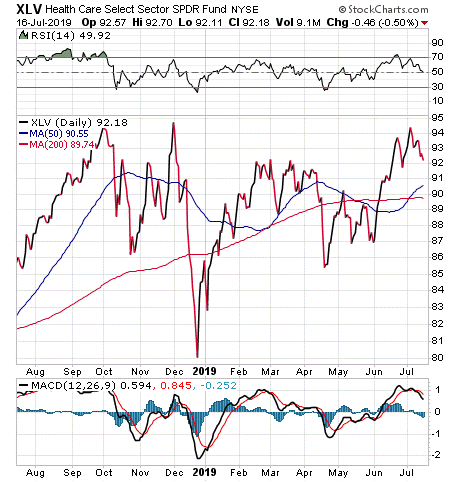

ETF Talk: Will This Health Care ETF Help Heal Your Finances?

The Health Care Select Sector SPDR Fund (NYSEARCA: XLV) is an exchange-traded fund that can give a prospective investor access to the segment of the global economy that is involved with health care.

XLV specifically tracks the Health Care Select Sector Index, which, in turn, attempts to provide an effective representation of the health care sector of the S&P 500 Index. Currently, the fund’s assets are divided among companies that are involved in pharmaceuticals; 43.42%, health care equipment and supplies; 31.17%, health care providers and services; 17.44%, biotechnology and medical research; 5.75%, food & drug retailing; 1.50%, machinery, equipment and components; 0.55% and collective investments; 0.16%.

Almost all the companies that make up the fund’s portfolio are based in the United States. One of the things that adds to XLV’s allure is the fact that this ETF is the oldest and largest fund in the U.S. health care segment. Furthermore, the fact that the daily dollar value of its traded shares averaged over the past 45 days is $954.38 million means that this fund’s level of liquidity is quite high. This, in turn, lets XLV provide investors with highly liquid exposure to high-end health care names.

This fund’s top holdings includes Johnson & Johnson (NYSE: JNJ), United Health Group Inc. (NYSE: UNH), Pfizer Inc. (NYSE:PFE), Merck & Co. (NYSE: MRK), Abbott Laboratories (NYSE: ABT), Medtronic Plc. (NYSE: MDT), Thermo Fisher Scientific (NYSE: TMO), Amgen Inc. (NASDAQ: AMGN) and AbbVie Inc. (NYSE: ABBV).

Readers who subscribe to my Successful Investing, Intelligence Report, Fast Money Alert or Bullseye Trader trading alerts might recognize some of those companies!

The fund currently has more than $17.74 billion in assets under management and an average spread of 0.01%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than some other ETFs.

This fund’s performance has been solid in both the short and long terms. As of July 16, XLV is up 0.95% over the past month, up 2.93% over the past three months and 7.25% year to date.

Chart Courtesy of stockcharts.com

In short, while XLV does provide an investor with the ability to profit from the world of health care, the sector may not be appropriate for all portfolios, especially given the current dispute about health care funding in the United States in the run-up to the 2020 Presidential Election. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

*****************************************************************

Freedom Is the Best Reason for Celebration

Freedom.

The Oxford English Dictionary defines it as “the power or right to act, speak, or think as one wants.” I think that’s a very good definition, as it encompasses the essence of what a human being does.

You see, as humans, we are beings that act, speak and think. Thus, any social system that stymies these attributes is inherently anathema to human life. Now, realize this is no simple task, since the presence of freedom isn’t exactly ubiquitous in the history of civilization. In fact, it’s downright rare.

Yet in America during the 21st century, we are privileged, for the most part, to enjoy the greatest freedoms and the greatest fruits of economic prosperity the world has ever known. Today, we largely can act how we want, speak our minds and think basically whatever thoughts we want — and we can do so mostly free from coercive government, free from oppressive religious organizations and free from the violent forces of group-think.

Still, freedom, to borrow a cliché, isn’t free.

To preserve the power and right to act, speak, or think as one wants, we have to make sure we reinforce the good ideas that buttress and extol freedom, while also combating the bad ideas that suppress, stifle and retard freedom’s progress.

As I’ve said many times in this publication, the only solution to bad ideas are good ideas. And because there is perhaps no better idea than freedom, there also is no better idea worth defending, propagating and celebrating.

It is for this reason that I am privileged to be a part of what has been called “the world’s largest gathering of free minds,” the annual intellectual and social celebratory banquet of liberty known simply as FreedomFest.

As I write this e-letter, we are just about to begin this year’s FreedomFest conference, and its 2019 theme celebrating “The Wild West.”

This year, we are expecting nearly 2,000 attendees, and we will have some 250 speakers and workshops on all sorts of freedom-oriented themes. What I really like about FreedomFest is that you can explore all sorts of facets of the freedom movement, including politics, investing, economics, healthy living, education and parenting, technology and science, philosophy and history, the arts and literature, government regulation, taxation, social trends and much more.

Basically, there’s something for every liberty lover’s palate at FreedomFest.

Now, if you are planning on attending FreedomFest, I invite you to come and see me and my Eagle Publishing colleagues Dr. Mark Skousen, Hilary Kramer, Roger Michalski and Paul Dykewicz. On Wednesday (today), July 17, 2:00 p.m. PDT, I will be giving a presentation titled, “Beyond Belief: Who Is the Fastest Financial Gun in the West?” As a bonus, I will team up with Wall Street money manager Hilary Kramer, 3-3:25 p.m., for a discussion title, “The Plungers and the Peacocks: What Really works on Wall Street and what the gold bugs are missing.”

Then on Friday, July 19, at 2:10 p.m., I will be part of a panel alongside Dr. Skousen, Hilary Kramer and Roger Michalski titled, “Top 10 Stocks to Buy Now.” For the full agenda of all speakers at FreedomFest, click here.

If you ever have wanted to celebrate one of the most-beautiful concepts in human history, then come to Las Vegas and celebrate freedom alongside me. And, discover why freedom isn’t “just another word for nothing left to lose,” as the classic song “Bobby McGee” says, but rather a concept that requires protecting, preserving, integrating and celebrating.

P.S. It is not too late to use the promo code “EAGLE100” for a special FreedomFest discount offer of $100 off the full price of $695 per person… So that’s just $595 per person/$895 per couple.

*******************************************************************

Simple Man Wisdom

And be a simple kind of man

Oh, be something you love and understand

Baby be a simple kind of man

Oh, won’t you do this for me, son, if you can

–Lynyrd Skynyrd, “Simple Man”

The southern rock classic “Simple Man” by the great Lynyrd Skynyrd has a chorus replete with some very deep wisdom. Let’s break it down here, because it can teach us all something.

First, “Be something you love and understand.” In other words, know yourself and love the person you are. Or, as Shakespeare might have put it, “To thine own self be true.” Then, “Won’t you do this for me, son, if you can.” A recognition by a mother that her advice to a son will be really hard to follow; but if he can achieve the peace of mind that comes with being a “Simple Man,” he will have achieved the greatest gift one can give oneself.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods